[ad_1]

This article will focus on the Vanguard Small-Cap Value Index Fund ETF Shares (VBR) as a possible investment in a period that could include negative yields and even a recession. Being that this is a Vanguard fund, most investors think of broad diversification, passive investing, and low fees. An agile investor who likes to trade and pick their own investments could benefit from this ETF given macro trends, which will be outlined below.

Negative Interest Rates

As pundits and theorists debate the context of negative interest rates what does an average investor need to do? It pays to start at the beginning, understanding why interest rates even exist. Why pay interest at all? Where did this concept originate?

the idea of positive interest rates come from pastoral societies, where livestock was used as currency. if you delay consumption, the livestock bears young. the Greek word for “interest” is τόκος, or “offspring”. it’s a natural (animal) right. – @eiaine August 27th, 2019

The basics of investing are simple. You start with a small amount of wealth and you delay consumption. As time goes by, the wealth grows through interest, earnings, and dividends. For ancient societies, wealth was measured in livestock or even grain. If you didn’t eat or sell the offspring, then it was possible to grow your herd. Growing your herd created a profit, or excess wealth. The same can be said for investing. If we consume everything we earn, then we have no wealth to grow.

Farmers that sow seeds and grow their crop also must set aside a portion for the future. Ancient societies selected seeds of wild grass, setting aside the best grains for future propagation. Over time, these wild grasses became more profitable variations that eventually became wheat, barley and rye. Over thousands of years, the best producing seeds became the staple crops. As investors, we often do the same with our investment portfolios, selling and consuming our worst yielding investments. Then, we must reinvest into the best ideas to help them grow. It is more profitable that way.

The concept of investing is rooted in having interest paid. Delaying consumption should be rewarded by growth and profit.

Starving for Yield

In historical context, it’s difficult to find a time that society chose to delay consumption without being paid a yield in return. Here’s one. In September 1941, the German army began a 900 day siege of Leningrad, Russia. Over 900 days, the 2,000,000 citizens of the city slowly starved. This includes the botanists that were protecting the Institute of Plant Industry where the world’s largest vault of 370,000 seeds existed. These scientists starved themselves rather consume the supply of seeds that would be needed to rebuild after the war ended. It was estimated that 80% of the crop yields in the Soviet Union in 1979 came from seeds stored in this seed vault four decades earlier. The scientists delayed their consumption and suffered for it. That’s what we call a loss, but ultimately, it was a short-term loss that gifted the future a large reward. Negative interest rates are temporary, just like the siege of Leningrad.

This metaphor may seem to only loosely fit here, but in truth you can’t disagree. Many investors are starving for yield. Investors are replacing bonds with utility stocks. They are buying index funds instead of Treasury bonds, simply because the dividends seem safe. More often than not, this money is flowing into large cap stocks and even junk bonds. Small cap value stocks are being ignored.

Historical texts are filled with examples of borrowing and lending. Fortunes have been made. In the year 1118, a group of nine French knights formed an order called the Poor Knights of Christ and the Temple of Solomon. These Knights Templar are sometimes credited for creation of the modern banking system. They chose a life of poverty and service, but also were in the business of lending. A pilgrim could deposit silver coins with them in Jerusalem, receiving a written note in return. This paper note, written in code only decipherable to the Templar could be given to Templar knights in London, Paris, or many other places and an equivalent amount of money could be retrieved from the Templar system. They also invested their deposits, gaining interest.

Ironically, the Knights Templar may have helped form the modern banking system Switzerland. More ironically, Switzerland is credited with creation of the first negative interest rates mandated by government authority.

Some of the best rewards available are in equities as an alternative to bonds. For instance, the Vanguard Small-Cap Value Index Fund ETF Shares (VBR) currently has an earnings yield of 6.7% and dividend yield 2.36%. You could compare that to a long duration government bond with a yield of around 2%. For comparable risk however, one might look at the S&P 500 with an earnings yield of just 4.9%. The S&P 500 is skewed towards a few larger growth companies like Netflix (NASDAQ:NFLX) with their 0.86% earnings yield. By the way, earnings yield is just the P/E ratio in reverse. These larger growth names get the most attention and the also tend to outperform in a period of economic expansion until late in the cycle. The P/E ratio of large growth stocks balloon out of control.

