[ad_1]

Liuhsihsiang/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Do Not Leave This One On The Shelf

To be clear – this is a short-term opportunity that we have been playing in our Growth Investor Pro service. To head off the inevitable barrage of comments from fossil bugs: We don’t believe energy is a going-down sector long term, we do believe that fundamentals and indeed policy mistakes will out, and drive up energy costs (and sector earnings) over the coming years, and we do believe there’s yet plenty of money to be made in both old-line names like Exxon Mobil (XOM) and revitalized sector plays such as uranium (OTCPK:SRUUF, U.UN, URNM and others).

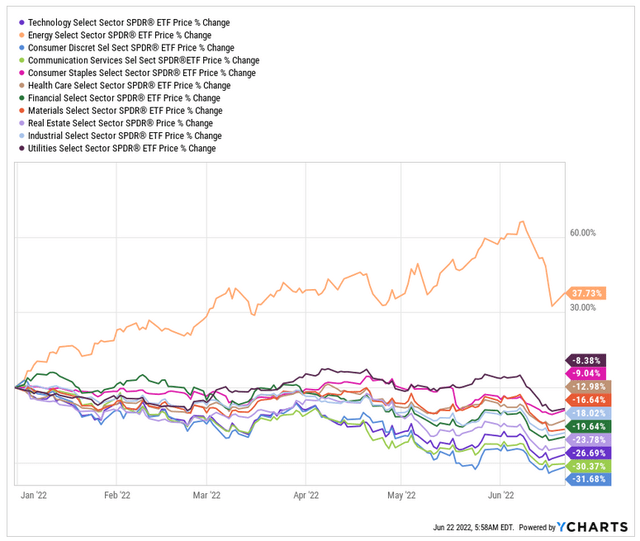

But in the last year or so, energy names have hogged money from the market at large. How much money, you might ask? Well, all the money. Look:

SPDR Sector ETFs, YTD (YCharts)

In 2022 year to date, using the SPDR series of sector ETFs as the lens, only energy has made money. When you think about it, that’s nuts. And when something in the market is nuts, it usually doesn’t last.

In 2020-21, high-beta growth names went nuts. Didn’t last.

In late 2021 and early 2022, defense names went nuts. Didn’t last.

You see where we are going here.

We think energy is nuts and won’t last.

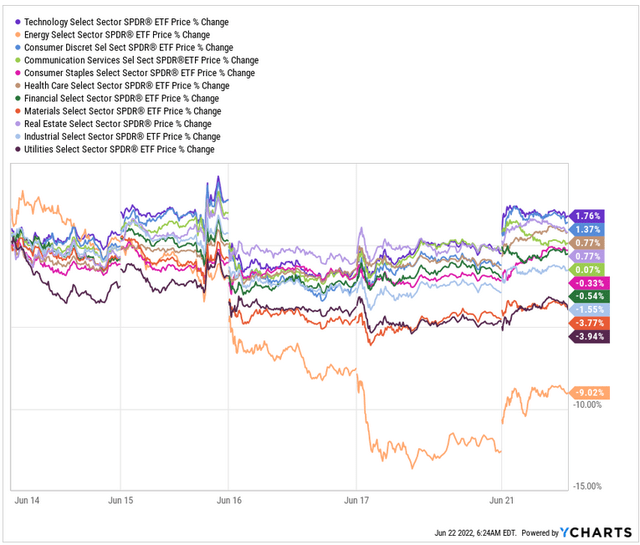

We think the rotation out of energy and into other sectors has started. Here’s those same SPDR sector ETFs in the last five days.

SPDR Sector ETFs, Last 5 Days (YCharts)

Returning to XLE specifically, we think XLE hit the top of an extended Wave 3 up and is on the way down, for now.

We think it’s trading rather well to technical levels, and we think the opportunity to short a little more remains.

