[ad_1]

ETF Overview

Vanguard Total Bond Market ETF (BND) focuses on intermediate-term investment grade bonds in the United States. The ETF tracks the Bloomberg Barclays U.S. Aggregate Float-Adjusted Index. BND has very low credit risk as all of the bonds in its portfolio are investment grade bonds. Hence, it offers investors good protection in an economic downturn. Unfortunately, the fund has considerable interest rate risk given its portfolio’s average duration to maturity years of 8.2 years. Given the fact that the market has priced in several rate cuts, and the U.S. economy is still robust. We think the likelihood of the Fed cutting its key interest rate several times as unlikely. Therefore, the current risk and reward profile is not particularly attractive. Investors may want to wait on the sidelines.

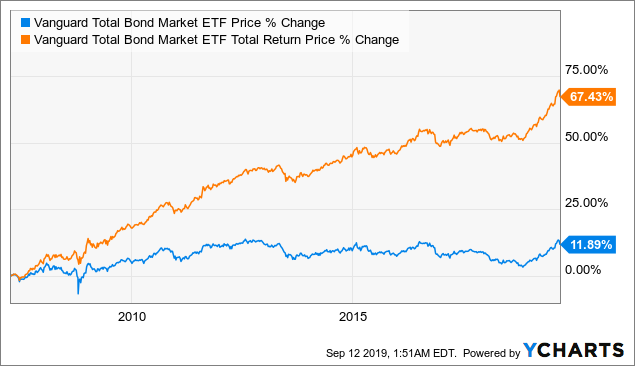

Data by YCharts

Fund Analysis

When evaluating bond ETFs, there are several things we check. First, we look at whether the bond is safe or not (credit risk). Second, we look at how well these bonds are impacted by the interest rate (interest rate risk). Third, we look at whether this is the time to buy these bonds or not. As usual, we will go through this checklist one by one.

Low credit risk

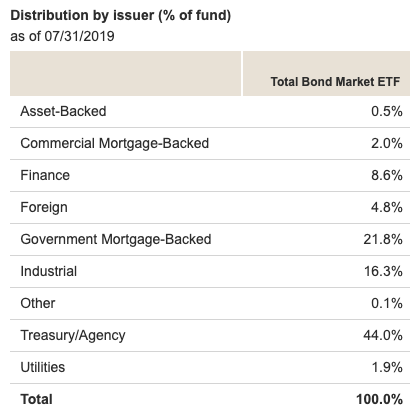

First, we will take a look at the composition of BND’s portfolio. As the table below shows, bonds issued by U.S. treasury represents about 44% of BND’s portfolio. These bonds are safe as they are backed by the U.S. government which has the top investment grade rating. These treasuries are probably one of the safest bonds we can find in the world right now. At the moment, U.S. government bonds have credit ratings of AA+ stable (S&P) and AAA stable (Fitch, and DBRS). The second largest type of bonds is mortgage-backed securities. These are securities backed by the government and credit risk is low. The remaining bonds are corporate bonds issued by different industry sectors such as finance (8.6%), industrial (16.3%), and utilities (1.9%).

Source: Vanguard Website

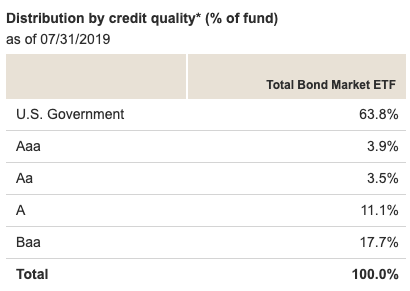

It may take a while to evaluate each corporate issuer. Fortunately, as the table below shows, all of the bonds in BND’s portfolio are investment grade bonds. As we know, investment grade bonds’ default rate is only about 0.10% per year (based on 32-year period measured). On the other hand, default rate for below-investment-grade bonds are about 4.22% per year. Therefore, we see little credit risk.

Source: Vanguard Website

BND’s fund price is sensitive to changes in interest rate

Now we will see whether BND will be impacted by the change of the interest rate. In general, short-term bonds are less impacted by the changes in interest rate as these bonds are almost reaching maturity. On the other hand, long-term bonds’ market value can be impacted by the change of interest rates. As can be seen from the table below, majority of its bonds will mature within 10 years (1~3 years: 24.3%; 3~5 years: 25.5%; 5~10 years: 31.1%).

Source: Vanguard Website

The average effective maturity year of BND’s bonds is 8.2 years. The intermediate average maturity term means that the fund performance can still be sensitive to interest rate. As can be seen from the chart below, BND’s fund performance is inversely correlated to the treasury yield rate. Therefore, interest rate risk is real. This means that as long as the treasury rate continues to decline, BND’s fund price will continue to climb. On the other hand, if treasury rate rises, BND’s fund price will fall.

Data by YCharts

Is it time to buy BND?

Since BND has minimal credit risk, what we really need to be concerned is how BND’s price is impacted by the change in interest rate. As we have observed in our analysis, a declining interest rate has the potential to move its share price higher. However, we think the decline of the 10-year treasury rate since the beginning of 2019 has gone too far. Although the 10-year treasury rate has climbed up a little bit in the past week, its current 10-year treasury rate of 1.75% is still near the low in late 2016 (see chart below). However, the Fed’s key interest rate is still much higher than the rate in late 2016. Therefore, the bond market is still expecting the Fed to cuts its key interest rate twice or more.

Data by YCharts

The question is whether the Fed will need to drop the key interest rate a few more times or not. We understand that the current global economic uncertainties primarily due to escalating trade tension between the U.S. and China have the potential to derail the U.S. economy. However, the U.S. economy is still quite robust. We are still seeing strong retail sales in the U.S. (U.S. consumer spending represent about 70% of the country’s GDP). In July, U.S. retail sales jumped by 0.7%. This is much better than many analysts had expected. On the other hand, inflation is still up 1.8% in July. In such an environment, we do not see the need for the Fed to significantly lower its key interest rates. In addition, the trade tensions between the U.S. and China seems to ease off a bit since the beginning of September. If the Fed disappoints the bond market or the economy continues to strengthen, 10-year treasury rate may continue to move up. This will suppress BND’s fund price. Therefore, we see the current risk/reward profile not attractive if your goal is to seek capital appreciation.

Risks and Challenges

Although bonds in BND’s portfolio are all investment grade bonds. In an economic downturn, issuers of many of these corporate bonds may receive credit rating downgrades. As we know, Baa bonds represent about 17.7% of BND’s portfolio. Baa bonds are bonds in the lowest level of the investment grade bonds. In an economic downturn, some of the issuers of these bonds may have their credit ratings downgraded to non-investment grade bonds. In such an environment, its bond value may decline.

Investor Takeaway

If your goal is to receive a stable dividend income, BLV may still be an okay choice for you as the ETF offers a dividend yield of 2.8%. The risk and reward profile is not attractive unless an economic recession is imminent. At this point, it is still too early to call for an economic recession.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News