[ad_1]

bjdlzx/E+ via Getty Images

Investment Thesis

According to data from Fidelity, telecom has historically been a defensive sector, but when recently expanded to communication services, it became more cyclical. Communication services stocks generally have higher multiples and betas than traditional telecom stocks, which makes them outperform when the economy is strong and underperform when things turn south. The risk of a recession is now considerably higher, as highlighted by the recent consumer sentiment data. For instance, in the last 70 years, the only time consumer sentiment was this low without the US being in a recession was a brief period during the 2011 bear market (Aug-Sep). I believe the Vanguard Telecom Services ETF (NYSEARCA:VOX) can outperform the market in the current environment given the fact it has a cheaper valuation, but I expect volatility to be high since it runs a portfolio concentrated in a handful of names.

Bloomberg

Strategy Details

The Vanguard Telecom Services ETF tracks the investment results of the MSCI US Investable Market Index /Communication Services 25/50. The index is made up of stocks of US companies within the communication services sector. These companies are typically involved in businesses that include telephone, data transmission, cellular, and wireless communication services.

If you want to learn more about the strategy, please click here.

Portfolio Composition

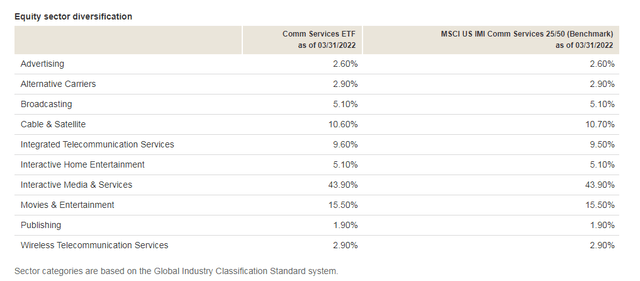

The index invests over 43% of total assets in Interactive Media & Services companies, followed by firms engaged in the Movies and Entertainment sector (15.5%) and Cable & Satellite providers (~11%). The largest three categories have a combined allocation of approximately 70%. In terms of geographical distribution, VOX invests exclusively in the US.

Vanguard

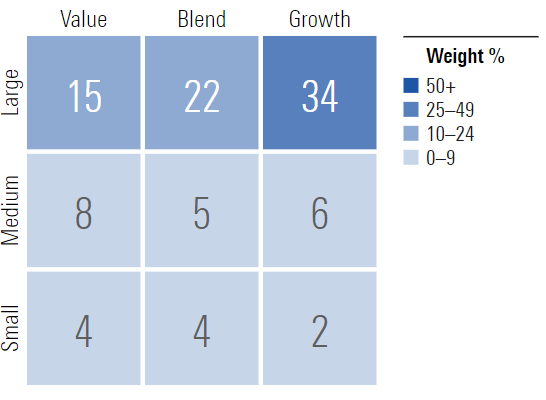

~34% of the portfolio is invested in large-cap growth issuers, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap blend equities, which account for 22% of the fund. I like that VOX is well-balanced between growth and value stocks. The strategy avoids buying only overvalued companies and provides some margin of safety when paying lower multiples for businesses.

Morningstar

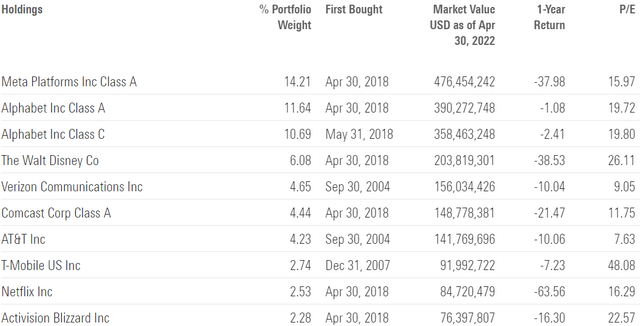

The fund is currently invested in 107 different stocks. The top 10 holding account for ~63% of the portfolio with no single stock weighting more than 15%. In my opinion, VOX runs a concentrated portfolio and a handful of names will drive future returns. I think it is important to see how that fits your investment goals and if you are comfortable holding a concentrated portfolio. The way this portfolio is structured can remove some of the benefits of diversification, which is something many investors would like to avoid when investing in ETFs.

