[ad_1]

shapecharge/E+ via Getty Images

The coronavirus pandemic led to significant underperformance in several equity segments and industries, including value, small caps, energy, financials, and BDCs. Most of these have since recovered, or at least posted significant gains, but there are a few exceptions. Small caps are one such exception, and one which could outperform as economic and market conditions continue to normalize. The Vanguard Small Cap ETF (NYSEARCA:VB) is a strong, simple, cheap, U.S. small-cap equity index ETF, and provides broad-based exposure to an equity sub-segment with the potential for market-beating returns. The fund is a strong investment opportunity, and a buy. With a 1.3% dividend yield, it is not an effective income vehicle.

VB – Basics

- Investment Manager: Vanguard

- Underlying Index: CRSP US Small Cap Index

- Expense Ratio: 0.05%

- Dividend Yield: 1.38%

- Total Returns CAGR 10Y: 12.38%

VB – Overview and Investment Thesis

VB is an equity index ETF investing in small-cap U.S. equities. The fund is administered by Vanguard, the second-largest investment manager in the world, and preeminent provider of index funds in the same. Vanguard’s unique, shareholder-friendly corporate structure makes it my top choice for simple index funds, and VB is no exception.

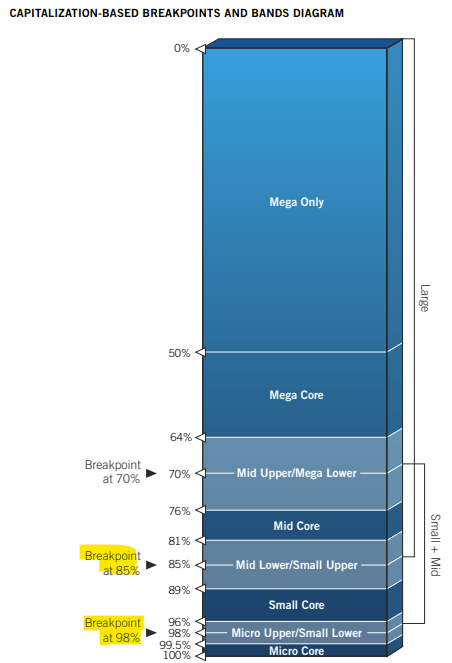

VB itself tracks the CRSP US Small Cap Index, an index of small-cap U.S. equities. The index includes U.S. securities whose market-cap accounts for the bottom 85%-98% of total U.S. market-cap. So, bottom 15%, but excluding the smallest 2%, which are classified as micro-cap stocks instead. The following graph summarizes the relevant securities, with market-cap breakpoints highlighted.

CRSP

Applicable securities must also meet a basic set of liquidity, trading, etc., inclusion criteria, as well as buffers and other assorted rules meant to decrease portfolio turnover. It is a relatively simple index, resulting in a relatively simple fund.

VB’s investment thesis rests on the fund’s:

- Diversified holdings, which provide investors with broad-based exposure to U.S. small-cap equities, and which reduce portfolio risk and volatility

- Cheap valuation, which could lead to strong, market-beating returns in the coming months

It is a relatively simple investment thesis, but quite strong. Let’s have a look at these two points.

Diversified Holdings

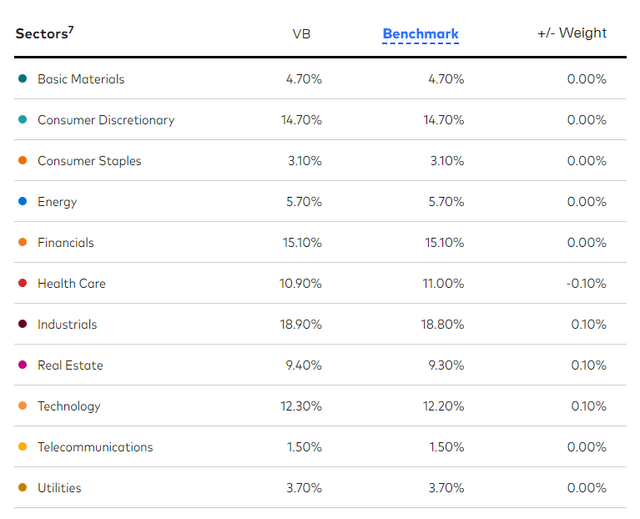

VB’s underlying index is quite broad, with relatively lax inclusion criteria. This results in a well-diversified fund, with investments in over 1500 different securities, much higher than average for broad-based equity indexes. VB also provides investors with exposure to most relevant industry segments.

