[ad_1]

Maksym Belchenko/iStock via Getty Images

Instrument

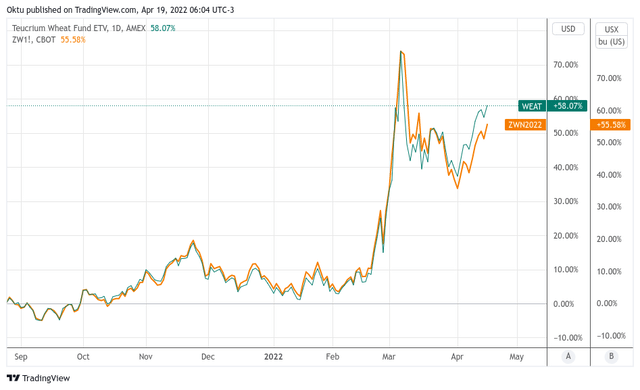

The Teucrium Wheat Fund (NYSEARCA:WEAT) provides investors unleveraged direct exposure to wheat without the need for a futures account. Therefore, the decision to invest in this fund should be made after analyzing the wheat market.

TradingView, Author

Ukrainian-Russian factor

The Russian invasion of Ukraine, despite been predicted in advance, has caused extraordinary volatility in the grain markets. The influence of this factor is difficult to overestimate. But the main thing is that this factor is only gaining momentum.

Ukraine provides almost 10% of world wheat exports, most of which goes to developing countries in Africa and Asia. By the way, this market is not key for the US.

The beginning of hostilities in Ukraine coincided with the beginning of spring field work. It is difficult to assess how successfully the farmers in the eastern regions coped, but that doesn’t matter. It is much more important whether they will be able to harvest and where and how they will sell it. Ports in the eastern part of Ukraine are not under the control of the Ukrainian authorities.

Now it is almost impossible to answer these questions because it is connected with the course of hostilities, which have now become more active. This is a big factor of uncertainty and it will remain in price.

Sanctions against Belarus and Russia

It should be understood that possible problems with the export of wheat from Ukraine are only part of the story. The consequences are much more painful.

Western sanctions have significantly reduced the export of fertilizers from Russia and Belarus. These two countries account for about 40% of worldwide potash exports. This is really a huge part of the market.

Rising prices for fertilizers will cause farmers to use less of them. In turn, this will lead to a decrease in yields and a reduction in acreage on a global scale. This is a powerful, long-term factor to ensure that prices on the grain market remain high for a long time to come.

