[ad_1]

grandriver/E+ via Getty Images

The Vanguard Short-Term Treasury ETF (NASDAQ:VGSH) is intended to provide modest income via its portfolio of short-term treasury bonds. However, with the Federal Reserve expected to continue hiking short-term interest rates until mid-2023, there is still price downside to VGSH due to its 1.9-year average duration. In the long-run, VGSH’s sub-1% average annual total return almost guarantees investors will lose purchasing power, even if inflation returns to 2%. I would avoid this fund.

Fund Overview

The Vanguard Short-Term Treasury ETF provides current income with modest price fluctuations. The fund has over $20 billion in assets.

Strategy

The VGSH ETF strategy is very simple. It owns a portfolio of short-duration treasury bonds with weighted average maturity of 1-3 years.

Portfolio Holdings

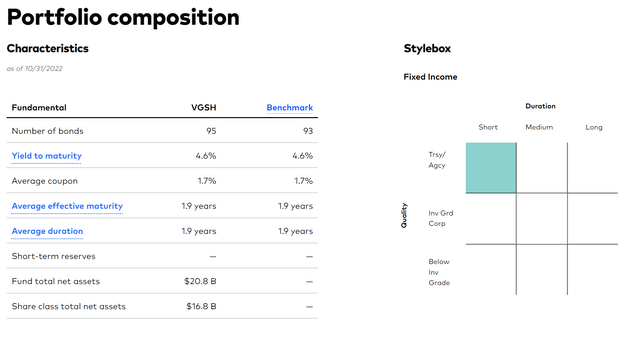

The VGSH’s portfolio has 95 positions with average yield to maturity of 4.6%. The average duration of the portfolio is 1.9 years (Figure 1). As the portfolio invests only in treasury bonds, there is no credit risk associated with VGSH.

Figure 1 – VGSH portfolio composition (vanguard.com)

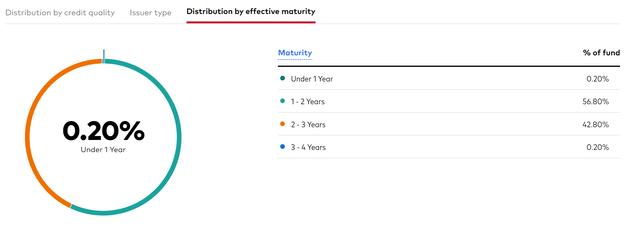

A little more than half of the portfolio is invested in treasury bonds between 1-2 years in maturity, and the rest is invested in 2-3 year maturity treasury bonds (Figure 2).

Figure 2 – VGSH portfolio distribution by maturity (vanguard.com)

Returns

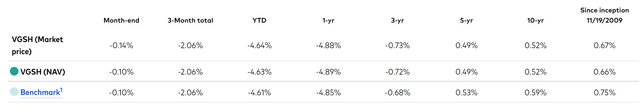

The VGSH ETF has provided very modest returns, with long term average annual total returns less than 1% per annum to October 31, 2022 (Figure 3). YTD, the rapid increase in short term interest rates have caused VGSH to fall by 4.6%, which is several years worth of returns for this fund.

Figure 3 – VGSH ETF returns (vanguard.com)

Distribution & Yield

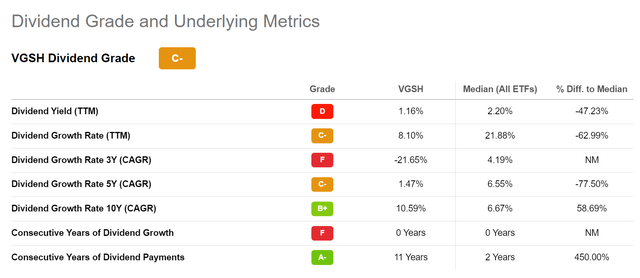

Although VGSH has a 30-Day SEC yield of 4.58%, this refers to the yield to maturity of the underlying portfolio. Actual distributions from VGSH have been much less than that. On a trailing 12 month basis, VGSH has only paid a distribution yield of 1.2% (Figure 4). VGSH’s distribution is variable and paid monthly.

Figure 4 – VGSH distribution yield (Seeking Alpha)

Fees

VGSH charges an ultra-low 0.04% expense ratio.

Rate Hike Headwinds In The Short-Term…

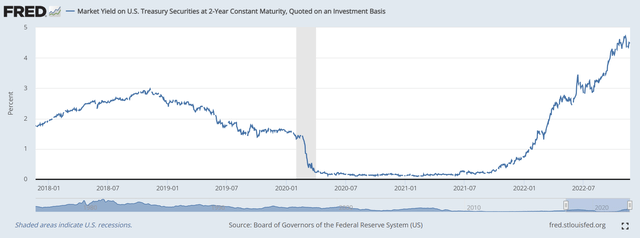

In the short-term, rate hikes by the Federal Reserve to combat inflation have led to a sharp increase in short-term interest rates, a headwind for VGSH due to its average duration of 1.9 years (Figure 5).

Figure 5 – 2 Year Treasury Yield (St. Louis Fed)

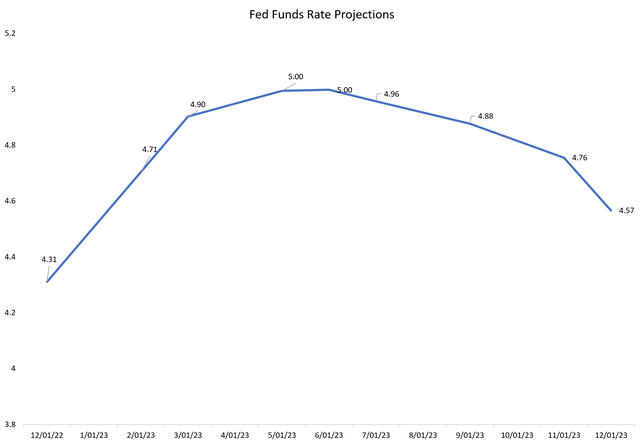

With the market expecting the Federal Reserve to raise Fed Funds rate to ~5% by May 2023 vs. 3.75% currently, there is still upside to 2-Yr treasury yields, and, therefore, downside to VGSH (Figure 6).

Figure 6 – Market Implied Fed Funds Rate Expectations (Author created with data from CME)

… And May Lose Purchasing Power In The Long-Run

In the long-run, investors should not hold the VGSH ETF, as its sub-1% average annual total return means they are almost guaranteed to lose purchasing power, even if inflation ever returns to the Federal Reserve’s 2% target.

TBIL Is A Better Safety Bet

If short-term safety is what investors are looking for, I would recommend they take a look at the U.S. Treasury 3 Month Bill ETF (TBIL). TBIL’s holdings are 3-month treasury bills, which have virtually no duration risk. On the other hand, TBIL’s distribution benefits from increases in short-term interest rates.

Conclusion

The Vanguard Short-Term Treasury ETF is intended to provide modest income via its portfolio of short-term treasury bonds. However, with the Federal Reserve expected to continue hiking short-term interest rates until mid-2023, there is still price downside to VGSH due to its 1.9 year average duration. In the long-run, VGSH’s sub-1% average annual total return almost guarantees investors will lose purchasing power, even if inflation returns to 2%. I would avoid Vanguard Short-Term Treasury ETF.

[ad_2]

Source links Google News