[ad_1]

Investment thesis

The natural gas markets remain oversold, following fast-paced inventory builds, dipping net speculative bets and toneless weather guidance. Besides, with summer unfolding and heat waves building momentum, traction is expected to develop on the United States 12 Month Natural Gas ETF LP (UNL). Yet, for the time being, we adopt a neutral stance on the complex, given the recent lows posted by natural gas futures.

Source: Tradingview

UNL – United States 12 Month Natural gas ETF LP

Source: Nasdaq

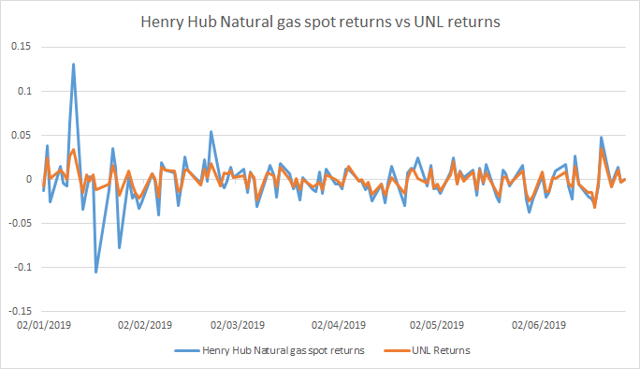

UNL is directly correlated to the daily changes in the spot price of natural gas delivered at Henry Hub. It measures the average price changes of 12 futures contracts on natural gas traded on the Nymex, containing the near month contract to expire and the contracts for the following 11 months. Besides, the fund spreads its futures exposure equally across the nearest 12 contract months in an effort to minimize the impact of contango returns.

In order to reduce incurred rolling costs and limit exposure to expiring natural gas futures volatility, the fund’s strategy could prematurely decide to shift its exposition on the next month contract to expire.

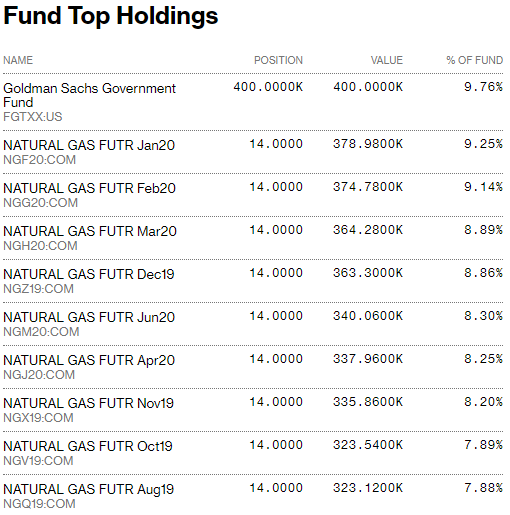

According to Bloomberg, the fund’s top holdings are as follows:

Furthermore, UNL offers an expense ratio of 0.88% and is cheaper than its principal peer (UNG), which applies a fee of 1.29%. However, UNL’s average spread on the last 60 days is equal to 0.77%, compared to just 0.05% for UNG. This is due to UNL’s lower liquidity, totaling on average a daily volume of just $15.86k, versus a massive $27.42m for UNG. In spite of that, UNL’s liquidity conditions are sufficient for individual investors and UNL’s 12-month natural gas futures contract exposure provides a broader diversification and lower incurred risks.

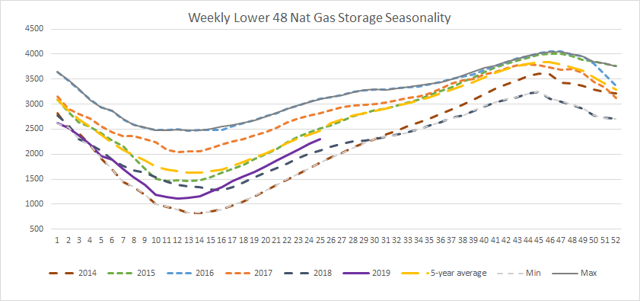

US natural gas storage

During the week, US natural gas storage build decelerated slightly (w/w), up 4.45% to 2 301 Bcf. While this two-figure advance is slightly below the consensus of the market, gas seasonality improves further, reaching a surplus of 10.9% or 227 Bcf on a yearly basis and reducing the 5-year average deficit to 6.7% or 164.6 Bcf. That being said, the fast pace inventory lifts are likely to continue to pressure natural gas futures and UNL shares. Nevertheless, recent gas pricing seems to have reached a floor, which is unlikely to be overtaken.

Source: EIA

Meanwhile, according to the EIA, US gas supply-demand improves on the week ending June 26. Indeed, supply continues to ramp up 0.4% (w/w) to 94.2 Bcf/d, amid lifting marketed and dry production, up respectively 0.6% to 100.4 Bcf/d and 0.7% to 89.6 Bcf/d, but is partly offset by dipping net imports from Canada, down 2.1% (w/w) to 4.6 Bcf/d.

