[ad_1]

Vertigo3d/E+ via Getty Images

Overview

It is such a challenging time for investors with record-high stock valuation, low-interest rates, surging inflation, and geopolitical tension building up in the Ukraine region. As a result, we are going through some large volatilities recently, with the market fluctuating more than 2%. To put things into perspective, the S&P 500 moves between -1% and +1% a day for 70% of the days from 1999 to 2019. It only moves larger more than 2% about 20% of the time, and above 3% for only about 10% of the time. The market moved more than 2% several times in the recent 2~3 weeks, and the VIX fear index exceeded its 90% percentile almost during half of the trading days.

At times like this, we feel urged to remind ourselves and our readers to stay principled and stick to methods that we truly understand. Both our own accounts and the accounts we help to manage repeatedly show that sticking to FEWER but well-understood holdings actually LOWERS risks.

And you will see that the Vanguard Dividend Appreciation ETF (VIG) is a good fund built on a sound index principal. For several good reasons:

- It focuses on dividend growth by specifically selecting US-listed firms that have increased their dividend payments for the past 10 years.

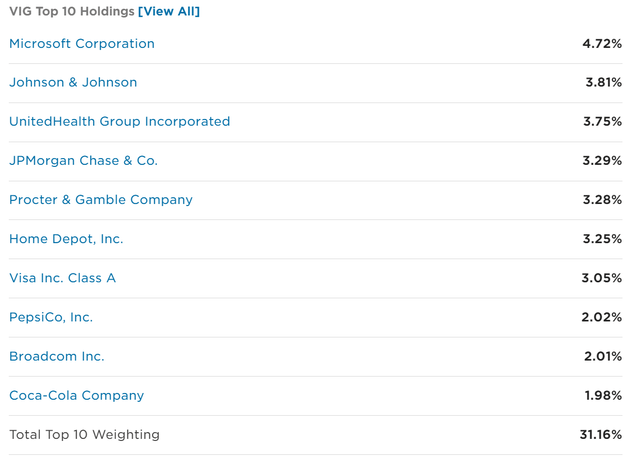

- As a result, its holdings tend to be stable and well-established businesses as you can see from its top 10 holdings.

- With its focus on dividend AND growth, VIG’s overall strategy provides a fund that consists of reliable and sustainable earnings. Such a strategy has proven to be an effective investing method (the one that we subscribe to ourselves) in the past, and we are confident that it will remain effective in the future too.

- In terms of valuation, the fund is reasonably valued, or even a bit on the cheap side as you will see from its yield spread against risk-free rates.

Source: ETF.com

Basic information

The following basic information is summarized for investors who are not familiar with this fund yet to facilitate a more in-depth discussion later.

* Number of stocks: 269 (all US stocks)

* Fund total net assets: $70.7 billion

* Expense ratio: 0.06%

* Distribution yield: 1.70%

The dividend yield is about 30% above the current 1.3% yield of the overall market (as represented by S&P 500) and about 15 below the 10-year treasury rates. So as aforementioned, VIG focuses more on the growth potential of dividends, not the current dividend yield level. Also note that VIG holds all US stocks and no foreign stocks, therefore the dividend is subject to a lower tax bracket than normal income for most investors. Also, note the 0.06% low cost – it is a major draw for many investors like ourselves who favor VIG (and other Vanguard products).

Secular rotation and spread yield

For bond-like equities funds such as VIG, an effective way to evaluate their valuation with interest rates adjusted is to calculate the yield spread. Details of the calculation and application of the yield spread have been provided in our earlier article. The yield spread is an indicator we first check before we make investment decisions. We’ve fortunately had very good success with this indicator because of:

- Its simplicity – it only relies on the most simple and reliable data points (treasury rates and dividends). In investing, we always prefer a simpler method that relies on fewer and unambiguous data points rather than a more complicated method that depends on more ambiguous data points.

- Its timeless intuition – no matter how times change, the risk-free rate serves as the gravity on all asset valuations and consequently, the spread ALWAYS provides a measurement of the risk premium investors are paying relative to risk-free rates. A large spread provides a higher margin of safety and vice versa.

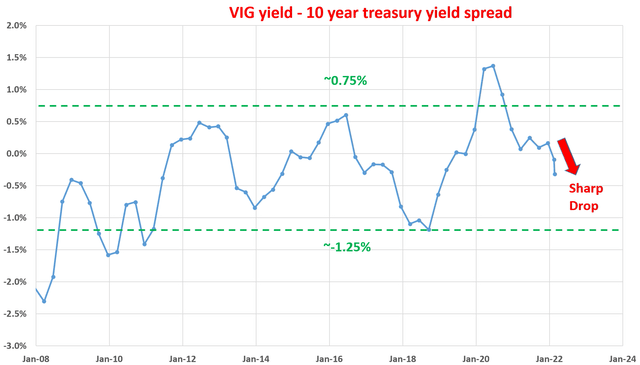

The following chart shows the yield spread between VIG and the 10-year treasury. The yield spread is defined as the TTM dividend yield of VIG minus the 10-year treasury bond rate. As can be seen, the spread is bounded and tractable. The spread has been in the range between about -1.25% and 0.75% the majority of the time. Suggesting that when the spread is near or above 0.75%, VIG is significantly undervalued relative to a 10-year treasury bond (i.e., I would sell treasury bond and buy VIG). In another word, sellers of VIG are willing to sell it (essentially an equity bond) to me at a yield 0.75% above the risk-free yield. So it is a good bargain for me.

And when the yield spread is near or below -1.25%, it means the opposite. Now sellers are demanding such a high price that drives yield to be 1.25% below the risk-free yield – which makes little sense to me as a buyer. Such a market timing method opens up opportunities for dynamic allocation to benefit from the price movement in the short- to mid-term with good reliability, as to be discussed later.

