Think there’s just one type of stock chart? Ever heard of candlestick patterns ? There are also several different types of stock charts that traders can review as part of their stock research.

If you’re a brand-new trader, you’ll probably start by looking at the simplest and least daunting line and bar charts. But once you start to gain a better understanding of the market, there’s a great tool to add to your stock chart analysis repertoire: candlestick patterns.

At first glance, candlestick patterns may look complicated. But they’re actually a lot easier to read than it might seem initially. And they offer different information than line or bar charts that can help give you a better bird’s-eye view of what’s going on with a stock.

Ready to learn more? In this post, you’ll get a basic education on candlestick patterns, including basic candlestick anatomy. I’ll also cover fundamental patterns and how to read and use the information you find.

Candlestick Patterns: What Are They and How Do You Use Them?

Believe it or not, it’s likely that the candlestick pattern was initially developed in the 18th century … by a Japanese rice merchant.

Munehisa Homma was a rice trader in Osaka — and apparently an enterprising fellow. According to some accounts, he got ahead in the rice market by establishing a network of employees located at regular geographic intervals.

Through this long chain of people, he could quickly receive word about the most up-to-date market prices, and he used this information to get an edge in the market.

Homma is also said to be the father of the candlestick pattern, although the information about exactly how he developed it is kinda sketchy.

Regardless of whether he’s the inventor of candlestick charts, the concept took off. The candlestick pattern was adopted by others. And it later spread more widely via Steve Nison, who wrote the book “Japanese Candlestick Charting Techniques.”

So what’s the fuss? A candlestick pattern can give you a lot of information about a stock in an easily deciphered graphic form. Many traders consider these patterns a great tool for technical analysis.

But what exactly is a candlestick pattern, and how can you use it? Here’s what you need to know…

What Is a Candlestick Pattern?

To understand a candlestick pattern, let’s start with the candlesticks themselves.

Each candlestick can show a stock’s open, close, high, and low prices within a specific time frame that you set. But really a candlestick chart pattern can actually offer much more than that, once you learn how to read it. It can tell you a lot about the attention and trader action around a stock.

As with any other stock chart, candlesticks can reveal stock patterns that can help you confirm trends and help you make more-educated trade decisions.

How to Read a Candlestick Chart

The first time you look at a candlestick chart, it might seem incredibly complicated. Don’t let that dissuade you from learning this pattern. The good news is candlesticks really aren’t so complex. Let’s review the anatomy…

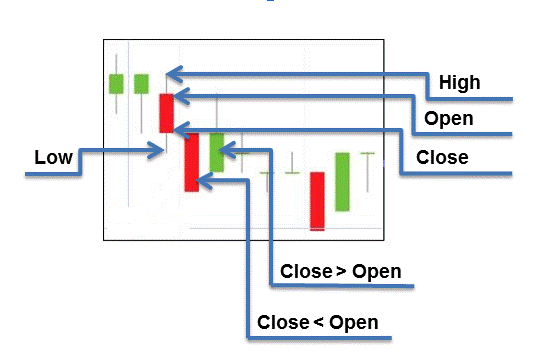

Candlesticks have two key parts: the body and the shadow.

The candlestick body looks like a pillar candle, and the shadow looks like the candle’s wick. The shadow can extend in either direction of the body, top or bottom — and sometimes even both ends (insert ‘burning the candle at both ends’ pun here).

(Source: StocksToTrade)

The candle’s body can tell you a few main things within the time period you set:

- Opening price

- Closing price

- Which direction the share price went — up or down

In StocksToTrade, a green candlestick tells you that the stock’s closing price was higher than its opening price.

On the other hand, red candles indicate that the closing price was lower than the opening price. At the bottom of the candlestick’s body, you’ll find either the opening or the closing price.

With a green candlestick, you’ll see the opening price at the bottom and the closing price at the top. With a red candlestick, you’ll see the opening price at the bottom and the closing price at the top.

What about those shadows? Within the time period you set, they can show you the high and the low.

The top shadow represents the period’s high, regardless of the candle’s bullish or bearish status. The bottom shadow indicates the period’s low.

Types of Candlestick Patterns

Now that you have an idea of how to decipher a candlestick chart, let’s discuss some of the different patterns you can look for.

Bullish Candlestick Patterns

Bullish candlestick patterns feature a closing price that’s higher than the opening price and will show an upward trend.

If the trend is moving upward within the time period you set for the chart, it’ll display in green on StocksToTrade.

Here are a few examples of popular bullish candlestick patterns:

The Hammer

This is a bullish candlestick pattern that shows that buying pressure has quickly overcome a temporary sell-off, aka bullish price behavior.

