[ad_1]

Vertigo3d

In my opinion, The United States Natural Gas Fund (NYSEARCA:UNG) should only be held as a trade for short to medium time frames. Over the long run, the monthly rolling of futures has a large negative impact on the Fund’s NAV.

In terms of natural gas fundamentals, the upcoming restart of Freeport LNG could be the positive catalyst needed to spur a natural gas price rally. However, weather remains a wildcard, as September and October have been unseasonably warm. We will need to see weather patterns normalize into November to get bullish on UNG.

Brief Fund Overview

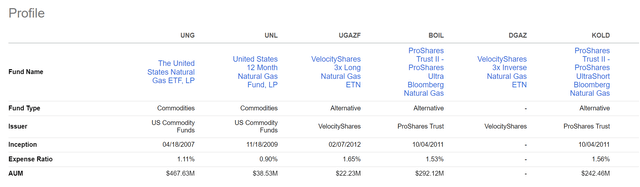

The United States Natural Gas Fund is an exchange traded fund that gives investors exposure to short-term natural gas price returns. It is one of the more popular exchange traded commodity funds, with $467 million in assets. The UNG fund charges a 1.11% expense ratio (Figure 1).

Figure 1 – UNG vs. Peer Funds (Seeking Alpha)

Do Not Buy And Hold

Due to the structure and mechanics of the fund (buying near-month natural gas futures and rolling them every month), the UNG fund is almost guaranteed to lose money in the long run.

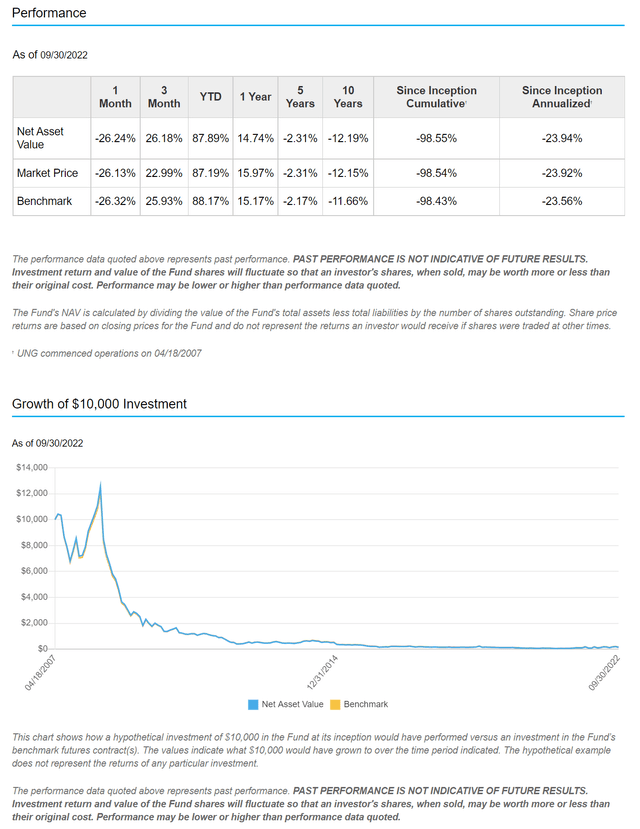

Figure 2 shows the UNG fund’s long-term performance along with a price chart. Since inception in April 2007, UNG has cumulatively lost 98.5% of investors’ money, if they had bought and held it.

Figure 2 – UNG Long-Term Returns (uscfinvestments.com)

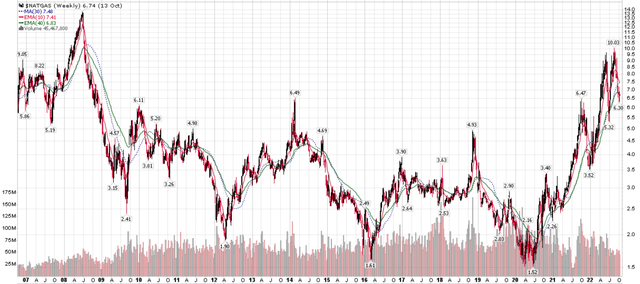

Figure 3 below shows spot natural gas prices since 2007. Notice at recent natural gas price of ~$6.50, we are effectively trading at the same level of prices circa 2007. Yet, UNG is trading for 1.5% of what it was worth in 2007!

