[ad_1]

marchmeena29/iStock via Getty Images

Investment Thesis

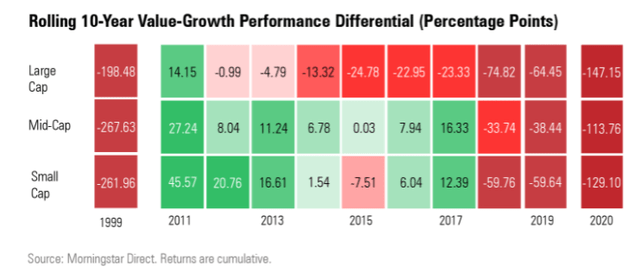

Growth stocks have been extremely popular in recent years thanks to their outstanding returns relative to value stocks. For instance, large-cap growth stocks outperformed value stocks by 147.2 percentage points over the 10-year period ending December 21st, 2020, the largest differential since 1999. As a result, investors have rushed to buy any dip in growth stocks, believing it might be the next multi-bagger investment.

Morningstar

Recent returns however point out the fact that we might be at an inflection point. Over the last six months, for instance, the S&P 500 has delivered a much better result than the NASDAQ 100. Given the hawkish stance adopted by the Fed and other central banks around the world, growth stocks are now starting to feel the pull of gravity and are likely to underperform cheap value stocks going forward. In this article, I will review the Vanguard Russell 1000 Growth Index (NASDAQ:VONG), which invests in a basket of US growth stocks.

Refinitiv Eikon

Strategy Details

The Vanguard Russell 1000 Growth Index is a passively managed ETF. VONG tracks the investment results of the Russell 1000 Growth Index. The index provides exposure to a broadly diversified basket predominantly made up of growth stocks of large US companies.

If you want to learn more about the strategy, please click here.

Portfolio Composition

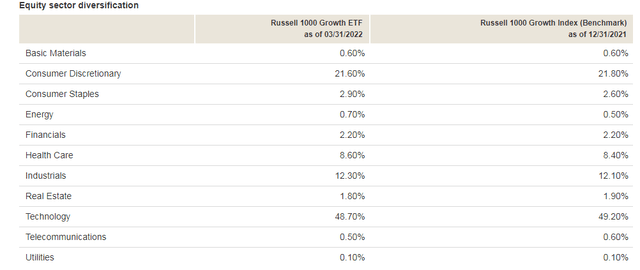

VONG invests ~48.70% of assets in tech stocks, followed by consumer discretionary (~21.60%) and industrials (~12.30%). The three largest sectors have a combined allocation of approximately ~83%. In terms of geographical allocation, VONG invests exclusively in the US.

Factsheet – VONG

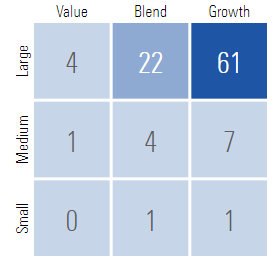

VONG has a 61% exposure to large-cap growth issuers, characterized as large-sized companies where growth characteristics are predominant. Large-cap issuers are generally defined as companies with a market capitalization exceeding $10 billion. The second-largest allocation is large-cap blend equities, which account for 22% of total assets. Unsurprisingly, VONG allocates approximately 69% of the funds to growth stocks, with a focus on large caps. Growth stocks generally have high betas, thus I think it is important to see if you are comfortable with a higher level of volatility before purchasing VONG.

Morningstar

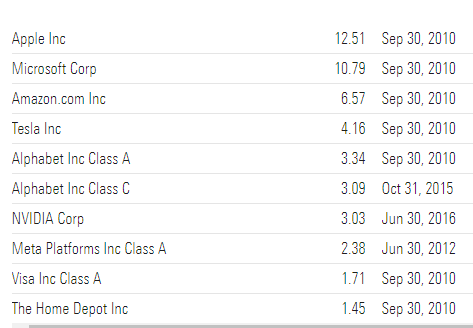

The fund is currently invested in 499 different stocks. The top ten holdings account for ~49% of the portfolio with no single stock weighting more than ~13%. The portfolio is in my opinion concentrated and a few names such as Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) are likely to drive future returns. I think it is important to be comfortable with the top 10 names before buying VONG, as such concentration can remove some of the benefits of diversification and increase volatility.

Morningstar

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Vanguard, the fund currently trades at a price-to-book ratio of ~12 and an average price-to-earnings ratio of ~31x. As we are now entering a new monetary regime, I think it is risky to hold high multiple stocks. Moreover, VONG’s average EPS growth rate over the last five years stands at 28.4%. If we assume that future growth will be as high as it was in the past, the ETF is currently trading at a PEG ratio of 1.09, which isn’t cheap. Lastly, I believe inflation is a game-changer for high multiple stocks. Broadly speaking, inflation has been negatively correlated to PE ratios in the past. As the CPI is reaching new highs, I believe growth continues to be the most vulnerable category going forward.

Is This ETF Right for Me?

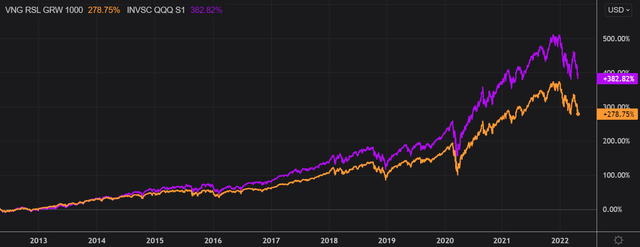

I have compared below VONG’s price performance against the Invesco QQQ ETF (QQQ) over the past 5 years to assess which one was a better investment. Over that period, QQQ outperformed VONG by a ~22 percentage points margin. It is interesting to see that both strategies delivered similar returns up until the COVID-19 crash, after which the NASDAQ 100 outpaced VONG. All in all, I think VONG achieved its mission to provide exposure to growth stocks and delivered solid results. To put VONG’s performance into perspective, a $100 investment in this ETF 5 years ago would now be worth $236.59, excluding dividends. This represents a compound annual growth rate of ~19%, which is an excellent absolute return.

Refinitiv Eikon

If we take a step back and look at the performance from a 10-year perspective, the results don’t change much. QQQ came on top once again, outperforming VONG by a 104 percentage points margin. I personally think VONG will turn out to be a good example of past returns not being illustrative of future returns. Most of its constituents benefited from record-high liquidity over the past decade, which pushed prices and valuations higher without really experiencing any major bear market. I think the Fed is now determined to fight inflation, and this will definitely have a negative impact on valuations. High-multiple stocks, therefore, tend to suffer the most from this change in liquidity regime, which should be a drag on VONG’s future returns.

Refinitiv Eikon

Key Takeaways

VONG provides an efficient way to get exposure to large-cap US growth equities. Even if VONG runs a portfolio concentrated in a few names, you still get exposure to over 400 companies from a wide range of sectors. In terms of valuation, VONG trades at over 30x LTM earnings, which makes this strategy expensive at the moment. Given the expected hawkish moves by central banks around the world in the upcoming months and elevated inflation, I think VONG is at risk of underperforming the S&P 500 and value stocks.

[ad_2]

Source links Google News