[ad_1]

Bet_Noire/iStock via Getty Images

Main Thesis & Background

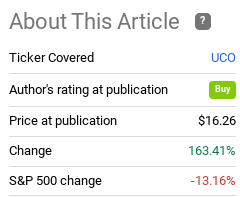

The purpose of this article is to discuss the ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA:UCO) as an investment option at its current market price. UCO is a double long instrument, designed to return two times the daily performance of the Bloomberg Commodity Balanced WTI Crude Oil Index. This is a futures market product, so it may not directly follow the current price of crude. However, it should bear a pretty strong correlation, and is a fund I regularly follow when I want to take an aggressive long position. In fact, I recommended UCO towards the end of last year, and its performance has been nothing short of astounding since that December article:

Fund Performance (Seeking Alpha)

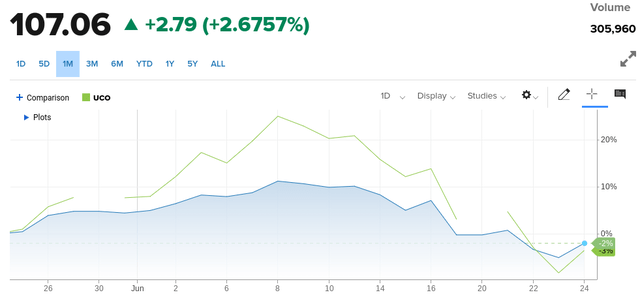

Clearly, this has been a strong performer. But the more important question is where it is headed from here. Certainly, it may be tempting to keep on buying, but readers should understand there has been a sell-off in crude recently, which has punished UCO over the past month or so:

1-Month Returns For Crude and UCO (CNBC)

I personally see this weakness as a buying opportunity. Crude does look expensive here compared to where it has been in the past decade, but many of the factors that have seen crude oil surge remain in place. There is still instability in eastern Europe, demand has been rising since last year, and supply continues to be challenged. None of these factors are likely to subside in the immediate term. This tells me UCO continues to have a path higher.

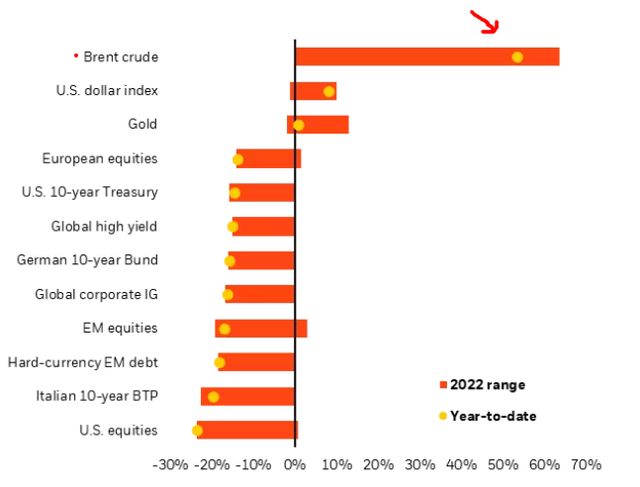

Oil Has Been A Great Hedge. I Would Stick With This Momentum

To start, let us take a minute to review how crude has performed in 2022. Clearly, the gains have been strong, very strong in fact. But everything is relative. When there is a bull market going up, gains are not that impressive – because it is likely most assets are rising. What is impressive at this juncture, however, is that crude has seen a massive gain year-to-date while most other popular asset classes are heavily in the red:

YTD Performance (Various Sectors) (BlackRock)

This is an important point because it suggests crude is a momentum play from a broad perspective. Yes, there has been some short-term weakness. But if we look over the past six months, we see the support lies with the bulls. Have conditions fundamentally changed since January? Not materially in my view. There is more political posturing to be sure, but the top story of demand growing and supply growing less quickly remains in place. This is a key bull point for crude, and I would remind readers that momentum plays often last for a long time. For this reason, crude at least deserves some consideration.

