[ad_1]

fotofrog/E+ via Getty Images

Investment Thesis

The top consumer staples firms have been able to deliver stable organic sales growth and appealing dividend yields despite the fact that the sector sees minimal innovation and development. Consumer staples firms have a strong capacity to weather downturns, raise dividends, and produce continuous, incremental growth. All of these traits make them appealing to investors seeking dependable, income-producing equities. Research has shown that consumer staples companies have been mostly found to outperform during market turbulences. Thus, the space generally acts as a safe haven for investors. In this article, I will review the Vanguard Consumer Staples ETF (NYSEARCA:VDC) which provides exposure to a basket of US consumer staples.

Strategy Details

The Vanguard Consumer Staples ETF tracks the performance of the MSCI US IMI Consumer Staples 25/50 Index. The index is composed of companies that provide direct-to-consumer products that, based on consumer spending habits, are considered nondiscretionary.

If you want to learn more about the strategy, please click here.

Portfolio Composition

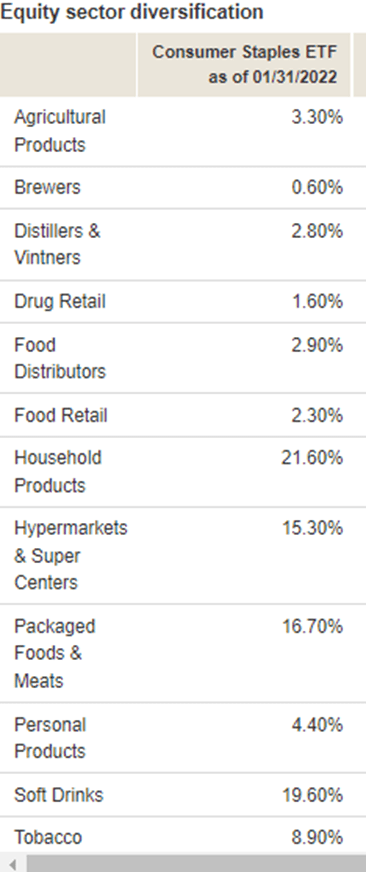

From the sector allocation chart below, we can see that VDC invested ~21.60% of its asset in the household product industry, followed by the soft drinks industry at ~19.60% and packaged food (~16.70 % of total assets). The largest three sectors have a combined allocation of approximately 58%. In terms of geographical allocation, the index invests only in US firms.

Vanguard

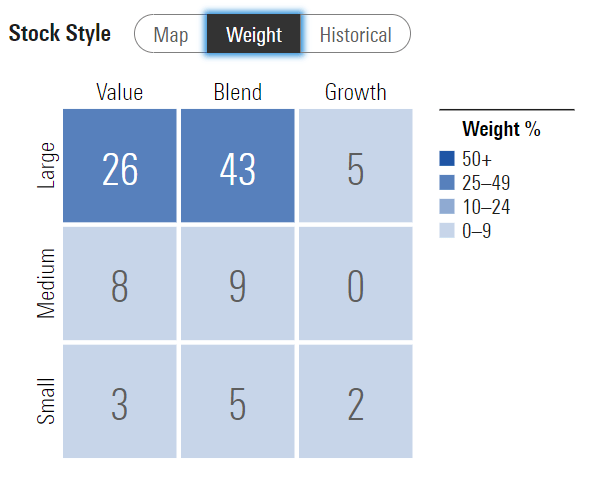

VDC invests over 43% of the funds into large-cap blend issuers, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap value equities which account for 26% of the portfolio. It is interesting to see that VDC puts approximately 74% of the funds into large-cap issuers, which are generally considered less volatile than small and mid-caps.

Morningstar

The fund is currently invested in 99 different stocks. The top ten holdings account for ~63% of the portfolio, with no single stock weighting more than ~14%. All in all, I would say that VDC is well-diversified.

Morningstar

As we are dealing with equities, one important characteristic is the valuation of the portfolio. According to data from Vanguard, the fund currently trades at an average price-to-book ratio of ~5 and an average price-to-earnings ratio of ~26. In addition to that, the portfolio has had an average return on equity of ~26%. I generally consider a company trading at a price-to-earnings ratio above 20 to be richly valued. That said, I think there are some exceptions where you can pay a premium for an outstanding business that delivers a high return on capital and has good growth prospects. In VDC’s case, these companies have an excellent return on equity (close to 26%) and that could explain why the market is ready to pay a premium for these businesses. That said, I still believe VDC is expensive at the moment, especially when you compare it to a plain vanilla S&P 500 ETF which trades at approximately 20x forward earnings.

Is This ETF Right for Me?

I have compared below VDC’s price performance against the performance of the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) and the Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP) over the past 5 years to assess which one was a better investment. Over that period, SPY outperformed both consumer staples strategies. However, the performance gap narrowed considerably during the March 2020 crash which highlights how resilient consumer staples are during downturns. To put VDC’s performance into perspective, a $100 investment in this ETF 5 years ago would now be worth $137.73, excluding dividends. This represents a compound annual growth rate of ~7%, which is an average absolute return.

Refinitiv Eikon

If we take a step back and look at the performance from a 10-year perspective, the results don’t change much. SPY came on top once again, outperforming VDC and XLP. I personally think VDC is suitable for a long-term investor rather than a trader. Given the strategy’s low volatility compared to the market, this ETF can be used to decrease the overall portfolio’s volatility.

Refinitiv Eikon

Key Takeaways

The consumer staples sector is considered a “safe bet” by market participants and tends to provide good returns with low volatility. VDC is a well-diversified ETF which provides a cost effective exposure to this sector. In terms of valuation, VDC is expensive at the moment relative to the S&P 500, trading at more than 26x earnings. I would personally wait for a 20% pullback from the current price before considering buying this ETF.

[ad_2]

Source links Google News