[ad_1]

The success of aerospace and defense companies rests not merely upon their research and development, their culture of innovation, and their quality of management – which might be good enough for most industries – but they also must deal with (1) politicians and (2) Department of Defense acquisitions protocols. This makes the survivors particularly capable.

I discussed the industry writ large at a bit more length in my article on the Global Defense Industry here: The Global Defense Industry – Here Are The Best To Buy.

In that article I discussed both Elbit Systems (ESLT), which I own, and Raytheon (RTN), which I have previously owned and for which I now have a buy limit order in place. I was unable to spend the time to get to my favorite ETF in that article. I did, however, speak directly to the problem defense contractors doing business in representative democracies must face: politicians. Politicians whose cozy jobs are safe as long as they bring home the bacon to their state or district. Here is a short hypothetical example from that original article of how that sends costs skyrocketing:

“Let’s say the U.S. military would like to have a certain capability, for instance, a long loiter-time safe distance robotic de-mining capability without putting human beings in harm’s way. The various companies within the defense industry see they could do well by doing good and they bid on the contract, detailing why their particular vision and capabilities to deliver the best product should win out. So far, so good. The Congress intervenes. The members’ basic question, no matter how cleverly they phrase it (or try to conceal it) is, ‘How much pork can I bring home to my district so I can get re-elected?’

“A capability deemed desirable by the military and able to be designed, prototyped, accepted and built by industry – with an eye on their bottom line – suddenly finds itself held hostage to the demands that function ‘x’ or part ‘y’ be made by a sub-contractor, not because the original bidder can’t do it themselves but because the sub-contractor is located in Congress critter ‘Z’s’ home district.

“The result is pretty much a certainty that the de-mining robot will be built over budget and delivered late. Don’t get me wrong — cutting-edge technologies requested by DoD materiel acquisitions officers may already be rife with too many conflicting add-ons. Industry may already recognize that their bid was so low that cost over-runs are necessary to finish the production, but they are confident the prototype will wow the audience enough to get a little extra funding. But it is members of Congress’ insistence that pork be larded to their districts that puts the whole thing over the edge.”

While I am disgusted by this fact, I am also a realist. I understand that there is most likely to be a spreading (or larding) of the wealth across the entire industry. The biggest of the bigs, like Lockheed (LMT), Northrop (NOC) and Boeing (BA) are already well-known and widely held by institutions and individuals. This is unlikely to change.

In combat, officers and NCOs who question assumptions, improvise, adapt and move forward are rewarded. In the acquisition side of the military, not so much. It is a lot less likely your career will be abruptly ended if you select Lockheed as your prime contractor (even after the F-35 fiasco!) than if you select PoDunk Wannabe, Inc.

Since no acquisitions career field officers want to be assigned to Naypyitaw, Myanmar on their next assignment, it behooves them to take few chances. (I don’t know why they wouldn’t want to go to Myanmar. I volunteered for attache / human intelligence duty there and found the people fascinating, the geography stunning, and the leadership incompetent, slimy and vicious – basically your average third-world dictatorship.)

