[ad_1]

Vadzim Kushniarou/iStock via Getty Images

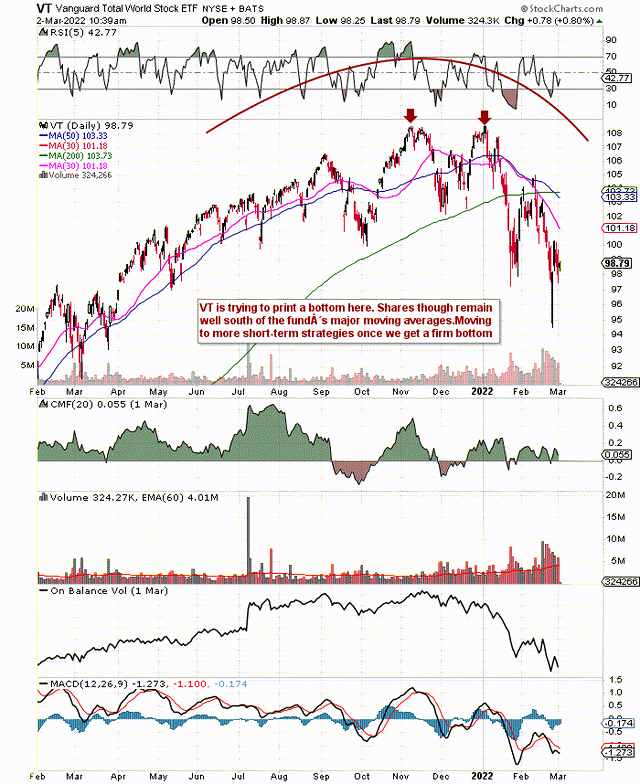

If we pull up a chart of Vanguard Total World Stock Index Fund ETF Shares (VT), we can see that shares are now trading firmly below the ETF’s major moving averages. Some profit-taking in VT had to be expected sooner rather than later given the significant gains the fund has made over the past 24 months or so. Considering the double top reversal pattern which recently played itself out in VT as well as the major overhead resistance that now comes as a consequence of this, we recommend that investors continue to look at VT from the long side but more from a short-term perspective. From our standpoint, we would need to see the share price take out the 30-day moving average ($101.18) convincingly before we would consider putting long deltas to work in here.

Before we get into the reasons why we are still bullish on this ETF, let’s touch somewhat on the benefits of short-term investing over its long-term counterpart. As noted, the main reason why short-term (once we get a bottom) is more advantageous at present is the overhead resistance which is now prevalent on the technical chart. Here are other points also that aid the short-term investor in particular circumstances.

- New investors can cut their teeth quickly in this industry by trading over the short-term instead. Multiple decisions over shorter periods bring badly needed experience to the table which would not have been garnered otherwise.

- In terms of a business in this industry, short-term investing enables the investor adjust a respective position when something fundamentally or technically has changed. On the contrary, long-term holds are rarely watched as much which means, on occasion, temporary pullbacks can turn into sizable paper losses over time.

Suffice it to say, here is why we believe VT remains a strong short-term vehicle once the ETF gets back to bullish mode.

VT ETF Trying To Catch A Bid (Stockcharts.com)

Being a diversified fund across multiple regions in both growth and value, risk in the $24+ billion fund is much less than many of its peers due to its high level of liquidity. This is essentially what ETF investors are looking for, which is strong liquidity and diversification all rolled into one fund. Currently, VT has over 9,000 holdings in the fund across sectors such as technology, financial & healthcare to name but a few. Suffice it to say, peers just simply cannot compete with VT’s sheer number of holdings.

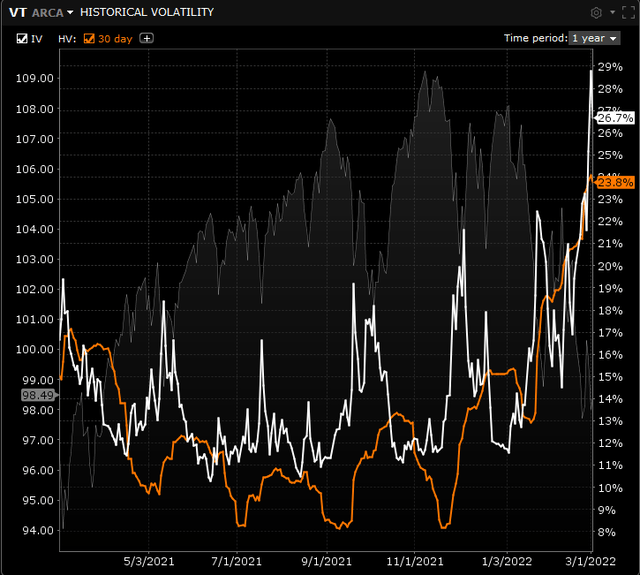

This may explain why VT’s implied volatility in March at present comes in just under 27%, which is quite low considering how volatile equity markets have been due to what has been happening in Ukraine. Implied volatility levels are a solid read on the fear among investors concerning the fund in question. Again, due to the lack of sheer volume and diversification in VT’s competing funds, a competitor such as the SPDR Global Dow ETF (DGT) would be reporting higher levels of volatility (fear) right now.

Historical & Implied Volatility in VT (Interactive Brokers)

Furthermore, Vanguard Total World Stock Index Fund ETF Shares has an ultra-low expense ratio of 0.08%, which is much lower than other global funds on average. Assets under management as stated are up around the $24 billion mark and growth in these assets has been outperforming the asset class median by quite some distance. Over the past 12 months for example, AUM in VT is up almost 42% whereas the global ETF space, in general, has only seen inflows of approximately 19%. Yes, there has been a steep fall-off in asset flow over the past 30 days (as in competing funds), but this is to be expected given what is happening in the world right now.

VT’s increasing assets under management led to a strong increase in the latest quarterly dividend which was paid out on the 23rd of December last. If indeed we annualize the quarterly distribution of $0.785, the forward dividend yield currently comes in at 3.14%. It will be interesting to see what the March distribution comes in at given recent volatility which has led to lower AUM growth but investors will be hoping for more of the same.

Therefore, to sum up, VT’s dividend, liquidity, AUM growth, and low volatility all play into the bullish case for this particular fund. However, given how the ETF’s technicals are shaping up at present, we believe investing in this vehicle over shorter timeframes will pay better dividends for some time to come. We look forward to continued coverage.

[ad_2]

Source links Google News