[ad_1]

Photo by Tarik Haiga on Unsplash

Photo by Tarik Haiga on Unsplash

Now is a good time to add exposure to Turkey (TUR) to your portfolio via the iShares country ETF. Turkish stocks are inexpensively trading at 6x earnings, and exports should almost mechanically boost growth after the fall in the Turkish Lira.

Mr. Market loves to swing between the extremes of fear and greed. Turkey shows this. It is a significant global economy, with the 20th largest economy in the world, about the size of Switzerland or Sweden. However, in late summer 2018, an economic crisis hit Turkey. A credit crunch hit after a lending binge, and the Turkish lira almost halved (see chart below). In response, the central bank raised interest rates to 24%. In addition, Turkish core inflation spiked into the high teens. Turkish interest rates and inflation remain elevated today. Turkish unemployment is now approaching 15%, the highest level in a decade.

Data by YCharts

Data by YChartsThe Risks Of Erdogan

There are political risks too. After the failed coup of 2016, Turkey has migrated to a presidential rather than a parliamentary system and President Recep Tayyip Erdogan has been criticized for his human and civil rights record.

In fact, Erdogan was imprisoned for inciting religious hatred in 1999 early in his political career. Censorship is high in Turkey, for example in H2 2018, Twitter received more removal requests from Turkey than any other country (though note China, North Korea, Iran and Turkmenistan block Twitter entirely). Still, though this makes bleak reading, it is less significant from an investment standpoint. Research by Credit Suisse in 2015 has found that countries with high corruption levels tend to see better than average stock market performance.

A Positive Outlook And Valuation

So why bother? Terrible economic data and a potential corrupt political environment do not inspire confidence. Nonetheless, Turkey may be set to outperform, simply because the situation is likely to improve from here. Past research on Turkey’s own history and the fate of countries in similar situations bears this out.

Just as we’ve seen many times in the past with the Dogs Of The World strategy, which involves owning the country ETFs of past poor-performing countries, it is now hard for things to get too much worse in Turkey and significant upside is on the table should things improve. This is especially true against an undemanding 6x earnings multiple. Research Affiliates estimate Turkey is now in the 3rd percentile of its historical valuation range. As such, Turkey is about as cheap as it has ever been, at a time when most global markets are at least moderately expensive on traditional valuation metrics. That’s why owning an ETF holding a range of Turkish stocks may be a smart move.

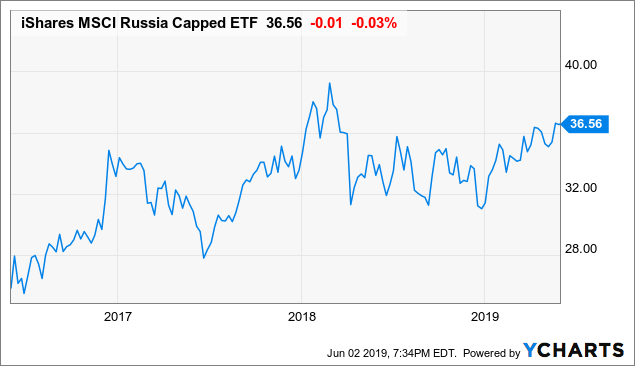

Perhaps the easiest way to illustrate this point is with two recent examples. The first example is Russia (ERUS), after a crisis in the currency caused in part by reactions to its Ukraine aggression and weak oil prices, Russia has seen material performance in recent years up over 40% in aggregate. Here we use a Russian ETF as a proxy for the market.

Data by YCharts

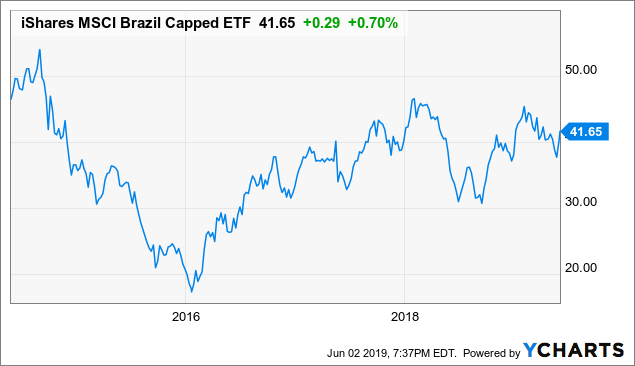

Data by YChartsA similar pattern is evident with Brazil (EWZ). The company experienced a 2-year recession and a corruption scandal. However, the Brazilian market has doubled off the 2016 lows. As the economy has picked up, so, broadly, has the stock market. Again using an ETF as a market proxy.

Data by YCharts

Data by YChartsThere are reasons to believe in similarly positive prospects for Turkey. In fact, statistical analysis of similar poor performing countries suggests Turkey could return around 12% a year over the next 5 years if the performance of similar countries is any guide.