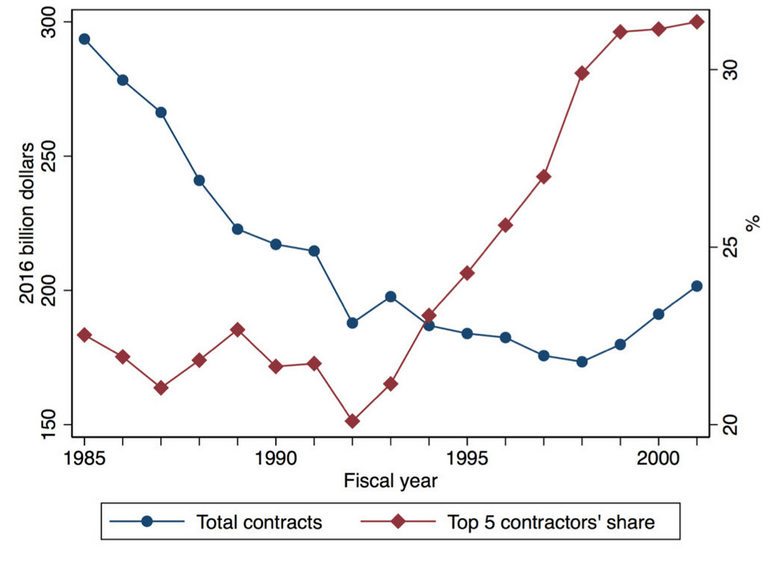

SOURCE

SOURCE: National Bureau of Economic Research

If almost all the contracts are going to the bigs but Congress wants the contracts to go to their districts, what does Lockheed, Northrop et al do? It makes sense to sub-contract extensive “pieces” of the work to firms they have vetted as capable. The work can go to small contractors without cutting into the big boys’ bottom line too much, and they don’t make a mid-size firm into a real competitor this way. There are further incentives for female-owned or minority owned businesses, so they get the sub-contracting jobs, too.

Are you seeing a pattern here? The biggest contractors get the prime contracts and they spread it to the smaller contractors who are no threat to them. That leaves the mid-level contractors looking for a bone. They will often get at least “something” from the prime contractors if for no other reason than the prime contractor knows – but doesn’t necessarily tell the acquisition folks – that these mid-level firms have expertise greater than their own in some or many areas. But the mid-levels get enough only to scrape by and make a few extra pennies a quarter to keep the shareholders happy.

Merging with firms their own size or buying smaller companies is the best way for these mid-range companies to jump into the big leagues and give Boeing, Lockheed, and Northrop some serious competition. And that is just what they have done.

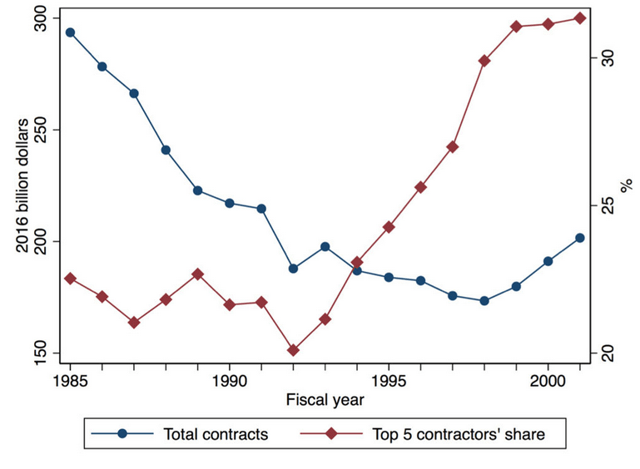

Here are a few of the deals from the last few months of 2018:

Source: Reuters, via PWC.com

Boeing scooped up 2 mid-range firms for about $8 billion, General Dynamics bought another for $9.5 billion, and the biggest of all, makes my point. In the last quarter of 2018, Harris Corp. and L3 Technologies, Inc. announced an all-stock merger deal worth $16.2 billion to create a company with a market value of $33 billion. This was an example of 2 mid-range contractors combining forces so they could bid on larger government contracts.

Of course, the Raytheon (RTN) and United Technologies (UTX) merger, if approved, would catapult the new firm into the ranks of the super-majors, with $75 billion in annual sales.

(I have italicized the word “billion” in honor of the late Sen. Everett Dirksen who, decrying government spending, never said “A billion here and a billion there, pretty soon you are talking real money.” But the mis-attribution has taken on a life of its own!)

The point of this little exercise is simply to solidify why I believe, at today’s prices, there are no bargains among the usual suspects held by most ETFs. Two of these, the Invesco Aerospace & Defense ETF (PPA) and the iShares US Aerospace & Defense ETF (ITA) are passively-managed capitalization-weighted ETFs. Buying these ETFs gives you the most representation of the biggest companies so the new Big Man on Campus LHX, as well as LMT, UTX, BA, GD et al dominate.

