[ad_1]

ThamKC/iStock via Getty Images

Continuing the series of articles that provide a deeper look at international dividend-focused ETF, today I would like to discuss the WisdomTree International High Dividend Fund (NYSEARCA:DTH).

This $187.4 million fund with an expense ratio of 58 bps mixes developed-world equities (excluding the U.S. and Canada) adding a value filter via the dividend yield screen and a small quality ingredient. This strategy is seemingly ideal for an environment where growth premia are being squeezed amid U.S. interest rates climbing higher. However, the crucial point not to miss is the FX risk. FX headwinds have resulted in the fund’s price declining in double-digits this year and may continue weighing on its returns going forward.

Its dividend yield is fairly solid, now teetering marginally above 6% compared to the WisdomTree U.S. High Dividend Fund’s (DHS) yield of ~3.4%. Moreover, DTH’s forward yield of over 11% is clearly phenomenal and might be indicative of deep undervaluation and large upside potential. However, it will be explained below why this blockbuster level is more likely unsustainable.

Investment strategy: ex-U.S. and Canada value players from the developed world

DTH’s investment mandate is to track the smart-beta WisdomTree International High Dividend Index. Its selection universe comprises equities present in the WisdomTree International Equity Index encompassing dividend-paying developed world equities except for the U.S. and Canada. The list of eligible countries includes Australia, Israel, Hong Kong, Japan, Singapore, and fifteen countries in Europe (the U.K. amongst them). Inevitable FX issues stemming from it will be discussed below in the note.

This makes it distinctively different from the Vanguard International High Dividend Yield ETF (VYMI), which has emerging markets and Canadian equities in the portfolio but also ignores the U.S., and from the Global X SuperDividend ETF (SDIV), which has a riskier strategy investing in developed, emerging, and even frontier markets (e.g., Kazakhstan).

Micro-caps (less than $200 million in market value) are barred from joining the index, more likely to cut down on volatility, and avoid dealing with poor trading volumes, and quality issues. As a brief digression, issues inherent to the U.S. micro-cap universe were discussed in my May article. The index also shuns stocks that have sub-$200,000 average daily dollar volumes as the figures below that level would make it uncomfortable for DTH to add/remove shares from the portfolio at a desirable price and impair its ability to track the benchmark as closely as possible.

Stocks are ranked by the dividend yield, and those in the top 30% proceed to the index. A company must also be in the group of 80% with the highest composite risk score which amalgamates a set of value, quality, and momentum characteristics. When the yield compresses for whatever reason, be it capital appreciation or a dividend cut, the constituent would be removed only in case it ranks “outside of the top 35%.”

The key factor influencing a stock’s weight in the index and, hence, the share of net assets DTH would allocate to it is “dividends paid over the prior annual cycle.” That said, DTH’s strategy has a comparatively moderate turnover (40%) since reconstitution takes place only once a year. More details can be found in the prospectus and methodology document.

As of June 24, DTH was long 412 stocks, with Japanese (18.8%), UK (16.8%), and Australian (15.3%) equities occupying three leading positions. France (8%) and Germany (6.3%) are in third and fourth places, representing the key economies from the eurozone this ETF is most exposed to. DTH is underweight in Danish (34 bps) and Israeli (18 bps) stocks.

Though I have already addressed the yen question in my recent article, I suppose it is worth touching upon that matter once again. The yen is currently teetering around the 24-year low as the Bank of Japan has been sticking to the ultra-loose policy, in sharp contrast to other dedicated doves like Switzerland that has finally switched to interest rate increases. This spells trouble for the DTH NAV. The same is relevant for other currencies despite interest rate increases in the respective countries as they are not immune to the dollar appreciation.

Speaking of sectors, financials have the largest weight, ~23%, followed by materials (16.2%) and communication services (13.2%).

With 5.4% of the net assets allocated, BHP Group (BHP) is DTH’s largest investment at the moment. Overall, the key ten holdings account for ~23.4%.

