[ad_1]

macky_ch/iStock via Getty Images

Many times I write about companies where earnings growth may be subdued or free cash flow may not be in abundance. However, when I come across a company with the above-mentioned characteristics (that still is managing to stay afloat) trading for pennies on the dollar, then I start to look at the respective stock with far more interest. Ultimately, if you are in the market, you are an opportunity seeker. From a valuation standpoint for example, the larger the divide between the company’s value in your eyes and its going price in the market, then the bigger opportunity involved. Suffice it to say, the best opportunities come when the market (in our opinion) has totally mispriced a selected underlying. Investing or trading in this manner firmly places the odds in one’s favor in the long run.

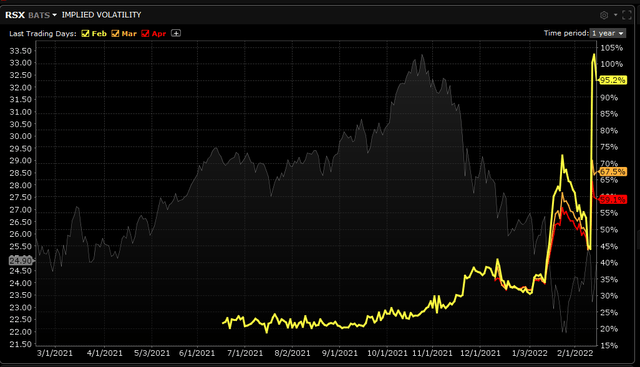

The problem with the above approach is that it is hard to find quality plays trading well below their intrinsic values which is why I fully agree with the mindset of being open to every opportunity (irrespective of market conditions) the market gives us at every juncture. Take the implied volatility of VanEck Russia ETF (RSX) for example where we see implied volatility in the front month (February) almost at 100% and in the back month (March) at 67.5%. Implied volatility (IV) or projected volatility is basically a read on how expensive the ETF’s associated options (calls and puts) are. The higher the IV of RSX, the more expensive the options which obviously suits option sellers. Nevertheless, what is the opportunity the market is giving us here, and why would be interested?

Implied Volatility in RSX (Interactive Brokers)

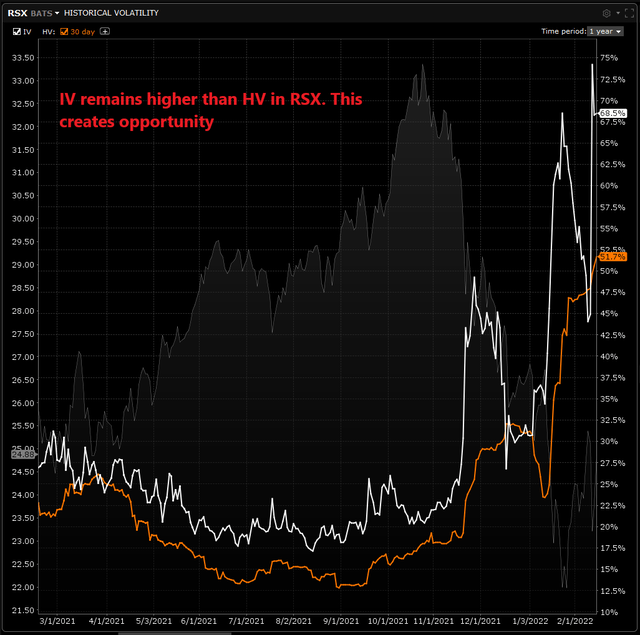

We get the answer to this in the chart below. Below, we also see historic volatility being charted against IV over a period of 12 months. This metric (HV) is basically a read on how RSX has traded over the given timeframe. The big difference is that historical volatility is not forward-looking whereas implied volatility is. Suffice it to say, the bigger the difference between RSX’s HV & IV, the bigger the opportunity due to the inflated nature of RSX’s option premiums.

Implied volatility v Historical Volatility in RSX (Interactive Brokers)

Suffice it to say, the opportunity here is not directional in nature but rather RSX’s volatility. In essence, a delta neutral volatility play in RSX means we want RSX to go nowhere for a foreseeable period of time. Now, the trading industry (with this type of set-up) would probably recommend something like a strangle (sale of an out of the money call and simultaneous put option) or an iron condor which is the same strategy only that you are also buying options further out in order to define your risk. Although iron condors are obviously more suitable for smaller accounts where buying power may be limited, they significantly reduce the position’s vega (Sensitivity of option prices compared to the underlying’s IV). Furthermore, given that options trading is notorious with short-term trading due to the acceleration of theta decay, the trading industry would recommend daily and weekly but most definitely not a multi-month strategy which longer-term investors would most likely prefer.

It does not have to be like this, however. In fact, here are three reasons why long-term option selling can be better than the alternative.

- Selling longer-term options have the highest volatility due to the extra amount of extrinsic value in the options. Therefore, it stands to reason that they will perform the best when we get a contraction in RSX’s implied volatility alluded to earlier.

- Selling longer-term options reduces one’s risk because of the extra credit received. Short-term traders may argue to the contrary by saying that the extra “time” brings more risk to this strategy. This is true but by being open to taking profits early, our trades rarely run to the expiration date.

- By selling out longer in time, there will be less volatility overall in the premium selling position due to delta changing much slower (gamma). This keeps emotions in check as you wait for that volatility to contract. Remember, successful investors and traders are calm and unstressed. The time in the options works to your advantage here as any sizable move early on will not hurt your P/L in a big way.

Therefore, to sum up, we may look to put on something in VanEck Russia ETF (liquidity allowing) shortly. It will not be a short-term play and may actually be a straddle (at the money options) that actually takes advantage of the highest volatility. We look forward to continued coverage.

[ad_2]

Source links Google News