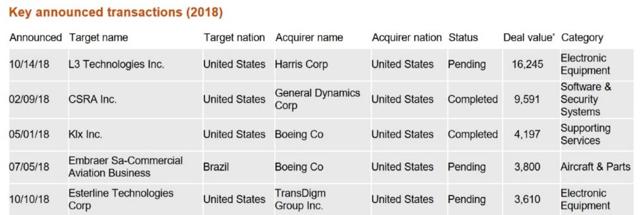

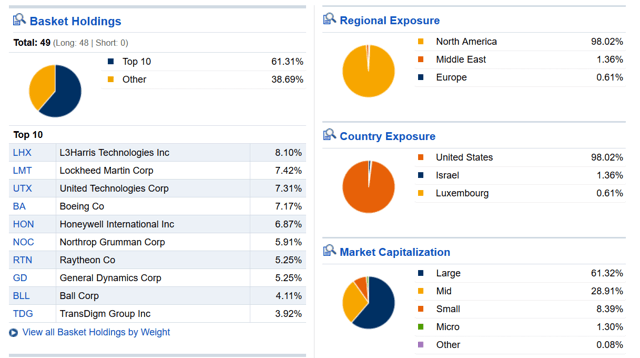

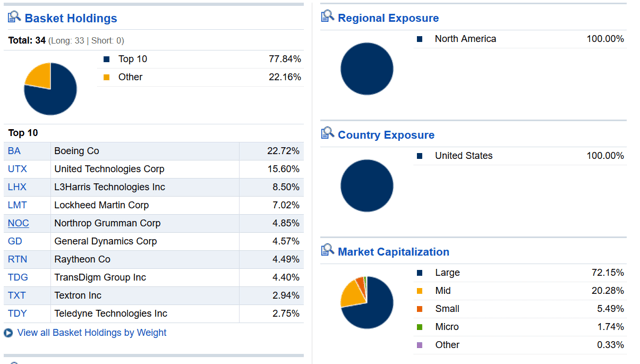

Here is a showing of the top 10 holdings, regional and country exposure, and market cap differentiation for PPA, which uses the SPADE Defense Index as its benchmark. (While passively managed, using this index provides more flexibility than a purely market cap approach):

Source: Fidelity.com

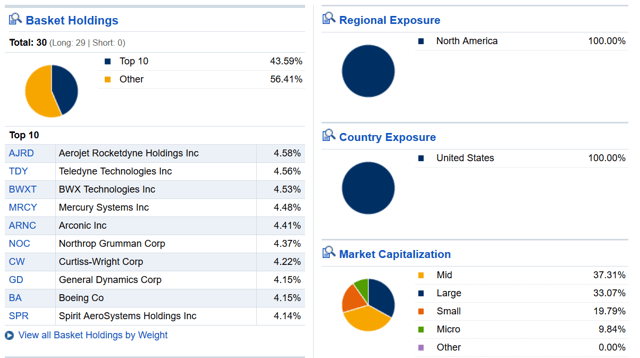

… and here is the same information for ITA, which is tied to the Dow Jones US Select Aerospace & Defense Index, a purely market cap approach:

Source: Fidelity.com

ITA is even more concentrated in the top few. But if you like concentration, check the next one!

The Direxion Daily Aerospace and Defense Bull 3x Shares (DFEN) is a relatively new ETF in this business. It uses the same Dow Jones US Select Aerospace & Defense Index but via derivatives multiplies the gains – or losses – by an order of magnitude of 3 times. If that is yyour cup of tea, fine. It isn’t mine!

Finally, there is the S&P SPDR Aerospace and Defense ETF (XAR). While also passively-managed, XAR is an “equal-weighted” ETF which strives to hold equal percentage amounts of all the aerospace and defense companies listed among the S&P 500. As a result, XAR’s charter provides for the broadest exposure to large-caps, mid-caps and even the occasional mid-small-caps.

