[ad_1]

We Are

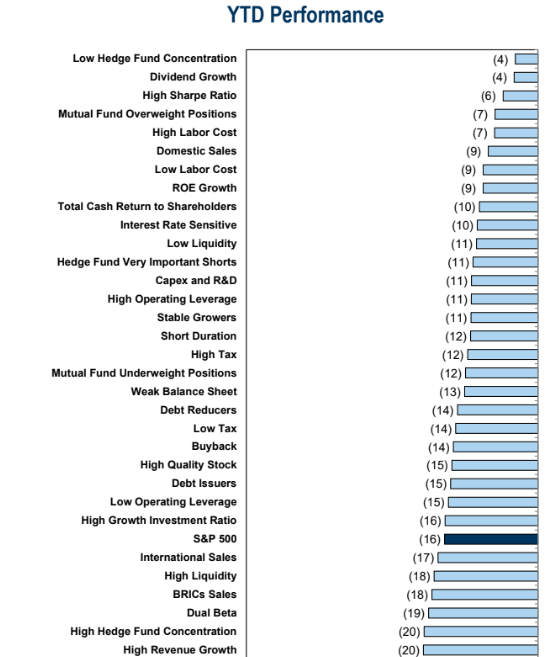

Goldman Sachs reports that the year-to-date factor performance picture favors dividend growth companies in the U.S. Right now, though, with a weakening U.S. dollar and foreign stocks that are beating domestic equities in 2022, I’m turning my eyes to the ex-U.S. market.

One popular index fund offers exposure to non-U.S. dividend growth companies – and the fund has rallied huge in the last several weeks. Is there more upside to come, or is it time for a breather? Let’s dig in.

Goldman Sachs: Year-to-Date U.S. Equity Performances

Goldman Sachs Investment Research

The Vanguard International Dividend Appreciation ETF (NASDAQ:VIGI) gives investors exposure to large-cap equity, emphasizing stocks from developed and emerging markets, excluding the United States, with a record of growing dividends year over year, according to Vanguard. With an expense ratio of just 0.15% and a median 30-day bid/ask spread of only five basis points, it is an efficient and effective way to access foreign companies with a track record of growing payouts to shareholders.

The fund holds 313 stocks with a median market cap of $70 billion. Impressively, the average earnings growth rate among its holdings is high at 11.4%, but the P/E ratio is also a bit pricey at 18.0x, per Vanguard. Still, that yields a PEG ratio under one, which is still somewhat attractive to me, but not as cheap as the broad non-U.S. market.

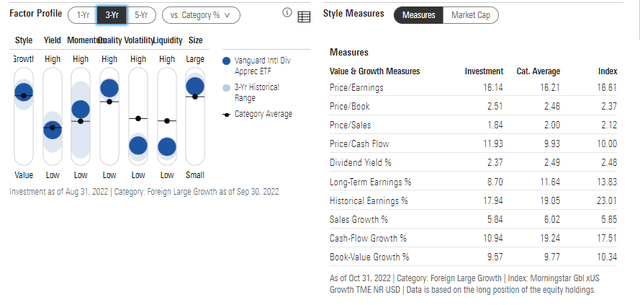

VIGI generally features higher-than-market growth and middle-of-the-road total yield, per Morningstar. The factor profile in the table below is a useful gauge of what investors can expect out of the fund. What’s ideal is that it is a low-volatility product, but it can also have weak liquidity. The overall dividend yield is 2.4% (it is higher if you include capital gain distributions).

