[ad_1]

ETF Overview

Vanguard Global ex-US Real Estate ETF (VNQI) has a portfolio of real estate stocks internationally but excludes U.S. stocks. The ETF is a good vehicle for investors seeking exposure in the real estate markets outside of the U.S. However, it has a high exposure to emerging markets that are more volatile. Its fund performance is often inversely correlated to the treasury yield. This fund’s performance lagged behind S&P 500 Index over the long run. Its 4.2%-yielding dividend income is attractive but is also behind its peer iShares Global Real Estate ETF’s (REET) 5.1%. Therefore, we believe investors may want to seek opportunities elsewhere.

Data by YCharts

Data by YCharts

Fund Analysis

High exposure to Asia and emerging markets

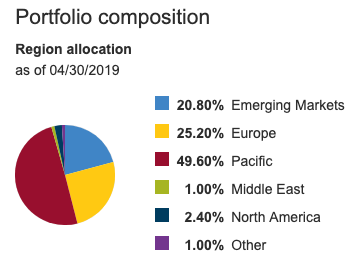

VNQI’s stocks are mostly located in the Pacific with a high exposure to Japan. In fact, Japan represents about 20% of its total portfolio. As can be seen from the pie chart, about 25% of its stocks are located in Europe and about 21% of its stocks are located in emerging markets. As we know, emerging markets tend to have higher economic growth rates, and stronger business activities. These should translate into stronger rental rate growths, and more property development activities. However, these markets are also much more volatile than the general market.

Source: Vanguard Website

This is not an REIT ETF, and the risk is higher

REITs consists about 45% of VNQI’s portfolio. The rest of VNQI’s portfolio consists of real estate developers and property managers. For reader’s information, REITs derive their revenues mostly from rental revenues. On the other hand, real estate developers derive their incomes by selling the constructed buildings to interested buyers. REITs often generates stable incomes from rental revenues. However, real estate developers’ incomes are less stable and often depends on the strength of the economy. They may start a real estate development project when the economy is booming. By the time the construction is completed, the economy may be in a recession and hence it may be harder to sell these units. Therefore, VNQI possesses higher risks than REITs.

Limited capital appreciation, but higher dividend income

Although emerging markets tend to deliver strong economic growth rates than developed countries, this does not necessary translate into strong market returns. As can be seen from the chart below, VNQI’s fund performance lagged behind S&P500 index in the past 10 years. In fact, its fund performance in this period was only about 15%. On the other hand, S&P500 delivered a return of nearly 132% in the same time. Therefore, VNQI may not be the stock to go to if your intention is capital appreciation.

Data by YCharts

Data by YCharts

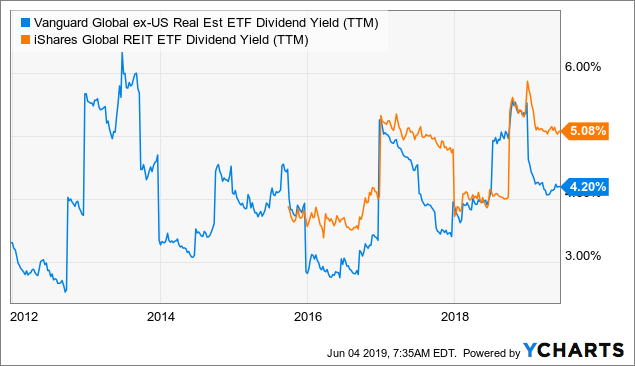

On the other hand, VNQI’s dividend yield of 4.2% is not bad if your goal is to receive a good dividend income. However, we think there are better REIT ETFs that investors may want to pursue than VNQI. For example, REET offers investors a 5.1%-yielding dividend and similar fund performance.

Data by YCharts

Data by YCharts

Currency risk

Since VNQI invests in real estate stocks outside of the United States, its fund value can be impacted by the swing of foreign exchanges. As we know, emerging market currencies can be much more volatile than currencies in the developed countries. Since emerging markets represent about 20% of its total portfolio, its fund performance can be impacted by the swing of currencies in these markets.

Low management expense ratio

Vanguard charges a low management expense ratio of 0.12% for VNQI. Its MER is lower than other ETFs such as SPDR Dow Jones International Real Estate ETF’s (RWX) 0.59% and iShares International Developed Real Estate ETF’s (IFGL) 0.48%.

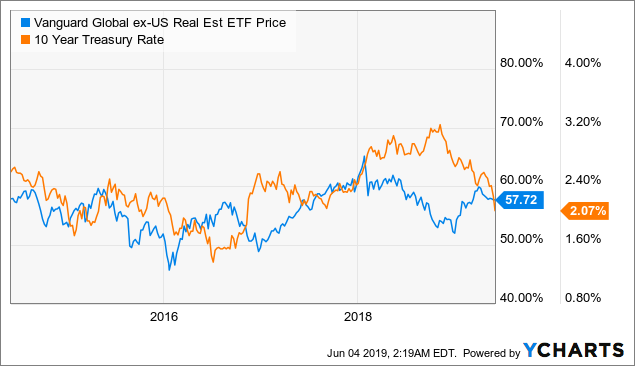

Pay attention to Fed’s interest rate policy

One strategy investor can do is to pay attention to Federal Reserve’s interest rate when investing in real estate markets outside of the United States. When the FED raises the interest rate, it will often result in stronger USD as money flows from other countries to the U.S. to take advantage of higher interest rates. On the other hand, when the FED lowers the key interest rate, funds will flow out of U.S. to other countries. The money will often invest in emerging markets and drive the stocks oversea higher. As can be seen from the chart below, VNQI’s fund price inversely correlates with the strength of the interest rate.

Data by YCharts

Data by YCharts

Investor Takeaway

VNQI is a good vehicle to gain exposure to real estate markets internationally. However, if your goal is for capital appreciation, this ETF may not satisfy your purpose. On the other hand, if your goal is for dividend income, we believe there are better ETF choices elsewhere. Therefore, we do not find this ETF appealing and would recommend investors seek other ETFs instead.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News