This is not too hot, nor too cold, but juuust right for my taste. By equal weighting, but limiting it to the S&P 500, we get a little of every one of those meaningful middle-tier companies I believe will be acquired or will merge and become prime contractors themselves in the coming years.

I don’t want to own the biggest of the big, which are already selling for large premiums and I don’t want to own too many of the smaller firms that are kept alive solely by Congressional largess. I want the ones with the financial ability to survive and the room to grow. Here is the same information provided for PPA and ITA above, this time for XAR:

Source: Fidelity.com

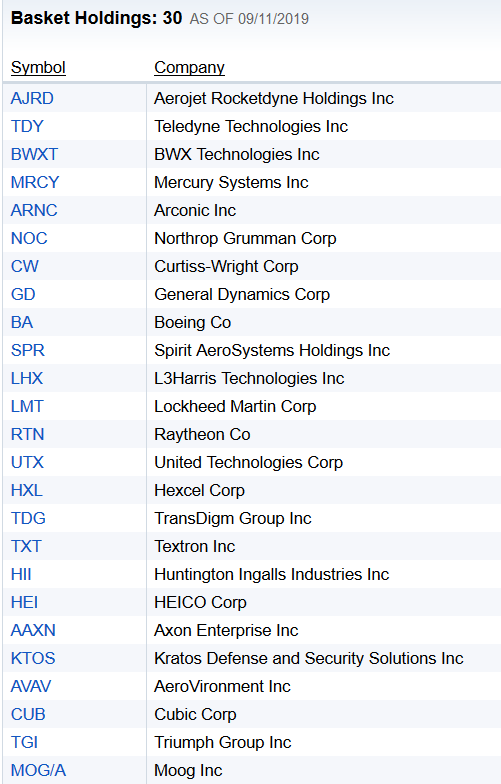

I have included all 29 holdings below. These are all the aerospace & defense firms big enough to be included in the S&P 500. I think you will see many familiar names here. Don’t get too accustomed to them. Unless there is a sea change in acquisitions policy, many of these will be acquired or will merge with their fellow mid-range firms to make the leap to the next level.

Subscribers and clients will recognize a lot of these as current or former portfolio holdings. XAR just gives us the diversification across the spectrum.

XAR carries the lowest expense ratio of all these ETFs – although we are talking a range of only 0.35% for XAR and 0.59% for PPA. As I regularly advise clients, subscribers, and readers, with apologies to The Eagles, “Get Over It” with this fixation of going cheap for a few pennies difference while potentially leaving $20 bills on the table!

Finally, XAR is the purest play on the industry. All three ETFs are way up there, but the other two own more shares of the conglomerates that are primarily aerospace and defense firms but also have other divisions that do other things.

Having purchased XAR earlier in the year and sold it for a tidy profit versus a trailing stop, I do not now own shares. That might change at any time.

In a future article, I will discuss the “other” firms that are prime contractors for DoD, Homeland Security and other national defense agencies. I think you will be surprised at just how huge some of these “defense contractors” are that sell information, analytics, cybersecurity, logistical support and more. A number of them would crack the Top 15 in the above reviews and at least one makes it into the Top 10!

Good investing,

Joe

Stovepipes are dangerous to your wealth. Whether you buy only tech, only aerospace & defense, only REITs, or only anything, sooner or later it will cost you dearly. At Investor’s Edge® our clients and subscribers sleep well at night, knowing I create structured portfolios that cross all those lines. To every thing there is a season.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in XAR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional Disclosure: Joseph L. Shaefer is CEO of Stanford Wealth Management, an SEC-Registered Investment Adviser. This means I do not merely have a suitability requirement when offering investment advice, but also a fiduciary responsibility. For that reason, if you are not a client of Stanford Wealth Management, I want to be crystal clear: my articles do not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. I offer my thoughts solely for your due diligence, and I hope you enjoy them as such!

[ad_2]

Source link Google News