On the other side, demand accelerates steeper, up 2.7% (w/w) to 84.1 Bcf/d and evolves now only 10.7% below aggregate US supply. This lift is due to mounting power needs, up 7.3% (w/w) to 36.6 Bcf/d and is moderately counterbalanced by declining residential and commercial demand, down 6.9% (w/w) to 9.5 Bcf/d.

Source: Bloomberg

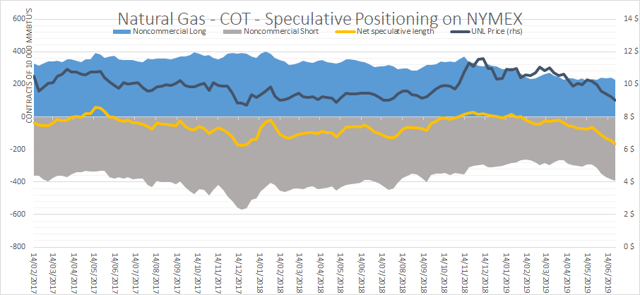

Net speculative positioning

Source: CFTC

According to the CFTC, latest Commitments of Traders Report on Nymex natural gas futures indicates that net spec bets decrease accelerated (w/w), down 13.53% to 165 702 net short contracts, on the June 18-25 period, whereas UNL’s performance on the corresponding period declined 2.32% (w/w) to $9.04 per share.

This decline is due to both moderate long liquidations, down 4.7% (w/w) to 227 893 contracts and is accentuated by short coverings, up 2.21% (w/w) to 393 595 contracts. With this fifth consecutive weekly speculative positioning decline, the complex is likely to remain depressed in the coming period, indicating additional bearishness on natural gas futures and UNL shares.

Since the beginning of the year, net spec bets plunged more than 20 times or 157 750 contracts, whilst UNL’s yearly performance dipped 11.98% to $9.11 per share.

Backdrop changes

Since our last take on UNL, published on May 21, the complex bearishness prevailed, dipping 11% to $9.11, following strong storage injections and weak weather forecasts for this time of the year.

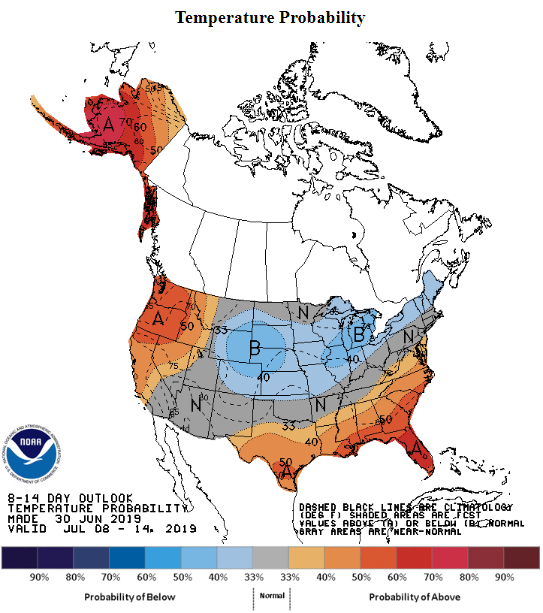

Looking ahead, the weather forecast turns hot in the southeast and on the West coast, with above-average temperature expected to sustain gas demand in these markets. Nevertheless, mild temperatures anticipated in the Midwest and Northeast will likely offset that for the first half of July.

Source: National Weather Service

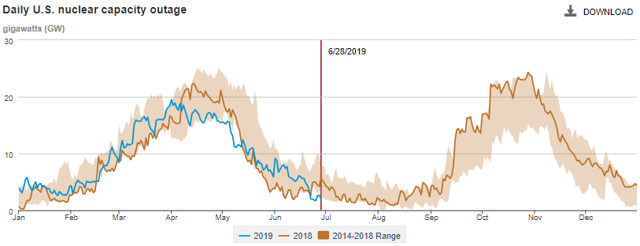

Besides, according to the EIA, U.S. nuclear capacity outage reaches a fresh low, establishing at only 2 GW, well below the five-year range for this time of the year.

Source: EIA

That being said, and in spite of heat slightly building up over the country, robust oversold conditions continue to pressure the complex. Yet, as summer unfolds, volatility is expected to tick up, which might cause a pullback on natural gas futures and UNL shares.

In this context, and given a low natural gas pricing, we expect that the complex will trade in a horizontal pattern in the coming period and we believe that only a prolonged and sustained heat wave is likely to offset fast-paced U.S. supply. Therefore, for the time being we are deciding to adopt a neutral positioning on UNL shares.

I look forward to reading your comments.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News