[ad_1]

DNY59

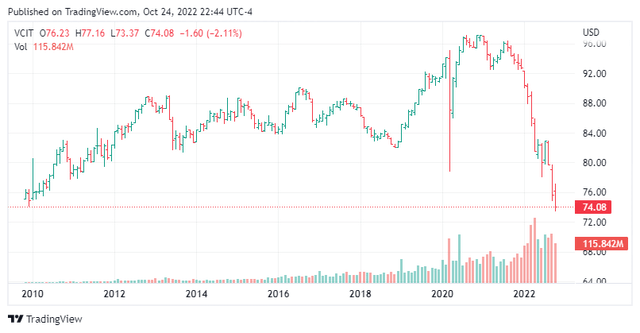

Fixed income as an asset class has become one of the biggest casualties this year after the Federal Reserve hiked interest rates aggressively in a bid to tame inflation running at levels not seen since the 1970s. Taking a longer-term perspective, we view this collapse in bond prices as an opportunity for investors to lock in attractive yields for a balanced portfolio.

Our core view is that inflation has peaked and that current bond prices already reflect expectations for peak yields. As such, we see high-yield bonds providing the best reward-to-risk for fixed-income right now. For investors with a lower risk appetite and preference for investment-grade quality, we think the Vanguard Intermediate-Term Corporate Bond ETF (NASDAQ:VCIT) is an attractive and cost-effective choice.

Seeking Alpha

According to fund information provided by Vanguard, VCIT seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity. VCIT defines intermediate-term bonds as those expiring in the next 5-10 years. The fund’s investments are selected through an index sampling process that aims to approximate the targeted index. At least 80% of the fund’s assets will be invested in bonds included in the index (Bloomberg US 5-10 Year Corporate Bond Index).

Ideal Investment Horizon For Fixed Income

We view 5-10 years as the ideal investment horizon for fixed income in the current economic environment. Although we acknowledge that short-dated bonds look attractive at the moment, we see more return potential in longer-dated bonds when the Fed eventually pivots on monetary policy.

We believe that the low interest rate environment we have experienced in the last two decades is structural and that inflation will ultimately be transitory. We continue to see evidence of moderating inflationary pressures broadly across commodity prices, while supply-side disruptions continue to unwind. Since June, prices for commodities, which affect input costs for producers of all kinds of consumer goods, have broadly declined.

To be sure, we do not expect the Fed to pivot anytime soon. Instead, we see the Fed holding policy rates at around 4.5% to 5.0% for an extended period of time to anchor inflation expectations. Nonetheless, we think the Fed will eventually bring interest rates back to more neutral levels of around 3%, which should reignite performance for longer-dated bonds.

Not only are longer-dated bonds likely to outperform due to higher sensitivity to interest rate changes, but they also provide long-term investors with the option to hold to maturity, avoiding the risk of having to reinvest at lower yields for the next 5 to 10 years. VCIT’s portfolio currently has an average duration of 7.6 years.

Investment Grade Quality At 5.8% Yield Is A Great Deal

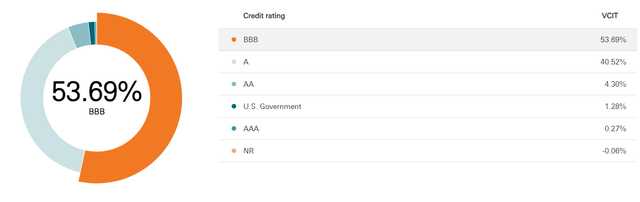

The majority (53.7%) of the fund’s holdings are in “BBB” rated corporate issues, while the rest are in higher-quality issues from large U.S. financials such as Bank of America (BAC) and JPMorgan Chase & Co. (JPM).

Vanguard.com

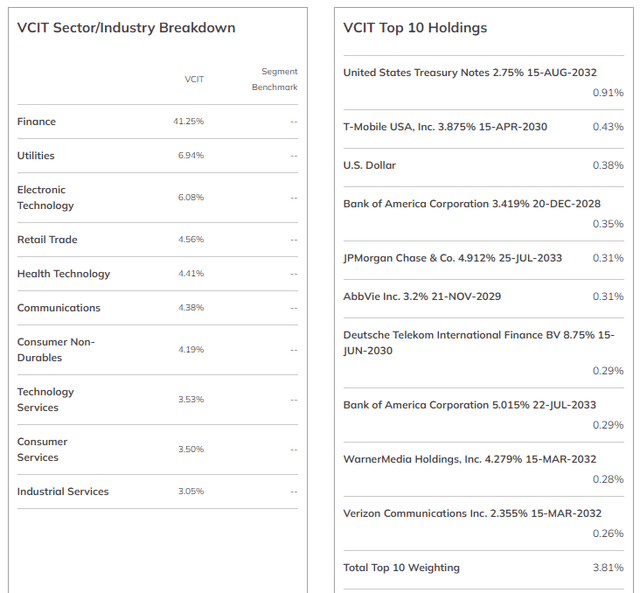

The fund is well diversified with 2,108 holdings as of 30 September 2022. However, due to the investment grade mandate of the fund, the portfolio naturally weighs more heavily on bonds issued by financials, with 41.3% of the portfolio invested in that sector.

