[ad_1]

ETFs have become a dominant force in the market.

Here are the winners and losers so far this year.

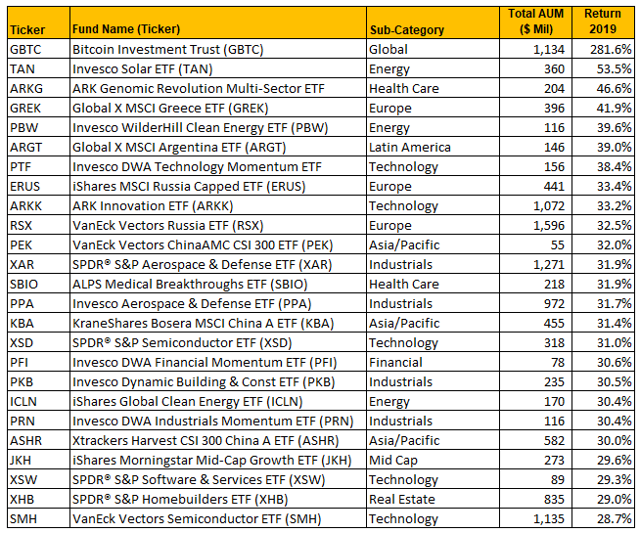

Winning ETFs 2019 First Half

It should not come as a surprise that one of the most volatile of all asset classes – bitcoin – is the top-performing ETF this year. Bitcoin aficionados have been paying a heavy price for the last two years, and the minority of true believers who have stuck with bitcoin have been rewarded in 2019. But they haven’t yet been made whole.

In 2nd place is Solar Energy. Regardless of what you may think of the climate debate/fossil fuel debate, solar is growing and creating a massive number of new jobs.

In 3rd place is Genomics. There is so much promise in this slice of the economy that more and more investors want to be a part of it.

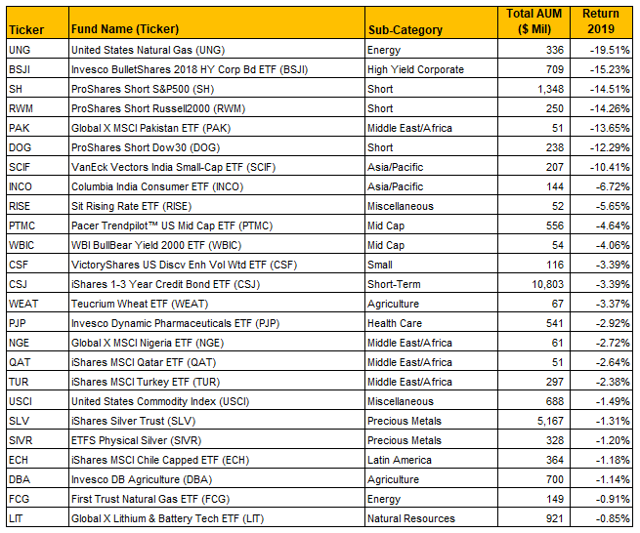

Losing ETFs 2019 First Half

This is the list of unfortunate souls who simply guessed wrong. Who among us can claim that we never bet on a losing horse? Not me. Betting on a loser is just part of the game. Smart investors look at the numbers and ask themselves why they made that bet in the first place. That’s what self-awareness is, and it can save you from a string of bad choices if you are willing to do some soul-searching.

Natural Gas was the worst performer in 2019 first half. I don’t know how many times I’ve tried to pick the bottom of this asset class, but I can tell you that I’ve been burned every time.

Corporate High Yield Bonds take the 2nd spot on the losers’ list. My view is that investors perceive that the risk of default for junk debt is increasing.

Skipping over the ETFs that are short in a rising market we arrive at the 3rd worst performer – Pakistan. After years of outperforming other countries, Pakistan has succumbed to mean reversion. It may rise again in the next 6 months, but for now it’s a loser.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link Google News