[ad_1]

PM Images

ETF investing is great because it allows you to invest with conviction while keeping your expenses low. Moreover, it’s a quick and easy way to lock in exposure to specific market segments without having to endure endless portfolio reorganizing.

Today we turn our attention to the Vanguard Russell 1000 Value ETF (NASDAQ:NASDAQ:VONV), which provides exposure to large-cap value stocks. Most of our recent ETF analysis focused on high-dividend and low- volatility ETFs because we thought they were helpful to hedge against inflation risk. However, we now turn to value as a means of capitalizing on changing macroeconomic variables.

Price level and interest rate patterns could likely alter over the coming quarters, and we believe value is the place to be.

Factor Analysis: Value Returns Explained

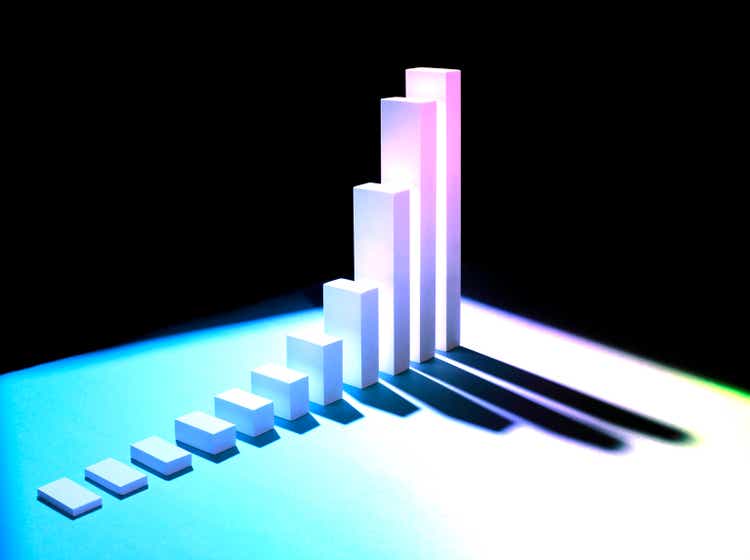

It’s widely argued that value stocks outperform during rising interest rates or early-stage market recoveries. Growth stocks took a beating during the latest interest rate hike cycle as the steepening in rates was accompanied by severe push inflation that caused a vacuum of consumer headwinds. To elaborate, push inflation has remained resilient due to supply constraints (especially in the energy and food markets), but interest rates were hiked to curb core consumer spending power. Thus, we’ve experienced pressure on the consumer from all ends.

Many believe that growth stocks underperform in high interest rate environments due to higher discount rates on future cash flows. The theory is true, but it needs to be expanded upon. The discount rates on future cash flows are utilized to compute the current value of an asset, and they’re determined by pricing risk systemic and idiosyncratic risk. Therefore, the higher inflation we’ve recently experienced added increased systemic risk to asset discount rates, in turn devaluing them on the marketplace.

Although the increased discount rate theorem also holds true for value stocks, value stocks have one exception. Much like dividend-paying and low-volatility assets, investors often prefer value stocks during economic uncertainty because they contain “ready compensation.” Investors’ utility to consume increases whenever future economic circumstances are glum, and they will either divest or invest in nearer-term gains.

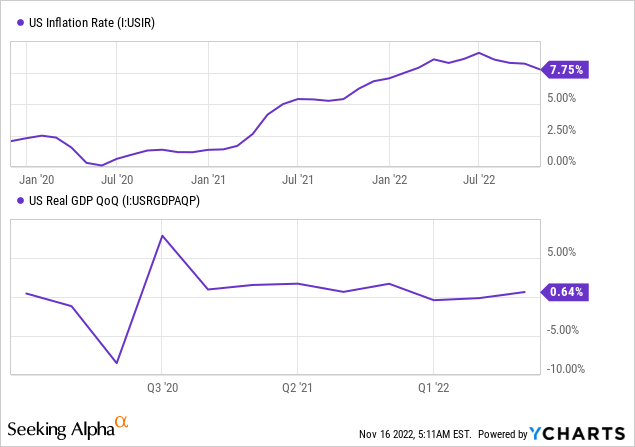

Value Stock Performance (Seeking Alpha)

The financial markets had a grim outlook around February this year. The interest rate hike cycle had just started, a war broke out in Ukraine, and emerging market civil unrest was heating up. Initially, we hypothesized that low-volatility and dividend stocks would outperform other stock categories. Our rationale was that low volatility and high dividend assets usually outperform other stock categories during uncertain economic periods. We were correct with our hypothesis, but the relative outperformance of value took us by surprise; we didn’t expect value stocks to hold up well because they typically succumb to high-volatility environments.