Figure 3 – Long Term Natural Gas Prices (StockCharts.com)

UNG Holds Futures, Not Physical Commodities

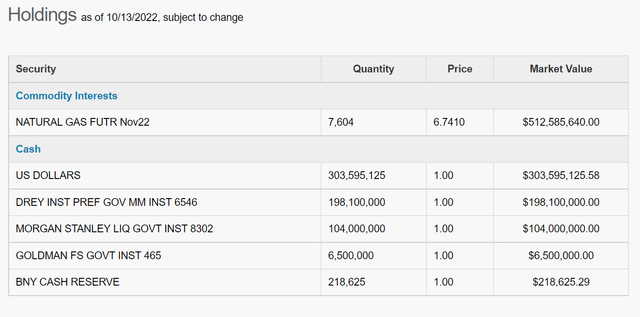

Unlike exchange traded metals products like the SPDR Gold Shares (GLD) that holds physical gold bars stored in vaults, the UNG ETF does not hold any physical natural gas. Instead, UNG holds near-month natural gas futures and cash (Figure 4).

Figure 4 – UNG Holdings (uscfinvestments.com)

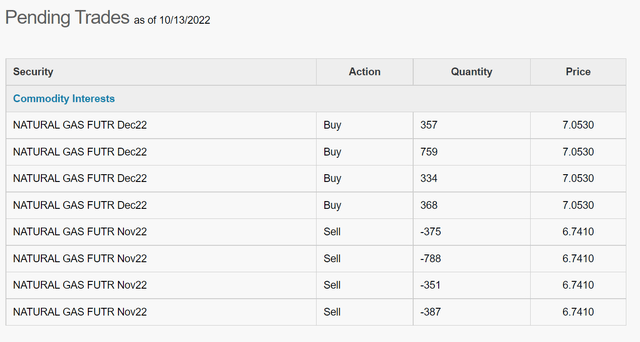

Therefore, every month when the current futures expire, UNG must sell the expiring futures (in the example above, the November 2022 Futures) and buy the next next-month futures (December 2022 Futures). Figure 5 shows UNG’s pending trades.

Figure 5 – UNG pending trades (uscfinvestments.com)

As commodity futures are typically in contango, where longer-dated futures are higher in price, the UNG loses value during most monthly ‘rolls’ when they sell the expiring futures and buy the next near-month future.

Therefore, I believe the UNG fund is only suitable as a ‘trading’ asset for when investors have a short-term view on natural gas prices.

Natural Gas At Critical Levels

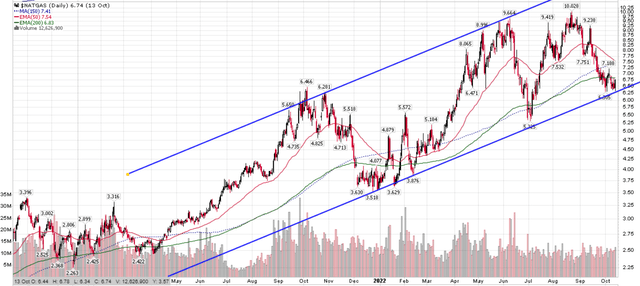

Technically, natural gas prices are currently at a critical level just above the late June lows and at the lower end of an uptrend that has defined the current bull market, which began in early 2021 (Figure 6).

Figure 6 – Natural Gas at lower end of uptrend (Author created with price chart from StockCharts.com)

Bull Case Widely Understood

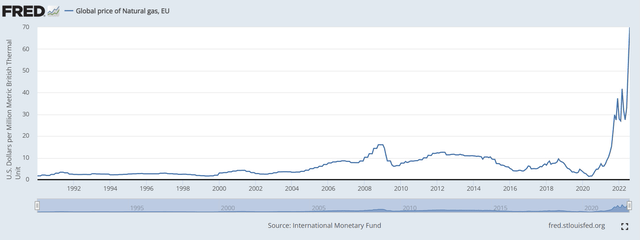

By this point, the natural gas bull case is widely understood. With its invasion of Ukraine and subsequent shenanigans on the Nord Stream pipelines, Russia has effectively stopped exporting natural gas to Europe. This has created a huge supply deficit in Europe, causing natural gas prices to skyrocket there (Figure 7).

Figure 7 – European Natural Gas Prices (St. Louis Fed)

US natural gas prices have risen in sympathy, as global natural gas markets are somewhat linked via liquified natural gas (“LNG”) cargoes.

What Caused The Recent Pullback?

While the bull case for natural gas is very compelling, price action has not been supportive. Natural gas prices have fallen by over 1/3 from August highs ~$10 / mmbtu. What happened and is the UNG fund now looking attractive?