As you can see, the yield spread has sharply narrowed since the beginning of the year due to the surging 10-year treasury rates. The yield spread has dropped to about -0.32% now. However, despite the sharp narrowing, the yield spread is currently still above the historical average, thus still providing a cushion against future interest rate uncertainties. And at the same time, it also provides favorable odds for short term price appreciation as we are going to see immediately below

Source: author based on Seeking Alpha data

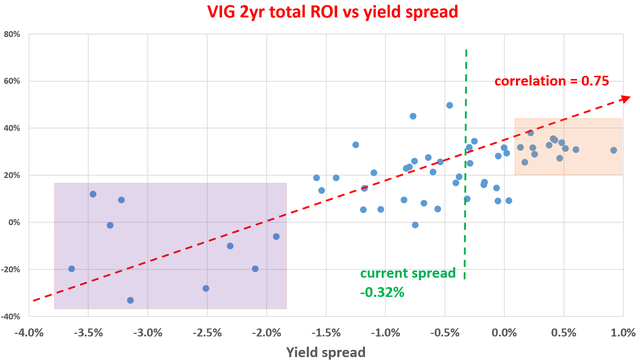

The next chart shows the two-year total return on VIG (including price appreciation and dividend) when the purchase was made under different yield spread. As can be clearly seen, first that is a positive trend, indicating that the odds and amount of the total return increases as the yield spread increases. The correlation actually is quite strong, with a correlation coefficient of 0.75. Particularly as shown in the orange box, when the spread is about 0% or higher, the total returns in the next two years have been all positive and very large (all above 25% exception one data point of ~10% total return).

On the other hand, as shown in the purple box, when the spread is about -2% or lower, the total returns in the next two years have been mostly negative. Out of the 9 times (my analyses were performed on a quarterly basis) this occurred, the 2-year ROI has been negative 7 times, and many of the losses have been pretty large (in the -20 to -30% range).

As of this writing, the yield spread is -0.32%, actually closer to the thicker end of the historical spectrum, signaling mild risks ahead and favorable odds for near-term return.

Source: author based on Seeking Alpha data

You should consider VYM too

We are scheduled to update our conservative SWP in the middle of February. The theme that we see in this portfolio is the rotation to value stocks, and we anticipate the theme to continue. As you can see from the following chart, currently the valuation gap between value stocks (represented by SCHD) and the total market (represented by VTI) is at a secular peak. We will update the model portfolio right away – again, we write what we actually do. We then will provide an article shortly afterward to detail the changes we’ve made, our key thoughts, and our outlook.

At an overall level, we currently see a rotation toward value stocks. And VIG is definitely more value-oriented than the overall market with its focus on large-cap and dividend growth. However, an even more value-oriented is VIG’s sister fund, the Vanguard High Dividend Yield Index Fund ETF (VYM). We anticipate the theme to continue and holding/adding high-quality values stocks (like those in VIG or VYM) is a key part of our strategy.

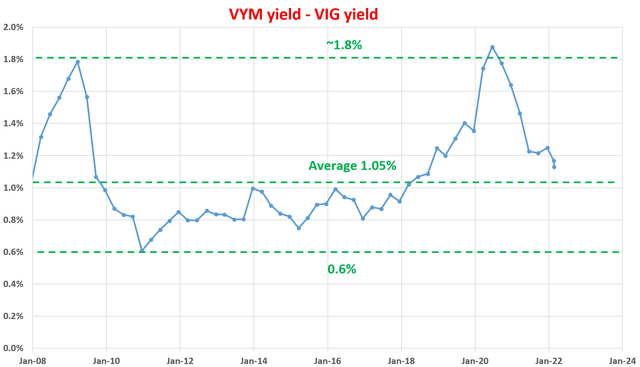

The following chart illustrates the valuation gap between VIG and VYM by their yield spread. As can be seen, the spread bottomed around 0.6% about 10 years ago. And the gap has gradually widened to a peak above 1.8% during 2020 – a widening of a whopping 120 basis points.

Now we are starting to see the reverse – the market rotation back to value stocks. The spread yield has gradually narrowed to the current level from its peak in the past year or so. The long-term average is about 1.05% in the past ten years – which makes good sense as value stocks should pay higher dividends than the overall market (that’s part of the reason why they are value stocks).

And as you can see, the current spread is still above this average and we see favorable odds for value funds/stocks to outperform the overall market in the years to come.

Source: author

Conclusions and final thoughts

At turbulent times like this, it is especially crucial to stay principled and stick to methods that we truly understand. Both our own accounts and the accounts we help to manage repeatedly show that sticking to FEWER but well-understood holdings actually LOWERS risks. And VIG is a good fund built on a sound index principal. The specific takeaways are:

- At an overall level, we currently see a rotation toward value stocks. And VIG is definitely more value-oriented than the overall market with its focus on large-cap and dividend growth.

- The fund is reasonably priced as indicated by its yield spread relative to the 10-year treasury rates. Currently, the spread is -0.32%, actually closer to the thicker end of the historical spectrum, signaling mild risks ahead and favorable odds for near-term return.

- Finally, we also suggest you take a look at VIG’s sister fund, VYM – an even more value-oriented fund. We anticipate the rotation to value to continue. Holding/adding high-quality values stocks (like those in VIG or VYM) is a key part of our strategy. The valuation gap between VIG and VYM by their yield spread is still above the historical average and we expect the gap to further narrow.

Thx for reading! And let me know your comments and thoughts in the meantime.

[ad_2]

Source links Google News