During every economic cycle, some expert comes along and declares that value investing is dead. The reality is that a wide dispersion in P/E ratios from ultra-low to ultra-high usually comes before a period of out-performance among value stocks. In other words, the winners don’t keep winning. Eventually, the laggards make up the difference.

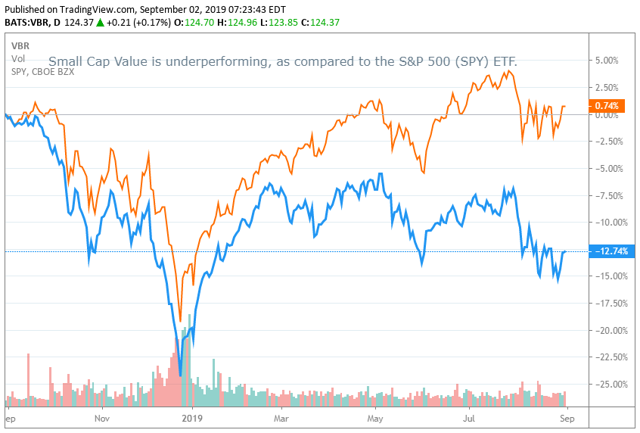

The Vanguard Small Cap Value ETF (VBR) that we are analyzing here has significantly under-performed this year. While the S&P 500 has been flat, this index has dropped 12.74%. As you will see further below, this strategy usually catches up.

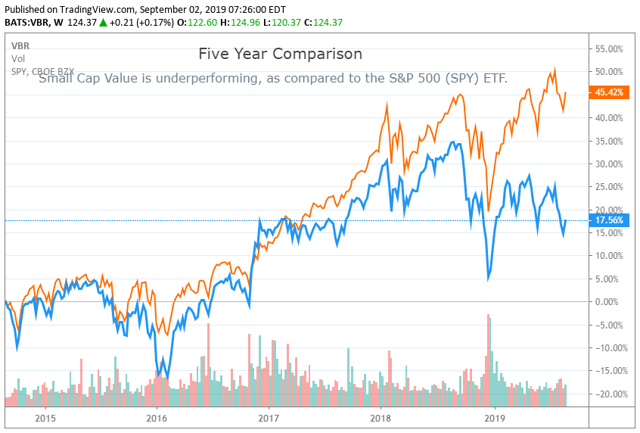

The comparison holds true on a 5-year basis as well. Value has under-performed for years.

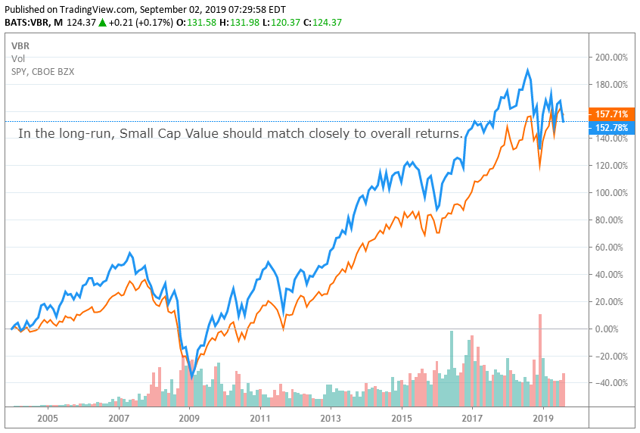

In the long-run, small cap value tends to outperform, or match market returns. Over more than a decade, the broader market and the small cap value ETF has pretty much returned the same.

