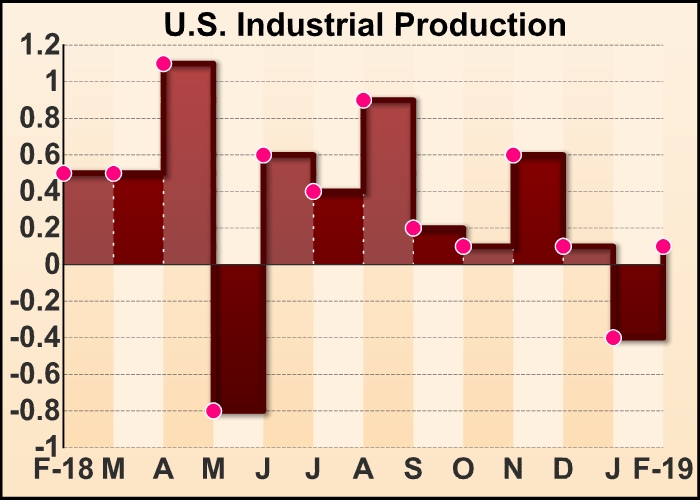

A report released by the Federal Reserve on Friday showed industrial production in the U.S. rose by much less than expected in the month of February.

The Fed said industrial production inched up by 0.1 percent in February after falling by a revised 0.4 percent in January.

Economists had expected production to climb by 0.4 percent compared to the 0.6 percent drop originally reported for the previous month.

The uptick in production came as utilities output spiked by 3.7 percent in February after slumping by 0.9 percent in January and plunging by 5.2 percent last December.

Mining output also rose by 0.3 percent for the second consecutive month, although the increases were largely offset by a continued drop in manufacturing output.

The report said manufacturing output fell by 0.4 percent in February following after sliding by 0.5 percent in the previous month.

“The further decline in manufacturing output in February confirms that the global industrial slowdown is now weighing more heavily on U.S. producers,” said Andrew Hunter, Senior U.S. Economist at Capital Economics.

He added, “With tighter fiscal and monetary policy constraining domestic demand, the weaker external environment is another reason to expect a sustained slowdown in economic growth this year.”

Meanwhile, the Fed said capacity utilization for the industrial sector edged down to 78.2 percent in February from an upwardly revised 78.3 percent in January.

Economists had expected capacity utilization to tick up to 78.4 percent from the 78.2 percent originally reported for the previous month.

Capacity utilization in the utilities sector jumped to 78.6 percent, while capacity utilization in the manufacturing and mining sectors dipped to 75.4 percent and 94.6 percent, respectively.

For comments and feedback contact: editorial@rttnews.com

Business News