VIGI: Factor Profile & Key Portfolio Statistics

Morningstar

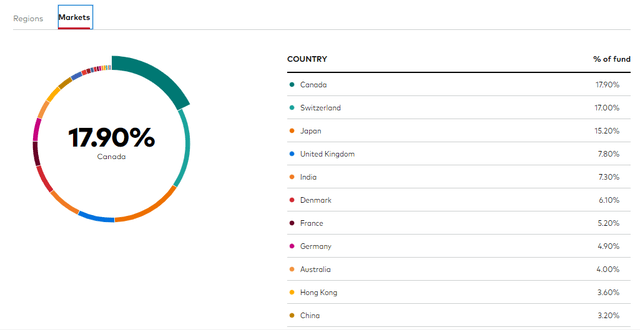

In terms of the portfolio composition, you can get ex-U.S. equity exposure without worrying much about the volatile China market through this fund. The world’s second-biggest economy is just 3.2% of VIGI while Hong Kong is merely 3.6% of the ETF. In all, emerging markets comprise 12.7% of the fund, smaller than its roughly 25% weight in the ACWI ex-U.S. index. Most of the holdings are domiciled in Canada, Europe, and the Pacific regions, which can offer more stability compared to the emerging world.

VIGI: Primarily A Developed-Markets Fund

Vanguard

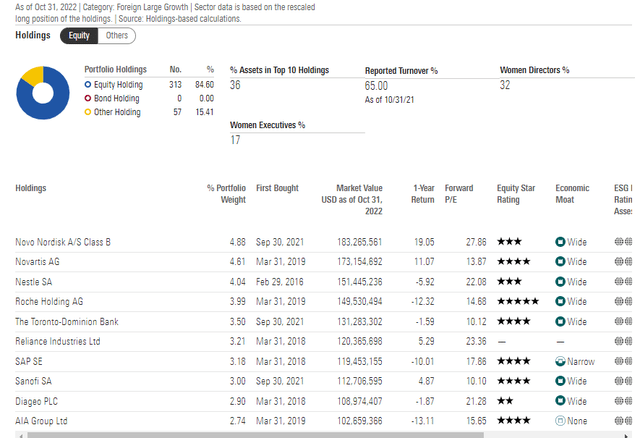

What is also reassuring for risk-conscious investors is that VIGI is not a highly-concentrated product – the biggest holding as of October 31, 2022, is Novo Nordisk at 4.9%. In all the top 10 holdings makeup 36% of the ETF, according to Morningstar, which is not bad considering the total holding count.

VIGI Portfolio: Major Foreign Names in the Top 10

Morningstar

The Technical Take

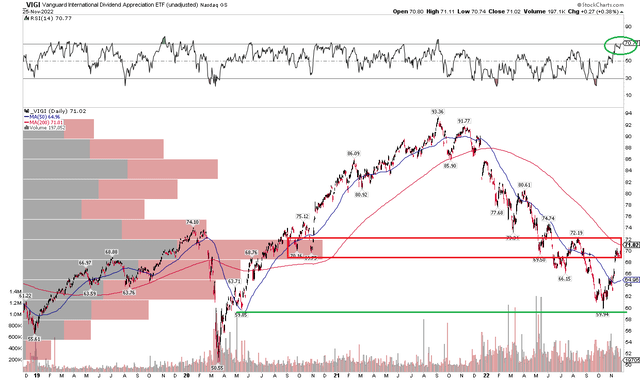

VIGI is right at a key spot on the chart. Notice how shares have rallied sharply to the falling 200-day moving average for the first test of this key long-term trend indicator line since the start of the year. With a very high RSI, which I often take as a bullish sign, the fund could be due for a near-term pullback.

Buttressing that argument is a significant amount of bearish supply as measured by the volume by price indicator on the left side of the chart. A decent low looks to have been put in back in October, but it is common for securities to retreat on a first attempt at a big resistance level on the chart. A buy-the-dip strategy is appropriate here.

VIGI: Some Resistance Near-Term at the 200-Day Moving Average

Stockcharts.com

The Bottom Line

I am a hold on VIGI as shares are not too cheap and the technical picture suggests some caution here. Still, for long-term investors, VIGI is a solid choice due to its liquidity, tradability, and diversification. Moreover, cash and low-risk bond funds are not bad places to hang out as you wait for better opportunities to buy equities.

[ad_2]

Source links Google News