[ad_1]

ijeab/iStock via Getty Images

Thesis

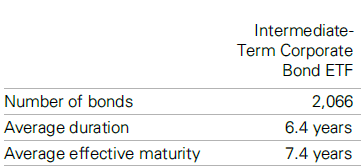

Vanguard Intermediate-Term Corporate Bond Index ETF (NASDAQ:VCIT) is an exchange-traded fund that seeks to track the performance of the Bloomberg U.S. 5–10 Year Corporate Bond Index. The fund, similar to the index, follows the investment return of U.S. dollar denominated, investment-grade, fixed rate, taxable securities issued by industrial, utility, and financial companies with maturities between 5 and 10 years. The fund falls in the medium duration bucket, having an average duration of 6.4 years, and an average effective maturity of 7.4 years.

The ETF has a massive AUM of $45 billion and represents an alternative to the popular iShares iBoxx Investment Grade Corporate Bond ETF (LQD). VCIT is down more than 7% this year as the yield curve has shifted up on the back of a hawkish Fed and the first lift-off in rates during this tightening cycle. The fund has two market risk components, the prevailing one represented by rates and a secondary represented by credit spreads on the underlying bonds. We do not anticipate another credit shock such as the Covid event in the next twelve months, hence we believe rates are going to be the main driver for the ETF’s NAV in the next twelve months.

As reflected in its 5- and 10-year trailing total returns which sit at 3.47% and 3.74% respectively, the ETF generates an approximate 3.5% total return per year throughout monetary cycles for a long-term buy-and-hold investor. The fund achieves this with a 0.5 Sharpe ratio and 5.64 standard deviation (both measured on a 5-year lookback). Helped by its size, the fund has a very small expense ratio of 0.04%, and a 30-day SEC yield of 3.24% which is paid monthly.

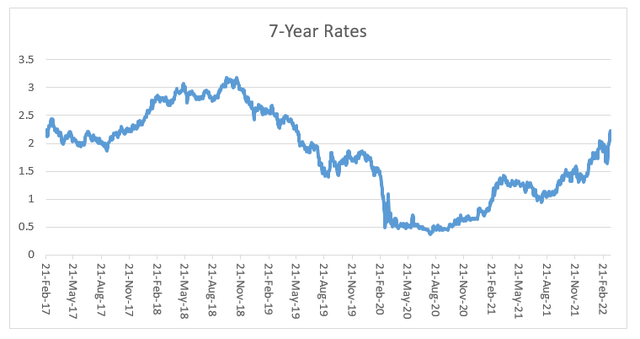

Most of the year-to-date performance has been driven by higher rates and specifically higher 7-year yields. Inflation is running at a much higher level than in 2018, thus we fully expect the 7-year point in the treasury curve to retrace the performance during the past tightening cycle, with the possibility of rates going even higher. We believe 7-year rates will move to 3%, which translates into the ETF NAV experiencing further weakness of around -5%. We expect to see the NAV weakness materialize in the next months, with the ETF carry compensating for the performance as the year progresses. We thus rate VCIT a Sell, to be revisited in June/July after the negative move is to be exhausted.

Holdings

The fund has a very granular portfolio, with over 2,000 bonds in the portfolio:

Portfolio Characteristics (Fund Fact Sheet)

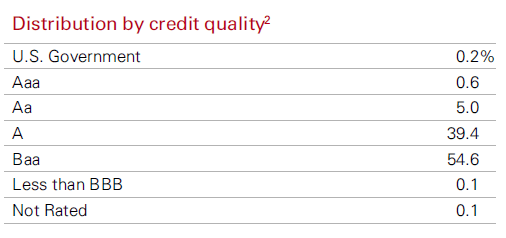

Although the ETF is exclusively an investment grade vehicle, the bulk of its holdings sit on the lower rungs of the high grade rating spectrum:

Credit Quality (Fund Fact Sheet)

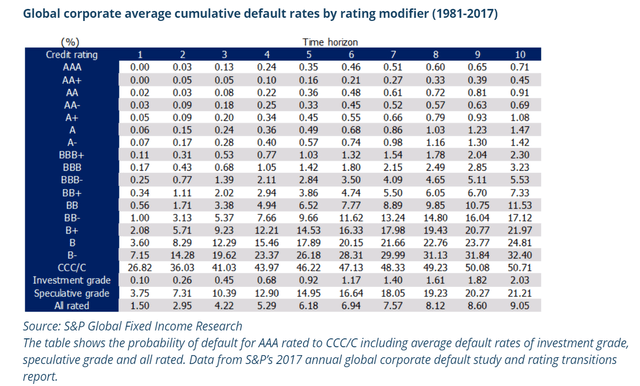

With a concentration of over 50% in the BBB bucket, the probability of downgrades in a protracted downturn is higher than funds which have higher portfolio percentages in double-A and single-A buckets. As a quantitative way of looking at probabilities of default from ratings, please find below an S&P study:

Default Probability From Ratings (S&P)

We can see that for a 7-year tenor (the average maturity of the fund holdings), a single-A bond has a 0.86% probability of default, while a BBB- bond has a 4.09% probability of default. In a stressed economic scenario, those differentials matter.