Valuation

Valuation supports this. Turkey currently trades on both a PE and 10-year PE (CAPE) of under 8x and has a dividend yield approaching 4%. At a time when the U.S. market trades at double to triple those valuation metrics, there is relative valuation to support for Turkey. Plus, Turkey is reasonably well-diversified as a country with major products including textiles, electronics, cars and steel. The country is not exposed to just a single sector of the global economy, which could add risk. With some country ETFs you are placing a bet on just a handful of companies or a particular sector that dominates an economy, but with Turkey your risk is spread more broadly.

Favorable Demographics

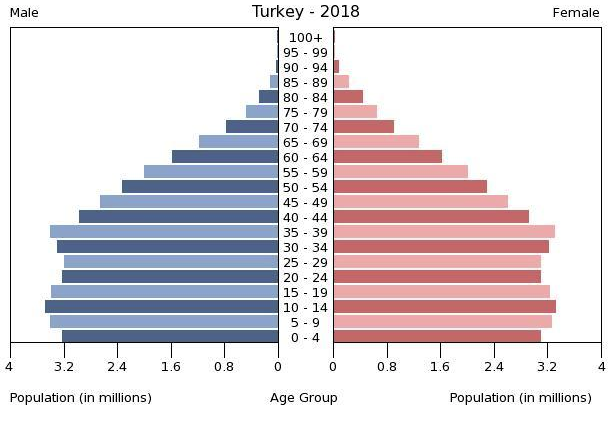

One issue for much of the world today is that the population is aging. Yes, of course, you might say, people get older, why is this important? Well today, as people age they are not then replaced by new births as they were for much of the post-war period. Basically, people are having fewer kids. The effect of this is you end up with a large elderly population and fewer young people to support them. That can slow economic growth. Ideally, you want a lot of working age people and fewer very young or very old people in your population. Fortunately, even though most of the world lacks this demographic structure, Turkey has it. You can see below that Turkey has a large working age population and fewer elderly people. This is positive for economic growth.

Source: CIA World Factbook

Why Country Performance Can Be Mean Reverting (And When It Isn’t)

The other thing that is helpful for Turkey is simply that the Lira has depreciated (fallen in value) so much. This makes Turkey’s exports far more cost competitive globally. It is a growing export sector that should help power the improvement in Turkey’s fortunes. For example, textiles or steel from Turkey is now significantly cheaper for other countries given the Lira’s fall and as a result demand should rise for Turkish exports.

This is also one of the reasons the Dogs of the World strategy did not work as well for Greece, since Greece is a member of the Eurozone it was unable to depreciate its currency to help with its economic problems. Though a collapse in the currency is never painless, it can be a better choice than other ways of helping an economy adjust.

Owning Turkey Via An ETF

The is just a single ETF choice for investors in Turkey looking for pure Turkish exposure. It’s the iShares MSCI Turkey ETF with net assets of $385M and an expense ratio of 0.58%. It contains 48 individual stock holdings. The primary sector exposures are financials (26%), industrials (22%), consumer staples (16%) and materials (12%). The top ten holdings are 59% of the ETF, though no individual holding exceeds 10%. The largest holdings each representing 5% or more of the fund include: two major banks (Akbank and Garanti Bank), food retailer Bim, oil refiner Tupras, and the diversified industrial conglomerate Koc Holdings. As such the iShares Turkey ETF offers a diversified way to play an anticipated macroeconomic rebound in the Turkish economy over the coming years, without any excessive exposure to company or sector risk.

Of course, owning individual stocks could result in more targeted exposure and remove the 0.58% expense ratio cost. Though in this case, the ETF offers simplicity, diversification and relatively broad exposure to a set of companies in the materials, energy, industrial and consumer sectors that should benefit from greater export growth as the currency devaluation increases Turkish competitiveness.

Final Considerations

So we can conclude Turkish stocks may be set for a positive run. The extremely weak historical performance is typically a good sign and the country is inexpensive on valuation metrics in absolute terms and relative to its own valuation history. Not only that, but logically the fall in the currency should help the growth and profitability of the Turkish export sector going forward, which is well represented within the ETF, Turkey’s demographic trends are also favorable for the medium term.

Remember, this is a volatile strategy. Turkey’s high inflation and unemployment suggest that over time things should improve, simply because it’s harder for them to get much worse from here and the currency depreciation should ultimately deliver strong export growth. However, if there are further political or economic crises then Turkey could, of course, fall further.

Nonetheless, in the current market bargains are hard to find. Turkey appears to offer one, backed by the prospect of export-driven growth over the coming years.

Disclosure: I am/we are long TUR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News