BHP is a heavyweight producer of copper, iron ore, zinc, etc. with a staggering LTM dividend yield of ~12.1%. The question is whether this level is sustainable, and I am of the opinion it is likely not. The 2021 revenue probably represented the cyclical peak, and pundits are anticipating it to decline until mid-2024 before plateauing (the results for 1H22 are yet to be reported), with the EPS also shrinking. That is to say, it seems plausible that the DPS will likely be trimmed; the analyst forecast is $4.77 for FY2023 vs. $6.02 paid in FY2021. Anyway, if purchased at close to $59 a share, BHP would still have a YoC of ~8% should the DPS fall to that level.

Performance: subdued past returns due to value drought, FX headwinds

Like its peers which are focused on international high-yield stocks, DTH delivered a rather subdued 5-year performance compared to the iShares Core S&P 500 ETF (IVV).

For comparison purposes, I selected the following funds that incorporate the high-yield screen and invest globally (some are also holding U.S. stocks):

- SDIV, which invests in the U.S., DMs, EMs, and FMs,

- VYMI, which ignores the U.S. but not other DMs and favors a few emerging markets,

- iShares International Select Dividend ETF (IDV), which has no exposure to the U.S., but is long Canadian and other DM stocks; it also has a marginal allocation to China.

- First Trust Dow Jones Global Select Dividend Index ETF (FGD), which has a single-digit allocation to the U.S. in the current version, with the rest deployed to other developed countries (South Korea included).

- WisdomTree U.S. High Dividend Fund (DHS).

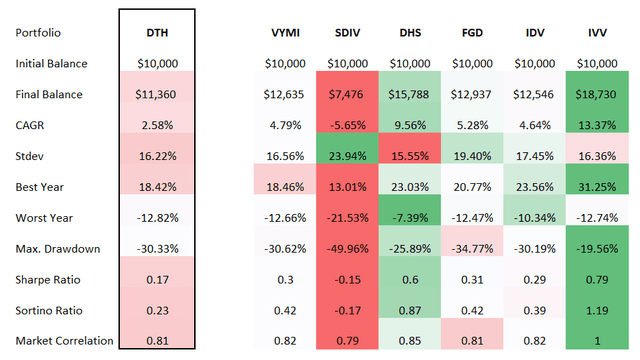

As the table below illustrates, investors who seek value abroad were rewarded by the much weaker CAGRs compared to those who opted for the U.S. market. The SDIV investors even saw their capital declining. Risk-adjusted returns (the Sharpe, Sortino ratios) are also much softer. Please do note that the table is based on returns delivered from May 31, 2017, to May 31, 2022.

Created by the author using data from Portfolio Visualizer

Interestingly, the U.S. high-yield stocks focused fund DHS delivered the second-strongest return in the group, only lagging IVV.

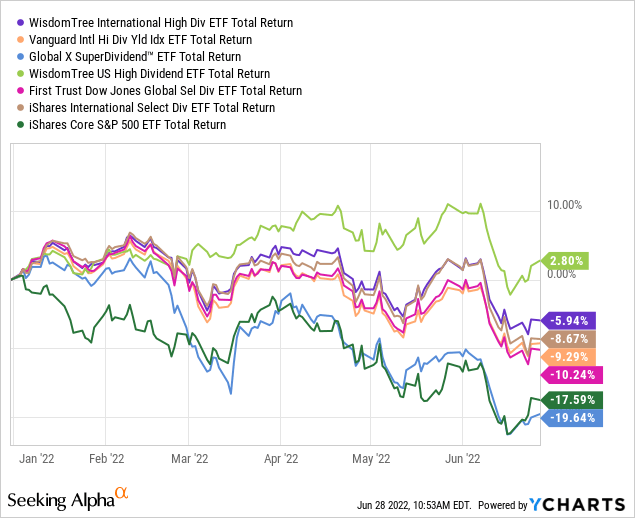

This year, which is remarkable for the continued recuperation of the value style that began in 2021 (known as the capital rotation), DHS has been chugging along, while the rest of the group is down in single-to-double digits. DTH’s total return is the second strongest though it is also in the red. SDIV has failed to deliver returns in line with its peers, lagging even the tech-heavy IVV.

