[ad_1]

I recently published an article explaining why I think IMO 2020 could imply higher shipping rates and a higher price for the Breakwave Dry Bulk Shipping ETF (BDRY). In this article, I provide projections for BDRY price based on statistics and oil futures prices. Though the price has appreciated greatly over the past month, I find the latest closing price of $17.20 is still about 18% to 20% undervalued.

Methodology

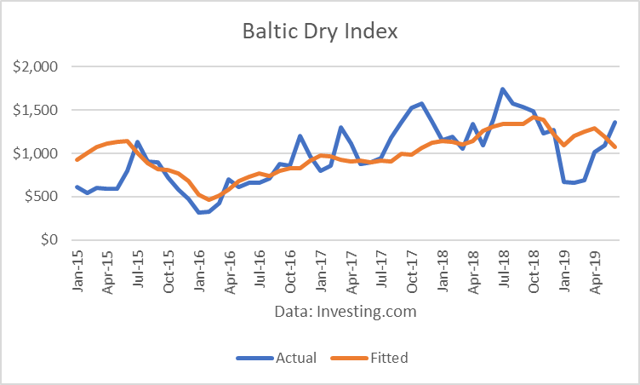

Shipping rates are based on supply and demand. However, because of lead times required in ship building, the supply of ships is highly inelastic. Therefore, the Baltic Dry Index is highly sensitive to changes in demand.

The primary variable cost in shipping is fuel, since capital costs and manpower (wages) are relatively fixed costs. Therefore, I performed a regression for the Index as a function of high sulfur residual fuel prices in the U.S. (data: Energy Information Administration). Of course, fuel prices vary throughout the world, and so this data is only a proxy for world oil marine fuel prices. The fitted line in the graph above comes from the regression equation.

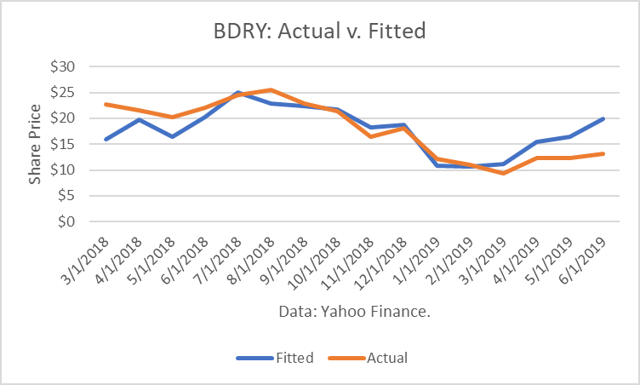

Next, I performed a regression between BDRY and the Baltic Dry Index. Data for BDRY are limited. The fitted values are in the graph above.

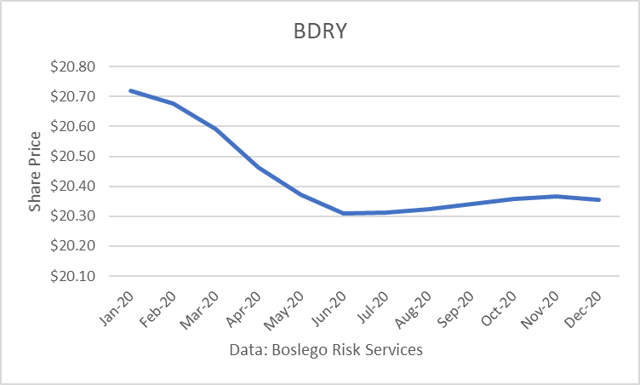

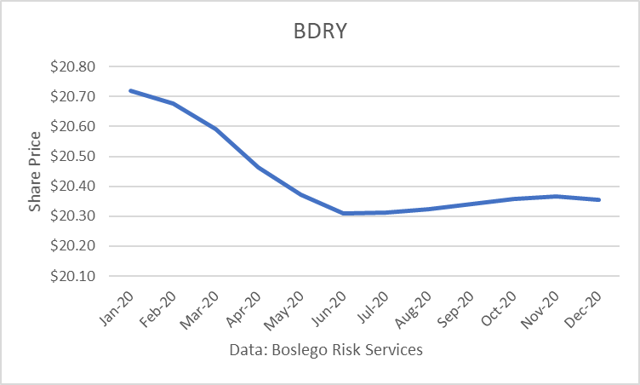

Finally, I used the regression equation with NYMEX futures prices (dated July 17th) for heating oil, as a proxy for the low sulfur marine fuel for 2020. The resulting price forecast for 2020 varies from $20.30 to $20.70, an appreciation of 18% to 20% over the latest closing price (July 18th) of $17.20.

Source: MarketWatch.

Conclusions

Based on the methodology explained above, the ETF BDRY is still undervalued, even after climbing 84 % over the past month. And as I explained in the prior article, the supply of ships may decrease between now and the year-end due to ships being outfitted with scrubbers, and so the BDRY could go above the projected level prior to year-end.

However, oil futures prices may go higher or lower, and that would impact the projections. Perhaps the biggest risk to the downside is if there is a negotiation with Iran that leads to the ending of sanctions. In that event, Iran’s 2 million+ barrels of oil would return to the market, cratering oil prices.

Are you pleased with your energy sector returns?

To guide investors who are interested in profiting from outstanding opportunities in the energy sector, I provide a service on Seeking Alpha’s Marketplace oriented toward individual investors, Boslego Risk Services. A long/short Model portfolio is continuously updated, along with on-going analysis of the oil market.

I am now accepting new members to Boslego Risk Services and invite you to sign-up. There are monthly and annual pricing options as described here. You may also read reviews posted by members here.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BDRY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News