[ad_1]

KreangchaiRungfamai/iStock Editorial via Getty Images

Investment Thesis

Long periods of underperformance and lost decades make no one excited about buying a stock or ETF. Typically after a decade of underperformance, only real investors remain. These investors are focused on business ownership, earnings, and dividends. It is these long periods of consolidation that lead to huge bull markets. Maybe the best example of this is how the enduring pain of the Great Depression made the S&P 500 the best performing index over the past century. A long period of consolidation for technology from 2000 to 2015 was followed by an outstanding bull market for the NASDAQ. The time has come for the Vanguard FTSE Pacific ETF (NYSEARCA:VPL). In the decade ahead, we expect investors to be rewarded with a return of 11% per annum.

Relative Valuations

| As of May 31, 2022 | Vanguard FTSE Pacific | Vanguard FTSE Europe (VGK) | Vanguard S&P 500 (VOO) | Vanguard FTSE Emerging Markets (VWO) |

| P/E | 11.7 | 12.5 | 20.2 | 10.6 |

| P/B | 1.3 | 1.8 | 3.9 | 1.8 |

| ROE | 11% | 13% | 22% | 15% |

| Dividend | 3.8% | 4.2% | 1.6% |

3.3% |

|

Earnings Growth (Since 1995) |

6.5% (Japan, Korea, Australia) | 4.5% | 7% |

8% |

As you can see, Vanguard Pacific is among the cheapest of its peers. The ETF has exceptionally low price to book and price to earnings ratios, along with a healthy dividend yield of 3.8%. If we combine the earnings per share growth of VPL’s largest regions, we can see that earnings have grown nearly as fast the S&P 500’s since 1995. Despite this, the index trades at an enormous discount.

Core Holdings

An investment in VPL is an overweight bet on Japan. The index also has significant exposure to Australia and South Korea. Below are the weightings of the index’s geographical regions:

Geographical Weightings (Vanguard)

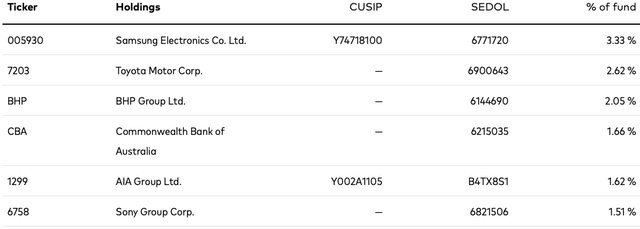

These are the fund’s largest holdings:

VPL’s Largest Holdings (Vanguard)

As you can see, the Vanguard FTSE Pacific ETF has a blend of financials, auto manufacturers, commodity producers, and consumer discretionary businesses. BHP, for example, is a huge mining business out of Australia. Then you have consumer technology giants such as Samsung and Sony, providing the world with state-of-the-art smart phones and gaming consoles. There are also a number of huge auto manufactures in the mix: Toyota, Kia, Mitsubishi, and Hyundai. The more exciting VPL businesses include SoftBank out of Japan, which invests in the future of A.I. and technology. As well as Sea Limited and Coupang Inc, leading e-commerce companies in emerging Asia.

Risks

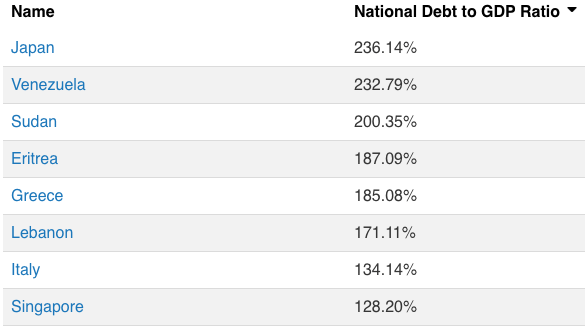

The risks primarily lie with an overweight exposure to Japan, 55% of assets. Japan’s population is in decline, and many of the country’s companies rely on international revenues (Toyota, Samsung, etc.). Meanwhile, Japan sports the highest percentage of government debt to GDP in the world, right next to countries like Sudan and Venezuela. Notice that Singapore (3.2% of assets) is also on the list:

Countries By Government Debt To GDP (World Population Review)

This puts Japan is a precarious position. As Japan holds down the interest rate on this debt, the value of the Japanese Yen is decreasing. A weak Yen should be good for international sales, but it weakens the value of domestic sales. If the interest on this debt were to rise, it would squeeze the government, which could lead to higher taxes and austerity. This is a scary situation for a country to be in.

Since 1995, Japanese businesses have grown earnings per share at 6.9% per annum. But, government debt to GDP expanded rapidly during this period. Going forward, we’ve projected this to slow to 4.5% per annum.

Long-term Returns

We project VPL’s earnings growth to slow, from 6.5% per annum to 5% per annum, due to the debt issues in developed Asia. Despite these issues, the ETF has strong underlying businesses, with entrenched competitive positions. If we see a boost in overall share buybacks, 5% growth is very attainable. We expect a lot of innovation to come out of Asia.

Our 2032 price target for VPL is $136 per share, indicating a return of 11% per annum with dividends reinvested.

- VPL has earnings of $5.96 per share as of May 31, 2022. With 5% annual growth, this becomes $9.71 per share in 2032. We’ve applied a terminal multiple of 14, which is appropriate for this level of growth. Going forward, we’d expect regions like South Korea and Hong Kong to make up a larger portion of the fund. The outlook should be better in 10 years time, resulting in a multiple expansion.

Conclusion

While having a 55% weighting in Japan, with record government debt does feel a little uncomfortable, VPL has priced in the risks with an exceptionally low valuation. The ETF currently has a 9.4% earnings yield. We’re betting on the underlying enterprises, innovation in Asia, and more share buybacks to carry investors through to an 11% annual return. This should handily beat the S&P 500 over the decade ahead. We spy deep value in the pacific and have a “buy” rating on VPL.

[ad_2]

Source links Google News