[ad_1]

akinbostanci/E+ via Getty Images

The pandemic was once in a century event that upended capital markets. Specifically, it not only led to enormous increases in negative-yielding debt across the globe, something so counter-intuitive and unnatural I cannot even find a proper analogy, but also spawned a few fresh themes investors recklessly chased. Excess cash growing by the means of deferred spending and stimuli created a perfect backdrop for the retail investing boom that left these themes flourishing, supercharging momentous rallies, and exposing those who were late to the party to debilitating losses.

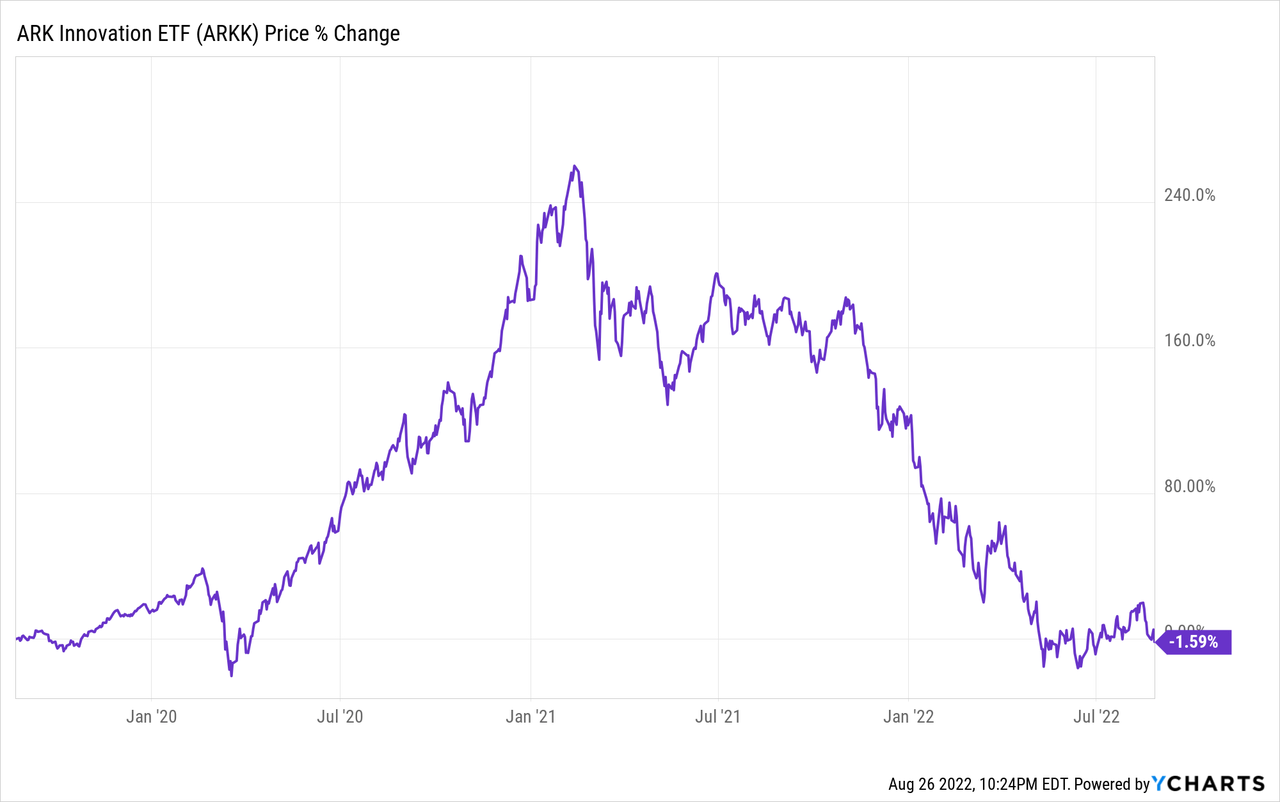

The pandemic market relied on sky-high hype premia and buy-everything-now investor sentiment. That was a highly flammable FOMO atmosphere, and investors sitting at a double-digit unrealized loss in case they bought into the ARK Innovation ETF (ARKK) in February 2021 perfectly understand what we are touching upon here.

When the pandemic started to somewhat abate, the phenomenon of a meme stock was born, partly supported by the similar forces that drove the 2020 speculative tech rally. And the investment industry quickly responded with fresh products capable of capitalizing on the ever-evolving, fluid social sentiment.

VanEck Social Sentiment ETF (NYSEARCA:BUZZ) was incepted in March 2021, when the GameStop (GME) saga was still reverberating through financial media. The monthly-rebalanced BUZZ NextGen AI US Sentiment Leaders Index which lies at the crux of the ETF’s strategy focuses on

75 large-cap U.S. stocks which exhibit the highest degree of positive investor sentiment and bullish perception based on content aggregated from online sources including social media, news articles, blog posts and other alternative datasets.

Another way of saying, this is a somewhat hype-centered strategy favoring those that are in the limelight. The hype should mean investors see value in these names, thus they are flocking to them for a reason (perhaps FOMO, I would say), so there should be surfeit liquidity supportive of more gains. We will see whether historical data support this premise in the performance section.

