[ad_1]

The Vanguard Real Estate ETF (VNQ) is the largest real estate ETF. VNQ seeks to closely track the return of the MSCI US Investable Market Real Estate 25/50 Index, and currently offers an expense ratio of 0.12 percent.

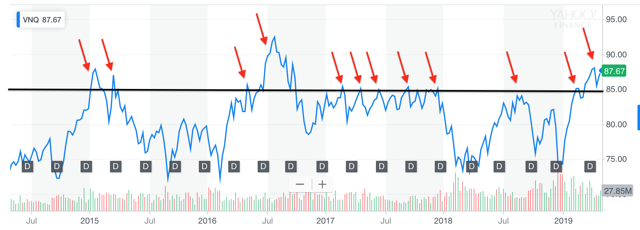

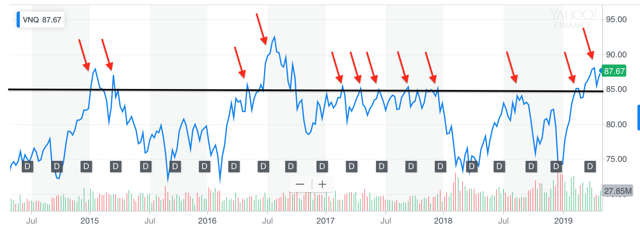

VNQ is probably the best ETF option for strictly passive investing in public REITs due to its cheap diversification, but its recent strong performance indicates REITs are broadly overbought. Because of this, it is likely that REIT allocations should be reduced and/or DRIPs turned off at current valuations.

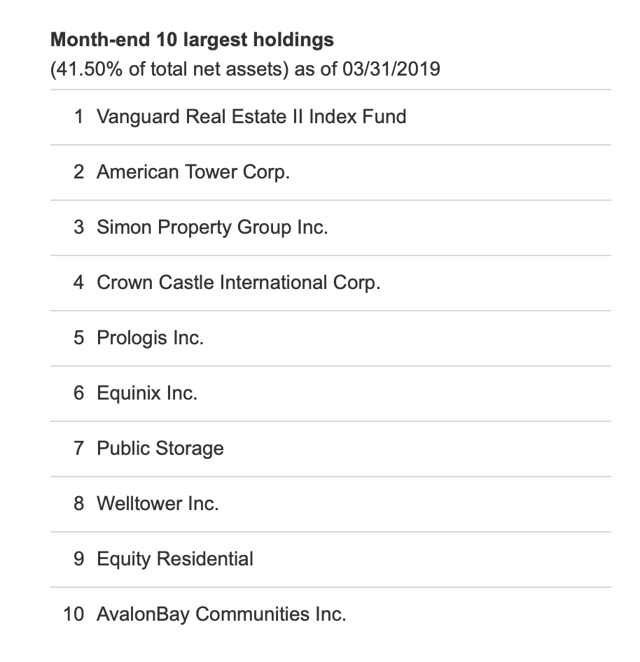

VNQ is heavily weighted in its top holdings

Due to market weighting and a tremendous disparity in size amongst publicly traded REITs, and because there are fewer than 200 REITs in the index, it is a rather top-heavy ETF. As a result, VNQ’s top ten holdings amount to over 40% of the fund’s total holdings.

(source: Vanguard)

The above includes American Tower (REIT)”>AMT), Simon Property (SPG), Crown Castle (CCI), Prologis (PLD), Equinix (EQIX), Public Storage (PSA), Welltower (WELL), Equity Residential (EQR) and AvalonBay (AVB), but the first holding is essentially the index itself. Digital Realty Trust (DLR) is the 11th holding, or tenth if solely considering individual equities.

The above includes American Tower (REIT)”>AMT), Simon Property (SPG), Crown Castle (CCI), Prologis (PLD), Equinix (EQIX), Public Storage (PSA), Welltower (WELL), Equity Residential (EQR) and AvalonBay (AVB), but the first holding is essentially the index itself. Digital Realty Trust (DLR) is the 11th holding, or tenth if solely considering individual equities.

REITs have outperformed for months and that is unlikely to continue

The large cap REITs that dominate VNQ are all clearly sizable companies, and many have grown considerably over the last 5 years through development and acquisitions. Several are at 52-week and/or multi-year highs, and most are outperforming the market within 2019, as well as so far this quarter.

Despite being at such highs, most REITs continue to outperform the broader market on the strength of their income production and the concurrent surge in both equities and the dollar. This outperformance is likely to soon stop, and many major components to the ETF could drag it down from here. This is true both because REITs appear generally overbought and because several of the largest REITs appear considerably overvalued.

Retail REITs make up nearly 15% of VNQ and office REITs are around ten percent of the fund. Office and retail REITs are both likely to underperform the broader real estate market. Retail locations continue to suffer declines due to the growth of e-commerce, and it is clear that the retail landscape will continue to change as online sales grow.

Retail has been one of the strongest property sectors so far this quarter, malls returning over 11% in April, as a group, and freestanding single-tenant retail properties doing even better. Such a move cannot continue for much longer.

VNQ’s yield is getting low due to high valuations

Many holders of REITs are allocating there specifically for income production, and as more of a supplement or alternative to bonds than to equities. Further, REIT distributions are generally taxed as income, like bonds and MLPs, and not at the lower rate that most corporate dividends receive.

As a fixed income alternative that distributes cash flow in U.S. dollars, REITs have performed exceedingly well in 2019. With VNQ now yielding around and often under four percent, income investors are taking on considerable risk for a small increase in yield. Here, REITs in the aggregate can act much like mid-grade corporate bonds. The yield getting too low or too high is often a warning sign of imminent price correction, and a large segment of buyers will move to another asset class if the yield is too low.

REITs are also susceptible to secondary offerings. With such strong demand for shares, many REITs are likely to issue secondaries in the coming quarters to raise capital. This is a a probable anchor to REIT prices here. REITs needing financing or refinancing are likely to seriously consider secondaries here.

REITs are also susceptible to secondary offerings. With such strong demand for shares, many REITs are likely to issue secondaries in the coming quarters to raise capital. This is a a probable anchor to REIT prices here. REITs needing financing or refinancing are likely to seriously consider secondaries here.

Conclusion

The VNQ’s recent price appreciation is unlikely to continue for much longer, at least so quickly. While many individual REITs may still be attractive investments, the sector appears overvalued and at risk to decline due to issues with either fixed income or U.S. equity markets, as well as the dollar. Simultaneously, VNQ appears top-heavy with few large cap REITs, and the yield does not seem substantial enough for the apparent risk. For these reasons, I believe REITs are generally overbought and it is likely the time to take some profits in VNQ on any further strength, or to temporarily turn off dividend reinvestment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News