Morningstar

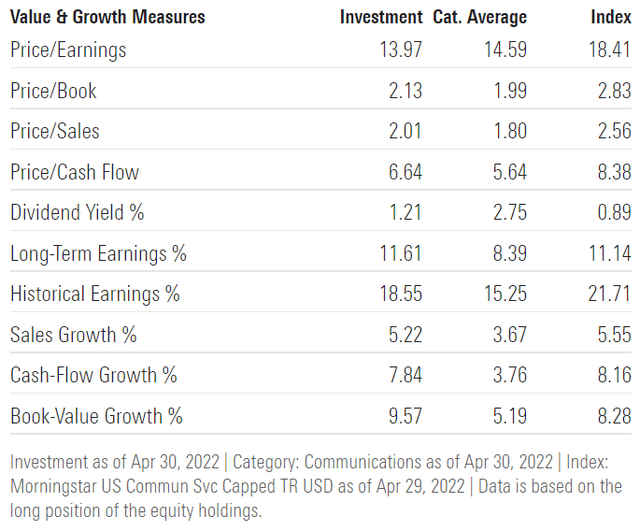

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, VOX trades at a price-to-book ratio of ~2 and has a price-to-earnings ratio of ~14. These multiples are lower than what you would be paying to acquire a plain-vanilla S&P 500 ETF, which trades right now at ~18x earnings and has a price-to-book ratio of ~3.4. I believe there is definitely some value in VOX based on the quality of constituents and its relatively cheap valuation.

Morningstar

Is This ETF Right for Me?

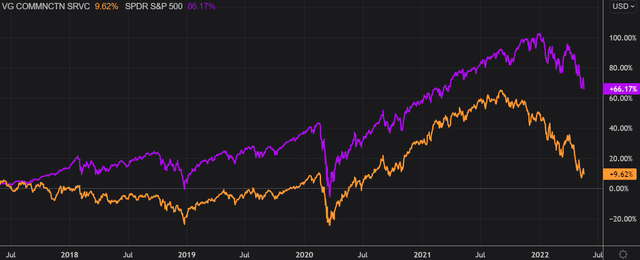

I have compared below VOX’s price performance against the SPDR S&P 500 Trust ETF (SPY) over the last 5 years to assess which one was a better investment. Over that period, SPY clearly outperformed VOX by a ~56.55 percentage points margin. It is interesting to see that SPY did much better than VOX straight from the start back in Q3 2017. This was one of the greatest bull markets in US history and investors would have been better off buying the market. The past 5 years are defined by growth outperforming value, which was a clear drag for VOX given a relatively high allocation to low PE stocks. However, past performance is not representative of future returns and I think value has a good chance to make a comeback in the current market environment.

To put VOX’s performance into perspective, a $100 investment 5 years ago in this ETF would now be worth ~$109.62. This represents a ~1.85% compound annual growth rate, excluding dividends, which is a mediocre absolute return.

Refinitiv Eikon

If we take a step back and look at the 10-year price returns, the results don’t change much. SPY came on top once again, outperforming VOX since Q3 2013. As previously mentioned, I think the next 5-10 years can be very different depending on how inflation will ultimately impact Western economies.

Refinitiv Eikon

Key Takeaways

VOX provides exposure to US stocks within the communication services sector. VOX runs a concentrated portfolio and a handful of names will drive future returns. I think it is important to see how that fits your investment goals and if you are comfortable with higher volatility. In terms of valuation, VOX offers a better deal than a plain-vanilla S&P 500 ETF. VOX trades at 14x earnings vs. 18x for the S&P 500 ETF, which is relatively cheap. I think VOX provides a better margin of safety compared to the market in a rising rate environment, and the fund has a good chance of outperforming it over the next couple of months.

[ad_2]

Source links Google News