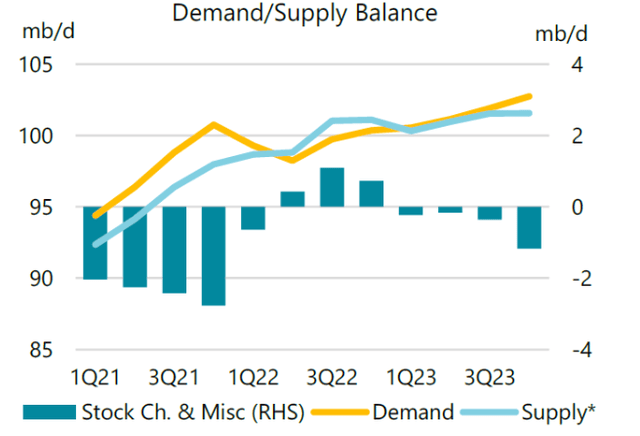

Demand Forecasted To Keep Rising

As I alluded to above, a key drive for crudes performance has been demand. This is an attribute that was expected for 2022 and was key to why I recommended a leveraged play on the space through UCO. The case for oil to go higher seemed pretty clear, and UCO indeed surged as a result.

But that is the past. The question now is – will this demand tailwind remain in place going forward? Fortunately, the answer appears to be yes. Recent projections from the U.S. Energy Information Administration tell a story that while demand may soften (or at least fluctuate) in the coming months, the bigger takeaway is that demand will continue to outpace supply in 2023:

YTD Performance (Various Sectors) (U.S. EIA)

Of course, readers are right to question why one would buy a leveraged oil fund like UCO if demand may soften in the short-term. This is a valid point and reiterates that one should not overextend themselves in this space. But I am not deterred by it for a few reasons.

One, the crude market is a futures market. This means the contracts UCO holds are based on future projections. The drop in current prices is likely already reflecting this upcoming softening demand. Essentially, it is also priced in (hence why crude has been falling of late). For longer-dated contracts, the rebound in demand is the bigger story, so expect those contracts to get more valuable with time, boosting UCO’s share price.

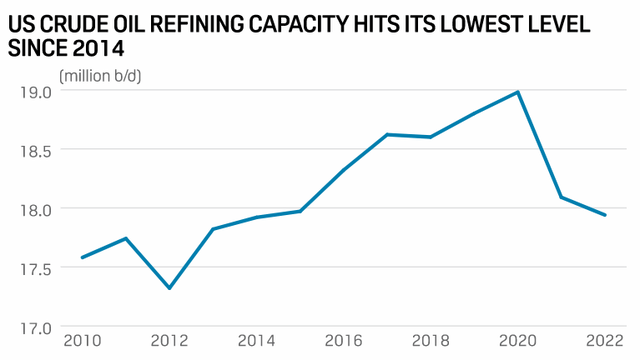

Two, a primary rationale for the drop in demand is coming from China. The country is imposing stricter Covid-lockdowns than most of the world at the moment. This is not a sustainable trend, and one that is almost positively going to be reversed in late 2022 and definitely in 2023. Chinese oil demand is an important part of the global market, and once it recovers prices are going to rise if supply doesn’t ramp up in a meaningful way. At this point, I’m not sure where that supply is going to come from. OPEC+ has been consistently showing restraint when it comes to increasing production. Further, refining capacity in the U.S. is well below where it has been in the past. While this presents an opportunity for more capacity going forward, that is going to take time and is not a “quick” fix to this imbalance:

U.S. Crude Oil Refining Capacity (S&P Global)

Ultimately, the demand-supply catalyst remains in place. While crude oil is not likely to have another 50% surge due to some of the headwinds facing the sector (more on that below), I still feel confident prices are well supported now. With the recent drop in prices, the next logical move is higher, suggesting that UCO is a reasonable bet at this juncture.

