[ad_1]

Floaters are instruments that when used correctly can help preserve capital in one’s portfolio during periods of rate increases.

PM Images/DigitalVision via Getty Images

Since the Federal Reserve embarked on its latest rate hike program, we have had more and more of our family and friends contact us with questions surrounding bond funds offered by their 401(k) plans. Many figured that they owned bonds which would hold their value in times of duress, and have been surprised to realize that duration can actually crush your returns in certain environments. Worse still, some of their short-term bond funds (which did have relatively short durations) have performed poorly and when we began looking at some of these products we were left to shake our heads. This is because on the institutional side it would be rather easy to rectify what plagues their portfolios with a few trades on the fixed income side, however, these were not institutional investors, so we had to look at what was offered and in some cases find solutions for portfolios (where they did have discretion and the ability to source their own funds) to better protect assets which were not supposed to have a lot of volatility.

One Useful Product

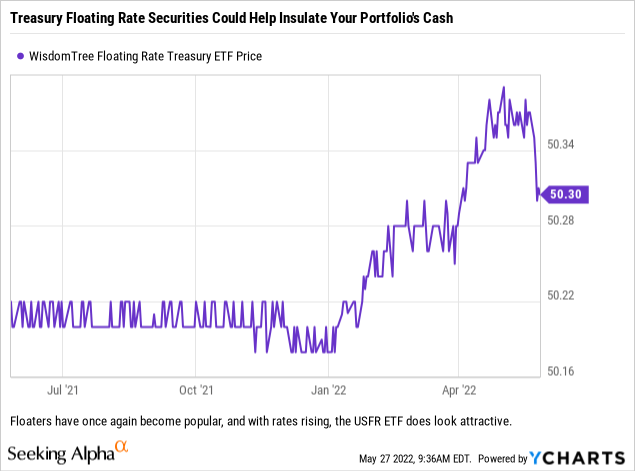

One product that we came across (and that checked quite a few boxes) was the WisdomTree Floating Rate Treasury ETF (NYSEARCA:USFR) which has a 0.15% expense ratio and roughly $5.75 billion in assets under management. We view this product as an ETF which can be used to maintain a relatively stable NAV for cash equivalents in your portfolio and although the price does fluctuate, we would point out that the 52-week high is $50.39 (set on 05/02/2022) and the 52-week low is $50.1758 (set on 07/01/2021) – a very tight range for a product that does enable you to ride rates higher. We have also attached a chart below to show that most of this price volatility has come since the beginning of the year due to floaters with positive spreads (which this fund has a few of) trading strongly.

Part of the reason the price stays relatively stable is because it holds essentially 100% exposure to floating rate notes issued by the US Treasury. We have used floaters as a way to hedge fixed income portfolios during times of rate hikes; helping us to benefit from increased interest payments while also protecting capital which otherwise would have come under pressure as rates rise. This product serves the same function, with each of the floating rate notes held by the fund benchmarked against the 3-month US Treasury Bill Money Market Yield +/- an issuance spread (which could change if purchased on the secondary market). Essentially, when you purchase a floater you negotiate the spread above whatever the floater is benchmarked to (the benchmark is your base rate which will reset per the structure of the bond – which could be daily, weekly, monthly, quarterly, semi-annually, etc. – but in this case will reset weekly).

Fund Structure

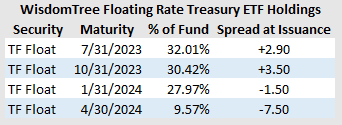

The current holdings of the WisdomTree Floating Rate Treasury ETF are in the table below:

As floaters have become more popular in recent months, spreads have turned negative but investors still benefit from resets. (WisdomTree, Bloomberg, Author)

We will point out that the fund does hold some cash and we had to round the % of the fund for each of the holdings, so it does not add up to exactly 100%. Also of importance, we included a column which shows the spread at issuance of the floaters in the fund. This shows just how much the floater market changes based on demand; in times of low demand because of low rate hike expectations investors can collect decent positive spreads (as can be seen by the positive spreads on the 2023 maturities), and when rate hike expectations increase, spreads can (as they did in this case for the 2024 maturities) go negative as the expectation is investors will benefit from rising rates and the resets, thus requiring less of a spread, no spread, or even a negative spread. Typically we prefer positive spreads on our floaters for when the market inevitably turns, but in this market and with the goal being to try and protect capital while participating in rising rates, we do think this is a decent short-term cash vehicle to utilize.

As we alluded to earlier, rates on the underlying floaters reset each week (based on the results of the most recent T-Bill auction of 13-week paper), so this fund is currently benefiting from the Fed’s interest rate tightening and investors’ perception of how aggressive the Fed will be moving forward. While rates reset each week, interest is paid out quarterly on the underlying holdings but this ETF does payout monthly interest distributions to investors, which is another nice feature when using this as a proxy for cash in one’s portfolio. The distribution for May came out to $0.029/share and based on where rates have trended in recent weeks we believe that the distribution will be in the $0.03/share to $0.035/share range next month.

Our Final Thoughts

With the US Federal Reserve continuing to raise rates and projected to raise rates by 50 basis points at each of the next two meetings, we think that the WisdomTree Floating Rate Treasury ETF could be utilized as a cash vehicle to preserve capital and potentially generate some additional interest income for one’s portfolio. While a corporate floater fund can provide richer spreads, thus generating more interest income, we like the treasury focus here in order to try to avoid ‘breaking the buck’ while participating in a structure that benefits from rising rates.

While investors can utilize money market funds for their cash equivalents, we like the idea of this ETF replacing ultra short-term ETFs as you can better maintain your capital.

[ad_2]

Source links Google News