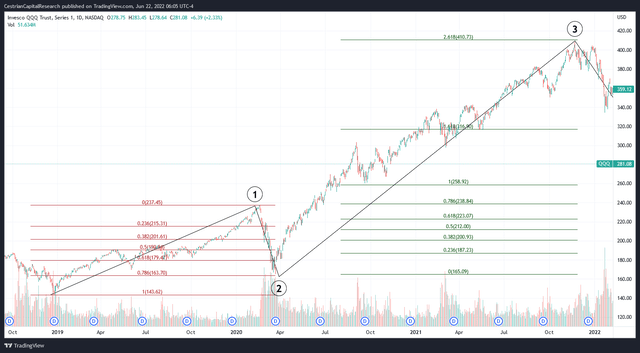

Here’s why we think that. First, let’s take a detour. Look at the Nasdaq-100 ETF, QQQ, from 2019-late 2021.

QQQ Chart (TradingView, Cestrian Analysis)

Wave 1 up, peaks right before COVID. Wave 2 down, troughs at a textbook 0.786 retracement of the Wave 1. Then a big old Wave 3 up, peaking at the 2.618 extension of Wave 1, which is a big extension.

We flagged this loud and clear in our Growth Investor Pro service last November.

Bear Flag! (Cestrian Capital Research)

You know what happened after that, right? So far the Nasdaq has given up around 50% of the gains it chalked up since the COVID lows.

Well, now look at the XLE chart.

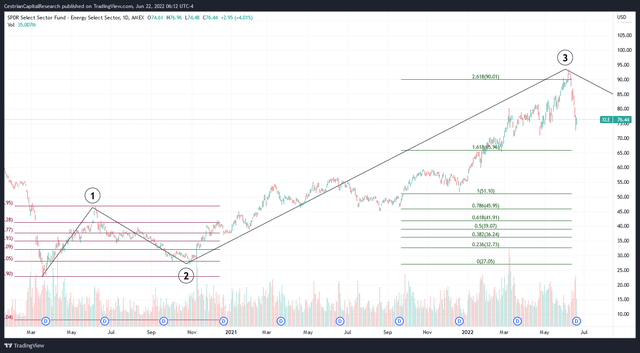

XLE Chart I (TradingView, Cestrian Analysis)

From the COVID lows, XLE puts in a Wave 1 up peaking in June 2020, then a Wave 2 down troughing around the 0.786 retracement level (that number again!) in October 2020. Then a giant Wave 3 up peaking at – yes! – the 2.618 extension of Wave 1.

And you know what happened next.

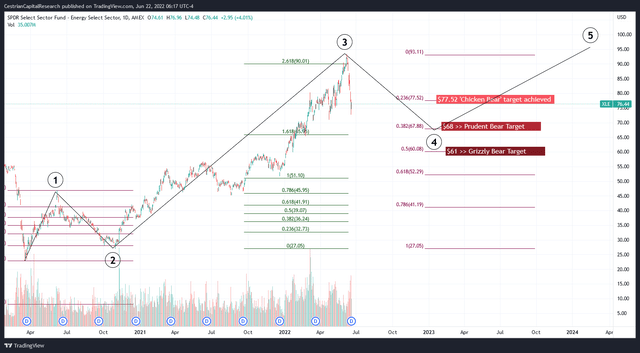

We flagged this a while back to our subscribers and said we thought there was an opportunity to short XLE while it corrected. So far that idea is working out well – we think there’s room to run yet. Here’s our targets.

XLE Chart II (TradingView, Cestrian Analysis)

Our first target, the Chicken-Bear, was around $78 – hit. The next leg we think could see a further drop to $68 or so – we’ll call that Prudent Bear. And for those who like to play aggressively – the Grizzly Bears – then $60-61 isn’t out of the question, since that’s the 0.5 retracement of that big Wave Three up.

After that? Most likely XLE starts to climb once more, on a Wave 5 up to make a high above the 2022 year to date peak. So, time to switch from Grizzly Bear to Chicken Bull (we thank fellow SA contributor Elazar Advisors for this latter term!) at some point.

For now, we believe XLE has room to run to the downside and we rate the fund at Sell. If you choose to play along we would note that reversals in this trend could be brutal and so, as always, a stop-loss is your friend.

Cestrian Capital Research, Inc – 22 June 2022.

[ad_2]

Source links Google News