In this pattern, the candle’s body is short with a long lower shadow. This can be a sign that sellers are driving the prices down during the trading day, but that buyers are coming in to push the trading-day close higher.

But it’s important to be able to confirm that the trend is turning upward — keep a watchful eye and remember to check the trading volume.

Another variation of the hammer is the inverted hammer. An inverted hammer has a long wick above its body. So, if seen in a downtrend, it can indicate that the market has tested higher, then been sold off.

Traders can clue into the fact that the market was willing to test higher and look for further bullish price action. It could be an early indication of a reversal.

This can be a sign that the opening price was followed by lots of buying, then lots of selling that failed to bring the price below the opening price. And just like with the hammer, you should look for further confirmation with other bullish price action, such as a gap up on higher volume.

The Morning Star

Like the first rays of light in the morning, the morning star can be like a beacon of hope for the new day ahead…

This pattern features three candles:

- The first one is a long red candle.

- The middle has a short body and can be either red or green.

- The third has a short green body.

This type of candle shows that prior selling pressure could be waning. The final candle can show that there’s a renewed trend of buying, potentially setting off a bullish reversal. This should always be confirmed with volume.

Bearish Candlestick Patterns

Bearish candlestick patterns feature a closing price that’s lower than the opening price and will show a downward trend.

If the trend’s moving upward within the time period you set for the chart, it will display in red on StocksToTrade.

Bearish Engulfing Pattern

This pattern sometimes occurs at the peak of an upward trend, or when a correction occurs during a downtrend.

This pattern is characterized by two candlesticks. The first has a long body, little shadows, and a higher close.

The second candle totally covers the body of the first candle, engulfing its entire range. It pretty much shows a total reversal in the momentum, with the second candle reversing the prior gains. That’s what makes it bearish.

Evening Star Pattern

The evening star is the yin to the morning star pattern’s yang. It’s another three-candlestick formation, featuring a first candle with a close that approaches the high.

The second candle extends above the first with a small body. And the third slips down below the second candle, closing beyond the middle of the first candle’s body.

This pattern is visually striking — the second candle is above the other candles, showing that the upward momentum may have played itself out.

Other Types of Candlestick Patterns

Another term you’ll encounter a lot when you start studying candlestick patterns is the doji. What’s that?

The Doji

(Source: StocksToTrade)

The doji is a particular candlestick-pattern phenomenon. This candlestick shows an open and close that are pretty much equal.

A doji candle kinda looks like an elongated plus sign or a religious cross, and depending on where it crosses, it might be called a gravestone, long-legged, or a dragonfly. By itself, this candle type is neutral, but it can figure into a variety of other patterns.

Often, the doji can be a signal of a reversal pattern in technical analysis, which can show indecision. With a lack of clear conviction, this could be a sign that the trend’s about to change. But that’s not always the case.

The doji could also represent a moment when either buyers or sellers are temporarily at a standstill before a trend continues. In this way, it shows the market could be consolidating in preparation for its next move higher.

What to Look for Before Trading

That wraps up your basic training on candlestick charts and candlestick patterns. So how can you start to use them? Here are some things to keep in mind:

- Don’t trade based on candlesticks alone. Candlesticks can tell you a lot about a stock’s momentum, but they should only be one part of your stock research. Be sure to back up your chart research with fundamental research and by checking indicators too.

- Shadows are significant. If there’s a long shadow, it can be an indication that there’s resistance to either buying or selling pressure … And one always comes out ahead.

- The time frame matters. Don’t make the mistake of thinking that you’re seeing something you’re not. A one-year chart is different from an intraday chart, for example.

- Don’t forget the doji. The doji can show the balance between buyers and sellers and can give you an indication of a reversal — so learn about the doji and its variations!

StocksToTrade

Candlestick patterns contain a ton of information that can help traders create strong, calculated trading plans. To make them work for you, you need knowledge … and powerful trading tools.

StocksToTrade was designed for traders by traders with the goal of helping every trader perform more-detailed, accurate research that’s essential for creating strong watchlists and trading plans.

Here are just a few of the perks of the platform:

- You can scan over 18,000 stocks from all the major U.S. exchanges.

- Amazing charting software can help you track price action and find patterns in the stocks you follow.

- A paper trading module that can help you learn the market, try out trading, and test new strategies before you put real money on the line.

- News integration to help you track things like SEC filings, company news, and social media buzz — all right from the platform.

- Broker integration that allows you to trade right from the platform — no switching back and forth between different apps, screens, or programs.

See how STT can help you on your trading journey every day. Get your 14-day trial of StocksToTrade for just $7 today!

Traders: How do you use candlestick patterns to inform your trades? Newbies: Are you ready to use candlesticks in your market research? Leave a comment and let us know your experience!