[ad_1]

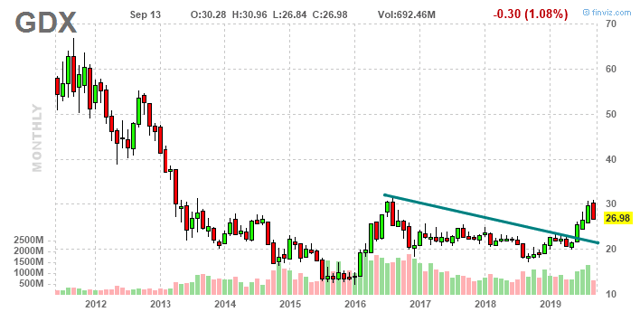

Just like last time, I am very excited to write this article. Not only because the current call to buy miners (VanEck Vectors Gold Miners (GDX)) has been one of my best trades this year, but also because the current gold miner thesis contains everything that’s important with regard to the current market. Over the past few months, I did not find it necessary to update my call as nothing groundbreaking has happened. However, now is the time to revisit the bull case and tell you why I am waiting for the next leg higher. So, bear with me!

Source: Digital Alabama

Source: Digital Alabama

Why So Bullish?

Let’s start by revisiting my article written in June. I advise you to read the entire article if you can spare a few minutes because I am only going to highlight a few key points in this article – for the sake of time management.

- First of all, we are in the midst of a global growth slowing trend as I will show you in this article. Asian and European growth peaked in Q1 of 2018 while growth in the US was able to remain strong until Q4 of 2018.

- As a result, the Fed is very likely about to start an easing cycle due to lower growth and pressure from tariff uncertainties. The Fed already cut rates once on July 31 of this year (see full history of Fed actions).

- Despite severe weakness in Europe, the euro was not able to break down signaling that the pressure on the dollar is seriously rising.

- The market was not heavily long gold, leaving a lot of upside from an asset allocation standpoint.

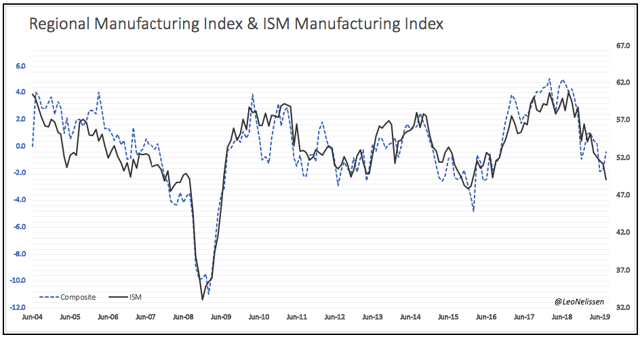

Interestingly enough, I can update almost every single point in this article, starting with economic growth. The leading ISM manufacturing index took a hit in August as America’s leading indicator dropped to 49.1. This is 0.9 points below the neutral 50.0 level and suggests that we now have entered contraction. If you want to know the full story, feel free to read my economic outlook article.

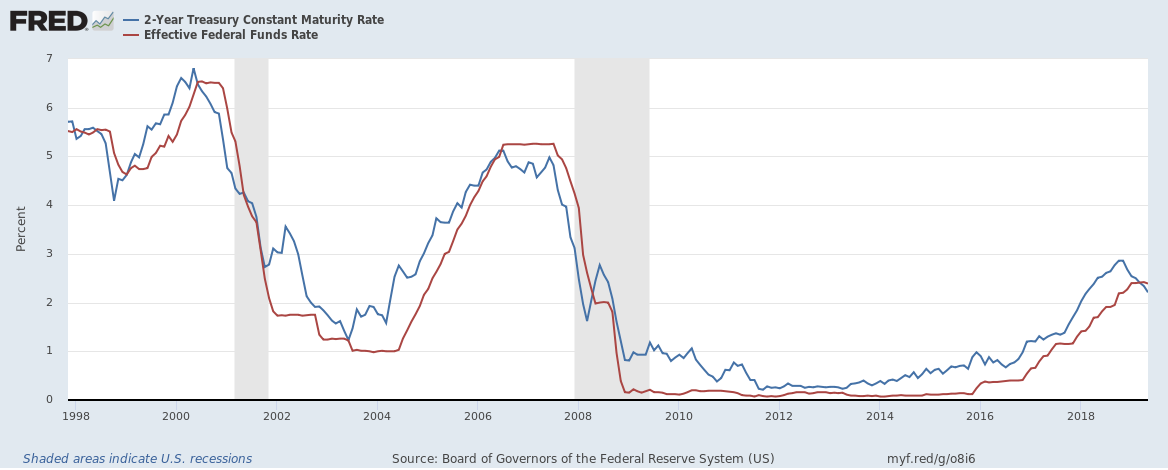

As a result, the Fed has started to cut rates as I already briefly mentioned. In July, the central bank cut its rate by 25 basis points to the new range of 2.00-2.25%. The graph below was also used in my previous GDX article and shows the difference between the Fed funds rate and the 2-year US government bond yield. After the recent rate cut, the difference has decreased. Nonetheless, “the market” is still expecting at least one rate cut on the mid-term and a decline as we can see below within a few months is usually the start of much more than just two potential rate cuts.

Source: TradingView

The reason I say we might be in for more rate cuts is the graph I showed in my previous GDX article. Peaking rates after years of economic improvement are almost always a sign of a new cycle. In this case, an easing cycle.

