[ad_1]

gorodenkoff

Thesis

The VanEck CLO ETF (NYSEARCA:CLOI) is an actively managed ETF focused on CLO investments. The vehicle is sub-advised by PineBridge Investments, and per its literature, it seeks capital preservation and current income. Its mandate allows it to allocate capital to investment grade-rated tranches of collateralized loan obligations of any maturity, but its portfolio is currently composed of AAA, AA and A tranches only.

We recently reviewed a AAA CLO ETF here, that successfully competes as a yield enhancing cash parking vehicle, and we are going to look at CLOI through that lens as well. At the end of the day, with floating rate increasing substantially we are going to explore secure alternatives to the classic treasury short term funds such as (SCHO), (GBIL) and (BIL).

In its current format, CLOI is virtually risk free, with no historic defaults in AAA or AA CLO tranches. The fund however has the mandate to invest in any investment grade CLO tranche, and can change its composition to include more BBB or A tranches. An allocation shift would make the vehicle more credit risky. The fund will keep increasing its distributions, based on rising rates. With a current 30-day SEC yield of 5.8%, the fund is going to go towards 6.5% in our mind. The only weakness here is that down the line (think 2024/2025), as rates decrease, the fund’s yield will decrease as well.

Holdings

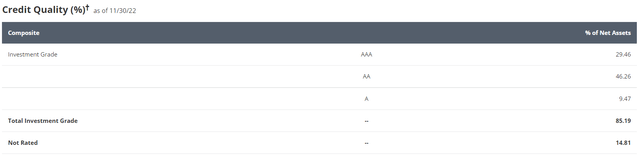

The fund holds AAA, AA and A tranches from CLOs:

Collateral Ratings (Fund Allocation)

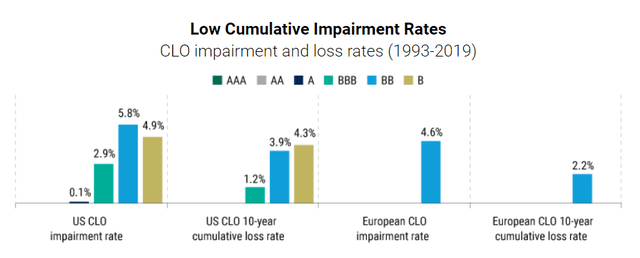

We can see that the majority of the collateral here is AA rated now. We have looked at probabilities of default for highly rated CLO tranches, and have found out that historically there are virtually no defaults for AAA/AA tranches:

Historic Loss (PineBridge)

While AA tranches do not really pose a true credit risk, they do expose holders to spread widening from risk-off conditions. We believe that, from a pure credit risk perspective, the fund is fairly insulated from a true credit event. However, the NAV can fluctuate if the CLO market seizes up and the manager is forced to mark the collateral lower on spreads and illiquidity.

If the fund moves down the investment grade spectrum and into BBBs, then it will become a bit more credit risky, although we can see from the above table that even BBB have a very small loss occurrence historically.

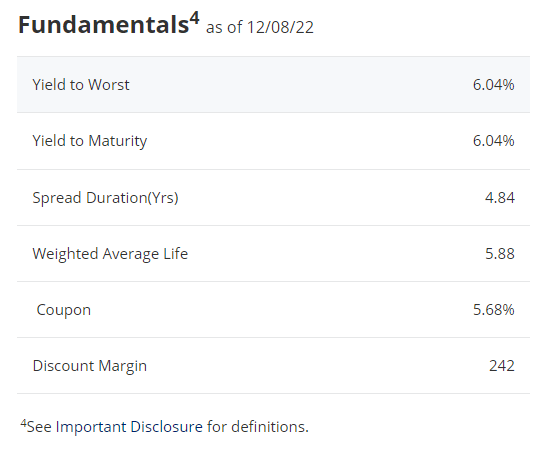

The collateral pool has the following features:

Fundamentals (Fund Fact Sheet)

We can see the weighted average yield of the underlying holdings is around 6%, while the average maturity is around 5.88 years. Please keep in mind that CLOs, as securitized products, do not have a fixed bullet payment date. They start receiving principal paydowns at some point, and that is how their notional decreases. We believe the market is already pricing in a substantial decrease in the collateral’s prepayment rates.

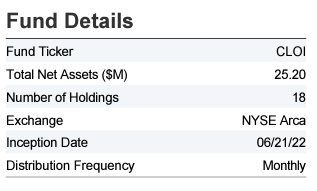

What is more important for this fund is the low number of securities:

Fund Details (Fund Fact Sheet)

The fund has only 18 holdings, however this is explained when looking at the total net assets. The fund’s AUM is only $25 million, which means that for securitized products that usually trade $0.5mm x $0.5mm or $1mm x $1mm, there cannot be substantial diversity here. As the AUM will increase, the holdings will as well. While in other instruments this might represent a concentration issue, it is not the case here since CLOs are by composition extremely diversified – i.e., the underlying assets are hundreds of leveraged loans. The only issue that can exist with such a small asset pool is a systemic failure for one of the asset managers. We do not think that for a mature market such as the CLO market, this is a true risk.

Performance

The fund is up year to date:

Total Return (Seeking Alpha)

We can see how CLOI is up almost 2% year to date. However, the total return line is not a smooth upward sloping one. The fund does not have credit risk, but does pose credit spread risk – that means that the prices of the CLOs can decrease if there is a risk-off market environment where credit spreads move wider. This does not translate into actual credit risk, just a total return profile volatility.

Conclusion

CLOI is a new ETF from VanEck / PineBridge. The fund was launched this year and is set to focus on investment grade CLO tranches. Currently, the structure has an overweight positioning in AA tranches, with AAA collateral having the second-highest weighting. While from a credit risk perspective this fund is virtually risk free (i.e. no collateral impairment), the vehicle is subject to credit spread risk – i.e. loss of NAV during market risk-off environments when spreads widen. From this lens, the fund is less of a cash parking vehicle and more of a risk-on endeavor when compared to (JAAA) or (MINT). We like this fund for the next two years. We expect the dividend to keep increasing to a rate closer to 6.5% and the fund to deliver a total return in 2023 close to 7.5% (dividend yield plus capital appreciation). As Fed Funds will decrease in 2024 (as per the Fed Funds curve) the fund will yield less, but credit spreads will tighten further. We are penciling in a 6% total return for the fund in 2024. Expect slight volatility (-3% drawdowns) here, but a fairly nice upward sloping total return profile otherwise.

[ad_2]

Source links Google News