[ad_1]

cagkansayin/iStock via Getty Images

Thesis

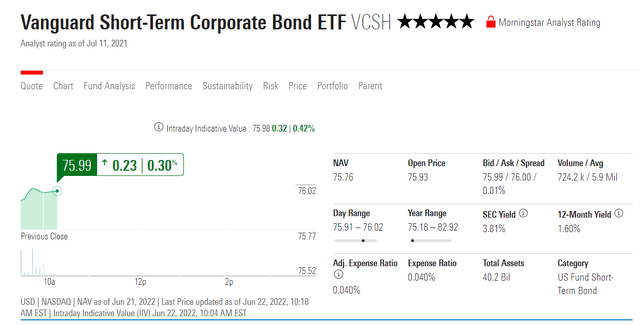

The Vanguard Short-Term Corporate Bond ETF (NASDAQ:VCSH) is an exchange traded fund with a 2.8 years duration that is exclusively composed of investment-grade bonds. The fund aims to track the performance of the Bloomberg U.S. 1-5 Year Corporate Bond Index and offer investors exposure to the investment-grade U.S. corporate market. The fund has a 0.6 Sharpe ratio (10-year lookback) and a 2.41 standard deviation (10-year lookback). The fund is down more than -5.7% year to date given the rise in three-year yields that has exceeded 200 bps YTD.

With a long-term annualized total return north of 2%, the fund is a great portfolio pick for unleveraged investment-grade corporate exposure once the Fed is done with raising rates. VCSH should be traded as a macro portfolio play with a greater allocation once rates rise to multiple-year highs and an allocation closer to nil towards the end of monetary easing cycles. With an underlying corporate bonds allocation that is tilted towards single-A and triple-BBB credits, the fund extracts yield from the bottom of the investment-grade space.

We feel there is another 50bps left in rates left for this fund (from risk-free rates and credit spreads), so an investor should aim to increase allocation to the vehicle once the 30-day SEC yield goes north of 4%.

Dividend Yield vs 30-day SEC Yield

VCSH currently has a 30-day SEC yield of 3.81%, while its dividend yield is only 1.88%. A retail investor needs to focus on the larger 30-day SEC yield and understand the difference between the two metrics.

Dividend Yield

Usually, financial websites show a trailing 12 months dividend yield when reporting this metric. For example, if you look at VCSH on Seeking Alpha, you will notice that the dividend box shows a 1.88% ratio – when looking into the details of how this is calculated (go to the Dividends tab – Dividend History). You will notice that this metric is actually calculated by adding the dividends paid out in the past 12 months and then annualizing that figure as compared to the current fund market price. In a stable interest rate environment, this metric is suitable, but in an increasing/decreasing interest rate environment, looking at this analytic would be very misleading (as rates go up, the dividend yield would be understating what you are getting, for example).

30-Day SEC Yield

This is the best metric when analyzing a short-duration bond fund, given the current interest rate environment and the propensity for some funds to have a roll effect in their bond holdings, where the discount to par is being absorbed by the maturity pull and higher-yielding bonds are bought. This creates an effect of having a much higher 30-day SEC yield when compared to a trailing 12 months dividend yield. The 30-day SEC yield is the best metric to look at when considering short-duration bond funds because it gives you an accurate snapshot of what cash you are actually going to receive based on where the portfolio currently is, and where the market price clears:

30-day SEC Yield (Morningstar)

Please note that Seeking Alpha and Morningstar show close, but different 12-months yields (1.6% for Morningstar and 1.88% for seeking alpha). We have utilized the 30-day SEC yield from Morningstar since not present on Seeking Alpha.

Holdings

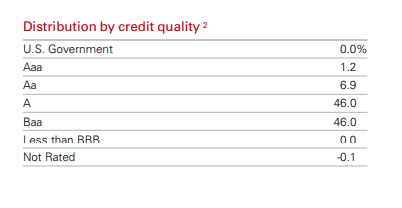

The fund is composed exclusively of corporate bonds:

Composition (Fund Fact Sheet)

We can see from the above table that the fund focuses on investment-grade corporate bonds, with no treasuries included. VCSH is overweight single-A and triple-BBB credits, which reside at the bottom of the rating spectrum in the investment-grade space. This translates into a larger credit risk as compared to funds with double-AA or triple-AAA instruments. Given the fund’s short duration and the investment-grade nature of most of the collateral, the ultimate default risk is small, but the downgrade risk is not negligible.