By large-cap, the index provider means companies that have a market cap of no less than $5 billion. In essence, there are no other quality or quasi-quality considerations, and the fund could easily end up holding a basket of debt-burdened, cash-burning companies with great expectations premia, a highly flammable mix, especially for an environment where the S&P 500 can slip by almost 4% in one day following somewhat hawkish comments made by Fed Chair Jerome Powell at the Jackson Hole symposium.

What is inside the portfolio at the moment?

As of August 24, BUZZ was long 75 stocks, with the top ten accounting for close to 31% and Tesla (TSLA) being the major holding with a 3.3% weight. GameStop and AMC Entertainment (AMC), stars of the 2021 short squeezes, are also present, with 2.65% and 1.2% weight, respectively.

As of my analysis, the IT sector is its primary allocation (close to 29%) followed by communication (23.6%) and consumer discretionary (20.2%).

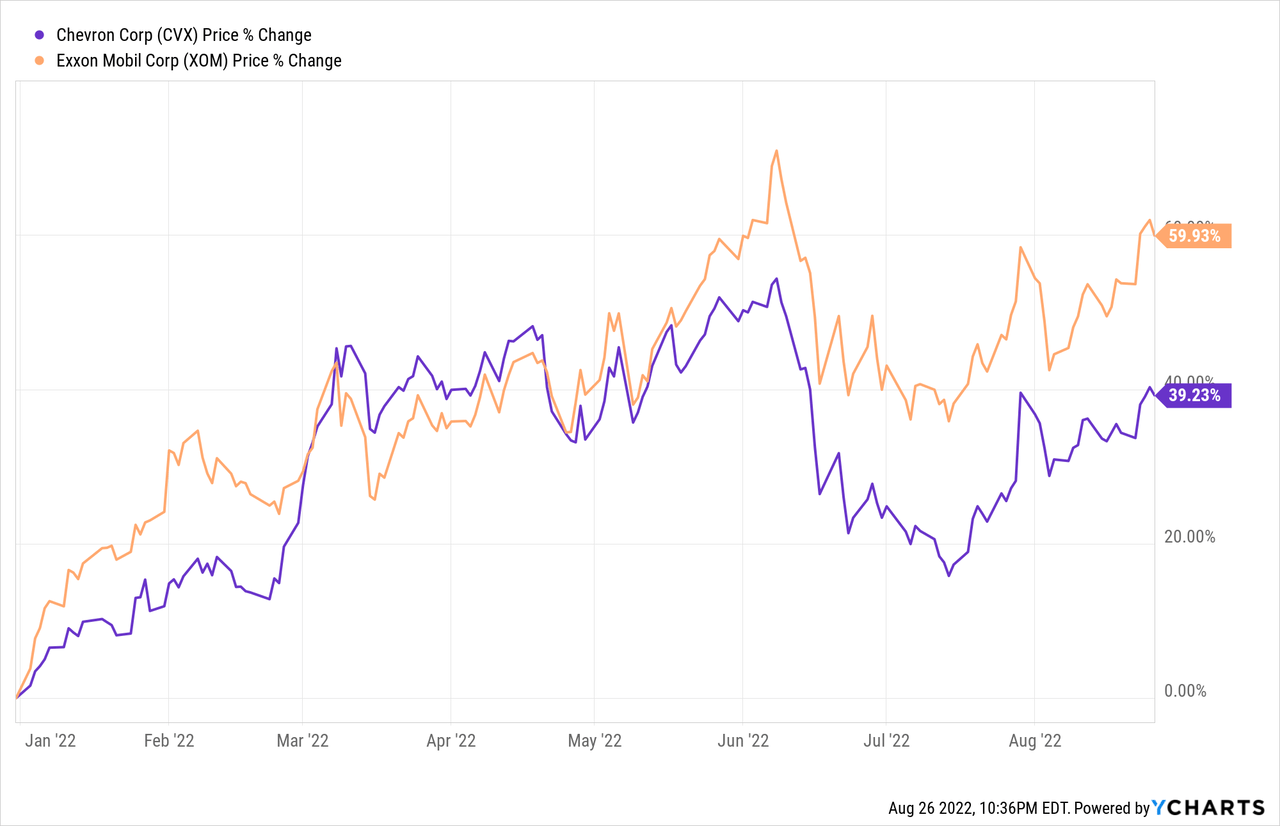

Interestingly, delving deeper, with weights sub-1%, we see Chevron (CVX) and Exxon Mobil (XOM) in the mix, which is barely coincidental given the energy crisis made a perfect backdrop for their outstanding performance this year, which certainly reverberated through social media, attracting a multitude of positive comments and bolstering great expectations.

Moving to factor exposure, I see over 71% of the holdings have a Quant Valuation grade of D+ and worse, which does not surprise me, at all, as the fund ignores that factor. Growth is solid, with 47% allocation to stocks with no less than a B- grade. I do not see serious quality issues, at least for now, but there is still something to dislike about here as just 65% have a B- Profitability rating or better; this is surprisingly large for the social sentiment-centered strategy. Still, I prefer to see no less than 80%.

