[ad_1]

MicroStockHub

UUP – Invesco DB U.S. Dollar Bullish Fund

Invesco DB USD Bullish ETF (NYSEARCA:UUP) is a well-traded exchange-traded fund (“ETF”) with net assets around 1.71B and an expense ratio of 0.75%. It was created on 2/20/2007 and has an average daily trading volume of over 3 million shares. As such, UUP is suitable for use as a “safe” asset during market risk-off periods.

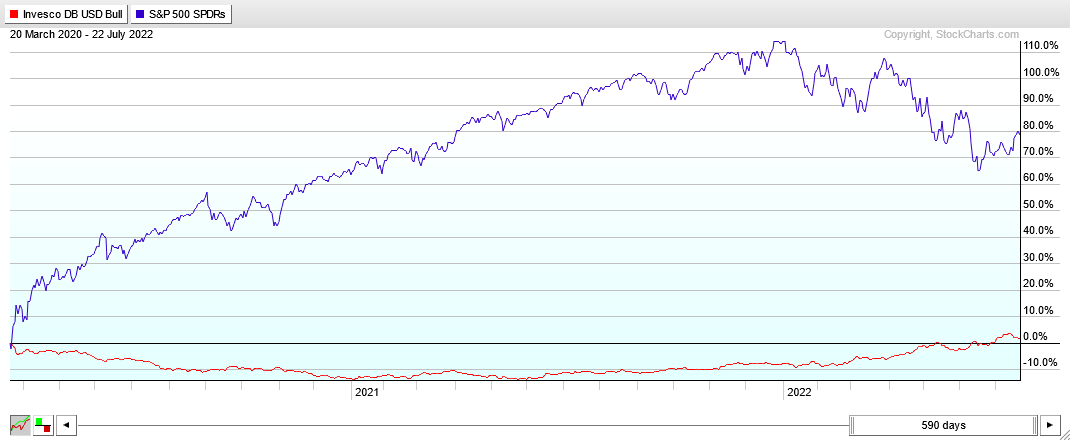

UUP is, in general, negatively correlated to the U.S. equities market. That relationship is clearly seen in the following PERF chart. UUP bottomed in June 2021, six months in advance of the January 2022 SPY top.

stockcharts.com

Additional insight into U.S. Dollar Index’s relationship with other asset classes can be gained from the correlation matrix shown in the table below.

Table 1. Asset correlations for time period 03/01/2007 – 06/30/2022 based on monthly returns.

|

SPY |

IEF |

UUP |

FXY |

DBC |

|

|

SPY |

1.00 |

-0.25 |

-0.48 |

-0.17 |

0.52 |

|

IEF |

-0.25 |

1.00 |

-0.07 |

0.51 |

-0.33 |

|

UUP |

-0.48 |

-0.07 |

1.00 |

-0.32 |

-0.56 |

|

FXY |

-0.17 |

0.51 |

-0.32 |

1.00 |

-0.04 |

|

DBC |

0.52 |

-0.33 |

-0.56 |

-0.04 |

1.00 |

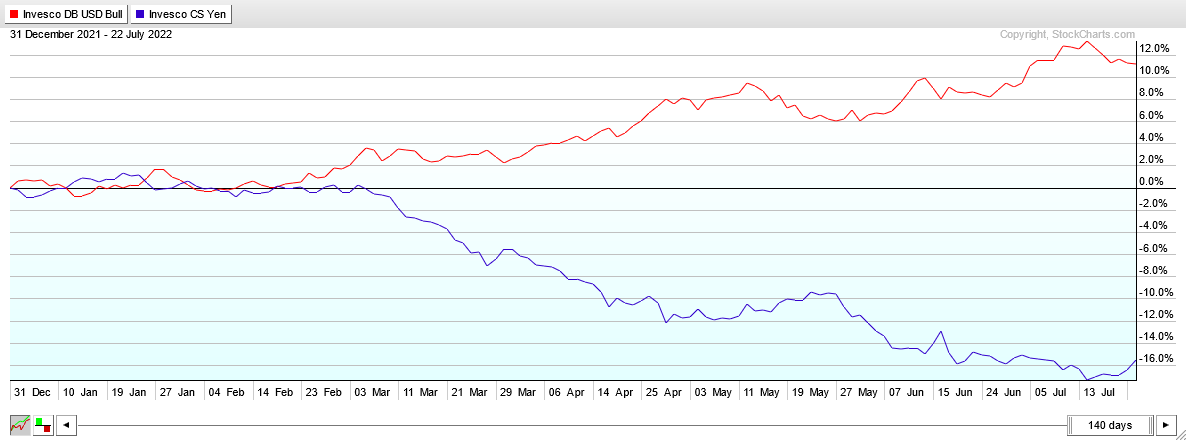

The following chart illustrate the negative correlation of the US Dollar Index ETF and the Invesco CurrencyShares Japanese Yen Trust, FXY. It is obvious that the Japanese Yen shows a trend reversal to the upside. That implies a topping process in the UUP.

stockcharts.com

Effect of Rising Interest Rates

Raising the U.S. interest rates strengthens the U.S. Dollar. This effect has played well during 2022 when the FED has raised the rate three times for a total of 1.50%. This month, the FED is expected to raise the interest again by 0.75% or even by 1% in order to combat inflation.

Although, the schedule of the FED raising the interest rates has been very transparent and highly anticipated, it still was associated with a steady increase of the value of the US dollar.

UUP has declined somewhat since July 14. It is my expectation that the dollar would recover that loss, but that it will not sustain a strong rally above that July top.

UUP as “Safe Asset”

Until the beginning of May 2022, I have used the following Base Set of “safe assets”: [BIL IEI IEF TLT]. Since then, I added UUP and DBC to that Universe.

To demonstrate their usefulness, I did some simulations with and without UUP as a safe asset. The simulations were performed for the simplest portfolio possible that invests in SPY during risk-on periods, in XLP during risk-neutral, and in the top safe asset during risk-off.

The summary results are shown in the following table.

Table 2. Summary performance results

|

2008-22 |

CAGR |

stdev |

maxDD |

Sharpe Ratio |

Sortino Ratio |

|

Base Set |

19.36% |

13.31% |

-13.38% |

1.46 |

1.90 |

|

Base Set + UUP |

20.03% |

13.24% |

-13.38% |

1.51 |

1.97 |

|

SPY |

9.19% |

20.35% |

-52.36% |

0.45 |

0.54 |

Conclusion

Although I do not expect UUP to continue its strong uptrend started in June 2021, I also see no reasons to fear a major decline. Therefore, my stance is that UUP in a HOLD.

Additionally, as of this writing, UUP is the top momentum asset in the Safe Asset Universe. My model portfolios are long UUP.

[ad_2]

Source links Google News