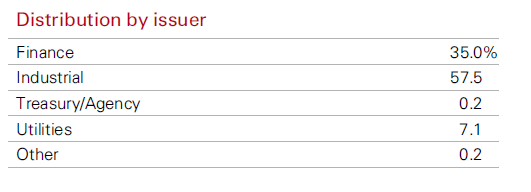

Financial and industrial issuers dominate the portfolio and have the top weightings, sitting at 35% and 57.5% respectively:

Distribution by Issuer (Fund Fact Sheet)

Credit & Market Risks

The fund can lose money via a lower NAV and price from several factors:

Credit Risk is the chance that the fund will lose money from an issuer default. This risk is fairly remote given the investment grade nature of the portfolio, however, given the high preponderance of BBB credits, it is still present. We do not think at present this represents a significant factor given that we are exiting a period of record corporate profits and a zero rate environment which has allowed corporates to strengthen their balance sheets, term out their funding profiles, and reduce all-in yields they pay on their liabilities.

Market Risks – Interest Rate risk and Credit Spread risk are the major factors to consider here.

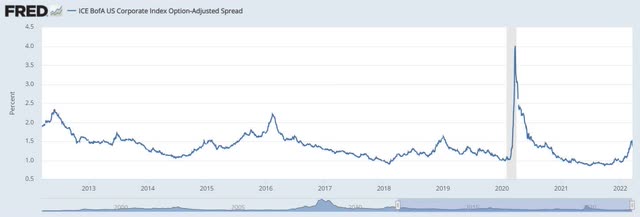

Credit Spread risk, unlike pure Credit Risk, addresses NAV losses from a loss in value on the underlying bonds given a credit spread (market required yield) widening. We have seen this during the Covid pandemic where we did not have a significant number of investment grade issuers defaults, yet we saw a spike in required market yields (i.e. where the bonds were trading in the market). An exogenous shock or a full-blown recession can suddenly cause a spike in credit spreads. We do not think there is such an event set to occur in the next twelve months, and we feel we have already seen some widening from ultra-low levels on investment grade credit spreads:

Corporate Spreads (The Fed)

We can see that historically the OAS has a nice trading range of 1%-2% and we are now in the middle of that range in terms of required credit spreads on the underlying bonds. We have seen an almost 50 bps widening in this metric in 2022.

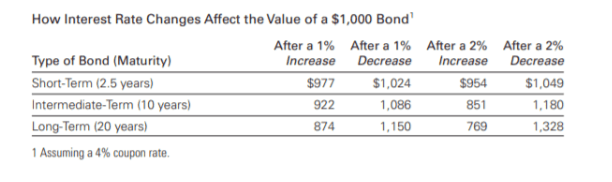

Interest Rate risk is the major factor to consider for VCIT, with the fund having an intermediate duration of 6.4 years:

Duration (Fund Fact Sheet)

Most of the year-to-date performance has been driven by higher rates and specifically higher yields on the 7-year point in the yield curve:

7-Year Yields (Author)

Inflation is running at a much higher level than in 2018, thus we fully expect the 7-year point in the treasury curve to retrace the performance during the past tightening cycle, with the possibility of yields going even higher. A continuous inversion of the yield curve, however, tells us that the market does not think the Fed has as much leeway as it should in such a high inflation environment, thus we do not think 7-yield rates will overshoot by much the 3% mark.

Looking at a bond math table, we will translate our rates view in a fund NAV performance:

Duration Impact (Vanguard)

We believe the relevant point in the yield curve (7-year rates) will move to 3%, which translates into an intermediate bond portfolio experiencing further weakness of around -5%. We expect to see the NAV weakness materialize in the next months, with the ETF carry compensating for the performance as the year progresses.

Performance

The fund is down more than -7% on a year-to-date basis:

YTD Performance (Seeking Alpha)

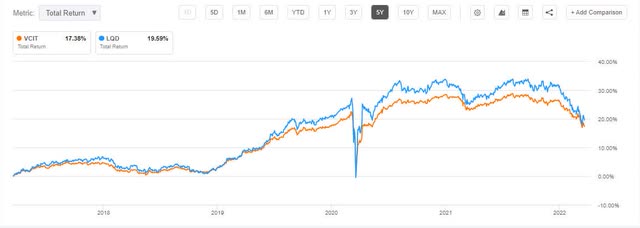

On a 5-year period, VCIT benchmarks quite closely to LQD, although there is a slight underperformance:

5-Year Return (Seeking Alpha)

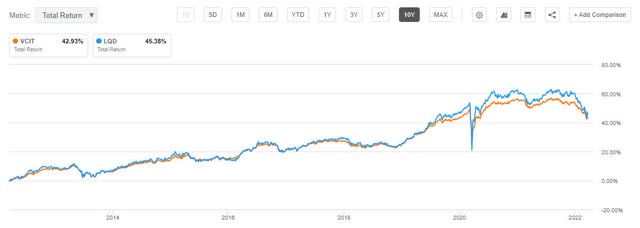

We see the same correlation on a 10-year chart, with the bulk of the differential occurring after the Covid crash:

10-Year Performance (Seeking Alpha)

The fund displays a robust performance, driven by monetary cycles and exogenous shocks, and has a nice upward total return slope, characteristic of its predicted 3.5% annual return profile.

Conclusion

VCIT is an exchange-traded fund that focuses on investment grade bonds. The fund has a high weighting of BBB bonds, but we do not expect credit spreads to be a factor in its performance this year. The fund has an intermediate duration of 6.4 years and most of its YTD move has been driven by higher 7-year yields. We expect that point in the yield curve to move to 3% in the next months, retracing a move we witnessed in the 2018 tightening cycle when inflation was not running as high as today.

We expect to see the NAV weakness driven by rates to materialize in the next months, with the ETF carry compensating for the performance as the year progresses. We thus rate VCIT a Sell, to be revisited in June/July after the negative move is to be exhausted.

[ad_2]

Source links Google News