[ad_1]

It goes without saying that Turkey has had a tumultuous recent history. Events began following the July 2016 failed coup attempt that helped spur a fall in capital flows and put the economy into a state of serious stagflation. Inflation rose from 6% in 2016 to a peak of 25% in October of last year. The Lira collapsed and, for a moment, lost nearly half of its value. To make matters worse, the country temporarily had extremely high tariffs on its steel and aluminum exports that have since been reduced.

That said, the fundamental outlook for the Lira is improving and many companies in the country have valuations at a quarter of what would be found in developed countries. One way investors can gain exposure to the improving Lira and these undervalued companies is through the iShares MSCI Turkey ETF (TUR).

TUR is an older, more established ETF that has been trading since March 2008 and currently has $360M in AUM and has ample liquidity for both long and short positions. The fund currently has 47 holdings and tracks the MSCI Turkey IMI 25/50 index. According to iShares, the ETF currently has an extremely low average P/E ratio of 6.7X and a P/B ratio of 1.08 so it holds some of the cheapest companies available to investors today.

Of course, cheap does not always equal good investment. The fund has a very high annualized standard deviation of 34% and has lost over 40% of its value since the beginning of 2017. Further, the country’s leader Recep Erdogan has fought to lower interest rates despite high inflation which poses an ongoing risk to the Lira.

That said, while the many fears regarding Erdogan and Turkey are valid, that fear has created a fire-sale opportunity for asset prices. The country is in a recession, but has an improving macroeconomic outlook and economic fears may subside soon. Over time, I expect the country to rebound and realize its high growth potential and for long-term investors in TUR to be rewarded as long as the Lira remains stable.

ETF Sector and Asset Exposure

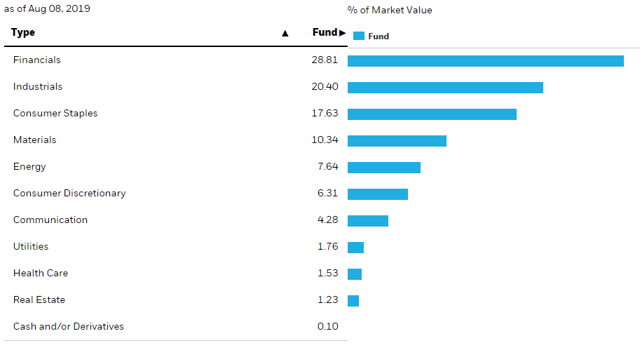

The sector breakdown of the TUR ETF is reflective of the economy of the country. Its largest sectors are financials, industrials, and consumer staples. Fortunately, those three sectors are exposed to the domestic Turkish economy and less of the global economy as they are not export-heavy. Here is the full sector breakdown:

Source : iShares

Overall, this sector breakdown tells us the ETF is relatively balanced between defensive and risky sectors. Financials and industrials are cyclical, but will also gain greatly from long-run growth in the country as the vast development gap between rural and urban Turkey shrinks. Further, the country may near the end of its recession which will likely cause a cyclical rebound for the two sectors.

Consumer staples, the third largest sector, tends to pay stable dividends and lowers the overall risk in the ETF as it is less exposed to the cyclical domestic economy. Speaking of dividends, the fund currently pays a decent dividend of 2.7% after the fund’s 0.59% expense ratio.

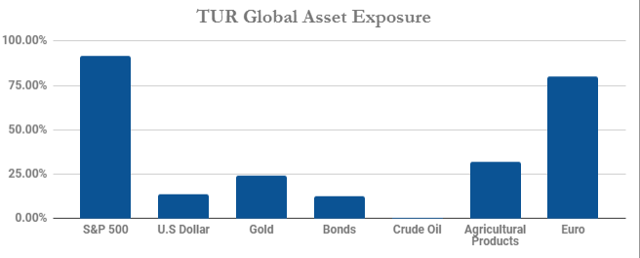

Like the country, the ETF is highly exposed to global assets. It may appear to be well diversified as it is advertised as having a beta of 0.3, but when more factors are taken into account, one can see that it has high exposure to global equities. I measure “true exposure” using what is known as “multiple least squares” that let’s us see betas for each major asset class.

Here is the multi-asset exposure for the fund:

Data source : Google Finance

The advertised beta is low because TUR is highly exposed to gold, agricultural products, and the EUR/USD exchange rate. When those are taken into account, we can see that TUR is just as exposed to equity markets as most single-country ETFs (if not more so).

This high exposure to the U.S equity market is not necessarily a bad sign. I have become increasingly bearish on U.S. equities and may short-sell them soon. So, by being long TUR, I can effectively hedge the short position and hopefully generate some alpha.

It is interesting to see that the fund has high exposure to gold and agricultural products even though very little of its holdings are involved. While Turkey does not produce as much gold as it did 2,000 years ago, the country’s citizens are known to own a lot of the commodity and the central bank more than doubled its reserves in recent years. Further, about one in five citizens still work in the country’s agricultural sector which explains the ETF’s high exposure to the agricultural commodities.