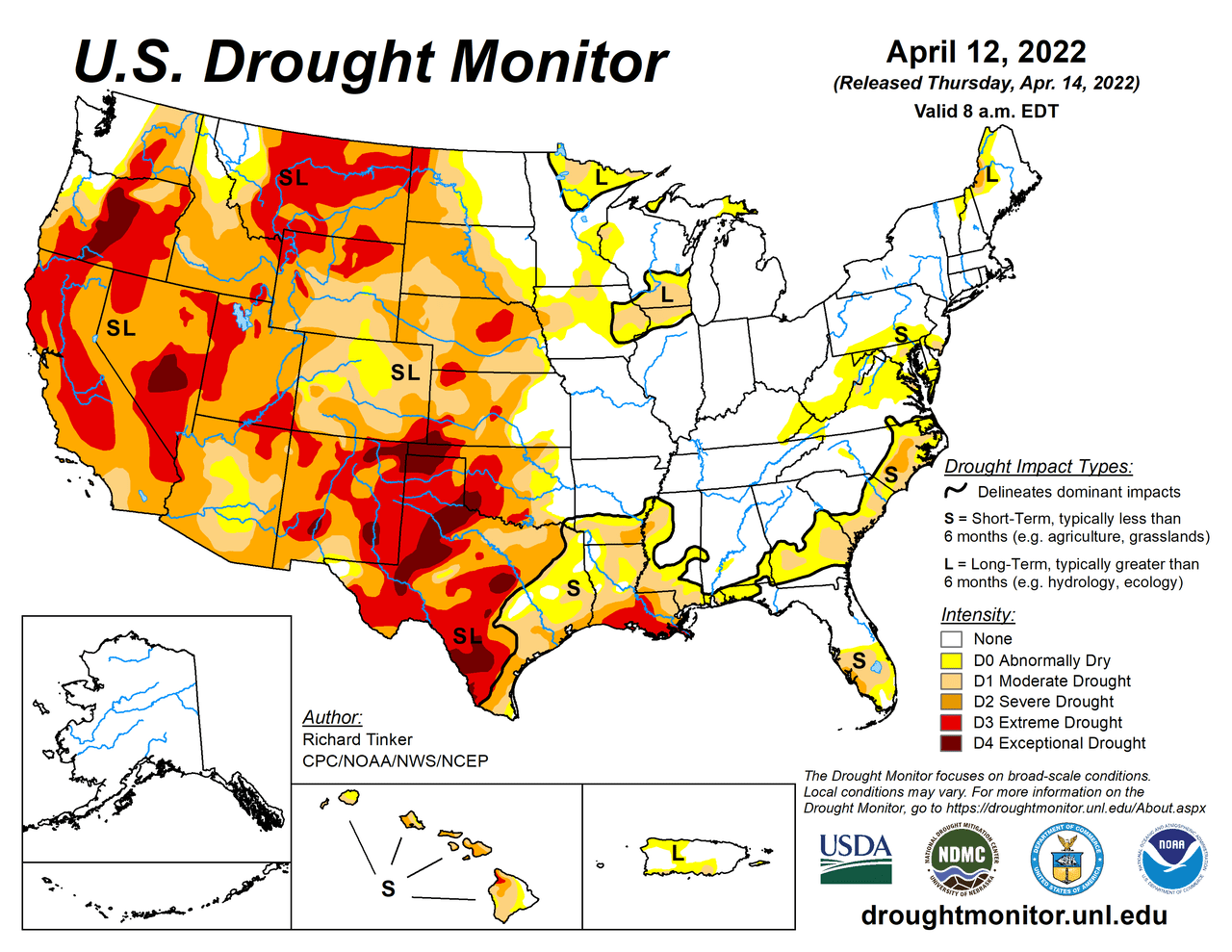

Weather issues are also present

At the same time, we should not forget that we are entering a period of increased weather risks for key wheat growing regions in the US and Europe. There are also problems here. And by the way, here is how threateningly the drought map in the USA looks like:

US Drought Monitor

In general, it is naive to hope that the weather will be perfect. Experience teaches that the opposite is often the case…

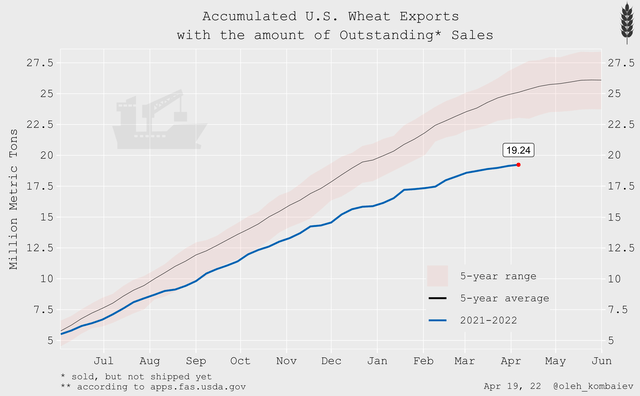

Impact on US exports

Now let’s move directly to the US market, since that is the focus of this article.

After everything I’ve written up to now, you can expect demand for US wheat to be strong. Alas, export statistics do not confirm this.

According to the USDA data the accumulated volume of exported wheat together with the outstanding sales in the U.S. amounted to 19.24 million tons. This is the worst result in the last five years:

Author

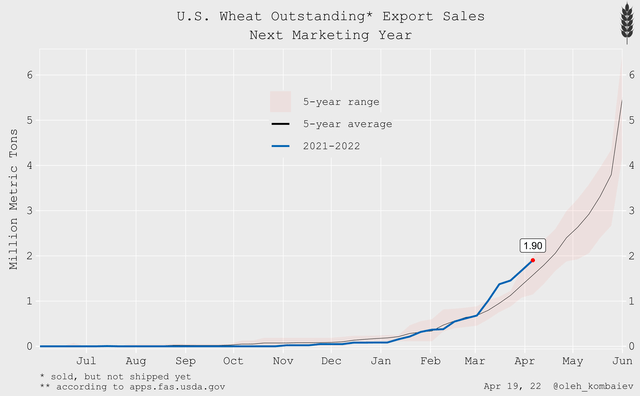

The sales volumes of the crop of the next marketing year are within the average:

Author

Admittedly, there are clearly emerging problems with the supply of wheat in the world, but so far this has not led to an acceleration of exports to the United States.

