[ad_1]

Seth Love/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the VanEck Vectors Gaming ETF (NASDAQ:BJK) as an investment option at its current market price. This is a broad casino/gaming fund, with an objective to track an index consisting of companies involved in casinos and casino hotels, sports betting, lottery services, gaming services, gaming technology and gaming equipment.

When 2022 began, I cautioned readers that this probably wasn’t the best move. I wanted to wait for a pullback before adding to my position and, in hindsight, this was indeed the right call. While BJK has seen some ups and downs this calendar year, the broader trend is mostly down, as seen below:

YTD Performance – BJK (Seeking Alpha)

Given that BJK is almost in a bear market for the year, I wanted to take another look at it to see if I should change my outlook. After review, I do see a bit more value here than I did back in January, and believe a buy rating is now warranted. There are a few reasons to be optimistic on this sector going forward, and I will go into detail on these attributes below.

Las Vegas Is Coming Back As A Popular Destination

I want to start this review by highlighting some of the most positive points about this sector more broadly. When considering BJK, one has to factor in quite a bit of macro-themes. This is because this is an international fund, with exposure that spans brick and mortar casinos, e-betting/online sport betting, Las Vegas (and other gaming centers in North America), as well as exposure in Europe, Australia, and Macao / Asia. As a result, quite a bit of analysis has to go into this fund and the underlying holdings. It is not an ETF for just one idea, but spans many.

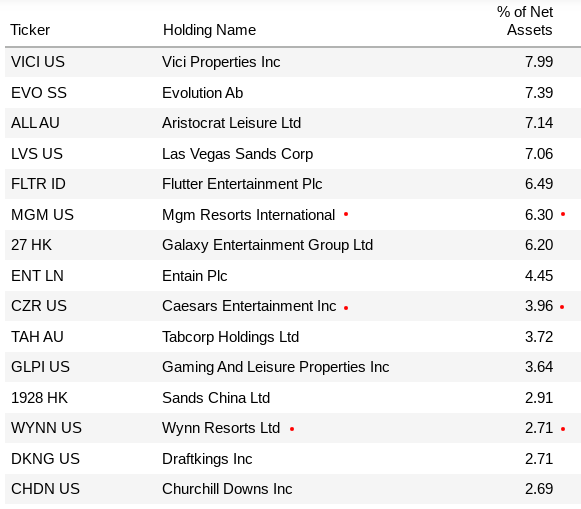

Understanding this, what is happening in Las Vegas is still an important attribute. This is because some of the fund’s top holdings are the flagship companies that dominate the “Strip”. These include MGM Resorts (MGM), Wynn Resorts Limited (WYNN), Caesars Entertainment (CZR), among others:

BJK Top Holdings (VanEck)

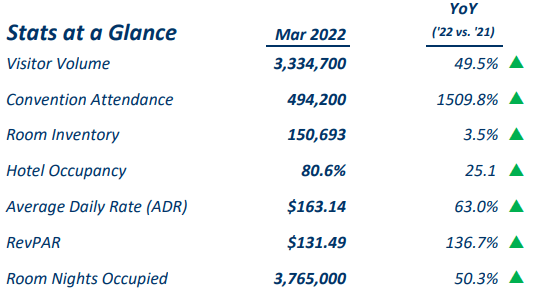

On this front, there is definitely some good news. Specifically, tourism and travel into Vegas has seen a resounding uptick. When we consider year-over-year results for March 2022, we see strong performance across the board compared to 2021:

Headline Numbers – Las Vegas (Las Vegas Convention and Visitors Authority)

Of course, 2021 was not a great year for Vegas, but these strong numbers point to a recovery of the city. Clearly, gaming and casino stocks need visitors to drive revenue and profit. With such a sharp boost in foot traffic coming into the city, investors should regard this positively.