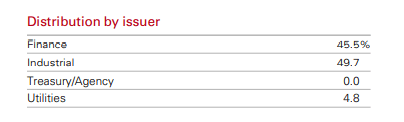

Most of the underlying issuers are from the Finance and Industrial sectors:

Industry (Fund Fact Sheet)

There is a bit of a concentration issue in our view given the lack of diversification, but absent a repeat of the Great Financial Crisis (‘GFC’) the lack of sectoral diversification should be small.

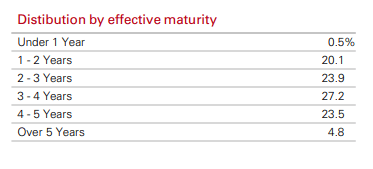

In today’s interest rate environment, the most important aspect is the maturity ladder of the underlying securities:

Maturity (Fund Fact Sheet)

The fund has an overall duration of 2.8 years and as per the Morningstar classification falls in the short duration bond category, but for us, given the current interest rate environment, we would look at it as a medium duration bond fund. “Why?” you might ask – because of the lack of a “roll” effect. A short-duration bond fund, even when it experiences a price drop due to a sudden increase in interest rates, tends to have many near-term collateral maturities which ensure a “pull to par” or “roll” effect. VCSH has virtually no bonds with maturities under 1 year (only 0.5% of the portfolio) and there is an even maturity distribution up to the 5-year bucket. This means that an investor runs substantial interest rate sensitivity here and for the rest of 2022 one should expect the price here to be fully driven by the change in the yield curve and the spreads on the underlying bonds.

After the shocking lack of liquidity during last week’s market fall, we feel spreads and yields are going to play a significant part in pricing for the rest of the year and only true short-term bond funds which will see underlying collateral maturing will be able to benefit from the pull to par effect of short-dated paper. An investor can choose where the Fed is going to end up, but assuming a 3%-3.5% range for risk-free yields and a range of 0.5%-1% in spreads for short and medium-dated investment-grade bonds gets us to a target entry-level here north of 4% all-in yields.

Performance

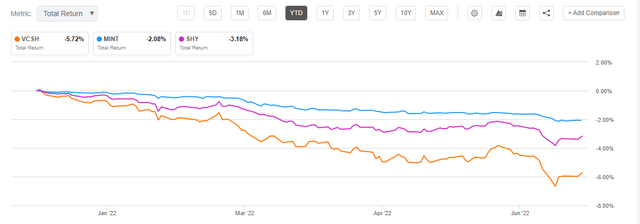

The fund is down more than -5.7% year to date on a total return basis:

YTD Performance (Seeking Alpha)

We can see from the above graph the impact of duration on performance. MINT is a true short-term corporate bond ETF and is down only -2% year to date while VCSH with its 2.8 years duration is tilted towards medium-duration funds. When a fund has no bonds maturing in the upcoming 12 months, then it will not have any “roll” or “pull to par” effect, and it will be driven solely by rates and credit spreads. We are witnessing this for VCSH.

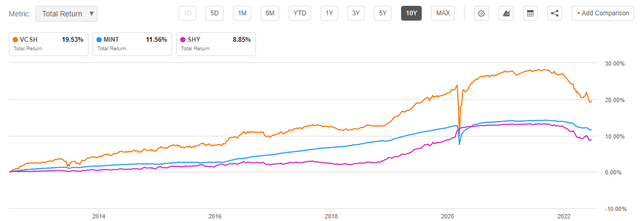

On a long-term basis, expect annual total returns north of 2%:

10-Year Returns (Seeking Alpha)

Conclusion

VCSH is an investment-grade bond ETF with a 2.8 years duration. The fund is down more than -5.7% year to date due to the rise in risk-free rates. In our book, the ETF is closer to a medium-duration fund given its lack of a roll effect for the underlying collateral. VCSH is not a short-term cash parking vehicle, and it represents a tool to obtain unleveraged exposure to the U.S. short and medium-term investment-grade corporate bond space. The vehicle offers robust long-term risk/reward metrics and is best suited to begin accumulating once 30-day SEC yields go above 4%.

[ad_2]

Source links Google News