[ad_1]

outline205/iStock via Getty Images

Thesis

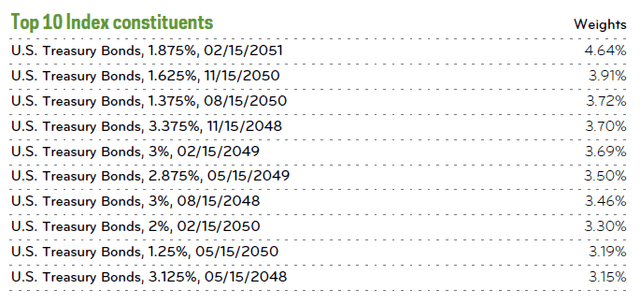

The ProShares Trust – ProShares UltraPro Short 20+ Year Treasury ETF (NYSEARCA:TTT) seeks daily investment results that correspond to the -3x daily performance of the ICE U.S. Treasury 20+ Year Bond Index. The index includes only treasury securities that have a remaining maturity of greater than twenty years and an outstanding face value of $300 million or more, excluding amounts held by the Federal Reserve. Inflation linked securities and stripped bonds are excluded. An investor should keep in mind that the ETF is designed to replicate -3x of the daily performance on the index, hence longer term returns will diverge from a pure -3x performance metric due to daily compounding and fund expenses.

Like any highly leveraged product, TTT is not a pure buy-and-hold investment, but rather a tool to be utilized in an aggressive tightening environment such as the one we are currently witnessing. To that end, the product displays a negative 5-year Sharpe ratio of -0.52 and a standard deviation of 35.37. 20-year yields are up more than 71 bps year-to-date which has driven a +35% performance in the fund so far given the high ~20-year duration TTT is running in its portfolio. The fund has a high expense ratio of 0.95% and an AUM of $0.21 billion.

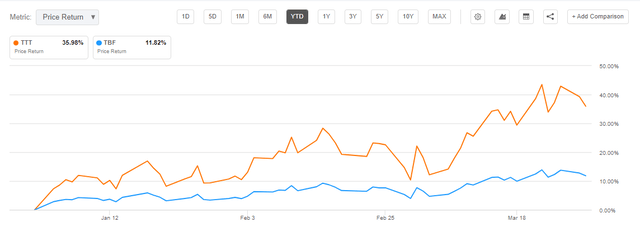

When comparing TTT to the unleveraged ProShares Short 20+ Year Treasury ETF (TBF), we can see how leverage significantly magnifies the move in rates, with TBF being up a little bit over 11% year-to-date versus the outstanding 30%+ we have seen in TTT. Leveraged products are for sophisticated investors since they magnify not only a move up, but also a move down. We believe that in 2022 the 20-year point in the yield curve will revisit its 2018 highs and we are going to have an even further outperformance in TTT. If our target of 3.37% in 20-year rates is met, that means there are another 69 bps of rate increases to occur at the 20-year tenor point, which translates into another gain of ~+30% to be had in the ETF.

A sophisticated retail investor who is comfortable with leveraged products and believes we have not seen the highs in 20-year rates this year can utilize TTT to obtain a -3x magnified return from the push higher in long end US rates. We thus rate TTT a Buy.

Holdings

The fund holds exclusively treasury securities:

Constituents (Fund Fact Sheet)

Since the portfolio is composed of treasuries only, it is risk free from a credit perspective (i.e. a default is not contemplated for the portfolio) and is driven only by rates / yield curve.

The fund has a very long duration of approximately 20 years.

Duration (Fund Fact Sheet)

Mimicking the index, the fund is weighted by market capitalization and the securities are updated on the last business day of each month.

Performance

The fund is up more than 35% on a year-to-date basis.

Fund Performance (Seeking Alpha)

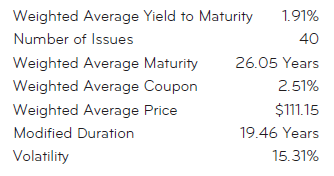

The robust year to date return has been driven by a significant move higher in 20-year rates which are up more than 70 bps as of the writing of this article.

20-Year Rates Chart (YCharts)

We believe we are going to see a reversion to the November 2018 highs in 20-year yields which topped out at approximately 3.37%.

20-Year Rates (YCharts)

There are also increased discussions of a potential end to the secular bond bull market we have witnessed in the past decades. While we are not very sure the economy can currently sustain significantly higher overall rates, we do believe that the levels seen in 2018 will be revisited, especially given the substantial inflation differential between the two periods.

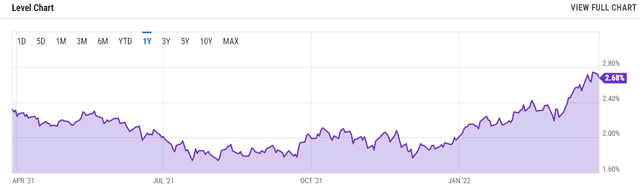

If we have a look at a bond duration / price action matrix, we can derive an implied potential move and price action if our target is met.

Duration / Price Matrix (Vanguard)

If our target of 3.37% is met, that means there are another 69 bps of rate increases to occur at the 20-year tenor point, which per the above matrix translates into a roughly -10% price move. This move is for an unleveraged position, hence for the TTT product the result is another gain of ~+30% to be had. In a very aggressive Fed scenario where the economy holds up well and the Fed has a free hand is raising rates to fight inflation, we might see long rates go even higher, depending on the balance sheet run-off from the Fed that has been keeping a lid on long end rates for a while now.

We can also see how the leverage embedded in the product significantly magnifies the yield move.

3x leverage vs 1x leverage (Seeking Alpha)

When we look at the unleveraged ProShares Short 20+ Year Treasury ETF, we see it is up a little bit over 11% year-to-date versus the outstanding 30%+ we have seen in TTT. Again, leveraged products are for sophisticated investors since they magnify not only a move up, but also a move down.

5Y Return (Seeking Alpha)

We can see that on a 5-year time horizon, TTT experienced a violent drawdown in the Covid monetary loosening environment which bottomed out at -75% versus roughly -35% for TBF.

Conclusion

Investors currently find themselves in an interesting rates environment marked by a very aggressive Fed, which might be behind the inflation curve in terms of maintaining price stability. Rates have risen sharply year-to-date, especially in the front end of the curve, and market participants think there is more to come if the economy holds up well. By seeking daily investment results that correspond to the -3x daily performance of the ICE U.S. Treasury 20+ Year Bond Index, the ProShares UltraPro Short 20+ Year Treasury ETF is set to benefit in a leveraged fashion from higher 20-year yields.

We believe that in 2022, the 20-year point in the yield curve will revisit its 2018 highs and we are going to have an even further outperformance in TTT that amounts to roughly another +30%. A sophisticated retail investor who is comfortable with leveraged products and believes we have not seen the highs in 20-year rates this year can utilize TTT to obtained a 3x magnified return from the push higher in long end US rates. We thus rate TTT a Buy.

[ad_2]

Source links Google News