And speaking of easing, the European Central Bank just cut its rate again. The ECB cut its deposit rate to -0.5% from -0.4% and mentioned a new QE program starting November 1st. This will include buying debt worth 22 billion EUR ($22 billion) on a monthly basis until the ECB achieves its inflation targets.

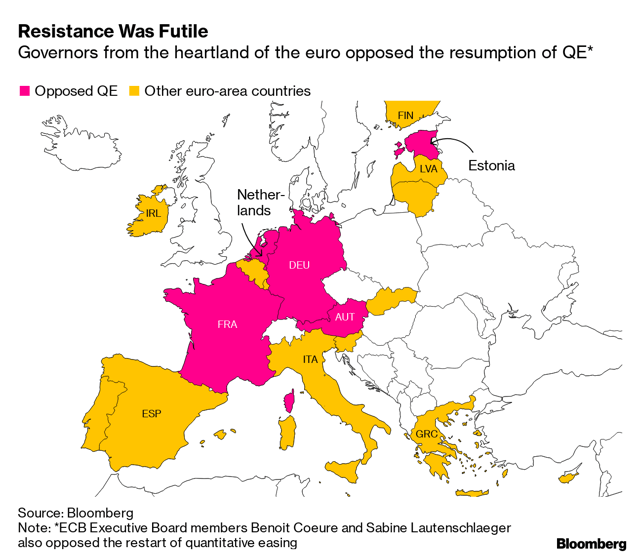

So what is this based on? A recession? The answer is NO. According to the ECB, the probability of a recession is low, but the probability has gone up. At this point, I could start a 50,000-word essay covering European politics. However, to keep it short, I want to show you the map below (source). The map shows which countries supported QE and which ones did not. Almost needless to say, the stronger countries like Germany and the Netherlands oppose QE. Even France is opposing QE. The weaker countries like Spain and Italy are in favor of QE.

I think we are going to see a lot of “interesting” cash flows from the stronger countries as these countries are getting a load of QE on top of already high inflation rates. The inflation rate in the Netherlands is at 2.8%. Italy’s inflation rate is at 0.50%. I am one of the people who live in the Netherlands as you might have seen in my Seeking Alpha bio. And let me tell you one thing, everyone with liquidity is looking for investment and gold is one of the places people put their cash.

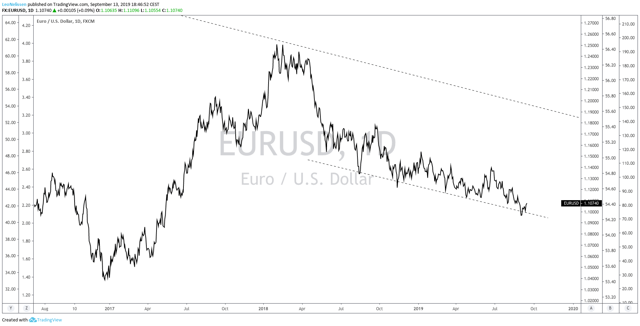

With that said, this article is not aiming to tell you how Europe is doing. The reason why I am discussing the ECB is the current euro strength. Even after the QE announcement, the euro rallied.

The graph below shows the EUR/USD. There is a clear downtrend but no breakdown. In other words, the entire global growth slowing trend and talk about a possible German recession was not able to cause an EUR breakdown or a dollar index breakout. That’s how much upside potential is currently building up in USD index currencies.

Source: TradingView

Source: TradingView

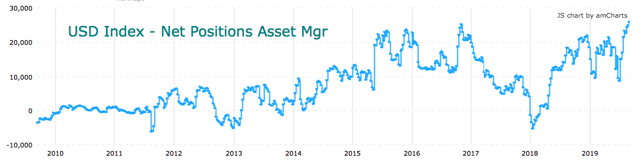

Moreover, more than 90% of asset manager USD index futures are long which is a new cycle high. We are now at levels above 2015 highs shortly before gold started to rally. To be fair, gold net positions are also at cycle highs (source).

Source: TradingSter

Source: TradingSter

So, both USD and gold net positions are at cycle-highs. This can happen, but one of them has to go down. This is unsustainable on a longer-term basis. Personally, I expect that dollar positioning will fall. At this point, dollar bulls will be fighting pressure on the Fed, positive news regarding trade talks and the fact that the dollar is not able to rally against currencies like the EUR.

That said, the GDX ETF is my main trading tool and core of my gold articles. Simply because this ETF contains a lot of gold miners, meaning one does not need to pick a single miner. Picking strong miners is tough and single mining stocks are very volatile. Anyhow, this ETF is up 30% year-to-date and almost 60% higher compared to 12 months ago. I am happy to see that the ETF is pulling back a bit as I expect this uptrend to pick up again on the mid-term. In my previous article, I mentioned that $30 was my target. Interestingly enough, that was the exact peak before the ETF declined $4.

Source: FINVIZ

Source: FINVIZ

At this point, I do not own GDX or any gold miners. I am waiting for a bottom and further USD weakness to start buying again. We are living in crazy times, and I expect more dollar weakness on the mid-term. I also expect the inflation rate to pick up in Europe and in the US, which is why I want to be long GDX maybe even on a long-term basis.

I want to thank everyone for the interesting discussions that started after my last GDX article and hope to hear everyone’s opinions.

Stay tuned!

Thank you very much for reading my article. Feel free to click on the “Like” button and don’t forget to share your opinion in the comment section down below!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

[ad_2]

Source link Google News