[ad_1]

onurdongel/E+ via Getty Images

The past two years have seen the global energy market transition from a record glut to a record shortage. Two years ago, in June of 2020, retail gas prices were around $2.40 ($5.1 today), a barrel of crude oil was around $40 ($118 today), and an MBTU of natural gas was around $1.60 ($7.7 today). While gasoline gets most of the media attention, natural gas has risen far more – moving from a three-decade low to a 14-year high in just two years. Natural gas is the largest source of electrical power in the U.S., generating about 38% of total electricity.

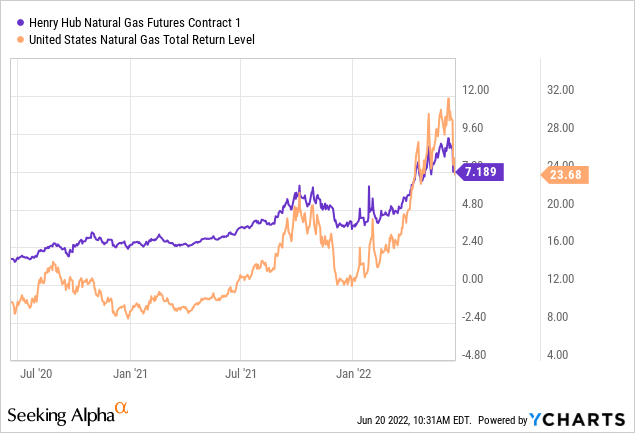

Since the U.S. shale boom around 2010, the country has become far more dependent on natural gas due to the associated decline in prices and its relative cleanliness compared to coal. However, with the U.S. energy supply remaining stunted following 2020’s shutdowns, seasonally-adjusted natural gas storage has trended lower. More recently, a surge in European export demand and a hot summer outlook has caused natural gas to rise even higher. The surge in natural gas prices has also dramatically boosted the natural gas futures ETF (NYSEARCA:UNG). See below:

When futures surge at such a rapid pace, many speculative traders often jump on board, occasionally causing prices to rise far above their fair value. While fundamentals suggest natural gas is in a shortage, it may not be as significant as natural gas prices indicate.

The most notable misunderstanding today may be the popular outlook that U.S. natural gas prices will converge toward Europe’s (roughly $30 per MBTU) due to rising U.S. exports. In reality, because natural gas must be compressed and liquefied (“LNG”) to be exported to Europe and all LNG plants are operating at full capacity (or are non-operational), it’s unlikely that U.S. exports will rise much higher. That said, low U.S. storage levels, potentially large temperature fluctuations, and stagnant production may maintain the bullish outlook. Overall, this situation may make the ETF UNG a very interesting speculative trade in either direction.

Natural Gas Fundamentals Are Shifting

Natural gas differs from most commodities in that it’s more expensive to export overseas since it’s a gas. This factor also makes it comparatively easy to move domestically via pipelines. Thus, there are two natural gas markets – the North American and Eurasian markets. In North America, production is somewhat balanced between the U.S. and Canada, while in Eurasia, it’s heavily skewed toward Russia, which produces roughly 40% of the E.U.’s natural gas.

Even before Russia invaded Ukraine, Russia was limiting its pipeline exports to Europe, causing winter prices to rise dramatically. The U.S. has increased exports to Europe via LNG, but today, U.S. export terminals are operating at full capacity, as well as Europe’s LNG import terminals. It will be some time before this issue can be resolved as it generally takes years to construct new terminals due to the involved complexity and even longer with production costs soaring. As such, the E.U. has generally avoided banning Russian natural gas exports compared to crude oil, which is far easier to export into Europe. However, Russia recently took an aggressive approach and choked off ~40% of flows to top European gas importers, causing Europe’s gas price to surge over 50%.

Natural gas storage levels rise in the summer (from April to October) and decline in the winter. However, because Europe’s natural gas price is far above Asia’s (and U.S. LNG exports), Europe has increased imports enough to bring storage levels back to the five-year average. Of course, as Europe outbid Asia for gas, Asia’s shortage has since become severe that its natural gas prices are now very similar to Europe’s. In my view, that may influence Russia to reduce exports to the E.U and send them toward Asia instead.

This situation bodes well for the U.S. LNG export market. Still, unfortunately, there was recently a significant fire at one of the largest LNG export terminals in Texas, limiting exports for around three months. The shutdown in Freeport’s exports will add around 2 BCF per day to U.S. domestic supplies, or 180 BCF by the expected end of the shutdown. Currently, U.S. gas storage levels are 323 BCF below average, so this factor will aid in closing the gap. Hence, natural gas dropped by around 16% on the shutdown news.

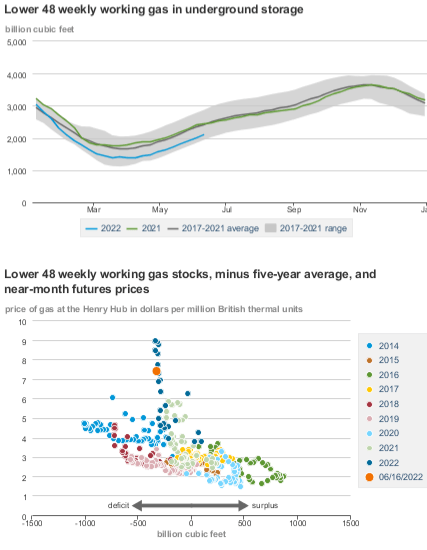

Still, U.S. natural gas prices are significantly elevated compared to historical norms of such a shortage. See the E.I.A.’s data below:

E.I.A Natural Gas Storage Data 6/16/2022 (Energy Information Administration)

Domestic natural gas storage levels are currently near the five-year average low range. However, the deficit was more extensive in 2014, 2019, and 2018. In those periods, natural gas was generally around the $3 to $5 range. While the summer may be hot, the recent fire at Freeport’s LNG plant will increase the expected BCF deficit by ~180, bringing the deficit from 320 BCF to 140 BCF, all else equal. Historically, gas has been in the $2 to $4 range, given such a storage deficit.

