[ad_1]

(Source – Pexels/Pixbay)

It is widely believed that the Healthcare sector is a safe sector in a recessionary environment because “people always need medical treatment.” While that is historically true, it seems that many investors are underweighting the substantial risks in the sector.

Healthcare stocks saw tremendous performance during the creation and deployment of Obamacare from 2011 to 2015. During this timeframe, the Vanguard Health Care ETF (VHT) outperformed the S&P 500 by roughly 50%. As is almost always the case, periods of extreme outperformance are met with periods of comparable underperformance. Since 2015, VHT has underperformed the S&P 500 by about 20% and, in my opinion, will continue to underperform for the next five years.

The companies in the ETF have among the highest valuations on the market today and have surprising balance sheet risks. Even more, the “aging population” narrative that is poised to push up the earnings of these companies appears to be a myth more than reality. Healthcare prices will fall, either by natural oversupply or by government intervention. Needless to say, VHT is probably more of a short-selling opportunity than a solid long-term investment.

The Vanguard Healthcare ETF VHT

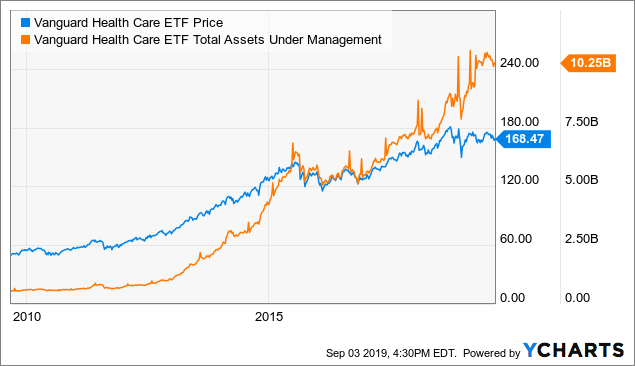

Now, I am bearish on the ETF but actually like the fund more than other healthcare ETFs. The fund is old and has been trading since the beginning of 2004 and currently has seen enormous AUM growth over the past decade. The ETF currently has $10.25 billion in assets under management. Let’s take a closer look at the fund’s flows to see how our fellow investors are positioning themselves:

Data by YCharts

Data by YChartsAs you can see, investors have been pouring money into the fund even as it has underperformed other equity sector ETFs. To me, this rampant AUM growth is a sign of a potential “light” bubble in the sector. You can also see that AUM is on a bit of a downtrend this year and looks to be topping out; usually, it is best to get out ahead of other ETF investors.

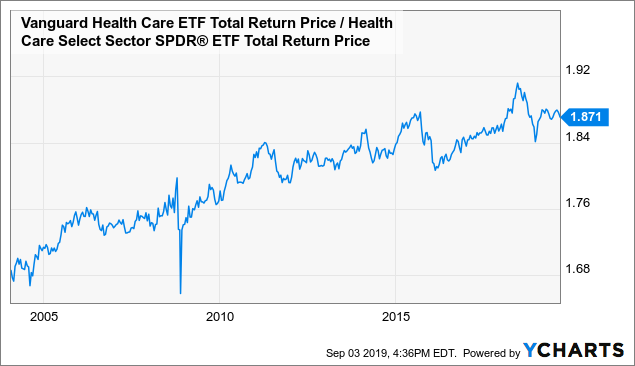

On a more positive note, the ETF has an extremely low expense ratio of 10 basis points, which is the lower than that of its peers: Health Care Select Sector SPDR (XLV), and iShares U.S. Healthcare (IYH). Even better, the ETF has consistently outperformed those peers since its inception. Take a look at the total return price of VHT divided by that of XLV. Note, this is a proxy of a pairs trade performance (1% higher ratio indicates 1% of overperformance):

Data by YCharts

Data by YChartsAs you can see, VHT has been generating alpha when compared to XLV. While I am bearish on the healthcare sector as a whole, I admit that the vanguard fund is the “best of the worst.”

Moving on to fundamentals, luckily Vanguard gives us a good portion of the fundamental statistics of the ETF’s holdings. The fund holds 390 stocks with a very high median market cap of $75 billion. The fund has a high weighted average “P/E” ratio of 23.3X and a strong return-on-equity of 15%. Over the past five years, the companies have had an average earnings growth rate of 5.3% that I expect to slow in years to come.

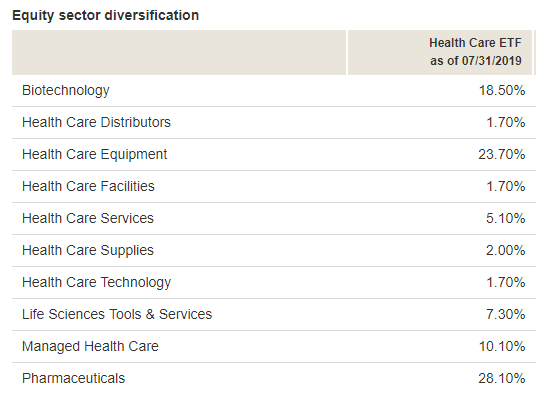

Finally, here is the industry breakdown for the ETF:

(Source – Vanguard VHT)

Those of you who read my articles may know that I am particularly bearish on the two largest industries in the ETF: Health Care Equipment (NYSEARCA:XHE), and Pharmaceuticals.

