[ad_1]

Andrii Dodonov/iStock via Getty Images

Thesis

Vanguard Short-Term Treasury ETF (NASDAQ:VGSH) is an exchange traded fund that seeks to track the performance of the Bloomberg US Treasury 1-3 Year Bond Index. The fund invests its cash in Treasury securities with remaining maturities between 1 and 3 years, and in a normalized or easing environment represents a great vehicle to gain yield and price stability from a credit risk free portfolio. Given the current aggressive monetary tightening environment the fund has lost 2.64% year to date but now yields 1.76%. As the front end of the yield curve stabilizes and the “roll” effect of the fund starts to take hold we predict a stabilization in the price performance for the fund and the transformation into a stable yield capturing vehicle. The fund has a significant $13.3 billion AUM, which indicates heavy usage by institutional investors. The fund has a 5-year standard deviation of 1.14 and a Sharpe ratio of 0.18. The fund has a very low expense ratio of 0.04%. VGSH represents a good partitioning tool for investors who do not like to roll shorter dated Treasury securities directly into their brokerage accounts and is an exchange traded vehicle which can be easily utilized by institutional investors looking to park cash. For a retail investor directly purchasing shorter dated Treasury securities in their brokerage account, which represents an active alternative to capturing yield and can be tailored to have a lower duration, VGSH represents a viable alternative. A retail investor who does not like to actively roll Treasury securities in their portfolio to capture the rising front end yield curve would be well served to consider VGSH as a passive yield enhancing tool in their portfolio as rates stabilize in the upcoming months.

Holdings

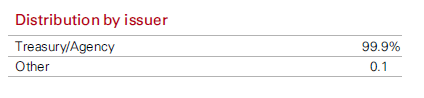

The fund holds exclusively Treasuries securities:

Holdings (Fund Fact Sheet)

Given the fund holdings the portfolio is rated AAA, hence the credit risk associated with the holdings is zero. An investor does not have to worry about the underlying securities defaulting.

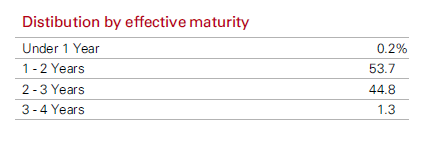

The vehicle is set-up to hold short-dated bonds only:

Effective Maturity Distribution (Fund Fact Sheet)

Most of the holdings sit in the 1-2 years bucket, hence there is a good “roll” effect in this fund – i.e. as time passes the holdings come down the maturity curve, hence the discount imposed by higher overall yields is moderating as the pull to par sets in.

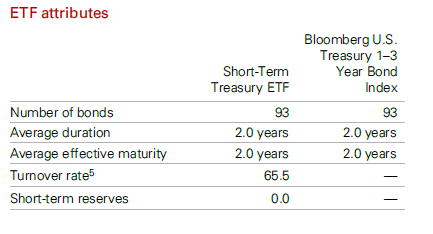

The fund has 93 bonds in its portfolio and a net duration of 2 years:

ETF Attributes (Fund Fact Sheet)

A duration of 2 years means the fund has been subject to price losses stemming from higher 2-year yields, but the short dated nature of the collateral gives it a strong “roll” effect. If we take a simple example with a portfolio with a 1-year maturity profile for example, while initially we are going to have price losses due to higher 1-year yields, as the portfolio nears maturity there is a “pull to par” effect, and at the end of the year the underlying collateral will have recouped all its mark-to-market losses due to interest rates.

Performance

The fund is down more than 2% year to date due to the rising yield curve and modest duration it runs:

YTD Performance (Seeking Alpha)

On a longer-term basis we can see the nice attributes of this vehicle which fits as a net partitioning for cash holdings in a portfolio:

5Y Total Return (Seeking Alpha)

Outside aggressive tightening environments (as we have seen in 2018) the fund has a nice accretive total return on a long term basis:

10 Year Returns (Seeking Alpha)

Conclusion

For the past 2 years obtaining any sort of safe short term yield was a challenge given rock bottom interest rates produced by the Fed monetary policy. As the Fed tightens and Treasury yields rise, retail investors have the ability to benefit from these higher credit risk free rates via either outright Treasury purchases or through short dated Treasuries ETFs such as VGSH which now has a 30-day SEC yield of 1.76%. The fund has a low duration of 2 years, which has caused only a modest 2.64% loss year-to-date as yields have spiked in the front end of the Treasury curve. Given its short dated maturity profile the fund benefits from a “roll” effect where bonds benefit from a pull-to-par effect. As the front end of the yield curve starts to stabilize as the Fed actions are priced in, VGSH is set to become again a good vehicle to park cash and obtain an attractive yield. A retail investor who does not like to actively roll Treasury securities in their portfolio to capture the rising front end yield curve would be well served to consider VGSH as a yield enhancing tool in their portfolio as rates stabilize in the upcoming months.

[ad_2]

Source links Google News