The most recent CPI report tells us that the interest rate hike cycle might slow down soon. We still don’t think there’s a chance of receding rates in 2023 because the inflation rate still remains well beyond the 2% to 3% target zone. However, we believe a scenario with moderate economic growth and moderate interest rate hikes is the most likely outcome, which could ignite value stock investing. Moreover, there are excellent deals on offer as bear markets typically oversell worthy assets. Thus, we’ve pivoted to overweight on value.

Assessing VONV’s Prospects

The Vanguard’s Russell 1000 ETF does exactly what the name says: It tracks value stocks in the Russell 1000. The ETF’s value-add is that it does so at a lower cost. For those unaware, the Russell 1000 tracks the 1,000 stocks with the highest market capitalization in the U.S.

Our pivot into value is geared toward large-cap stocks. We remain uncomfortable owning small-cap stocks in the current economic climate as we believe they require a lower interest rate environment to prosper. The Vanguard Russell 1000 ETF provides a viable option to us as it’s a well-allocated, low-cost ETF with a lucrative dividend yield.

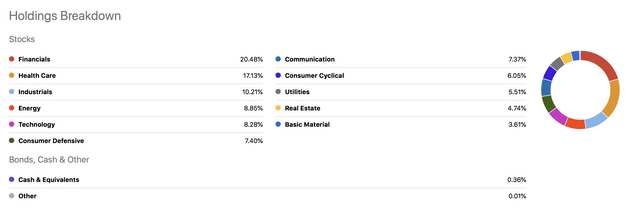

Let’s elaborate on the ETF’s attributes. The ETF’s allocation is well balanced as it counteracts cyclical exposure such as financials and energy with significant exposure to healthcare and consumer defensives.

The financial sector is significantly oversold. For example, the Financial Sector SPDR Fund ETF (NYSEARCA:XLF) has a book value that’s 2.26x (XLF PB; SPY PB) lower than the SPDR S&P 500 ETF Trust’s (NYSEARCA:SPY). Furthermore, financials could soon live up to their full potential as an already improved debt market might be met with an equity market recovery.

Healthcare and consumer defensive stocks comprise nearly 25% of this ETF’s composition, which is positive because various market participants might still be looking to hedge the economic cycle with countercyclical assets.

Holdings by Sector (Seeking Alpha)

Top Stock Holdings (Seeking Alpha)

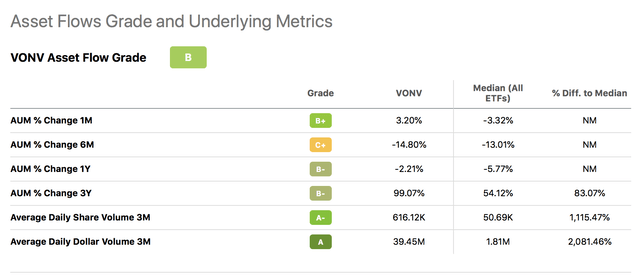

Furthermore, the Vanguard Russell 1000 ETF has garnered attention recently as it has been subject to large inflows during the past month. Although inflows and ETF performance aren’t always correlated, they provide an indication of investor style preferences – in turn, conveying the cyclical zeitgeist.