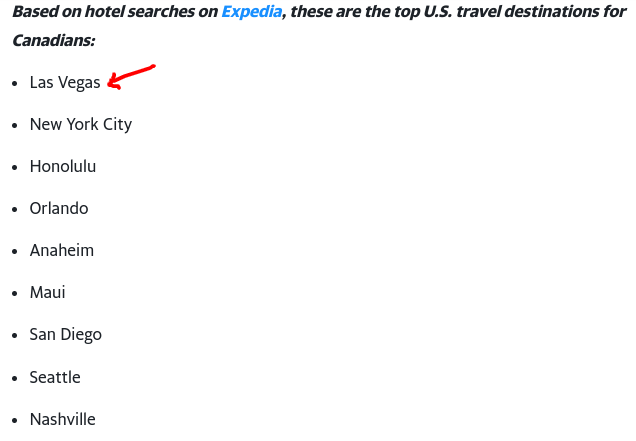

Expanding on that point, it is not just Americans who are coming back to Vegas in force. Now that the border between Canada and the U.S. is open again, there has been a release of pent-up travel demand from north of the border. While Canadians are a diverse group with a myriad of destinations in mind when they come to America, readers may find it interesting that recent data suggests Vegas is top of mind for many across the border:

Top Travel Destinations for Canadians (Expedia)

My takeaway from all this is that Las Vegas is once again a major force in American tourism. This bodes well for the local economy there, but also for leisure stocks that retail investors can choose from – whether that is hotels, restaurants groups, or casinos – such as through BJK.

Sports Betting Keeps Expanding

As I mentioned, BJK is more than just a brick and mortar casino play. One of the prominent themes investors are getting exposure to when they pick up this fund is the expansion of mobile sports betting in America. Importantly, investors are getting exposure to sports / online wagers in the U.K., Europe, Australia, and elsewhere, but the growth of American online sports betting is a new and exciting theme. (It has already been legal in those other jurisdictions for years).

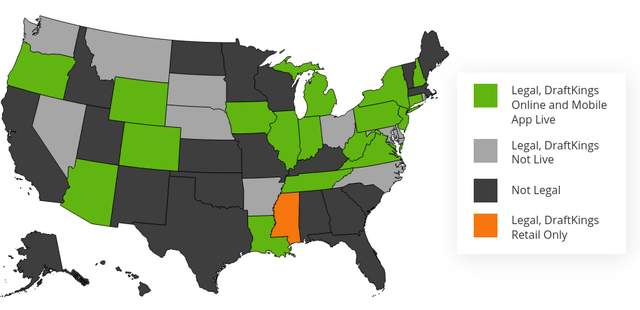

Readers are probably well aware that many individual states have been jumping at the chance to legalize this potential source of tax revenue. But while the legalization of online sports wagering has been in the news for a while, there is still quite a bit of potential to go. Many states have not jumped on the bandwagon yet, and others, such as my home state of North Carolina, still only allow in-person wagering. This means that the future could still bring in millions of more regular customers as more states move in this direction:

Online Sports Wagering Breakdown (DraftKings)

What is striking is that many states with major populations – California, Florida, Texas, and Massachusetts – have been slow to embrace this phenomenon. That spells opportunity to me.

Of course, readers could take this to me the opportunity right now is limited. After all, if just one-third of states offer online betting, is this really an area where investors want to positions themselves now? While it could be a fair point to wait for more clarity from other states, the bulls on this sector would be quick to point out that expansion into new states is happening quite quickly. In fact, just last week the Massachusetts Senate voted to legalize sports wagering within the state, as reported by WBUR News.

Personally, I think we will continue to see more states come online this year. As more states legalize, their neighbors have been quick to follow suit, not wanting to miss out on the potential for tax revenue. This is why, as the above graphic illustrates, many of those legals where online sports betting is legal tend to be clustered together. This is a trend that is likely to keep moving in one direction, as reports of state tax collections are going to keep their neighbors jealous. For example, Virginia has recorded almost $27 million in tax revenue from the sector, and neighbors like North Carolina, Maryland, and Kentucky are likely taking notice:

Virginia Tax Receipts (Richmond Times)

The conclusion to draw here is that online sports wagering is a growing sector, and BJK is a great way to place that space. Top holdings include Flutter Entertainment (OTCPK:PDYPF), which is a leader in Ireland and the U.K., and is gaining a strong foothold in America. Another top holding is DraftKings (DKNG), which has seen a sharp sell-off since breaking new highs over a year ago. This is a company whose app has tremendous name recognition in the U.S. and, is finally beginning to limit some promotions in an effort to turn to profitability quicker than previously anticipated. Further, the names above that I mentioned – MGM, WYNN, and CZR – all have their own online sports betting platforms. So, ultimately, if one wants to be long this sector and not pick and choose which companies will outperform, BJK is a reasonable option.