Performance analysis: the tectonic shift in market focus took its toll

The strategy looks nicely calibrated at first blush. Just rely on the AI and buy names that are grabbing positive headlines and tweets. But did it deliver? Here things turn much gloomier.

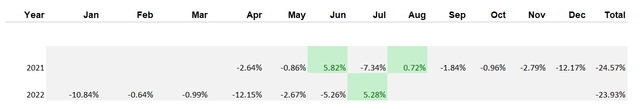

The table below provides a context. It shows BUZZ beat the iShares Core S&P 500 ETF (IVV) just three times, in June and August 2021, and then in July 2022; the latter can be explained by the temporary return of the risk-on sentiment supported by the bad news is good news narrative.

Created by the author using data from Portfolio Visualizer

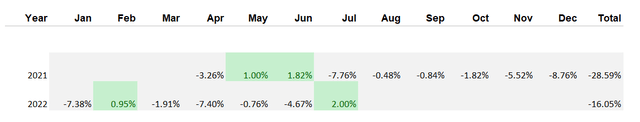

The next table compares the tech-heavy Nasdaq 100 cohort’s (QQQ) returns with BUZZ, with similarly disappointing results.

Created by the author using data from Portfolio Visualizer

All these are a direct consequence of the tectonic shift in the market’s focus, from speculative story stocks to cyclical and pro-inflation plays, with more attention paid to the value and quality factors. BUZZ failed to benefit from this shift.

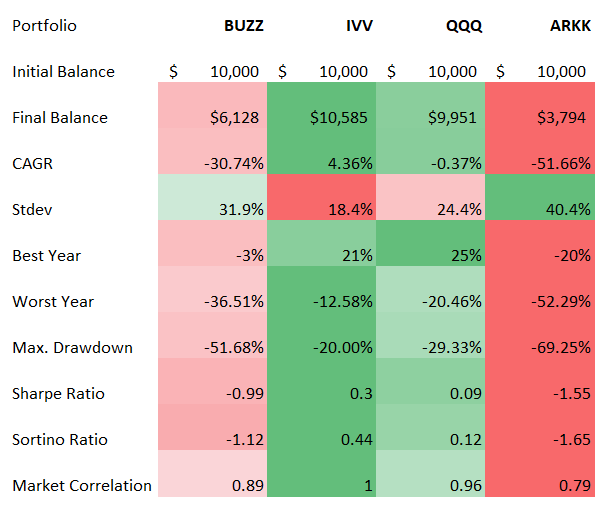

And yet another table, which provides an even better context for BUZZ’s historical performance adding volatility and risk metrics.

Created by the author using data from Portfolio Visualizer

As can be seen, buying into the hype cost investors dearly. It was way more volatile than IVV and QQQ, with a deeper drawdown and a weaker CAGR. Actively-managed ARKK was added as a perfect example of a speculative growth-focused strategy that suffered debilitating losses when the market finally acknowledged the multiples expansion party cannot go ad infinitum. And yes, BUZZ outperformed it, with lower volatility.

Final thoughts. The meme stock era revival?

What is the BUZZ ETF? Mostly, it is an excruciating standard deviation (close to 32% as the table shows) and precipitous drawdowns delivered over its fairly short history. Valuation is not simply a secondary consideration for its strategy. It is not assessed at all. Quality is also ignored, but in the current iteration, it does not look like an issue.

On a side note, I think that even though a passive strategy should be better in terms of turnover, an active approach still should be superior in the case of portfolios like BUZZ.

The point could be made that with risk-on sentiment returning and the inflation narrative losing relevance by the day (surprises still can dent the sentiment anyway), the dawn for BUZZ’s favorites is perhaps in sight. Even more, investors can riposte that BUZZ should evolve from an era to an era, as social sentiment is fluid, and when the growth echelon is out of favor, cyclicals gain more attention in the media, and the fund should gradually add and overweight them. However, what we have seen since its inception proves this hypothesis is wrong. The fund does hold XOM and CVX as the energy market woes catapulted their share prices and investors were flocking to them. This did little to stave off its painful NAV decline this year. Moreover, it also did not prevent the worrisome AUM trends pointing to investors becoming increasingly skeptical.

So, BUZZ was an exemplary play to benefit from the easy money era, less so for the period of capital scarcity. The market’s reaction to the hawkish comments of Fed Chair Jerome Powell made on August 26 distinctly illustrates that the appetite for risk is still low.

In sum, with all due respect paid to the sophisticated AI algorithm used by BUZZ, I see no reason to bet on the ETF in anticipation of the meme stock era revival or something a bit more tedious like a rotation back to growth stocks should inflation data continue surprising to the downside. BUZZ could be an ideal 2020 play (if it was launched earlier), but it is not 2020 anymore. That is to say, do your own due diligence and pay necessary attention to the downside risks.

[ad_2]

Source links Google News