[ad_1]

piranka

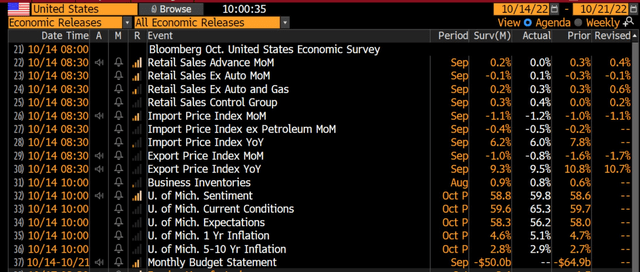

Stocks have had a wild ride this week. Key data like CPI on Thursday, retail sales early Friday, and University of Michigan Consumer Sentiment late this morning all had their impact on equities and bonds. In aggregate, data show that there is no clear downward trend in recorded inflation and that the consumer remains strong, much to the Fed’s frustration.

It’s not surprising that FOMC members have been making the rounds at various speaking events proclaiming that the fight to calm inflation is not going to end anytime soon. Expect Fed chatter next week to keep up that tone following this morning’s data. The 10 am University of Michigan report revealed the first bump up in 1-year inflation expectations since March. This is problematic as the more consumers expect prices to increase, the more they might demand wage increases, putting pressure on CPI.

Inflation Expectations Jump

Christian Fromhertz

This morning’s hot data came after a very strong core CPI report for September. Stocks initially plummeted, but after six consecutive down days and a big gap down to a fresh 52-week low on the S&P 500 Thursday, a major apparent short-covering rally sent equities much higher. Some of those gains were gone by this afternoon. With a VIX north of 30, expect whippy daily moves to continue – perhaps about 2% each session based on its calculation.

Hot UofMI Data Comes After Fiery September CPI

Hot UofMI Data Comes After Firey September CPI

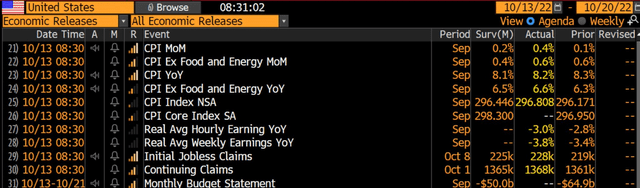

Economic data, in general, has been verifying better than expected. In a ‘good news is bad news’ investing environment, that’s led to a bearish situation for stocks and higher yields. The U.S. 10-year Treasury rate rose above 4% Friday afternoon as the S&P 500 dipped back under 3600. Interestingly, data has cooled in Europe relative to forecasts, according to the Goldman Sachs Economic MAP Surprise Index. Globally, data is a touch to the strong side. Expect equities to rise and yields to dip should poorer data be verified in the coming weeks.

Global Economic Data To The Strong Side

Goldman Sachs Investment Research

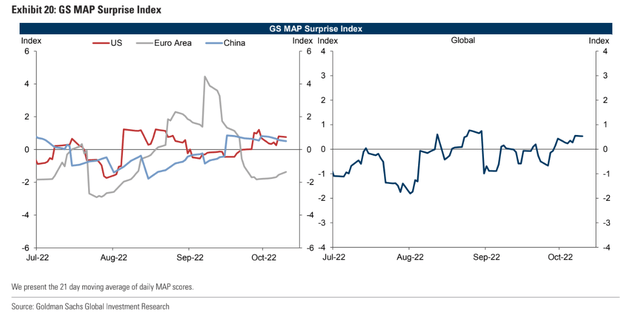

On valuation, the world of stocks looks like a decent buy with the forward price-to-earnings ratio at just 14, according to Yardeni Research. The U.S.’s big weight to the information technology sector and other growth areas is thought to warrant a loftier valuation while more value and cyclical areas of the global market feature lower earnings multiples. We’ll know a bit more about what the “E” will be as the third-quarter earnings season heats up next week. The big U.S. banks had generally positive earnings surprises this morning to back up decent numbers from a few early reporters.

Global Equity Valuations Continue To Fall, Uncertain Earnings Ahead

Yardeni Research

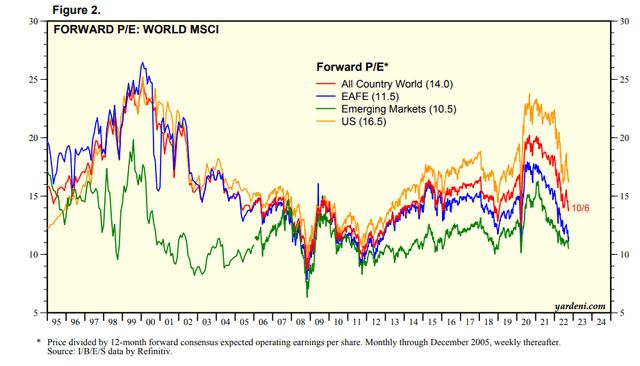

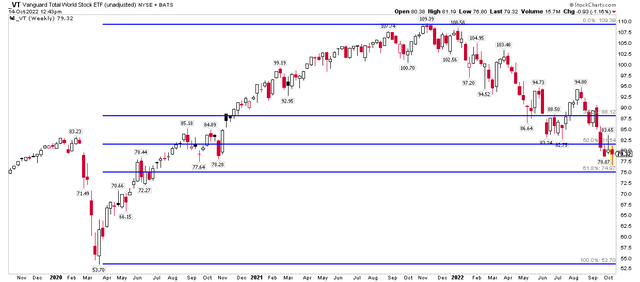

Taking a look at price action on the Vanguard Total World Stock ETF (NYSEARCA:VT), the equity market has now given back more than half of the gains from March 2020 through late last year. A 27% 2022 drop is made all the worse considering that inflation looks to take a bite of the market’s “real” return. Maybe the bulls can muster a rally off the September 2020 low of $77.64 on VT – this week’s nadir notched Thursday morning was $76.80, a more than two-year low.

For background, the ETF aims to track the performance of the FTSE Global All Cap Index, which covers both well-established and still-developing markets. It has a low 0.07% annual expense ratio with a median intraday bid/ask spread of just 0.01%.

VT: Global Stocks Fall Nearly 30% From The High Almost One Year Ago

Stockcharts.com

The Bottom Line

Long-term investors should stick with VT here. While earnings estimates will surely drop somewhat, valuations are compelling. Adding to this broad, low-cost index fund after a drop of nearly 30% and with a P/E in the mid-teens should prove worthwhile over the long haul. Moreover, I think stocks are about to begin an extremely bullish stretch from the U.S. midterm election through the pre-election year.

[ad_2]

Source links Google News