Reasons It Tops Other “Sexier” Alternatives

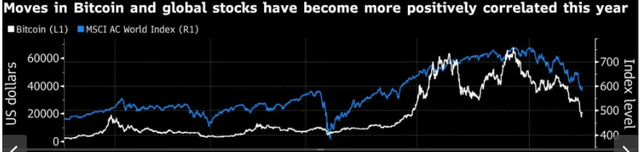

Another factor has to do with crude’s relative attractiveness to other equity hedges. I bring this up because most investors are probably overweight equities. To diversify, many likely move to global stocks and bonds. But the correlations of foreign stocks (as well as bonds) has been increasing over the past few years as most world economies are facing similar problems – high government debt loads, the need to increase interest rates, supply-chain shortages, etc. As a result, investors have been trying to get more creative when it comes to balancing portfolio risk. One way to do so is through crude oil, but that is also a very volatile asset and one that is prone to large drawdowns when economic news disappoints. Not surprisingly, some investors, especially younger ones, have been drawn to alternatives like cryptocurrencies as a way to diversify, instead of using traditional commodity assets.

In fairness, there is nothing “wrong” with this approach. In fact, I myself dabbled in Bitcoin at one point. But the reason I do longer buy it does not have to do with the coin itself. It has to do with the reasons why I purchased it in the first place. It was meant to be an equity and inflation hedge, and it has largely failed in that regard. What I mean is, I bought it in the hopes it would protect part of my portfolio from rising prices (by rising along with inflation) and by moving in a different direction than equity markets. Clearly, as inflation has risen in 2022, Bitcoin has fallen. Further, Bitcoin has begun to move almost in lockstep with global equities. This is not inherently “bad”, but I view it negatively because it negates a primary reason why I had considered it:

Bitcoin Correlated To Global Stocks (Yahoo Finance)

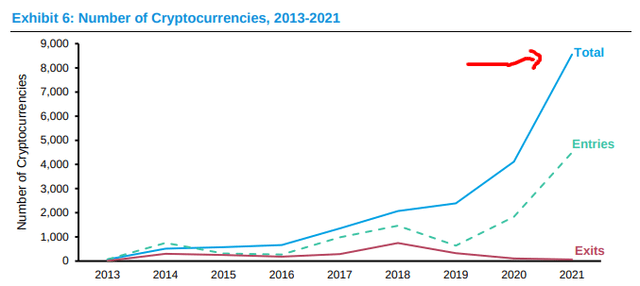

Beyond the increase in correlations between the assets, another major headwind for Bitcoin itself is the number of cryptocurrencies now on the open market. What started as a novel idea has been taken over by a plethora of options. While this can increase the legitimacy of the space, it can also confuse investors as well as draw money away from Bitcoin into these newer entrants. To understand why this is such a fundamental change, consider all the new entrants to the space over the past decade:

Number Of Cryptocurrencies On The Rise (Morgan Stanley)

Simply, I see Bitcoin losing some of its opportunity as investors begin to focus on newer or perceived “sexier” crypto options to find the next big thing. Since I have limited knowledge (and no real intention of learning more) about these small-cap cryptos, I simply stay away from them. I don’t invest in what I don’t understand as a rule – and that is a rule I suggest others follow as well. I understand crude, and while crude faces risks from other energy sources like gas, solar, and wind, that list is fairly limited unlike all the available cryptos.

This Isn’t “Risk Free”, And May Not Be For Everyone

So far in this review I have taken a fairly bullish stance, and I do stand by that. I have held UCO before, and plan on doing so again. But I have the ability to withstand volatility and short-term losses for a number of reasons. Perhaps others do not have that ability, or perhaps they simply don’t agree with my bull thesis. In any event, it is certainly a fair point to suggest this play is on the riskier end. In no way, shape, or form do I want to give the impression this is a “sure thing”. Any leveraged ETF has inherent risk, and a leveraged play on crude oil has the potential to be extremely volatile. As such, readers need to acknowledge their own risk tolerance, outlook for crude, and whether they can withstand losses before gains materialize.