VB Corporate Website

Relative to most equity indexes, including the S&P 500, the fund is overweight old-economy industries like industrials and real estate, industries in which comparatively small companies predominate. On the flipside, the fund is underweight tech, as said sector is dominated by a few mega-cap names, including Google (GOOGL) and Apple (AAPL), which are not included in the fund. In my opinion, VB’s industry weights are neither a positive nor a negative, just an important fact for investors to consider. The fund might be inappropriate for tech bulls, while being more appropriate for tech bears, for instance.

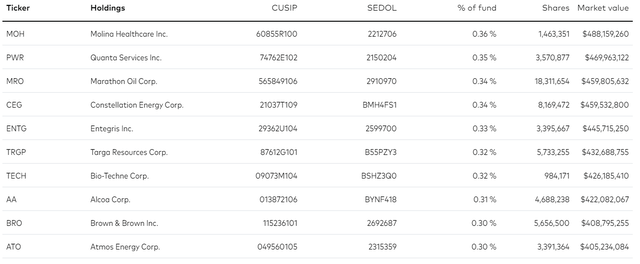

VB’s concentration is quite low too, with the fund’s top ten holdings accounting for less than 4% of its value. This is significantly lower than average for an equity index fund, with most of the fund’s peers being much more top-heavy, in the 20-30% range.

VB Corporate Website

VB’s diversified holdings provide investors with broad exposure to the small-cap U.S. equity segment. As such, the fund is perfect for investors looking for exposure to said market segment. Which brings me to my next point.

Cheap Valuation

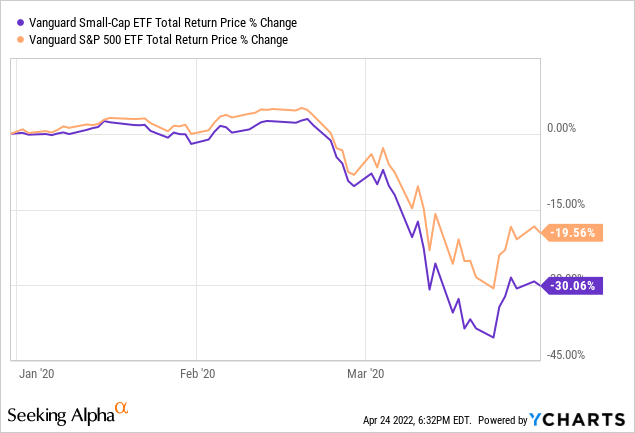

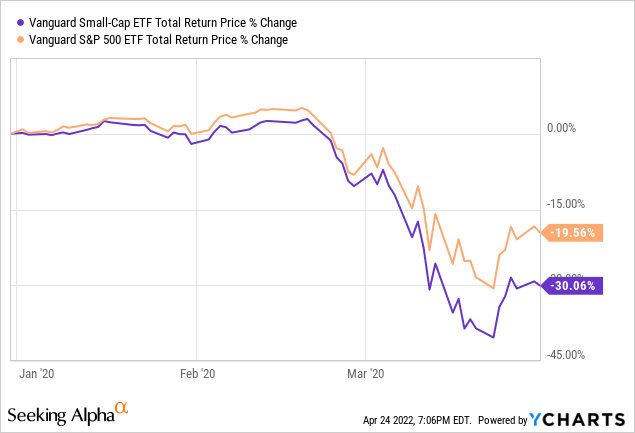

The coronavirus pandemic led to significant losses and underperformance in several equity market segments. Small-cap equities were hit particularly hard, as smaller companies tend to lack the cash reserves, access to credit, and diversified revenue streams necessary to effectively weather a recession. Small-cap equities also exclude some of the pandemic best-performers, including most mega-cap tech names. Smaller companies saw above-average financial losses during the pandemic, which resulted in significant capital losses and underperformance for their shareholders. VB itself was down by about 30% in 1Q2020, the onset of the coronavirus pandemic, moderately underperforming the S&P 500.

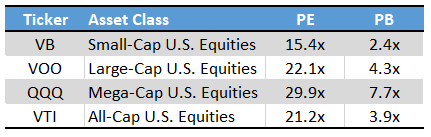

The losses above are reflected in the fund’s valuation. VB currently sports a PE ratio of 15.4x, and a PB ratio of 2.4x, both significantly lower than average for an U.S. equity index fund.

Fund Filings – Chart by author

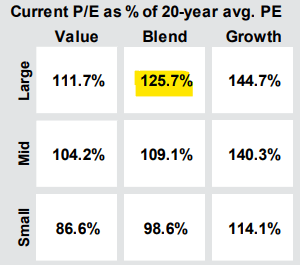

Small-cap equities are currently 9% overvalued relative to their historical average. Although these are not positive results, they are comparatively better (less bad) than average. Large-cap U.S. equities, for instance, are more than 25% overvalued relative to their historical averages.