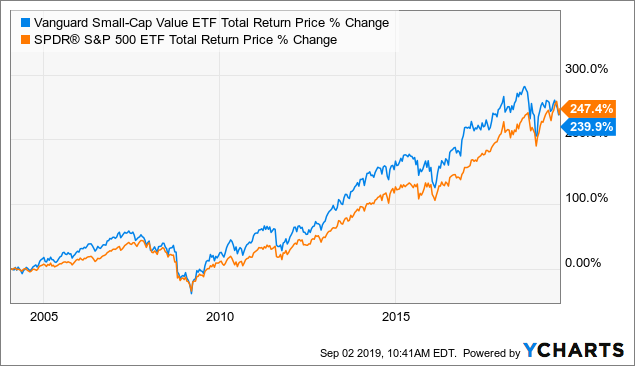

Not convinced? Here’s an example that adds in dividends to compute total return. The S&P 500 SPDR (SPY) barely nudges ahead of the Vanguard Small-Cap Value ETF (VBR) right at the end. This is the period we are in right now.

Recession Risk

What about a recession?

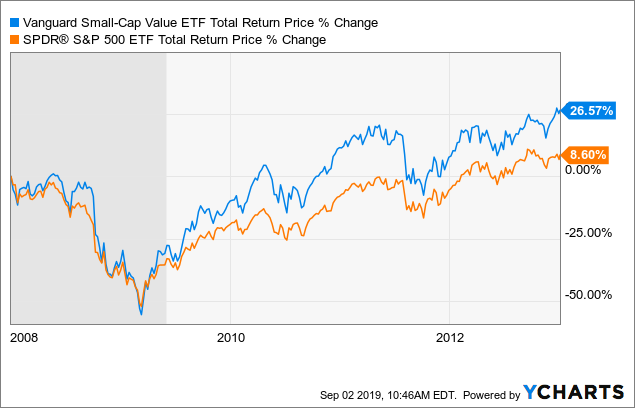

This ETF didn’t exist during a recession prior to the last Great Recession of 2008/2009, but beginning in 2008 and going forward 5 years, the ETF outperformed the S&P 500 by 17.97%, when you include dividends (and just by price performance, as well).

This isn’t the only example of smaller cap companies outperforming during a recession recovery period. There is a historical trend of this happening over many decades.

There are a multitude of reasons that small firms can quickly respond to changing market conditions. Small firms are more nimble. When business conditions deteriorate, they are first to cut staff. When conditions improve, they quickly sign contracts, make sales, and hire new staff.

Worried about Volatility? Don’t.

For many investors, volatility can be an opportunity. In a previous article, I outlined the concept of dollar cost averaging and how it can boost returns. Many typical investors are purchasing their investments in plans that allocate purchases on a quarterly, monthly, or even weekly basis. When prices drop, investors should rejoice. Their dollars stretch further to buy shares that were just trading for more a short time before.

In fact, a short-term drop in investment prices could provide an opportunity, just like short-term under-performance. Starting to invest in Vanguard Small-Cap Value ETF (VBR) today could provide an opportunity for out-performance in the coming period.

Still not convinced on Small Caps?

More often than not, the sector that is under-performing today will outperform tomorrow. This should be the case with small caps. In the period from 1979 to 2015, small-cap stocks in the Russell 2000 index performed better than large-cap stocks in the S&P 20 years out of the 37 year period. That’s better than half the time. Recently large cap growth stocks have out-performed. The basic premise of this contrarian pick is that this will flip and reverse in coming periods.

Here’s another good reason. Small caps also have more room to grow. Companies like Walmart (WMT), Coke (KO), and Disney (DIS) most certainly will grow, but the low hanging fruit is gone. Many markets dominated by large cap stocks have reached maturity. This is why large caps will often buy back their own stock, or acquire smaller competitors.

