[ad_1]

Eshma/iStock via Getty Images

The financial markets have seen a significant spike in volatility during the first weeks of 2022. This has been most apparent in the bond market, which has seen the most rapid declines in years. Notably, there has been little change in the inflation expectation rate, meaning most losses are due to a sharp rise in real interest rates. After accounting for inflation, so-called “real” interest rates have been at record lows in the U.S. Rates have been so low mainly because the Federal Reserve has purchased trillions of dollars’ worth of Treasury bonds and mortgage-backed securities.

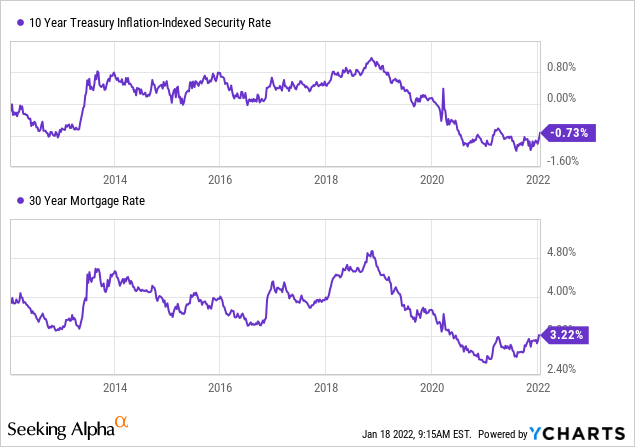

As detailed last month in “TIP: Federal Reserve Tapering To Boost Real Interest Rates”, this immense stream of asset purchases has artificially held real interest rates at abnormally low levels. As this QE stream is stopped over the coming months, it follows that real interest rates and related asset yields should spike. This can already be seen in real interest rates (via the 10-year inflation-indexed rate) and the 30-year average Mortgage Rate (closely tied to mortgage-backed securities). See below:

Overall, I believe it is fair to assume that we are on the verge of normalization of the bond market. This means that, at the very least, real interest rates should rise back to the 0% to 1% range, though perhaps even higher since real rates keep inflation in check. If so, then the 30-year mortgage rate should rise by at least the same amount and possibly more due to high inflation and potential economic risk factors facing the historically expensive property market.

While a more significant spike in rates is not guaranteed, I believe it is highly likely due to the urgent need to get inflation in check. Indeed, given growing constrictions in the energy market, the Fed (and the bond market) may be underestimating the continued potential rise in the inflation rate during 2022. Suppose this results in a further increase to the inflation breakeven rate. In that case, interest rates will need to spike even higher before consumer and producer prices likely stop accelerating.

In general, rising real interest rates are a bearish factor for just about all stocks, bonds, and even some commodities (like gold). However, some asset classes are usually hit harder than others. One asset class with exceptionally high exposure to rising real interest rates is the commercial property market, such as REITs in the Vanguard Real Estate ETF (VNQ). Unsurprisingly, VNQ was the worst-performing market segment during the first weeks of 2022 due to high exposure to real interest rates. In my opinion, the decline for REITs is only getting started.

The Capitalization Rate Conundrum

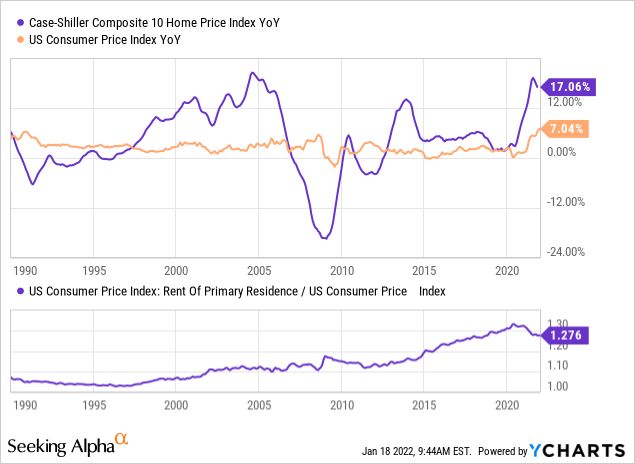

Many investors see real estate as a means of hedging against inflation. This, and their higher dividend yields, is one of the many reasons why so many have piled into REITs over recent years. While there is truth to this view, the historical correlation between inflation and property price growth is relatively weak and highly inconsistent. See below:

Property prices can fluctuate for many reasons which are unrelated to inflation. Real estate is far more cyclical than inflation and can see prices skyrocket and plummet at significantly faster paces. Land assets that do not physically decay over time should keep up with inflation in the long run. However, most REITs today are urban buildings with minimal land value and significant overhead such as maintenance and energy costs which rise with inflation. Rent levels generally keep up with inflation and have outpaced inflation to a large extent since the 90s, but recent data since 2021 has shown a reversal in that trend. As such, many REITs are facing pressure on their operating margins, particularly for those segments which have seen vacancies rise and asking rents decline since 2020.