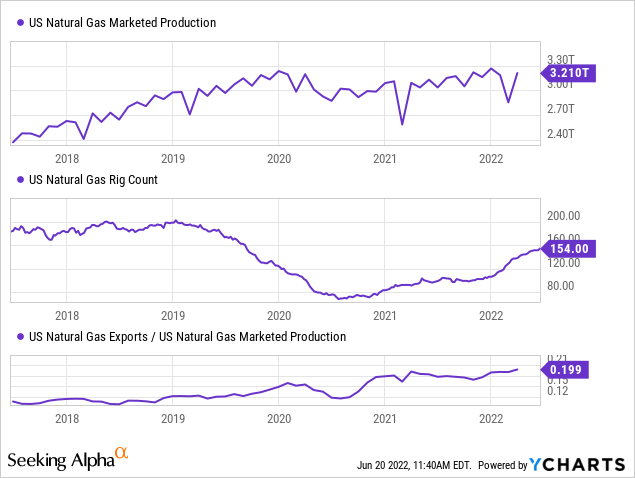

There are a few reasons why gas is higher than it usually is, given today’s minor deficit levels. Firstly, U.S. natural gas production remains slightly below 2020 levels while demand has risen as domestic coal use has declined. Furthermore, U.S. hydroelectric power is faltering in western regions due to the drought, causing critical reservoir depths to drop below the required levels. This is expected to result in a 21% Y/Y increase in California’s natural gas demand. The percentage of U.S. gas production going to exports also has risen to 20%, nearly twice as high as it was two years ago. That said, the gas rig count also has surged, implying production should rise as new wells are drilled. See below:

Undoubtedly, numerous factors are weighing on U.S. natural gas supplies. Chiefly, low production following lockdowns mixed with higher demand for LNG and a decline in domestic sources of non-gas power. That said, the U.S. export demand factor has now played out as capacity has been reached and has declined following the recent Freeport fire. Even more, the surge in the natural gas rig count implies there should be some domestic production growth by year-end.

Overall, barring a massive weather event, I do not believe the fundamentals fully justify the current U.S. domestic price of natural gas. That said, the natural gas market is very tight, and gas prices can fluctuate far more dramatically than other energy products due to thin storage capabilities. If efforts to increase production fail to reach demand, then we may see gas prices continue to rise. Even then, for now, I do not believe we will see U.S. gas prices rising above $10, as in the case of Europe, due to limited export capacity.

What This Means For UNG

Over the past two years, Henry Hub’s natural gas prices have risen by 315%, while UNG, which owns these futures, has only increased by 133%. Such a return is formidable, but investors in UNG may wonder why so much money was left on the table. This underperformance is mainly due to the strong contango effect in natural gas prices. Since natural gas is more costly to store than crude oil, the natural gas futures curve tends to be steeper with higher prices for longer-dated futures. Thus, as UNG purchases natural gas futures, the contract price usually declines as it nears maturity, creating negative carry for UNG.

Today, like other energy commodities, the natural gas market is in a state of backwardation where longer-dated contracts are cheaper than spot prices. For example, the August Henry Hub contract is currently at $6.7 while the July is at $6.73. If we assume spot prices stay flat, then UNG’s August contracts (currently the bulk of its assets) should rise by around a half percent (measured by the three-cent difference). Such a return is not a poor yield for a month-long trade, but given UNG’s immense volatility, I do not believe it is high enough.

If we look out to July 2023, Henry Hub futures are far lower at $4.89, 28% below today’s spot price. Theoretically, investors could earn a nice profit by buying these long-dated contracts if natural gas prices remain as high. That said, the futures prices may be low because the market expects natural gas prices to decline as the production-consumption gap finally closes. However, based on today’s fundamentals, I believe natural gas should be closer to $4.9 (see deficit-to-price relationship above). Indeed, natural gas spot prices may be artificially inflated due to an influx of speculation on near-term futures. If so, then UNG could see rapid declines as backwardation returns toward the more common contango.

The Bottom Line

To some extent, today’s commodities market is reminiscent of 2008. At that time, money rushed out of stocks and credit assets and seemingly flowed into the commodity market. During the first half of 2008, natural gas rose from $8 to $13, and crude oil rose from $80 to $145. While there were some slight shortages then, they were not large enough to justify the extreme increases in commodity prices. To some extent, history may be repeating today as investors exit stocks and bonds and look for inflation hedges instead of cash.

Today, the shortages are a bit worse, primarily due to the inability to increase production in the U.S. and abroad. In my view, the crude oil market is not in a speculative fervor, and, due to rising export demand, I would not be surprised to see crude oil ETFs like (USO) rise to new all-time highs. However, natural gas seems a bit overvalued based on its fundamentals, primarily because U.S. export levels cannot rise much higher. I’m bearish on UNG and believe it will decline back to the $15 to $20 range (or a natural gas price of $3-$5), barring a significant weather event. That said, it will be an excellent time to reassess in November as injections end. If production fails to rise by then, we may see natural gas rise to new highs.

[ad_2]

Source links Google News