Let’s take a deeper dive into the ETF’s fundamentals.

Falling Growth at Very High Price

They say the best investments offer growth at a reasonable price. Simply buying stocks and ETFs with low “P/E” multiples is a recipe for high cyclical risk exposure as low “P/E” companies tend to have high risk (i.e banks). VHT is at the other extreme, as it has some of the most expensive companies on the market today, but has similar risks to low “P/E” sectors.

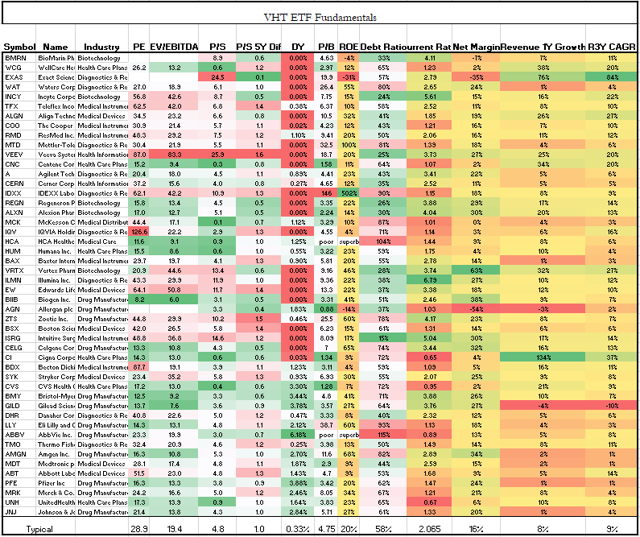

Take a look at the fundamental breakdown of the top 49 companies in the ETF:

Note, “typical” is a harmonic mean for valuation statistics and a median for others.

(Source – Unclestock)

I’ll begin with the positives. The companies have a strong median three-year top-line CAGR of 9%, but we can see that the trend may be fading as revenue growth over the past 12 months has been at 8%. Most of that growth is seen in medical devices and biotechnology companies. In my opinion, political pressure against such firms (particularly medical devices) will continue to rise and lower growth expectations will soon arise.

Net margins are also quite high, with the average firm taking home 15% of revenue. This is a sign the companies have wide moats, but it is also a sign that profit margins are more likely to fall than rise higher in years to come.

The balance sheets of these companies came as a bit of a surprise to me. The average company has a bit of debt with a median debt ratio of just under 60%. In itself, debt is not bad but it does increase the fund’s cyclical risks. I agree that the top-line of these firms will not be hurt much by a recession as their demand is relatively static. Still, increasing corporate credit spreads may cause financing difficulties for some of the companies and lower profit margins after interest expense. Thus, these healthcare stocks have more cyclical exposure than they used to.

The companies also have extremely high valuations, with the average company trading at nearly a 29X “P/E” ratio. In order for the companies to be at fair value given this valuation, they would need to be maintaining at least a 15%-20% top-line growth rate and have less debt exposure.

They are trading at a similar valuation to their five-year average as seen in their five-year relative “P/S” ratio, but it often takes years for valuations to return to stable levels. This happens in two ways: higher earnings and/or lower stock prices. Most would argue the former; I would argue the latter.

Misleading Macroeconomic Growth Narratives

If you take a look at long thesis for healthcare stocks, almost all analysts will cite the “aging population” as the primary driver of revenue growth. Indeed, about half of medical expenditures occur over the age of 65 and their baby boomers are rapidly crossing over into that age group.

That said, it has been consistently demonstrated in academic papers that aging only accounts for about 20% of the increases to healthcare expenditure. Even more, the primary benefactor of those increases is wage-earners in the healthcare industry, not investors.

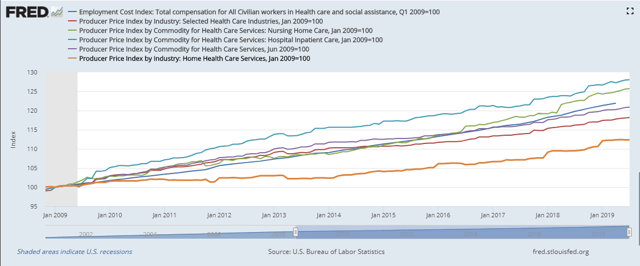

This is still a very subtle trend that most investors and economists have not yet seen. Take a look at the PPI indices for healthcare services vs. employment cost for healthcare services (dark blue):

(Source – Federal Reserve Economic Database)

It is admittedly difficult to see clearly on this chart, but notice how the blue (employment cost) line is slowly rising higher than the PPI figures? This is a sign that operational and gross profit margins will likely decline as employment costs are very large in the healthcare industry. Remember, unemployment is very low so wage inflation is likely to come as a negative shock to businesses that currently have large profit margins.