The decline in interest rates muddies the problematic situation for landlords. There was a considerable rise in refinancing activity that began in 2019, peaked around the summer of 2021, and has crashed recently. This trend has benefited most property owners by significantly lowering payments and freeing up cash flow. It has also allowed tech-centric “growth” REITs like American Tower (AMT) abnormally cheap access to capital. Easy access to growth capital has also aided the bulk of VNQ’s top ten holdings as it’s heavily skewed toward “growth” REITs.

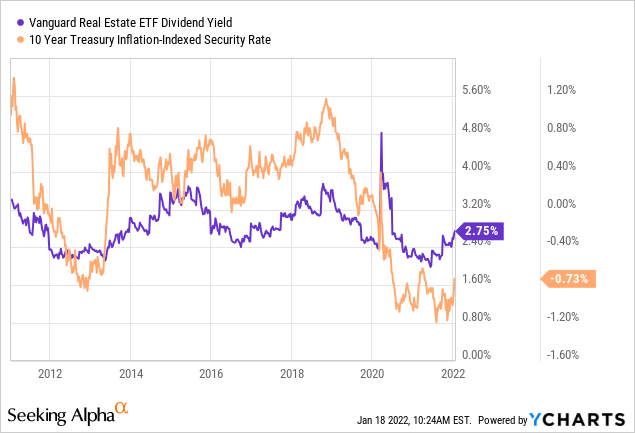

Since interest rates are low, property investors can pay more for buildings and obtain the same overall return. As such, there is a solid historical relationship between commercial property capitalization rates (Net Operating Income to Property Price), showing lower rates push property values up and vice versa. CBRE’s research has found that this relationship is even stronger after accounting for inflation using real interest rates. This relationship can be seen relatively clearly in the correlation between VNQ’s dividend yield and real interest rate:

As the real interest rate rises, REIT and landlords looking to make purchases will face higher interest costs, meaning capitalization rates should soon rise from extreme historical lows. For most REITs, this will push net asset values lower. To put that in perspective, a cap rate rise from 5% to 6% would push a property’s fair value down by 16-17%, given no change in NOI. Looking at the potential moves in the bond market, it seems an even more considerable spike in cap rates is possible, if not likely.

Specific Issues With VNQ And Alternatives

Overall, the rise in real rates and mortgage rates should negatively impact almost all REITs in VNQ. As with the stock market sectors, some areas will likely be hit harder than others. Importantly, VNQ is very similar to the S&P 500 in that its assets are highly skewed toward those with the highest valuations. This is primarily those REITs with higher growth rates and lower dividend yields. Similar to the technology sector, these assets usually have greater exposure to a rise in rates. This is because both the fair value of their discounted future cash flows and their asset’s net-asset-values would typically decline simultaneously given a normalization of interest rates.

The largest segment within VNQ’s portfolio is “Specialized REITs,” at 37% of holdings. The subsequent most significant portions are residential (15%), industrial (12%), and retail (11%). Notable examples of specialized REITs include the cell tower giants American Tower Corp and Crown Castle (CCI) (collectively making up ~11% of VNQ’s assets). I am specifically bearish on telecom REITs due to their massive overvaluation aided by unrealistic outlooks. The same is generally true with data center REITs (the other prominent “Specialized REIT” section) which carry very high valuations, growing competitive pressures, and exposure to energy prices.

In general, the most overvalued REITs can be avoided by looking toward small-cap REITs. There is an ETF for this space (ROOF), which, though it has low AUM due to underperformance, may benefit from a potential shift out of the mega-cap REIT giants toward smaller, cheaper, and more agile firms. Many smaller REITs have had far weaker performance over the past decade as they’re positioned in commercial property sectors with generally higher capitalization rates (retail, hotels, etc.). While these segments have significant issues today, they’re accounted for cap rates and REITs’ dividend yields.

Most importantly, those REITs with high cap rate properties will likely see smaller net-asset-value declines given a rise in interest rates. For example, a 2% cap rate rise from 5% (cap rate for many “high-quality” properties) to 7% would push a property price down by ~31%. In contrast, the same increase from 9% to 11% (a typical cap rate for low-quality properties) would only push a property down by 18%. Similar benefits can be found in international REITs, which generally have lower valuations (and much higher yields) and, of course, less exposure to the Federal Reserve and U.S. inflation issues.

The Bottom Line

Overall, I am very bearish on VNQ and believe the fund has already been catalyzed into a correction given the rise in real interest rates. As this trend marches on, I expect we will likely see a spike in mortgage rates, which would push commercial property sales volumes lower, allowing cap rates to rise to more reasonable levels. I expect this issue to become apparent to the market over the coming months unless the Fed finds a way to extend QE or keep interest rates low. In my view, this would only occur if there is a recession which would also be bearish for VNQ. Of course, in today’s shifting world, unlikely occurrences are seemingly increasingly common.

[ad_2]

Source link Google News