I bring this up because there are definitely risks on the horizon. These are coming from a number of different avenues. While the price of crude rising has been a boon for refiners, producers, and leveraged ETF investors, the fact is that these gains may be coming in too fast for comfort. What I mean is, pain at the price pump across the developed world is forcing politicians to take action. We have already seen a change in tone from the current U.S. administration, with a releasing of Strategic Petroleum Reserves (SPRS) and other measures now being under consideration to bring down the price for consumers. With fuel prices high and mid-term elections looming, it is easy to understand why this is the case:

Prices at the Pump (Gas Buddy)

We have also seen a number of other options up for consideration. These includes gas tax “holidays”. In fairness, that won’t really do much to the price of crude, albeit it may reduce what consumers pay for it. So while that is not really a material headwind, it supports the broader macro-picture that developed world governments are taking action to lower the cost of energy. This is a major shift from the Biden administration, which initially was reluctant to acknowledge this as a problem. Now, with political pressure mounting, their tune has changed. This suggests we probably have not seen the end of measures to reduce crude prices, presenting a challenging headwind for a fund like UCO. However, with the legislative summer recess about to hit D.C., there is probably little more than will be done in the short-term in this regard.

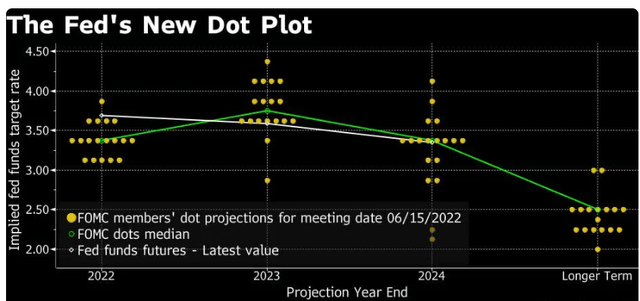

However, political pressures are not the only factor weighing on the outlook for crude. The other is the potential for a recession, or at least a slowing U.S./global economy. One attribute driving this is Fed rate hikes. The Fed is committed to bringing down inflation, and to do so they are raising interest rates in a historically aggressive manner. The impact could be a slowing of economic growth, which in turn would reduce demand (and the price) for crude, all other things being equal. While the rate hike cycle is already under way, it remains a headwind because the Fed’s “Dot Plot” suggests further hikes are going to be warranted:

Fed Dot Plot (Bloomberg)

This is one of a number of different factors that has economists and market forecasters worried about where the global economy is headed in the second half of the year. In fact, central bank tightening is a key reason why the risks of a recession has risen dramatically in a short time period:

Recession Outlook (Morgan Stanley)

The fact is that if the U.S., or the globe, does fall into a recession, demand for crude could fall. If it does, price will follow. Obviously, this is a bear-case scenario for UCO. Therefore, readers need to evaluate this risk, and not blindly enter this fund unless they are confident demand destruction from a recession is not on the horizon.

Bottom-line

Gasoline prices are in the news every day and politicians are vowing to lower them. This could mean investing in UCO is not the right move. But the reality is politicians have only so much control over the direction of crude. For one thing, this is a global commodity, so the whims of a politician in the U.S. (even the president) is not enough to push the price meaningfully in one way or another. Beyond that, even if we “want” lower prices, making it so is easier said than done. This requires increased production, refinery capacity to handle the inflows, and supply-chains that can get the finished product to market. See the problems here?

In summary, 2022 has been a boon year for crude so far. The attributes that made this possible remain in effect today. With equities getting a nice relief rally this week, I plan on taking some short-term profit and plowing that into crude to use as a hedge against further volatility in the equity market. For me, going forward the plan is staying diversified and balanced. UCO provides me with a way to do just that, and I would encourage readers to give this idea some consideration at this time.

[ad_2]

Source links Google News