[ad_1]

xavierarnau/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Vanguard Utilities ETF (NYSEARCA:VPU) as an investment option at its current market price. The fund’s stated objective is “to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector” and is managed by Vanguard.

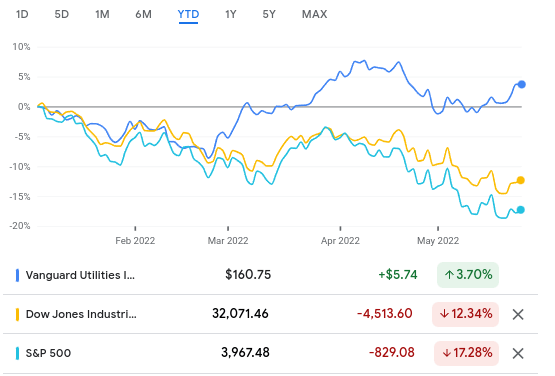

This is a fund I use to gain broad exposure to the Utilities space – and I recommended investors remain long during my last review at the start of 2022. In hindsight, this would have worked out very favorably for investors. While the market has been under immense pressures this year, the same is not true for VPU:

VPU versus Major Indices (Google Finance)

Given this performance gap, I wanted to take another look at VPU to see if it made sense to take some profit and rotate the funds into the S&P 500 or Dow Jones, or if holding on continues to make sense. After some thought, I see some definitive headwinds for Utilities as a whole, but that does not deter me from seeing the broader merit to having this sector represent a core hold for my portfolio. I will therefore present the pros and cons as I see them right now to explain the challenges VPU faces, but why I still feel comfortable holding it.

Utilities Are An Effective Hedge

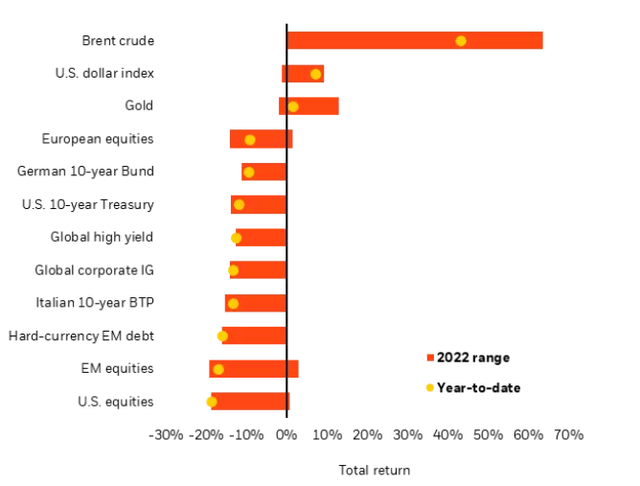

To expand on the point I touched on in the opening paragraph, a key reason why I hold, and will continue to hold, Utilities is their effectiveness as an equity hedge. This is important as the major indices continue to come under pressure and see increasing levels of volatility. While bonds used to work in the past, many IG fixed-rate bonds face some of the same pressures as stocks – rising yields and Fed tapering to slow inflation. As a result, investors need to be more creative when looking for ways to limit downside risk in equities. Importantly, if one was to just look at year-to-date performance of various asset classes, they may miss Utilities as an option. For example, a recent breakdown by BlackRock (BLK) of asset class performance shows that crude oil, gold, and the US dollar have out-performed in 2022. We see that “U.S. equities” falls at the bottom of the pack:

YTD Performance (BlackRock)

The thought I am conveying here is a simple look at “equities” may reveal that this is not a great place to be at the moment. Yet “equities” can mean a variety of things – Tech, Consumer plays, Energy, and of course, Utilities. By understanding this it opens investors up to more options when they want to diversify and, hopefully, protect against declines in the S&P 500.

