[ad_1]

Melena-Nsk

Published on the Value Lab 26/7/22

The iShares S&P Global Timber & Forestry Index ETF (NASDAQ:WOOD) is a bit of a strange ETF. It contains a lot of interesting businesses that in one way or another connect to forestry. However, they each represent distinct markets or distinct places within the value chain. We don’t necessarily want to buy them together when selectivity matters in a market like this. We think pulp can be avoided, and while lumber is risky it is still an interesting speculative play.

Breaking Down WOOD

The larger components of wood aren’t really timber or forestry stocks, they’re lumber stocks, and that’s quite a different market. A sawmill separates lumber from timber and timber isn’t only used for lumber. Some of it is stripped into fiber and used for pulp, which is its own peculiar market that interacts with packaging, which itself interacts with odd trends related to China, chemicals and recycled paper volumes. They don’t really make sense to invest together.

The largest holding in WOOD is West Fraser Timber (WFG) which is a lovely stock that we’ve covered in the past. Much like Weyerhaeuser (WY) they sell lumber and OSB to the housing markets. Building volumes and dynamics with building inventories are important. The housing shortage in the US is a nice secular trend for West Fraser, and supply near the Rockies is at risk to beetles so there are forces that support those markets. WY is more exposed to Japan which has a falling Yen and might see a slowdown of purchases on that account. However, in general, with lumber piling up at mills due to supply bottlenecks, the current goods slowdown picture that the Fed is aiming for is not all bad for these companies, despite the market pricing them at bankruptcy multiples almost between 1-2x EV/EBITDA.

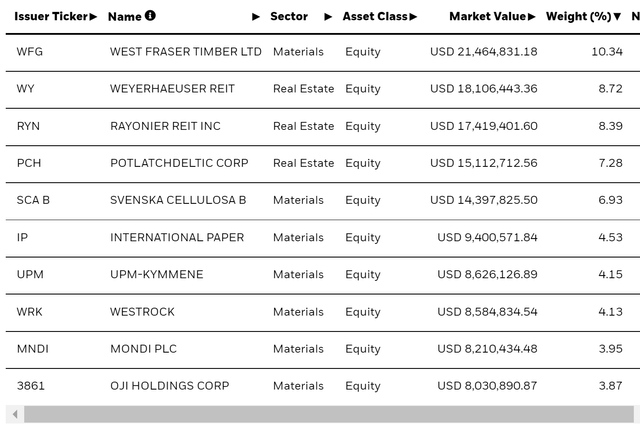

Breakdown of WOOD (iShares.com)

However, further down the list things get a bit more confused. SCA or Svenska Cellulosa (OTCPK:SVCBF) is on the list, and they, while vertically integrated, produce pulp and also some final packaging and paper products. Those markets operate very separately. Pulp is more connected to the goods boom, and has interactions with consumer staples and tissue demand. Bathrooms are more likely to have some Dyson style air dryers now, so tissues aren’t the greatest pulp demand sink anymore. The hawkishness is not that great for the ecommerce picture which threatens packaging, and recycling dynamics are a bit unpredictable there too if it re-enters the market, with the intensity of recycled paper and pulp being pretty high in ecommerce products.

The vertical integration into the forests themselves doesn’t have the biggest effect either. Fiber/timber prices have been rather stable and have not inflated much. There’s no real shortage of forests, and the realised prices for timber depend a lot on local markets, especially now with logistics being an issue, because timber is really just not very scarce.

Conclusions

WOOD is composed of stocks that address very different markets. Betting on housing and construction is really different from betting on goods velocity and packaging. Buying WestRock (WRK) is different from buying Mondi (OTCPK:MONDF) since one has meat and consumer end-markets and the other has construction and offices. If that’s already quite different, the difference between lumber and pulp is really big. These markets could go in quite different directions. Demographic lurches could be a benefit for housing and lumber while not for pulp. We don’t think that in the current environment it makes sense to be agnostic across these intersections. We’d bet on lumber and not pulp, for example. Investors should pick their side here and not run with an ETF.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News