[ad_1]

Velishchuk/iStock via Getty Images

The Russian invasion of Ukraine has caused immense volatility across financial markets. While the situation is still changing by the day, there are two overarching market impacts. First is an increase in global inflation stemming from another commodity supply shock. Second is a race for safe-haven assets situated outside of Europe, namely, U.S dollars. Accordingly, we’ve seen a significant combined rally in virtually all essential commodities and U.S dollar exchange rates. Notably, by far, Russia is the world leader in total natural resource exports and deposits, so disruptions to their exports will substantially upset the global supply chain. While this may be necessary to stop conflict, I believe it may have a more significant inflationary impact than COVID-related production cuts.

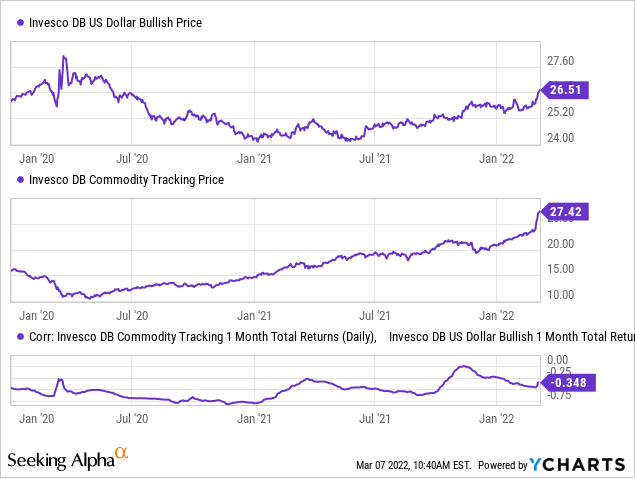

Usually, higher commodity prices mean higher inflation and a worsening exchange rate. However, the unique situation of global markets today has caused the opposite to be true. The monthly correlation between the commodity fund ETF (DBC) and the U.S dollar ETF (UUP) remains negative. However, I suspect this will change if the two asset classes continue to rally together. See below:

The dollar has been strengthening as the Federal Reserve made a slight hawkish turn last year while many other global central banks did not. In fact, I was bearish on the dollar last year as it seemed possible that the Fed would allow the “floor” to fall out. Admittedly, this proved incorrect as the European ECB and other key central banks have been less keen than the Fed on fighting inflation, causing the U.S dollar to rally. Today, it appears there is significant bullish fuel behind the dollar due to its “safe-haven” status and potential export gains.

Without Russia, A Positive U.S Trade Balance?

The United States is, by far, the world’s largest net importer with a roughly -$1T net trade balance in 2020. As such, it would seem that the U.S dollar exchange rate should not be a strong contender in an inflationary environment. However, like most of the Americas (and Australia/N.Z), the U.S is a decent commodity exporter and manufactured good importer. This is a major bullish caveat for the dollar since, as Russia’s exports decline, the U.S can benefit tremendously through more profitable net exports.

Most U.S dollar exchange rates are now back at long-term resistance levels despite the 40-year high inflation rate. This situation is logical considering that, while the “Russia-Ukraine” commodity shock will promote inflation around the world, it will likely be far more inflationary in Eurasia than it will in the Americas. For example, Russia and Ukraine agriculturally produce the vast majority of the wheat imported into Middle Eastern countries (as well as parts of Africa and Asia), so ongoing trade issues dramatically threaten essential food supplies in those regions. The same is true regarding Europe’s natural gas and crude oil dependence on Russia (partially transported through Ukraine).

On the other hand, the Americas are generally strong commodity exporters, with South America being the world’s largest net exporter of food and the U.S being, by far, the most significant overall agricultural exporter. The U.S is also occasionally a net exporter of petroleum products while parts of South America and Canada are strong net exporters. The Americas also have formidable mineral production that can counteract losses from Russia if need be.