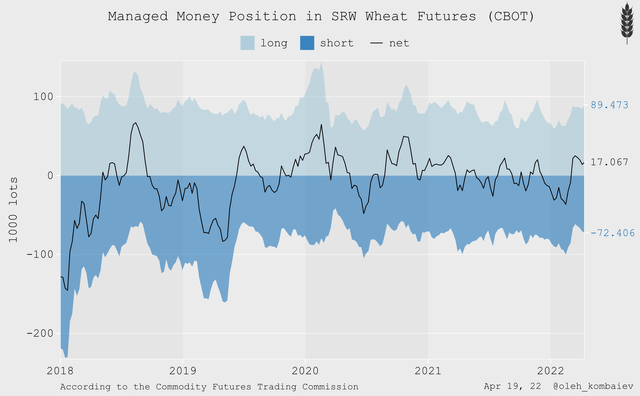

Speculators are surprisingly calm

The situation that is currently developing in the wheat market should theoretically attract the attention of funds. But they are surprisingly reserved in their actions.

Funds’ current net position on wheat (CBOT) is not close to the maximum. They still hold a fairly large number of sold contracts (~72 thousand):

Author

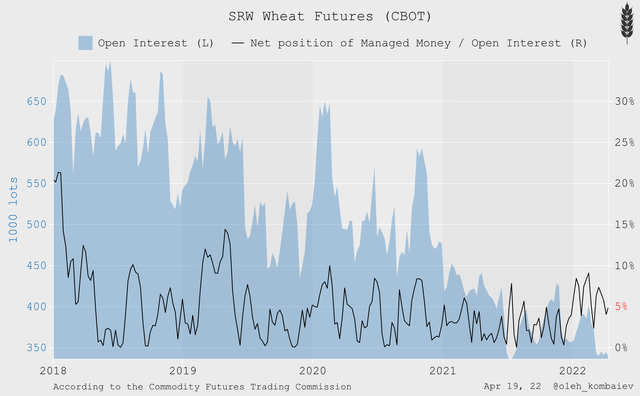

It is also worth noting that the liquidity of the market is now almost two times less than in 2018. And the funds control only 5% of the liquidity.

Author

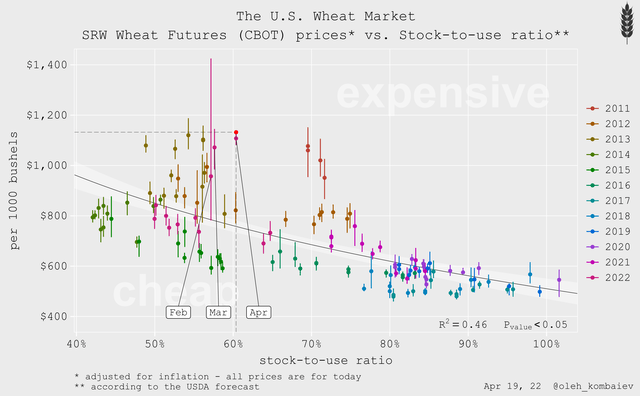

Fundamental Price

Now the price in the wheat market is controlled by risks. But this article would be incomplete without assessing the fundamental level of the balanced price of wheat.

In the wheat market, as a commodity market, the price is formed on the basis of the balance between supply and demand. One of the key markers of this balance is the stock-to-use ratio. Therefore, in the long run, there is the relationship between the values of the stock-to-use ratio and the average price of the wheat futures.

Based on this indicator, I built a model that allows you to approximately understand the adequacy of the current price in the market. Note that this model takes into account inflation:

Author

As you can see, the current price of wheat for the US market looks expensive. To be more precise, the price is at its highest level in the last 11 years.

What to do?

So, we have a situation threatening a significant reduction in wheat exports in the Black Sea region, on the one hand, and only indirect support for the US wheat market, on the other. It seems reasonable to me to consider selling put options. In my opinion, the price of the Wheat Fund ETF will not fall below $9 in the near future.

TradingView, Author

[ad_2]

Source links Google News