Digging Into The Fundamentals

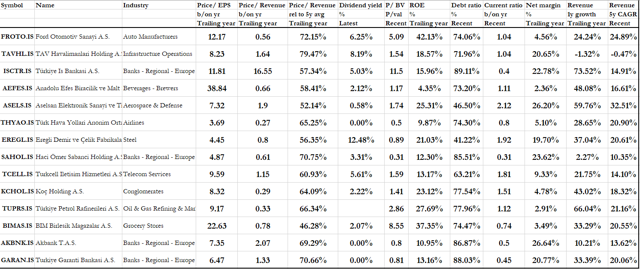

Now that we have a solid picture of the economic risks of the fund. Let’s delve into the fundamentals of its holdings and decide if there is enough value to offset the high risks:

Source : UncleStock

These companies collectively make up over 75% of the ETF’s assets so are representative of the fund itself. As you can see, P/E multiples are extremely low for most of the companies and reach as low as 3.7X in the case of Turkish Airlines (OTCPK:TKHVY).

My favorite metric, price to revenue relative to five-year average, also shows that the companies are trading at a 50% discount to their historical norms. Further, revenue growth is high, but it is slightly biased due the high inflation in the country. Still, top line growth is higher than inflation for most of the holdings. The equities are also very efficient, with ROEs above 15% for most of the companies and high net margins for stocks in competitive industries.

One area of concern is the high debt levels in the non-financial corporations. Granted, these are about as high as most would find in the United States, but given the high interest rate in the country, it does pose a risk. That said, it seems that overall, the fund is heavily discounted. While the ETF has high risks, its valuations are low enough that investors are being compensated. This is particularly true when the high long-run growth potential of the equities are taken into account.

Turkish Lira Strength May Boost Performance

Having a low valuation is not enough to make up for a good foreign investment. Pakistan, for example, has even lower valuations, but has such a weak currency that investors in the Global X MSCI Pakistan ETF (PAK) are almost bound to lose money due to currency devaluation. If you buy a single-country ETF, you are also buying the local currency. The large drop in the Lira last year was also the primary cause for the decline in TUR. Have a look at how the two perform together below:

Source : TradingView

Here we can see that the Lira and TUR are tightly bound. The primary cause for the decline in the Lira last year was the large spike to inflation in the country which put its economy into a state of stagflation. While the rest of the world is doing all they can to create inflation, the Turkish Central Bank is trying to fight it. At least, those who have yet to be fired by President Erdogan for raising interest rates.

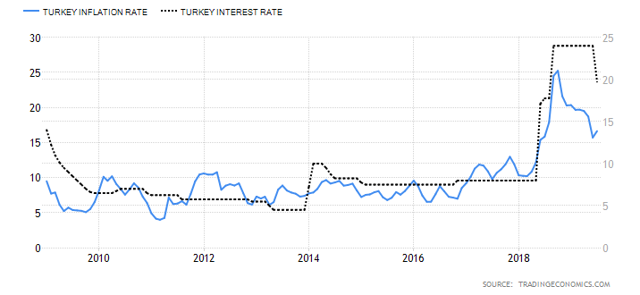

I’ll be one of many to admit that Erdogan poses a serious risk to the Turkish Lira and therefore to the TUR ETF. Like President Trump, President Erdogan wants their central bank to lower interest rates to boost the economy. However, unlike Trump, he does not have a currency with the strength of U.S dollar. The primary cause for weakness in the Lira was the sky-high inflation rate last year that has only been stopped by an even higher interest rate. See below:

Note: Interest rate corresponds to left axis while inflation is right axis.

Source: Trading Economics

The Turkish Central Bank managed to completely stop the fall in the Lira and cut inflation by raising the interest rate to just under 30%. However, the rate was lowered by 4.25% two weeks ago not because the economists deemed it best, but because they knew they would be fired like the last governor if they disobeyed Erdogan’s orders. Overall, I think the rate cut will not cause inflation to rise back to its previous level, but admit that it is risky to invest in an area with that much concentration of economic (and political) power.

The Bottom Line

Everyone knows that political and economic risks in Turkey are much higher than in most of the world. That is exactly why I find it to be a good investment. All of those risks are priced into the country’s stock market and then some. Thus, the potential reward is very high, particularly when a long-run outlook is taken.

If the Turkish Central Bank manages to keep inflation low despite pressure to lower the interest rate, then I expect both the Lira and valuations to rebound. The equities in TUR could probably command a fair P/E multiple of 10X when the economy gets back on a growth path. Further, the USD/TRY spot price will probably return to its 2018 $4 level if inflation continues to fall. Thus, we have 35% potential upside due to the currency and 50% upside due to fair valuation. This implies a total of just over 100% in possible profits or a price target of $52 for the ETF. I would expect this to occur over one to three years.

While that may seem like a high price target, it is given the Lira’s value is restored. If inflation returns and the central bank fails to raise interest rates due to political pressure, then the downside could be immense as there is no limit to how far a currency can devalue. This is why the position must be actively managed and closed if political/economic turmoil returns.

Interested In Closely Following Global Events?

We will soon be launching our first marketplace service, “The Country Club”. This will be a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We keep a close eye on emerging markets like Turkey, and will be providing subscribers further updates on this idea. Please give us a “Follow” if you would like to be notified upon our launch!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in TUR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News