The Conventional Wisdom

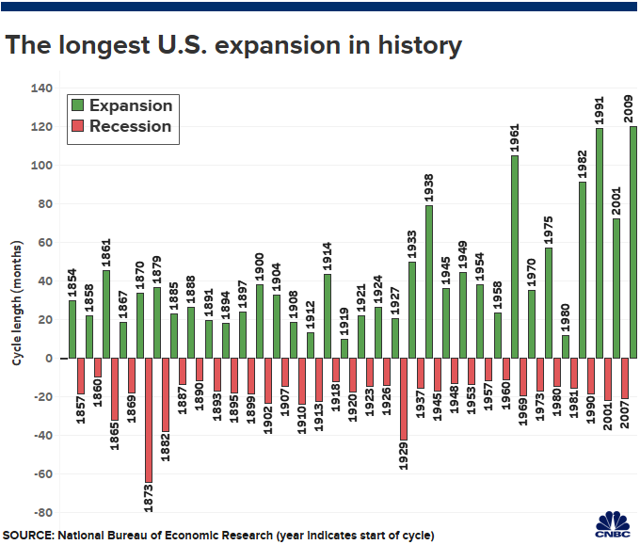

Conventional wisdom is that investors need to buy large blue chip stocks when signs of a recession creep in. That conventional wisdom tends to lead people astray. Why? This is the longest running economic expansion in U.S. history.

As the stock market bubble continues to expand, it is running very “long in the tooth,” as they say. Many people may argue that investors have already piled into blue chip stocks, looking for the safe place to park their money. The result is that big names like Waste Management (NYSE:WM), Visa (V), Anheuser-Busch InBev SA/NV (BUD) already trade at peak multiples over 25x earnings. These are stalwarts of their businesses, but in a market downturn the whole market falls, including these names. The giants have farther to fall.

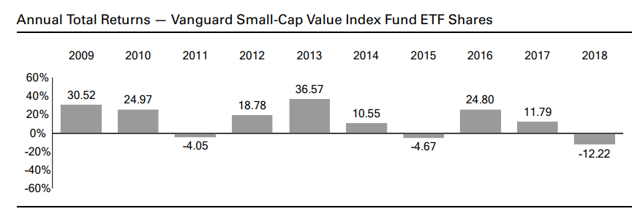

The flight to blue chips and safe havens took a toll on this index in late 2018, as the market corrected. In 2018, this index dove -12.22%.

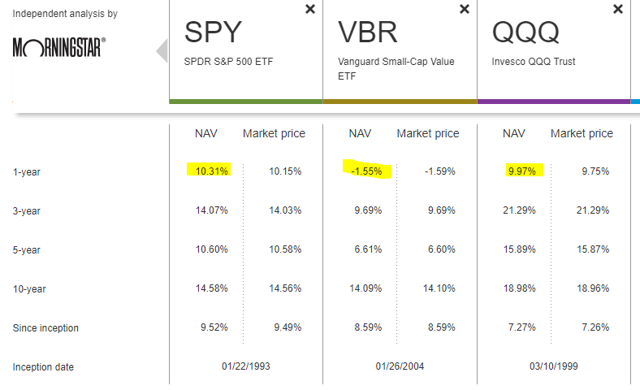

Overall, six months later, things still haven’t recovered for small caps. Here’s a very simple comparison of returns between the Vanguard Small Cap Value ETF and the other major ETFs, focusing on the Nasdaq (NASDAQ:QQQ) and S&P500 (SPY). Small caps were still showing a 1 year loss at 6/30/19. They never caught back up with the larger companies who are up nearly 10% year over year.

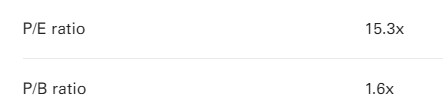

While many large cap names are getting all of the love from investors, they are sitting on stretch valuations. One could argue that the Small Cap Value (VBR) index also has a stretch valuation at 15.3 times earnings, but these companies are still cheaper than many others. It’s only slightly higher than historical norms.

While many large cap names are getting all of the love from investors, they are sitting on stretch valuations. One could argue that the Small Cap Value (VBR) index also has a stretch valuation at 15.3 times earnings, but these companies are still cheaper than many others. It’s only slightly higher than historical norms.

Conclusion

With the Nasdaq and S&P 500 trading at 23.75 and 23 times earnings, respectively, a small cap value strategy may be the contrarian approach to this market. The real risk here is believing that the index will continue to under-perform simply because it did so in the past. This index deserves a spot in any investor’s portfolio who wants long exposure to the market.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News