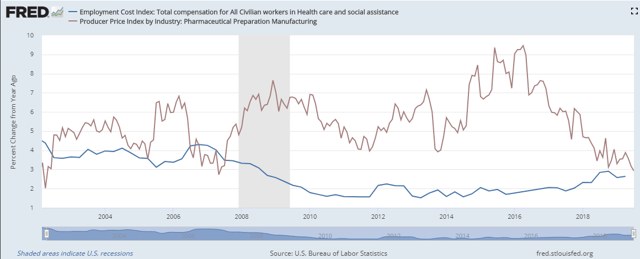

To see this even more clearly, take a look at PPI YoY change for the pharmaceutical industry vs. healthcare employment costs:

(Source – Federal Reserve Economic Database)

Take note, drug price growth is falling rapidly while wage pressures are rising. This trend is likely to come as a negative shock to VHT investors. I agree that top-line growth will remain, but believe it will be lower than many expect and that margins pressures will result in lower net income for most of the companies in VHT.

Quick Note on the Political Aspects

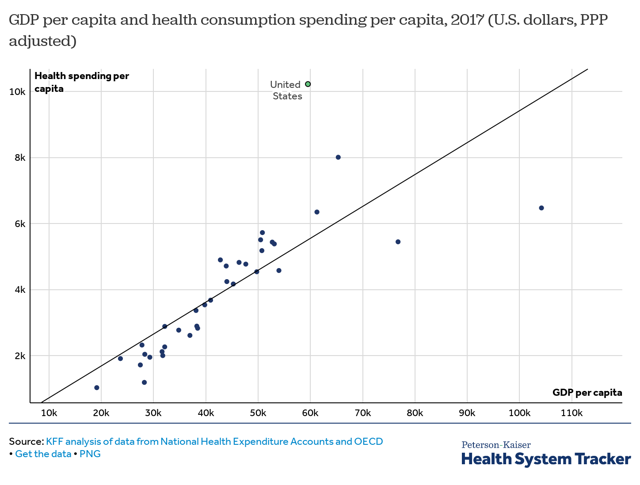

Remember, the U.S spends 20% of its GDP on healthcare while the rest of the world spends much less. You have almost definitely heard this in ongoing political rumblings, but just take a look at this chart of GDP per capita by country and healthcare expenditure:

(Source – Peterson-Kaiser)

Needless to say, I would not want to bet on that figure going even higher as is implicit in investing in VHT. While the ways healthcare prices will fall are beyond my pay grade, I think the risk of extreme (anti-capitalist) reform of the sector is much higher than most investors seem to believe. The politicians who want to nationalize healthcare are not known to look favorably upon Wall Street. In my opinion, this is a growing consensus between both political parties that healthcare investors should keep a close eye on.

The Bottom Line

Overall, it seems that the stars are aligning to make “short healthcare” a profitable trade. Here is my list of downside pressures/catalysts:

- Rapidly rising recession risk

- Rising corporate credit spreads (balance sheet risk)

- Falling top-line growth expectations

- Increasing healthcare wage costs

- Rapidly declining drug and medical device price growth

- 2020 Election / Democratic primary political risk

- Potential disruptive innovation due to high-profit margins (such as the Amazon-Berkshire Hathaway-JPMorgan Chase joint venture, Haven Healthcare)

Of course, there are factors that could prove my thesis wrong. If equities continue to rise, VHT will likely rise as well. Further, many of my “downside pressures” have a long-term orientation that may not be reflected in markets for years, though it seems that investors are beginning to realize those factors.

Actionable Trades

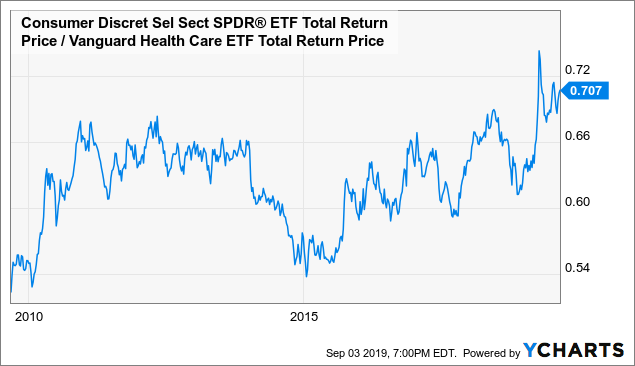

There are two ways to play this trade. The first is to directly short the ETF is you are bearish on in the equity market as a whole. The second is through a pairs trade to hedge away that exposure. In my opinion, the factors I don’t like about healthcare, are the ones I do like about consumer discretionary. Consumer discretionary, for example (XLY), will gain from rising wages and will rise more than VHT if equity markets recover. Further, I actually believe the next recession will hurt consumers far less than the past recession and cause the sector to become a bit of a “safety trade”.

Take a look at the recent performance of that pairs trade as seen by their total return ratio:

Data by YCharts

Data by YChartsAs you can see, this trade has actually been performing well for about four years. In my opinion, this trend will accelerate higher over the months to come.

Finally, I’d give VHT itself a price target of $100 given an equity bear market to give the ETF a weighted average “P/E” ratio of 14X, which I believe better reflects the many risks to the sector.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News