etf.com, Vanguard, VCIT

As of October 20, VCIT’s portfolio had an SEC yield of 5.84%, which is very attractive by historical standards. For many years prior to the pandemic, the investment-grade fixed-income space was extremely overcrowded due to pension and endowment fund mandates strictly restricting exposure to investment-grade issues. Many of these institutional investors were left with little choice but to accept yields of 3% or lower, despite the risks of inflation wiping out returns.

It is surprising, however, that even at the current yield of 5.84% we have yet to see more institutional interest in investment-grade issues. It seems that the overwhelming fear of inflation returning to the 1970s era levels may be crippling their investment decisions and strategies. As our core view of peak inflation plays outs in the coming months, we could see a surge in inflows back to the investment-grade space.

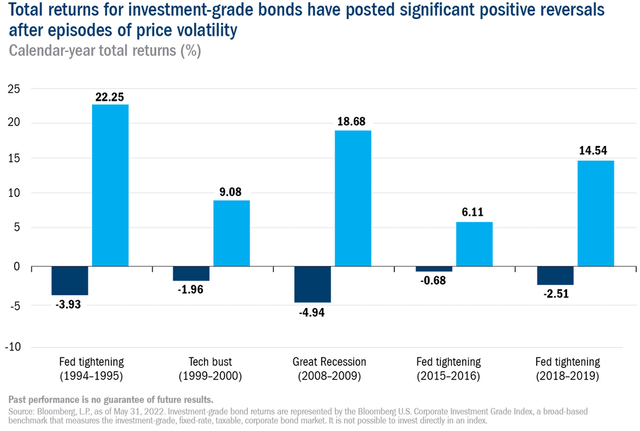

As the accompanying chart shows, total returns for investment-grade bonds following past episodes of high volatility and uncertainty have been exceptionally strong. Although we are certainly not in an economic crisis of such magnitudes, we nonetheless see the potential for outsized returns in investment-grade bonds due to the recent sharp sell-off.

Columbia Threadneedle, Bloomberg

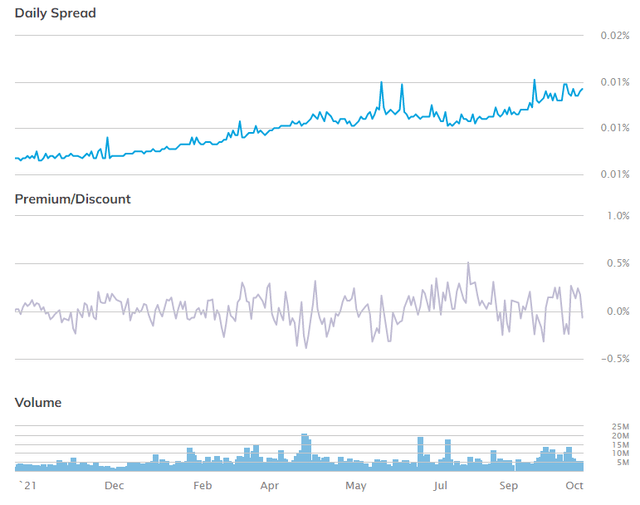

We also particularly like VCIT’s indexed strategy, which helps to keep its expense ratio low at just 0.04% and makes it cost-effective as a long-term investment. Trading metrics for VCIT are also healthy with low spreads, healthy volumes, and the fund trading very close to NAV.

etf.com

In Conclusion

We see an attractive entry point for investors with a lower risk appetite and preference for investment-grade quality to add longer-dated bonds to their balanced portfolios. VCIT is a cost-effective ETF that will allow investors to quickly build exposure to investment-grade fixed income and lock in an attractive yield of 5.8% for the next 5 to 10 years. We also see an opportunity to capture outsized returns on investment-grade bonds should we see institutional investors return in force.

We initiate coverage of VCIT with a “Strong Buy” rating.

[ad_2]

Source links Google News