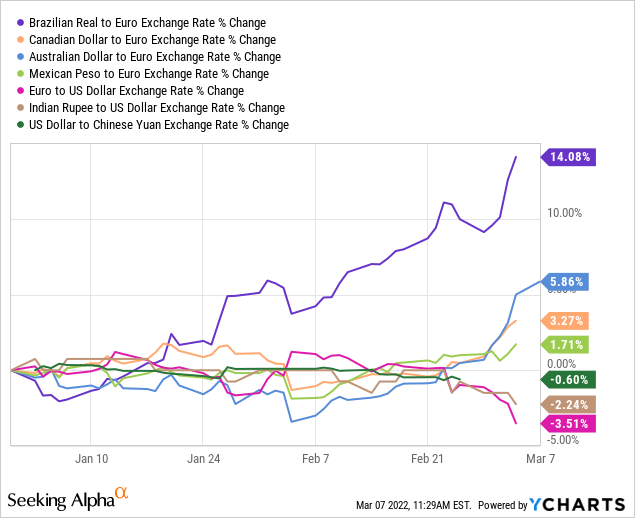

Overall, this situation has created a clear pattern in the global exchange rates: a rise in commodity exporters (particularly non-Eurasian ones) and a decline in the rest. See below:

The past month has seen a sharp rise in the Brazilian Real, Australian dollar, and Canadian dollar compared to the Euro. The U.S dollar has also risen quite dramatically compared to the Euro, Chinese Yuan, and Indian Rupee regions highly reliant on Russian commodities. Overall, I would argue that South American currencies, and their stock markets, may benefit tremendously from the situation since they have a trade advantage and generally stay out of “West vs. East” conflicts – a historically advantageous attribute in war times. Thus, it is no surprise that the Latin America 40 ETF (ILF) has consistently risen this year while almost all other stock market ETFs have declined.

Potential Impacts Of The Strong Dollar

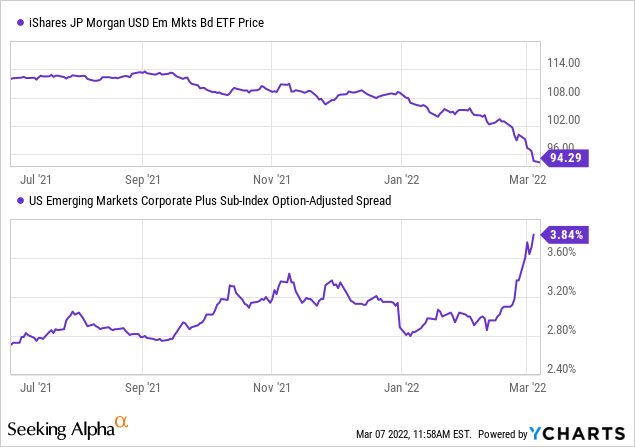

While the U.S dollar has not risen nearly as much as more substantial commodity exporters such as Latin America, the strong dollar may have more significant global financial consequences. There is currently roughly $13T in total U.S dollar-denominated debt existing outside of the U.S, twice as much as there was in 2010 and six times as much as there was in 2000. This immense debt burden effectively grows as the U.S dollar strengthens against foreign currencies with high dollar-denominated debt. A significant cause of this growth is likely that corporations and governments in emerging markets can borrow at far lower interest rates if they use U.S dollars instead of local currencies. As such, there has been a considerable increase in credit risk in dollar-denominated emerging-market debt such as the bonds that make up (EMB) and corporate EM bonds. See below:

If this trend continues, many emerging market countries with high U.S dollar-denominated debt could run into serious financial issues. This issue is already playing out in Turkey, Lebanon, and most Middle Eastern nations, which are already at high risk due to dependence on Russian & Ukrainian agricultural goods. In my view, this opens the door to knock-on black-swan events in this region.

At any rate, if the U.S dollar rises above its crucial resistance level (the same peak as 2016 and 2020), then we could see an even more dramatic U.S dollar shortage. As these countries race to obtain dollars to avoid being forced to pay more (in local currency), the dollar could rise dramatically high. This would effectively be the same as a “short squeeze,” though on a much larger scale. Fortunately for the U.S Federal Reserve, a rise in U.S dollar exchange rates may also mitigate the immense inflationary pressures from the commodity shock. In the U.S, I expect this shift will still lead to much higher gasoline and food prices but may cause some manufactured goods to become cheaper due to declines in Asia-USD exchange rates.

Where Is The Dollar ETF UUP Headed?