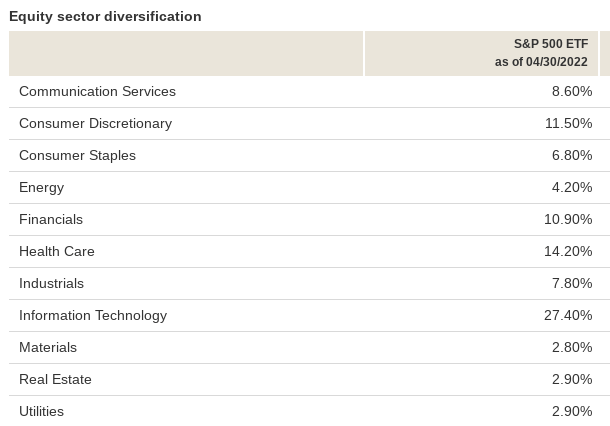

What makes this divergence (partially) possible is the under-weight exposure Utilities have in that index. While Tech and other discretionary sectors dominate the S&P 500, Utilities comes in at less than 3%:

VOO Portfolio (Vanguard)

This is paramount to my belief one shouldn’t take profits here. While VPU may seem ripe for a correction, its usefulness as a hedge and its ability to diversify away from the S&P 500 due to its lack of meaningful inclusion in the index tells me there is merit to holding on. These points are central to why I will hold VPU, despite its lofty price and the headwinds facing the sector – which I will discuss below.

Inflation Remains A Challenge, Slowing Growth Offsets That Risk

Traditionally, Utilities have had an inverse relationship with bond rates and yields. This is because the sector is more defensive, offering stable revenue streams and above-average dividend yields. While that is still the case today, readers should be aware that the sector has a history of under-performing as yields and rates rise. This is a critical concept to understand because inflation remains stubbornly high – pressuring the Fed and other central banks to begin raising their benchmark rates:

Inflation Indices (Yahoo Finance)

As such, I would be remiss if I did not mention this backdrop, and emphasize investors should not get too aggressive here. Yes, I believe Utilities, and VPU by extension, has merit now. But we should not blindly be pumping excess cash into this option. Inflation may be peaking but it is at elevated levels, and history tells us this may not be good for VPU.

However, this again is an area that has been challenged in 2022. Yields have been rising steadily and the Fed has already moved on rates. Despite that, VPU has out-performed. This is testing the traditional movement of this sector, and indicates the geo-political risks facing the globe are offsetting some of the headwind from rising yields. Despite the challenge this poses, investors still desire the safety from this sector, and that has helped VPU hold up well.

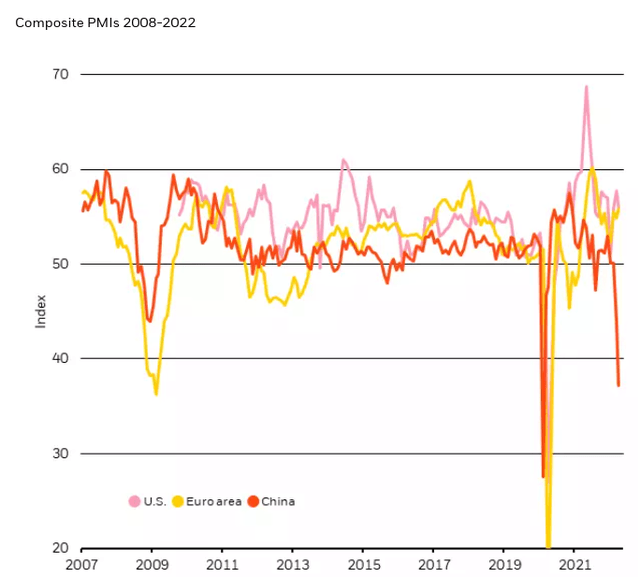

Furthermore, we are beginning to see a slowdown accelerate in China, and growth in other developed markets are coming under pressure too. This is illustrated by the sharp drop in the Purchasing Managers Index from China, the Euro-zone, and the U.S., which is one measure of future economic activity:

PMI Levels (World Bank)

To me this explains again why I continue to like Utilities. If growth slows and doesn’t come back quickly, defensive sectors are going to remain in favor. This is despite what is going on with rates and yields. Steady revenues become much more attractive when growth stocks are seeing their high-flying estimates come back down to reality. In sum, as long as the future remains clouded, Utilities will hold up reasonably well.

Regulatory Risk – “Windfall” Taxes Top Of Mind

As I mentioned, there are multiple issues with having too “bullish” of a stance on VPU going forward. Yes, I hold it and will continue to, but I would again caution readers not to get overly ambitious. Aside from the yields story I described above, another factor weighing on the sector is the increasing regulatory appetite for so called “windfall” taxes.