What About Macao? I Hope We Have Hit A Bottom

As I mentioned, investors in BJK have to look beyond America’s borders. These are global companies, for the most part, many of which have a heavy presence in either Europe or the Asia Pacific. On this front, the current story is not too glamorous. China in particular has been extremely sensitive to rising Covid-cases, and has responded by reinstating restrictions that have generally limited travel and discretionary spend in Macao. For companies like Las Vegas Sands (LVS), MGM, and Wynn, among others, this has had a very detrimental impact on the bottom-line.

On this front, I don’t have a lot of good news to report. The silver lining is hopefully that things can’t get much worse. In fact, I wrote recently about LVS, suggesting that the stock is a buy at recent levels because the outlook can only improve going forward. Fortunately, since that review, LVS has already posted a 6% gain, while the broader market has dropped a bit.

However, this strong short-term move is not necessarily one that is going to stick. I want to be upfront here and say that while I have painted an optimistic picture so far in this review, this investment idea is not for the risk averse. The gaming and casino sector – whether online, in Vegas, in Macao, or elsewhere – is having a difficult period. Macao in particular is seeing quite a bit of headache, with the Chinese restrictions I mentioned sapping revenues to the point where things haven’t been this bad since during the peak of the pandemic in mid-2020:

Headline News From Macao (Macao Gaming Commission)

Of course, headlines like this are not going to give investors much comfort. But we have to remember that buying into the underlying stocks when things look bleakest is often a recipe for success. Sure, there is probably going to be a more volatile time period ahead of us than we will like, but waiting for those headwinds to clear is going to be too late for investors who want to maximize the potential of this trade.

However, this is also a good time to manage expectations and reiterate that this idea is not for the risk averse. While I see a positive path forward, and I am indeed willing to take the risk, if Chinese restrictions linger for longer than expected, there is going to be a limit to the upside we will see in the near-term. Therefore, this thesis rests on the idea that better days are ahead, and if that story is proven wrong, there is more pain to come.

American Consumers Are Managing Inflation

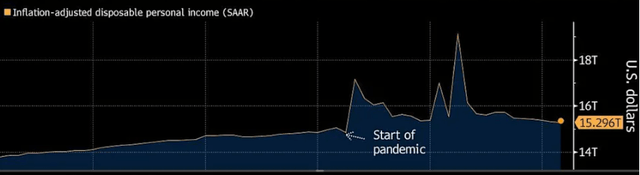

My final thought looks at the state of the U.S. consumer. While I brought up some points that focus on gaming specifically, BJK still relies on the overall health of consumer spending. After all, the outlook for a sector like online gaming could be great in isolation, but if consumers don’t have money to spend (or lose) on discretionary leisure activities like gaming, the companies will struggle to boost profits. In this vein, readers may be wondering why I would suggest buying a fund like BJK when all the headlines about inflation and consumer sentiment seem to be negative. While rising prices are indeed a concern, we have to remember that American workers and households remain in pretty solid financial shape. Of course, if prices continue to rise and wages stagnate or unemployment picks up, all bets are off so to speak. But at the current juncture, when we factor in inflation, personal income levels are actually above where they were pre-covid, as shown below:

Disposable Income After Inflation (Yahoo Finance)

I view this as a positive because it means that Americans, at least those who are gainfully employed, remain in pretty good shape. To be fair, inflation is a major sore point and they are worried about the future. I know I am too. But the fact remains wages and stock markets are up when we compare them to two years ago (pre-Covid). This means Americans have money to spend, and companies that rely on gaming and tourism that make up BJK’s portfolio are poised to capture some of that cash.

Bottom-line

BJK has been a loser, there is no doubt about that. While I was smart to hold off on adding to that position in 2022 so far, my position from a year ago is heavily in the red. Fortunately I resisted temptation to “double-down” for a while, which has saved me money over time. But I have finally begun to see value emerge that I am willing to add to my position here. Las Vegas is on the rebound, Macao is likely to see a stronger summer as Chinese restrictions are lifted, and sports wagering continues to expand domestically at a rapid pace. I like all of these developments, and believe BJK will post gains in the coming months. Therefore, I will be adding cash to this fund, and suggest readers give the idea some consideration at this time.

[ad_2]

Source links Google News