[ad_1]

ETF Overview

Vanguard Long-Term Treasury ETF (VGLT) focuses on long-term government bonds in the United States. The ETF tracks the Bloomberg Barclays U.S. Long Treasury Bond Index. The fund invests in treasury securities that will mature 10 years or later. BLV has very low credit risk as all of the bonds in its portfolio are U.S. treasury bonds. Hence, it offers investors good protection in an economic downturn. However, the fund has much higher interest rate risk due to the fact that its portfolio of bonds has a very long average duration to maturity. The ETF offers a 2.5%-yielding dividend. It is a good investment choice for investors seeking safety in an economic downturn.

Data by YCharts

Fund Analysis

Low credit risk

VGLT has a very low credit risk because all of its bonds that it invests are U.S. Treasury bonds. These bonds are backed by the credit of the U.S. government. At the moment, U.S. government bonds have credit ratings of AA+ stable (S&P) and AAA stable (Fitch, and DBRS). Therefore, we do not foresee any credit risk at all even in an economic downturn.

High interest rate risk

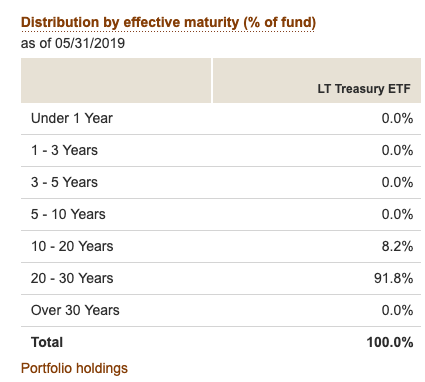

Most of VGLT’s bonds are long-term bonds with maturities over 20 years. As can be seen from the table below, about 91.8% of its portfolio of bonds will mature about 20 ~ 30 years from now and about 8.2% of its portfolio of bonds will mature about 10 ~ 20 years from now. VGLT’s average maturity duration is 25.4 years. This lengthy maturity duration means that its fund performance can be very sensitive to the change of interest rates.

Source: The Vanguard Group

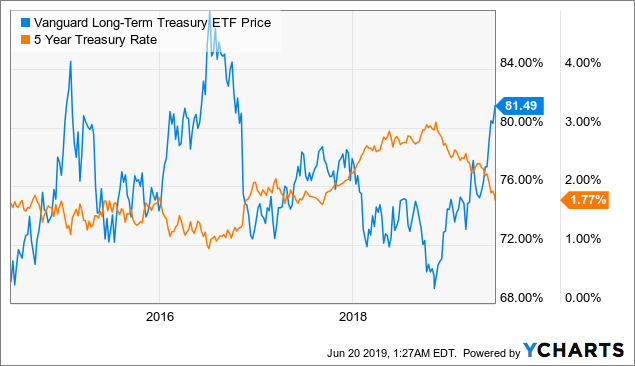

As can be seen from the chart below, VGLT’s fund performance is inversely correlated to the treasury yield rate.

Data by YCharts

Very low management expense ratio

Vanguard charges a very low management expense ratio of 0.07% for VGLT. This MER is lower than many other funds. Other funds such as iShares 20+ Year Treasury Bond ETF (TLT) charges a MER of 0.15%. However, TLT has better performance in the past 10 years. As the chart below shows, TLT’s return of 39.4% in the past 10 years is nearly 4 percentage points higher than VGLT’s performance of 35.5%.

Data by YCharts

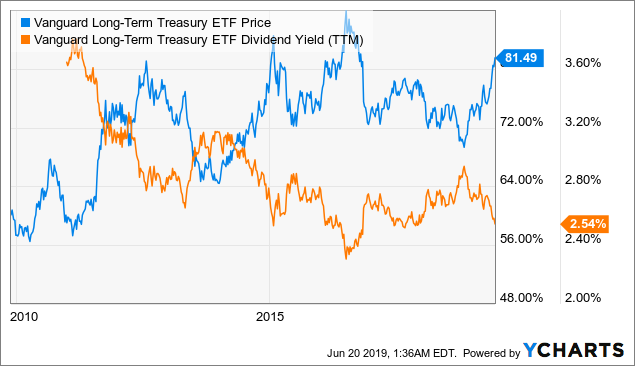

A 2.5%-yielding dividend

VGLT investors will receive dividends with an annualized yield of about 2.5% on a trailing 12-month basis. This yield is towards the low end of its 10-year yield range.

Data by YCharts

Macroeconomic Analysis

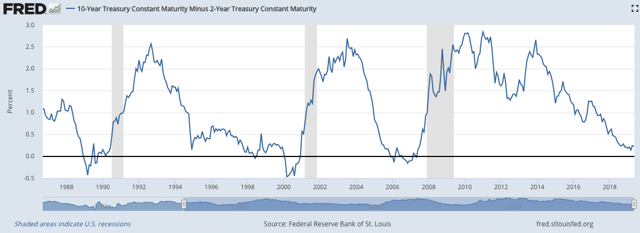

The current economic cycle has been well into its 10th year. Nevertheless, there are already many signs that we are already in the late cycle environment. For example, treasury yield (10-year minus 2-year) is now near the point of inversion (see chart below). As can be seen from the chart below, economic recessions often precede with yield inversions (when the 10-year yield minus 2-year yield falls below 0%).

Source: Federal Reserve Bank of St. Louis

Besides yield inversion, we are also seeing signs of investors rotating from riskier assets (e.g., energy, industrial, etc.) towards defensive sectors (e.g., telecom, utilities, REITs, etc.). This equity rotation is often a sign of a late cycle environment. VGLT’s fund performance should do well in an economic recession as investors will switch funds from riskier assets towards safe assets such as U.S. treasury bonds.

Should be safe to hold on to VGLT in the near term

Looking forward, Federal Reserve will more than likely to cut its key interest rate than raising it in the second half of 2019. If the economy deteriorates further (e.g., due to a full-blown trade war), we think Fed may have to aggressively cut its key interest rate in order to stimulate the economy. Therefore, we think it is safe to hold on to VGLT.

Medium to long-term outlook: Low inflation environment may persist

While it is difficult to predict what the economy will be like 3 to 5 years from now, we think we are now entering an era of low inflation environment. Interest rates will still go up, but they will not return to the levels 20 ~ 30 years ago. This low interest environment will have a tremendous impact on treasury bond ETFs like VGLT. A low interest rate environment means that treasury yield will remain low as well. This means that prices of funds like VGLT will likely face less downward pressure. The reason we believe we are now in an era of low interest rate environment is because inflation will likely remain low. In the past, inflation is often driven by energy prices as well as labor growth. However, years of investments in renewable energy coupled with technologies that helps to use energy more efficiently should keep energy prices low. In addition, the advancement in technology also helps to keep costs down for many products and services (e.g., e-commerce). Therefore, we think inflation will remain low. This will result in lower treasury yield and elevated bond prices.

Investor Takeaway

We think VGLT is a good ETF to be included in one’s portfolio as it provides downside risk protection vs equity ETFs. In addition, it provides a solid 2.5%-yielding dividend. Since we are already in the late stage of the current economic cycle, we think investors should continue to hold or perhaps increase exposure to VGLT.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News