An over 11% forward yield looks staggering. Is it sustainable?

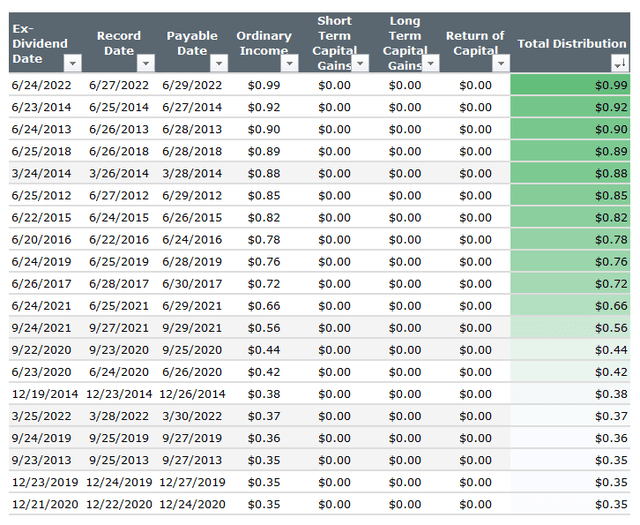

A crucial note that should be made here is that DTH’s forward yield of more than 11% is based on the most recent dividend payment, which is impacted by seasonality. It can be seen in the table below which contains the 20 largest distributions made in the previous ten years.

Created by the author. The data pulled from the WisdomTree website

The overwhelming majority of the distributions shown above were made in June, supporting my seasonality hypothesis. That is to say, stripping off this factor, investors should not expect this yield to last and, hence, should pay attention to the LTM yield of 6.3% in the first place.

Has the fund been consistent in increasing distributions?

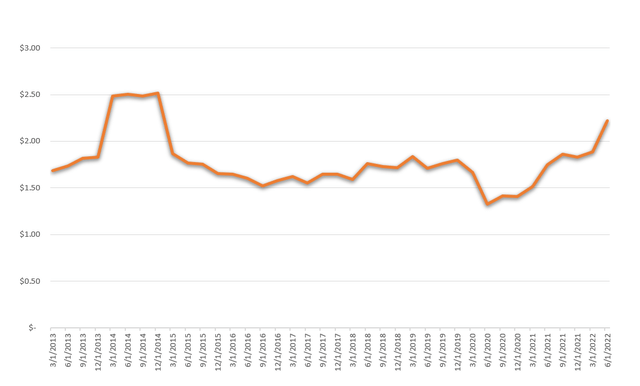

DTH has an A Dividend grade, which is supported by most compound annual growth rates being significantly stronger compared to all other rated ETFs. For example, its 3-year CAGR is ~9%, compared to all other ETFs’ median of only ~3.6%.

However, there is something to dislike. If we look at the previous decade, we will notice that the LTM dividend peaked in 2014, and even though DTH has demonstrated strong growth post-pandemic, distributions are yet to return to that level (which is questionable given FX headwinds and a slew of DPS cuts should recession materialize).

Created by the author. The data pulled from the WisdomTree website

Anyway, the fund targets the high-yield players, not those with a track record of raising the DPS.

Final thoughts

DTH is an international dividend ETF with value and quality filters yielding ~6.3% (the SEC 30-day yield is 4.8%).

Its performance in the previous five years was lackluster, which is barely a coincidence given FX issues and the different zeitgeist: investors favored U.S. growth and speculative growth, while the developed world currencies performed patchily, being affected by the trade war and then the pandemic later in the decade.

I appreciate its dividend growth trend, though I also see the FX risks worthy of concern, principally stemming from exposure to the Japanese yen, the pound sterling, and the Australian dollar. DTH is a Hold.

[ad_2]

Source links Google News