[ad_1]

Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

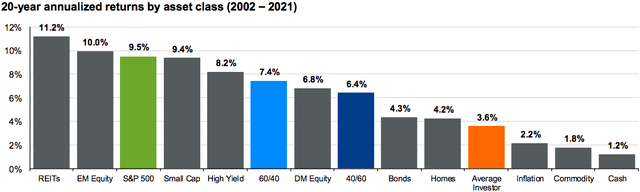

While trading high-yield stocks right before a dividend cut, industry collapse, or debt explosion may be more entertaining than buying an ETF, history has shown it’s a losing strategy. The average investor achieved just a 3.6% annual return over the past 20 years:

Returns By Category (JPMorgan Asset Management)

You see, humans suffer from what’s called herd instinct. We tend to follow the crowd because it feels most comfortable. When everyone’s optimistic, the average investor buys high, and when everyone’s pessimistic, the average investor sells low.

The easiest way to avoid this tendency is to set it and forget it. We think the average investor can buy consistently into the Vanguard High Dividend Yield ETF (NYSEARCA:VYM) and get a long-term return of 8% per annum. As Philip Fisher once wrote, “Conservative investors sleep well.”

An Ever Changing World

While high-flying tech stocks have crushed dividend stocks over the past decade, that appears to be coming to an abrupt end, much like it did after the dot com bubble of 1999:

Largest Companies In The World By Market Cap 1999-2004 (Visual Capitalist)

Energy, financials, and pharmaceuticals thrived after the dot com bubble as investors’ sentiment changed. Technology stocks also suffered from new competition as a wave of IPOs entered the industry.

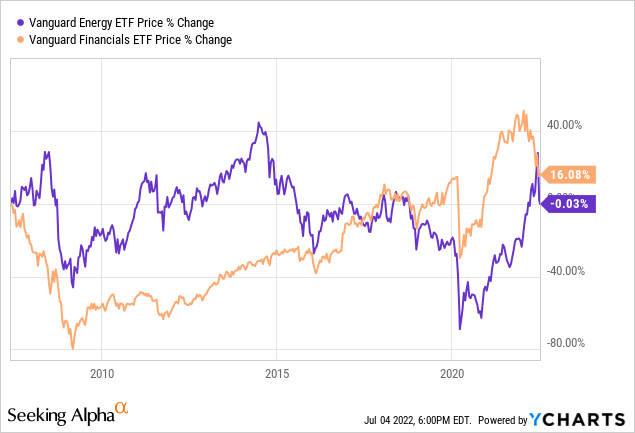

It is often long periods of consolidation that lead to huge bull markets. When an industry goes nowhere for 15 years, competition dries up, and outsized profits usually lie ahead. The Nasdaq went nowhere from 2000 to 2015, before exploding to the upside. Looking back now, both energy and financials have gone nowhere since 2007:

These two sectors make up 30% of VYM’s holdings, and we remain pretty positive on their 5-year outlook. An inflationary environment benefits energy stocks, and normalized interest rates benefit financials. With all the negativity still looming from the global financial crisis, financials have low valuations and strong fundamentals. We believe financials could be the best performing sector with a 5-10 year time horizon. That’s good news for VYM investors.

A Slow And Steady Growth Story

| Total | 100% | 6.3% | |

| Sector | Earnings Growth | Percentage of Fund | Share of Growth |

| Financials | 3.5% | 20.1% | 0.70% |

| Health Care | 8.7% | 14.4% | 1.25% |

| Consumer Staples | 5.8% | 12.8% | 0.74% |

| Energy | 9.6% | 10% | 0.96% |

| Industrials | 5.6% | 9.9% | 0.55% |

| Other | 6.4% | 32.8% | 2.10% |

As you can see, VYM’s underlying industries have grown around 6.3% per annum. For this analysis, we used the S&P 500’s earnings since 1980 (Other) and industry earnings since 2002.

Going forward, we expect earnings growth of 5% per annum for Vanguard’s high dividend companies. Remember, the above chart includes some companies that pay no dividends. Companies with lower dividend payouts tend to grow their EPS faster because they have more capital available to reinvest and buyback shares. It’s also possible that trailing earnings represent a peak in the economic cycle.

Valuation And Returns

Our 2032 price target for VYM is $165 per share, indicating a long-term return of 8% per annum.

- As of May 31st, 2022, VYM had earnings per share of $7.23. At a 5% annual rate of growth, we get 2032 earnings of $11.78 per share. We’ve applied a terminal multiple of 14. This is both appropriate for this level of growth, and in line with the S&P 500’s 150-year median P/E.

But, will VYM beat the market? Well, our projected return for the Vanguard S&P 500 ETF (VOO) is just 6% per annum. We think VYM has a good chance of outperformance if the dividends are tax-free and reinvested efficiently.

Risks

While an investment in VYM is quite diversified, it is heavily tied to the U.S. economy. It’s important for investors to understand that U.S. equities have benefited from some extremely favorable trends such as globalization, low corporate taxes, a booming economy, money creation, and zero interest rates. Are these trends sustainable? We believe the answer is no. Investors shouldn’t extrapolate the recent past into the future. That said, VYM has a number of blue chip companies, and the overall valuation is quite fair. We believe investors would benefit from dollar cost averaging into this ETF over time.

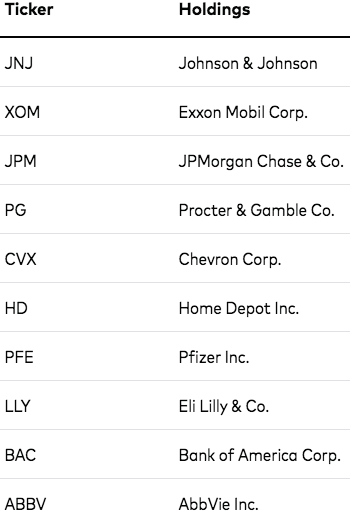

These are the fund’s largest holdings:

Largest Holdings VYM (Vanguard)

Time Is Your Friend

It has proven to be exceptionally difficult to outperform the market, and trading high yield stocks is likely a fool’s errand. In an ever-changing world, investors can achieve diversification and receive sustainable dividends with an investment in VYM. While reversion to the mean may hit U.S. equities, the risks can be mitigated by investing for the long term and reinvesting through thick and especially thin. In the words of John C. Bogle:

Time is your friend; impulse is your enemy”

With time on your side, we estimate a market-beating return of 8% per annum and have a “buy” rating on the shares.

[ad_2]

Source links Google News