[ad_1]

Torsten Asmus

When we last covered Virtus InfraCap U.S. Preferred Stock ETF (NYSEARCA:PFFA), we applauded the performance but said “no” to going long. We just did not think fixed income crowd, who had been on the wrong side of the rate cycle, was ready for what was coming next. Specifically we said,

We think there are likely to be even more aggressive surprises from the Federal Reserve and we would be cautious in general on leveraged income ETFs. The trading record to this point though has taken a lot of the pressure off from a potential distribution cut. If the NAV was down 15-20% instead of the 8.72% we have seen, we would press our distribution cut call. But as it stands, PFFA is furiously swimming against the tide. Two thumbs up for the performance.

Source: Exceptional Trading, Not Enough To Offset Macro Headwinds

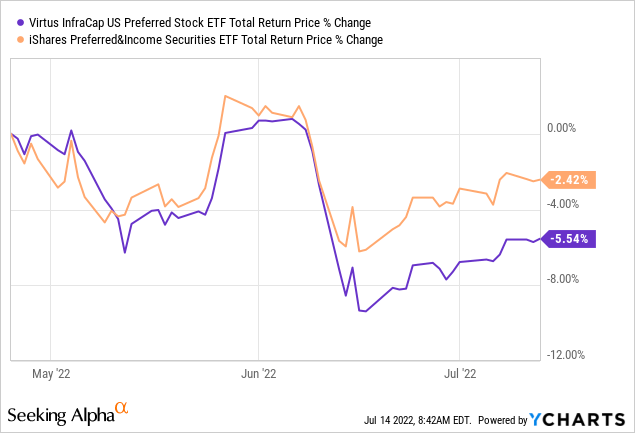

Interestingly, PFFA has actually underperformed even iShares Preferred and Income Securities ETF (PFF), a fund we often benchmark it against.

What has caused the recent drawdown and are we finally seeing the fund priced in a way that the distributions are actually not being offset by NAV drawdowns? We look at those two questions.

A Tale Of Two Timeframes

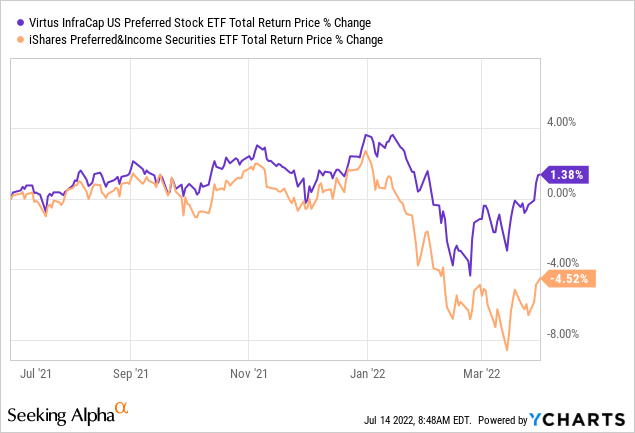

If you examine PFFA vs PFF during the July 1, 2021 to March 31, 2022 time frame, PFFA clearly has the advantage.

The key reason in our opinion was the extreme differential in the interest rate vulnerability of the two funds. Preferred shares are sensitive to interest rates and this is directly proportional to the face yield or yield on par. PFFA was long junk level preferred shares and these had far higher rates. Hence when the duration hit rang across the fixed income space, PFFA dodged the first bullet. We mean this in a relative way of course, but the performance was still applause worthy.

As we rolled past March, the markets finally began to get it. What they got was that the Federal Reserve was no longer the cuddly friend they had in the past. What they got was that never in the history of capital markets have we reduced inflation from 5% plus to under 2%, without a recession. It just has not happened. As the “R” word became the talk of the day, the shift was from duration sensitivity to credit sensitivity. As mentioned above, PFFA plays in the lower junk tiers than PFF and that is what drove the underperformance.

Holdings & Outlook

PFFA trades furiously so it is hard to derive conclusions from its present holdings. Nonetheless, our past conclusions have been on target, so we will try again today.

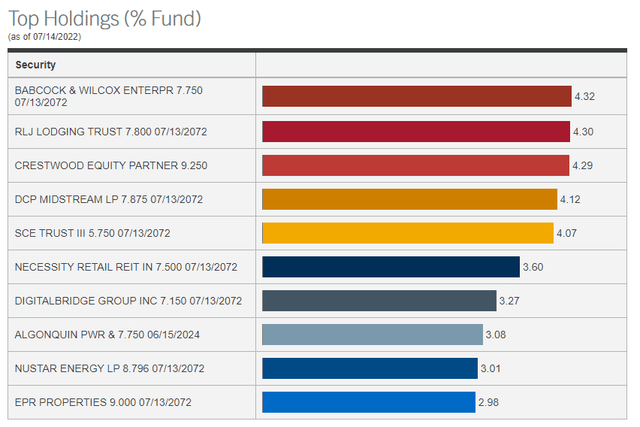

The fund is not betting too heavily on any one position and the top 10 make up less than 40% of the fund.

VIRTUS-PFFA

Unlike some previous occasions, most of the top 10 holdings like, Babcock & Wilcox 7.75% Preferred (BW.A), DCP Midstream LP 7.875 (DCP.PB), The Necessity Retail REIT Inc., 7.5% PFD A (RTLPP), trade under par. If investors recall, when we had suggested that there was no chance for PFFA to deliver total returns exceeding its distributions, the opposite was the case. If these securities are trading over par and have a very low yield to call, then you are setting yourself up for disappointment.

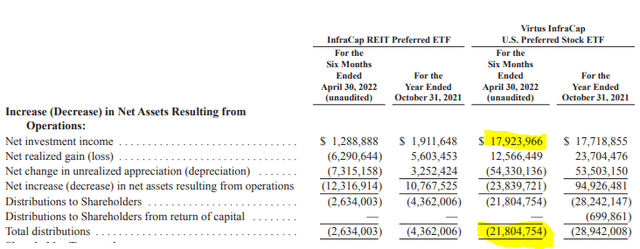

The latest semi-annual report also shows that net investment income has lagged distributions. This again points to our theme that investment income would lag distributions.

PFFA Semi Annual Report

Yeah, investors may point to net realized gains but those have to be offset against the even larger unrealized losses.

For an investor buying today at least, the yield being generated, over 9%, is being funded predominantly from internally produced income. There is no way to be certain of this as the high turnover and leverage costs are big moving targets. But we would wager that we are looking at an 8% plus internal yield. This puts less pressure to try and generate capital gains.

Key risk remains that we hit a severe recession, in which case the lower tier holdings likely get hit once more. Preferred shares tend to perform well in mild recessions but suffer in severe ones. Contrasting the 2001 recession with that of 2008-2009, proves this point. While that may be so, the preferred share asset class as a whole is nicely priced here. What we mean by that is we are getting 500 basis point spread to 10 year Treasuries for many preferred shares where we estimate an extremely low probability of default. This is good and while spreads can widen, the discerning investor can pick up a lot of good deals today.

Verdict

We are giving a weak buy to the PFFA fund at this point as we think a lot of damage has been done and reasons to avoid this are now in the rear view mirror. Risks are still present and perhaps higher today, but the underlying securities are better priced. We have been picking preferred shares one by one and not wading into closed end funds or levered ETFs, yet, but that moment may come as well.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Source links Google News