Seeking Alpha

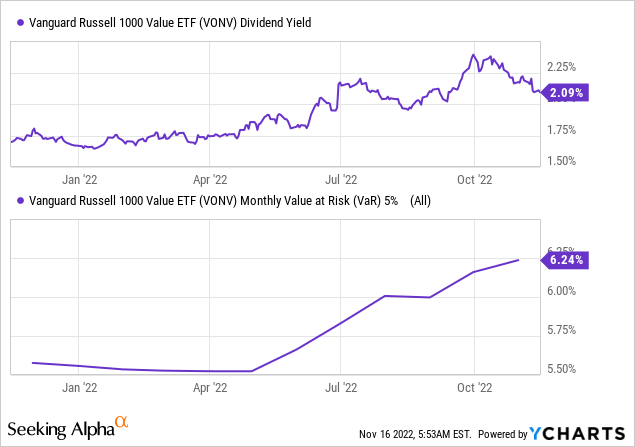

The ETF’s income-generating properties are lucrative and sound. Investors can benefit from a dividend yield of more than 2% and a yield on cost of approximately 2.64%, indicating that the ETF’s dividends are both attractive and sustainable. In addition, we believe the ETF has a low value at risk figure, meaning you likely won’t see your dividend benefits disappear into the abyss with excessive value losses.

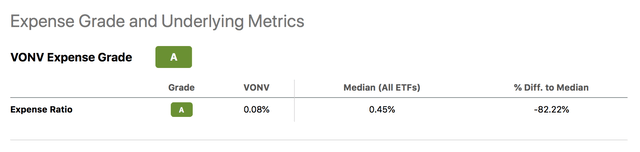

Lastly, let’s look at cost. As previously mentioned, the ETF’s primary value-adds are affordability and cost (or expense). According to the data, the ETF’s expense ratio is 82.22% lower than the median of the ETF population. Thus, parsimoniously speaking, the ETF provides significant cost benefits to investors.

ETF Cost (Seeking Alpha)

Embedded Risks

Broader market risk needs to be considered. Value stocks have outperformed equally weighted portfolios and the market portfolio since the turn of the year; however, the value segment still remains in negative territory. Thus, if 2022’s bear market continues, the value segment could decline even further without providing many conviction benefits.

There’s a reasonable basis to conclude that the broader market might enter a renewed bear trajectory. For example, investors could have overreacted to October’s CPI report, and future CPI reports might be unfavorable. Furthermore, the war in Ukraine is still in full flow, and Chinese pandemic lockdowns aren’t subsiding, meaning supply chain issues could resurface.

The final qualitative point to notice is that we need to remember that the financial markets aren’t always self-correcting. There aren’t any guarantees that undervalued stocks will ever reach equilibrium.

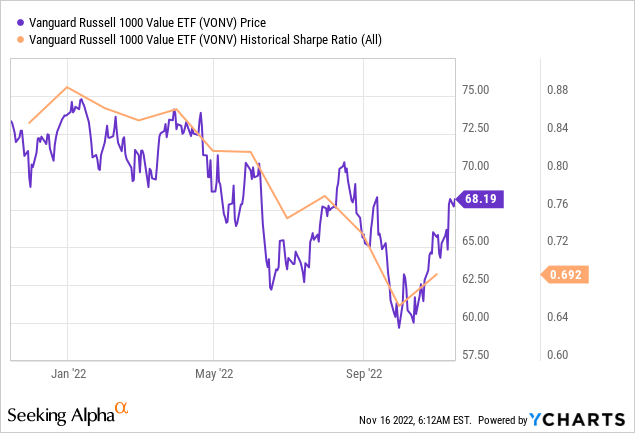

The ETF’s quantitative risk metrics also raise a few concerns. For instance, its Sharpe Ratio is under the generally accepted risk threshold (1.00). Therefore, there’s a fair argument that the ETF doesn’t yet yield favorable excess returns relative to its market volatility.

Concluding Thoughts

Value could capitalize in an economic climate with high, but stable, inflation and moderate interest rate hikes. Moreover, the category has outperformed our expectations this year, leading us to believe its resilience was underestimated by many.

Vanguard’s Russell 1000 Value ETF provides an excellent opportunity to capitalize on undervalued financial stocks while gearing up with exposure to countercyclical sectors such as healthcare and consumer defensives. Furthermore, the ETF exhibits favorable dividend attributes and low value at risk.

We think this is a phenomenal conviction play and assign a strong buy rating.

[ad_2]

Source links Google News