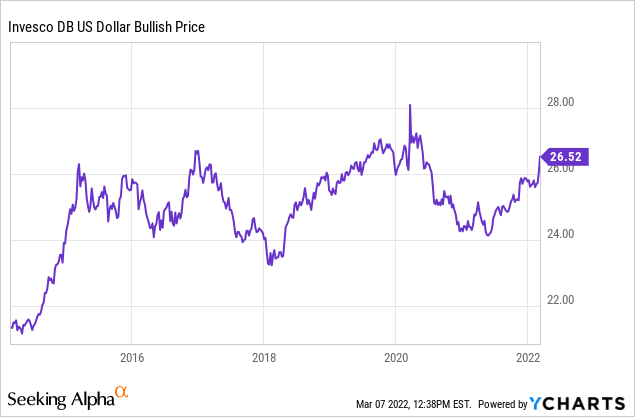

The U.S dollar index has risen by around 5% over recent weeks and, being at a key resistance level, is likely to either stop growing or accelerate much higher. This pattern can be seen quite clearly in the U.S dollar ETF (UUP) below:

At this point, I am apprehensive about stating a direct outlook on the U.S dollar index. Key bullish factors include the potential rush for U.S dollars in Eurasian emerging markets with high external debt levels. While the Federal Reserve has done very little to fight inflation, they have arguably made more hawkish stances than have their European, Japanese, and Chinese counterparts, which have generally retained a dovish stance. While this has been a bullish factor for the dollar over the past year, I imagine almost all global central banks are looking to change their policy outlooks given the wave of inflationary commodity shocks.

Suppose there is a dollar-shortage crisis in emerging markets. In that case, the Federal Reserve may be inclined to provide further monetary stimulus, particularly if the U.S inflation rate outlook falls on currency strength. For now, this seems unlikely given the bond market’s implied future inflation rate has risen dramatically over the past two weeks, meaning the Fed may need to pursue additional rate hikes to stabilize inflation. On the other hand, the U.S dollar index, and its ETF counterpart UUP, have consistently declined at current levels.

How To Play Both Sides

Invesco’s dollar index ETF (UUP) is a great way to speculate in either direction. The ETF is highly liquid, with nearly $1B in total assets under management. While I have a slight bullish bias today, I would avoid making a directional bet on the dollar. Instead, it appears likely that UUP and the U.S dollar index will likely experience a sharp rise in volatility as its new direction becomes clear. As such, speculatively-inclined investors may look at option strategies such as the “straddle,” which allows one to gain from a significant move in either direction. This strategy entails buying a long “call” and “put” option at the same strike price. A straddle option can also become more valuable as implied volatility levels increase.

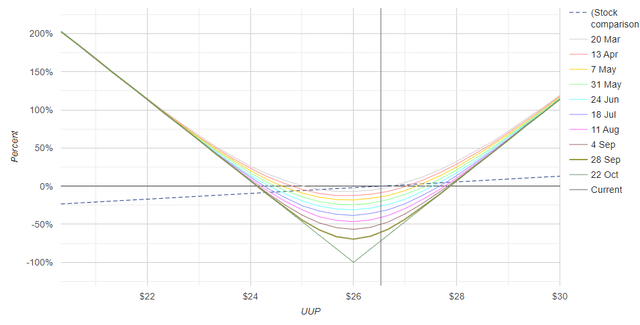

I imagine we’ll see a large directional in either direction move over the next six months. Using the $26 strike price “call” and “put” October 23rd options on UUP, we have the following payoff chart:

UUP $26 Oct 23rd “Straddle” Option Payoff Chart – 3.7.22 (OptionsProfitCalculator.com)

In my view, this is a decent trade today that allows speculators to benefit as long as the U.S dollar rises or falls by ~9% by October. To me, this seems very likely considering UUP has seen a ~4% rise over the past month, so at the current pace of volatility, a 9% move in either direction by October seems very possible.

Of course, those interested in such a strategy should do their own research and note that long-term options can have poor liquidity. Such a bet is best made with money that could be lost without a tear as the strategy could expire worthless if UUP fails to move materially by the expiry date. Even still, all investors, regardless of their interest in betting on the dollar specifically, would benefit from keeping an eye on the U.S dollar index ETF UUP as it will give us a strong indication of what to expect in the other asset classes.

[ad_2]

Source links Google News