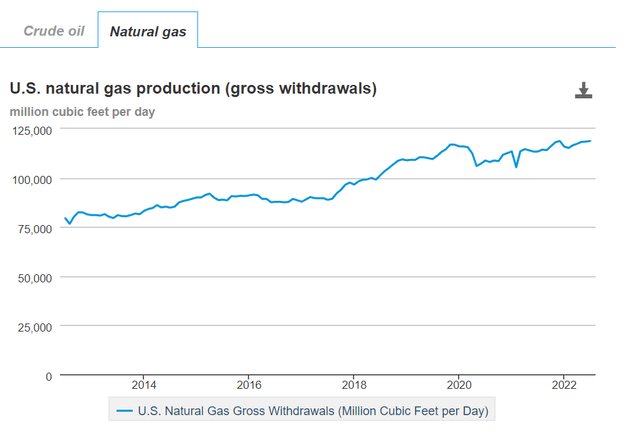

A number of factors combined to cause the natural gas price pullback. First, U.S. natural gas production continued to increase throughout 2022, with production currently pushing all-time highs of over 118 billion cubic feet/day (Figure 8).

Figure 8 – US Natural Gas Production (eia.gov)

At the same time, LNG exports have been temporarily constrained in the last few months due to a fire at Freeport LNG, the second-largest U.S. export terminal. Freeport LNG was expected to return to full capacity sometime in Q4.

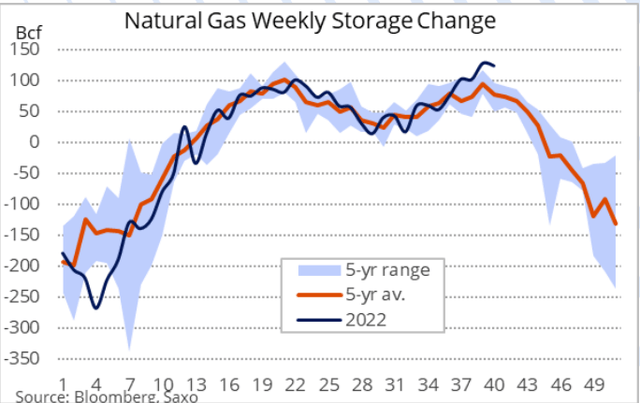

Finally, warmer-than-seasonal temperatures in most of the U.S. have led to dips in electricity demand and higher-than-average storage injections (Figure 9).

Figure 9 – Natural Gas Storage Injections (Saxo Market Call daily slide deck, October 14, 2022)

Upcoming Catalysts

Looking ahead, I see a number of upcoming catalysts that could affect natural gas prices. First, on the LNG front, the restart of Freeport LNG in November should be a welcome positive catalyst. Freeport LNG represents 15% of American LNG export capacity, and the company hopes to be operating at 85% of nameplate capacity by the end of November.

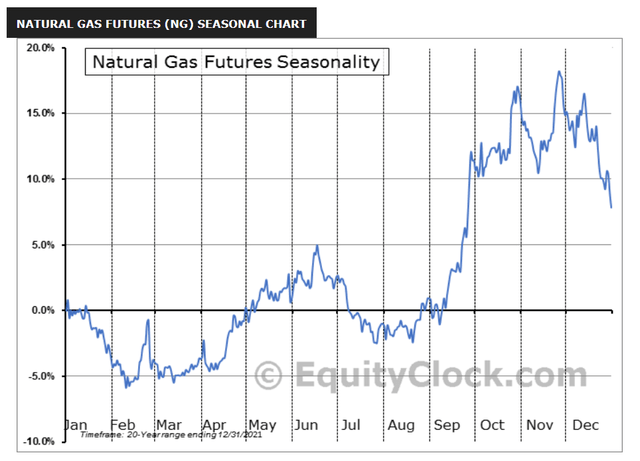

Seasonally, September and October tend to be the strongest months for natural gas price returns, as heating demand starts up and natural gas is placed into storage for the winter season (Figure 10).

Figure 10 – Natural Gas Seasonality (equityclock.com)

However, this year, we had the opposite effect, as the recent September had been one of the warmest on record. October is also forecast to be warmer than average, which could continue to suppress short-term natural gas demand. As we move into November, any normalization of the weather could spur dormant heating demand and provide support to natural gas prices.

Conclusion

In summary, the UNG fund should only be held for short to medium time frames, as over the long run, the monthly rolling of natural gas futures almost guarantees the fund will lose money. The upcoming restart of Freeport LNG could be a key positive catalyst. However, weather remains a wildcard, as September and October have been unseasonably warm. I would recommend a little more patience until we get a sense of weather normalization into November, coinciding with the Freeport LNG restart.

[ad_2]

Source links Google News