What these are in a nutshell is new taxes rates or one-time taxes against companies or sectors who are performing extremely well. Simply, when consumers are struggling, the political appetite for penalizing those who are doing well – whether it is individuals or corporations – increases greatly. Utility firms have benefited from rising gas prices, government subsidies, and tax credits for cleaner energy initiatives. Now, it seems, the government wants some of the money back.

Before you say this will not happen in the U.S., be careful with that outlook. Politicians in the UK are already introducing these types of proposals. If successful, this could pave the way for Democrats in the U.S. to capture some political momentum as consumers grapple with higher energy and utility prices. As we are in an election year, the majority-ruling party has every incentive to sway the minds of the voters in their favor. Taxes on companies that are currently doing well is one such option.

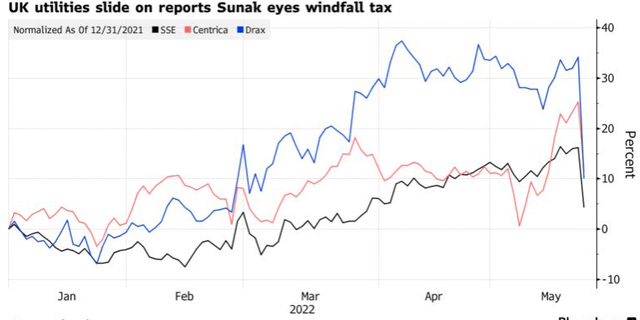

For perspective, consider that in the past few weeks the UK has seen major figures take a stance in favor of such a move. The Chancellor of the Exchequer, Rishi Sunak, has told officials to prepare plans for a possible windfall tax on power generators (as well as oil and gas firms). On the backdrop of this news, shares of UK utility companies fell dramatically:

UK Utility Performance (Bloomberg)

The implication here is that if similar proposals are picked up, or even just debated, in the U.S. we could see similar sell-offs. Longer term I do not view this as a major threat, as we need utility providers to be healthy financially. But in the short-term this is a headwind for sure, and is not too unrealistic considering we have already seen calls for “windfall” taxes on oil companies here in the U.S., in addition to similar measures put forth on large banks in Canada, which I discussed a few weeks ago.

For now, this remains a risk simply to monitor. But it emphasizes why someone needs to stay within their risk tolerance for this sector. If we do see similar rhetoric heat up domestically, VPU will suffer. If it does, however, I would absolutely view that as a long-term buying opportunity.

Modest Dividend Growth A Plus

To wrap up the review, I will point out that VPU remains a reasonable income play. Although interest rates are rising, VPU still offers a reasonable yield. Plus, that yield has seen growth on an annual basis. For perspective, notice that VPU’s Q1 dividend rose by over 5% compared to a year ago:

| Q1 Distribution 2021 | Q1 Distribution 2022 | YOY Growth |

| $.958 | $1.012 | 5.6% |

Source: Vanguard

My takeaway here is that VPU is doing a decent job of keeping up with inflation. Given that its income stream is already markedly higher than the S&P 500, there is merit to continuing to own this for the dividend yield. While a boost near 6% is nothing to get overly excited about, it confirms this ETF as an option for those looking for both stability and yield.

Bottom-line

Investors remain on edge – and who can blame them? The situation in eastern Europe has not stabilized and looks set to drag on for a long time. Yields are rising, and the Fed is being pushed to act in a more hawkish manner due to reality setting in that inflation was never going to be “transitory” without action. In addition, earnings are coming in weaker than expected for many “growth” names, leading to a de-leveraging of riskier asset classes within the Tech and Consumer spaces.

Add this all up, and VPU remains as viable as ever. The Utilities sector provides some shelter from geo-political risks, and its ability to pump out gains even during a Fed rate-hiking cycle suggests there is a lot of investor appetite out there for this space. Finally, the dividend for this fund is growing on a year-over-year basis, which is encouraging. Of course, risks remain. There is political appetite for higher taxes/regulatory burdens, and VPU sits near its 52-week high. Therefore, while I see holding, and perhaps even buying this fund, as a smart play, I would caution against getting too aggressive here. But given the underlying support for the sector, I do view any weakness as temporary and any sell-off as a buying opportunity. As a result, I continue to suggest readers look to Utilities as a way to diversify, and I will remain long VPU going forward throughout 2022.

[ad_2]

Source links Google News