J.P. Morgan Guide to the Markets

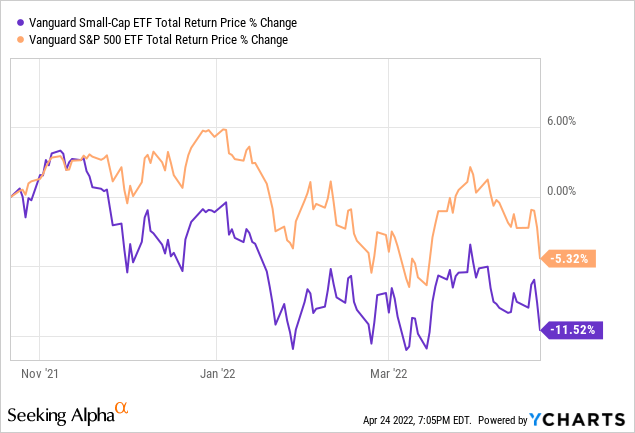

VB’s comparatively cheap valuation could lead to significant gains and outperformance if valuations were to normalize. As mentioned previously, that has been the case for most cheap, undervalued equity segments for the past few months, but it has not been the case for VB. The fund is down relative to the S&P 500 for the past six months, for instance, with similar underperformance for other similar time periods.

In my opinion, VB’s recent underperformance is a positive sign. Remember, most cheap, undervalued equity segments have seen recoveries in the past few months. VB has not, but I believe that it is only a matter of time until markets reassess the situation and reward the fund with a higher share price. Market sentiment around value stocks is currently quite bullish, and I believe sentiment will spread to VB in the coming months.

Finally, VB’s comparatively cheap valuation would also serve to minimize losses if valuations were to return to their historical averages. Remember, large-cap stocks, especially large-cap growth stocks, are sporting significantly above-average valuations relative to their historical averages. Losses could mount for these stocks, while the same is not true for small-cap equities. Valuation risk is very real, and VB does comparatively well in this regard.

VB’s comparatively cheap valuation could lead to significant gains and outperformance if valuations were to normalize, a significant benefit for the fund and its shareholders.

VB – Risks and Negatives

VB is a strong fund and investment opportunity, but it is not one without risks and drawbacks.

VB’s most significant risk is the fund’s focus on small-cap equities. As mentioned previously, small-cap equities tend to be riskier than average, due to their undiversified revenue streams, comparatively weak balance sheets and access to credit, and negative market perceptions of risk. Small-cap equities tend to suffer above-average financial losses when times are tough, and the market reacts accordingly. Expect underperformance during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

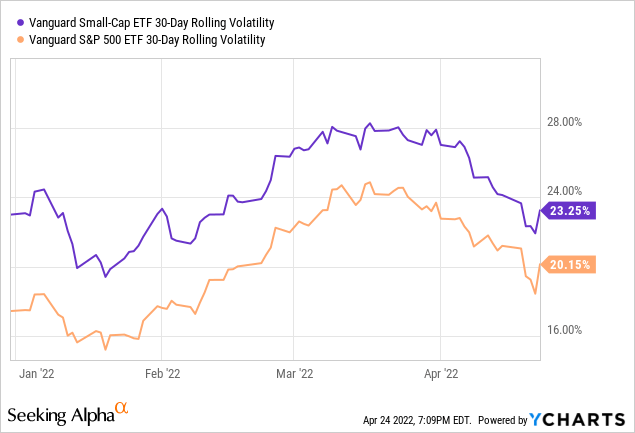

VB is also more volatile than average, although only slightly so.

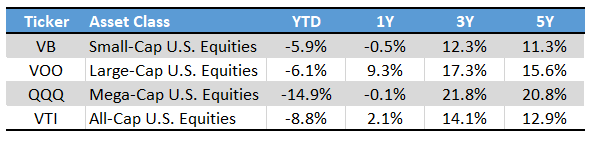

VB’s most significant drawback is the fund’s lackluster total shareholder return track-record. VB has moderately underperformed relative to all relevant U.S. equity indexes since inception, and for most relevant time periods. The fund’s performance has improved YTD, with the fund slightly outperforming its peers, but the situation remains broadly negative.

Seeking Alpha – Chart by author

VB’s lackluster returns are the flipside of its cheap valuation: the fund would not be cheap if it had experienced stronger capital gains and returns in prior years. In my opinion, the fund’s future returns will likely outpace those of its peers, but the consistent underperformance is still a negative, and likely a deal-breaker for many investors. It is difficult to be bullish about investments with a consistent track-record of underperformance, but I do think the fundamentals and sentiment point towards small-cap equities outperforming in the coming years.

Conclusion

VB is an equity index ETF investing in small-cap U.S. equities. The fund’s diversified holdings and cheap valuation make it a buy.

[ad_2]

Source links Google News