[ad_1]

As some regular readers may be aware, I have been talking a bit about emerging markets over the past several months. However, most of my attention has been on the high-yielding assets in these nations, such as those held by the iShares Emerging Markets Dividend ETF (DVYE). Of course, there are plenty of stocks in the world’s emerging economies that do not pay a dividend or otherwise do not qualify to be included in the indices tracked by these funds. Fortunately, Vanguard has an alternative ETF available for those investors that want to play these countries in a different way. This alternative is the Vanguard FTSE Emerging Markets ETF (VWO), and it will be the topic for the remainder of this article.

Emerging Markets Performance

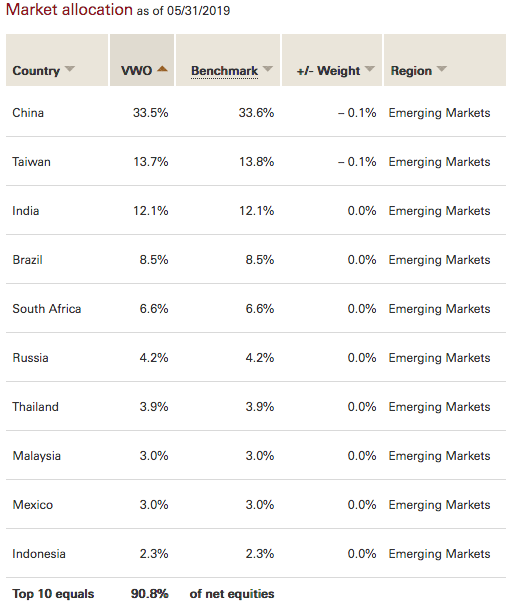

It is something of an open secret that emerging markets funds have not been performing particularly well lately. One of the main reasons for this is that many emerging markets funds have a very large exposure to China, which is admittedly the largest economy that is considered to be an emerging market. VWO is not an exception to this as the fund currently has 35.9% of its assets invested in China, by far its largest national position.

Source: The Vanguard Group

Source: The Vanguard Group

This differs somewhat from a fund like DVYE, which has a much lower percentage of its assets invested in the giant country, as I discussed in a recent article. This weighting has caused problems for those countries that have a large allocation to China as the escalating trade war between that country and the United States has had a devastating effect on the Chinese stock market. This is evident in the fund’s recent performance as it plummeted considerably in the month of May:

As we might expect too, several of the largest positions in the fund are Chinese companies. Many of the ones that are not are Taiwanese companies, which tend to have a lot of cross-borders connections, despite the political problems between mainland China and Taiwan:

As we might expect too, several of the largest positions in the fund are Chinese companies. Many of the ones that are not are Taiwanese companies, which tend to have a lot of cross-borders connections, despite the political problems between mainland China and Taiwan:

Source: The Vanguard Group

Source: The Vanguard Group

While these positions are in line with the fund’s benchmark index (the FTSE Emerging ACap CN Inclusive Index), I personally do not like seeing such a high exposure to China and Taiwan in the fund. One reason for this is the lack of diversity. As we saw recently, political tensions between the United States and China can have a devastating effect on the fund. In contrast, funds that are much more balanced like DVYE have held up much better. In addition, there are plenty of opportunities in other emerging markets around the world, and by having such a high percentage of its assets in one or two countries, it seems as though investors are missing out on these opportunities.

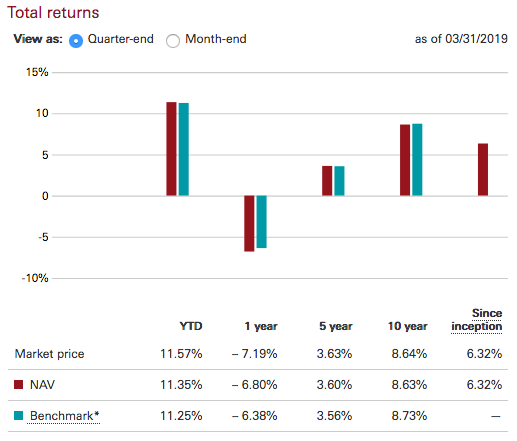

With that said, the fund has delivered a reasonable return to its holders over the years, although 2018 was rather disappointing:

Source: The Vanguard Group

Source: The Vanguard Group

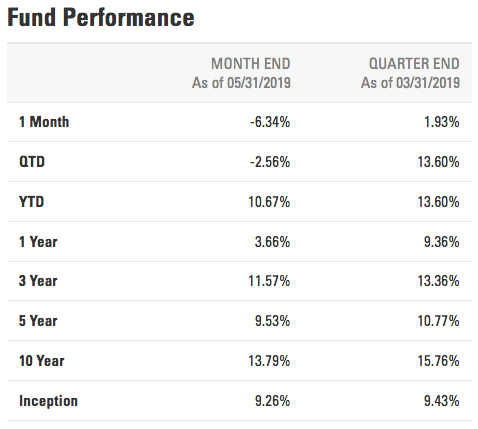

As a general rule, emerging markets are considered to be higher risk than developed markets like the United States. However, this is balanced out by the fact that they are generally considered to boast higher potential returns. It may be somewhat surprising then that VWO has trailed the performance of the S&P 500 (SPY). Here are the returns of this index for comparison purposes:

Source: State Street

Source: State Street

Perhaps counterintuitively, this could be presenting us with an opportunity. In particular, there are some reasons to believe that the S&P 500 index has become rather overvalued, so it could be time to rotate some of your money out of US equities and into emerging markets.

Comparative Market Valuations

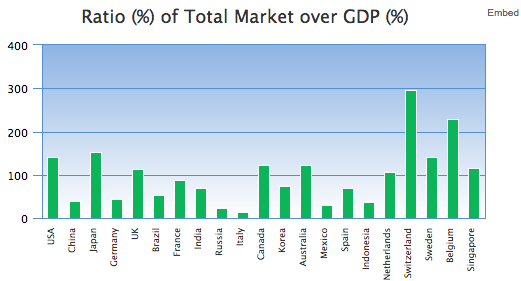

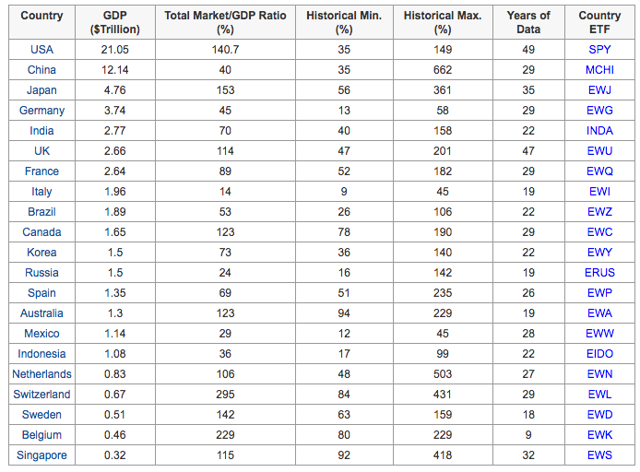

One little followed but quite useful valuation metric is the total market-cap-to-GDP ratio. Indeed, Warren Buffett once said that this is the best single measure of where valuations stand at any given time. As the name of the ratio implies, this is the ratio of the total market cap of all the domestic companies in a country to that country’s gross national product. As of the time of writing, the total market of all American companies is $29.62 trillion. This compares to the last reported GDP of $21.05 trillion, which gives the country a total market-cap-to-GDP ratio of 140.7%. Here is how that compares to a selection of other developed and emerging market economies:

Source: GuruFocus

Source: GuruFocus

As we can see here, the United States currently has one of the highest ratios on this list, although there are a few developed countries that are higher. For the most part, the United States has a considerably higher ratio than any of the emerging markets on the list.

Perhaps more importantly though is how the country’s total market-to-GDP ratio compares to its historical range. Over the past 49 years, the ratio for the United States has varied from 35% to 149%. Thus, the United States’ stock market is well above its historical median. The exact opposite is true for China as its total market-cap-to-GDP ratio of 40% is at the low end of its 35-662% historical range. India and Brazil, which are also major weightings in the ETF, are also right around the midpoint of their historical range:

Source: GuruFocus

Source: GuruFocus

Thus, it certainly appears that many of the major emerging markets in which VWO is invested currently boast somewhat more attractive valuations than the United States does. When we combine this with some of the signs of impending economic weakness in the United States (as I discussed here and here), it may make sense to take some of your gains and rebalance them into markets where the valuations are more appealing.

Another reason to be invested in emerging markets is simply to protect yourself against regime risk, which is the risk that the government of any given country will take some action that proves adverse to the companies operating in that nation. Investors who were too heavily invested in the United States saw the potential consequences of focusing too much on a given country in May when the government’s stance towards China delivered carnage in the equity markets. Admittedly though, VWO is a bit too concentrated in China for my tastes, but it still provides a reasonable way to achieve some of this international diversification.

Conclusion

In conclusion, emerging markets funds have not been performing all that well lately, which is at least partly due to the escalating trade tensions between the United States and China and the fact that many of these funds are heavily invested in China. The Vanguard FTSE Emerging Markets ETF is not an exception to this. With that said though, it could still be a good idea to move some of your assets out of the United States and into emerging markets due to the fact that valuations in the United States are a bit high compared to many emerging markets and to achieve some diversity. While I will admit that I personally prefer DVYE as the way to achieve this emerging markets exposure, VWO is certainly an acceptable alternative.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!

Disclosure: I am/we are long DVYE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News